|

市場調查報告書

商品編碼

1698337

商用車座椅市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Vehicle Seat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

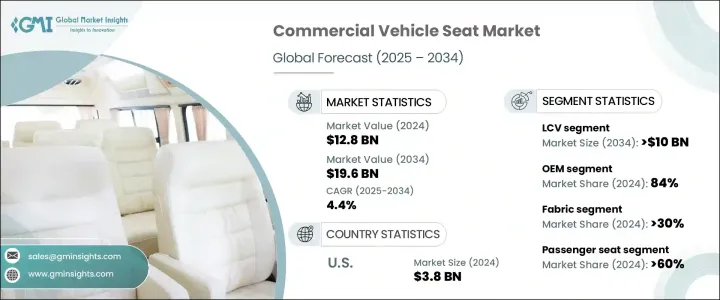

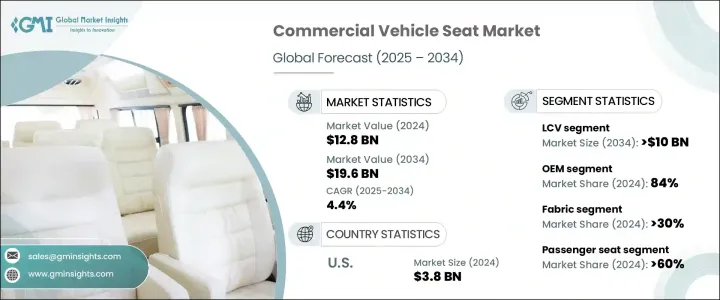

2024 年全球商用車座椅市場規模達到 128 億美元,預計 2025 年至 2034 年期間將以 4.4% 的複合年成長率穩定成長。商用車需求的不斷成長,尤其是在物流和運輸領域,繼續推動對耐用、符合人體工學的座椅解決方案的需求。汽車製造商和車隊營運商優先考慮能夠提高舒適性、安全性和使用壽命的高品質座椅,確保車輛滿足駕駛員和乘客不斷變化的期望。

在材料、設計和安全法規的進步推動下,市場正在經歷一場轉型。輕量化和節能的座椅解決方案越來越受到關注,特別是隨著汽車行業轉向電動和自動駕駛汽車。製造商正在整合高性能材料、智慧緩衝和自適應設計,以改善使用者體驗,同時最佳化車輛重量和燃油效率。模組化座椅結構的採用也日益增多,從而可以根據應用需求實現更大的靈活性和客製化。此外,嚴格的安全標準要求不斷創新,迫使汽車製造商開發符合全球監管框架的抗衝擊、符合人體工學的座椅。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 128億美元 |

| 預測值 | 196億美元 |

| 複合年成長率 | 4.4% |

輕型商用車 (LCV) 領域仍然是商用車座椅市場的主導力量,到 2024 年將佔據 55% 的市場佔有率。預計到 2034 年,該領域的產值將達到 100 億美元,這得益於城市交通和最後一英里配送服務中使用的緊湊型、省油車輛的需求激增。隨著城市化進程的加速,企業和物流供應商尋求能夠輕鬆穿越擁擠城市景觀的靈活交通解決方案。 LCV 兼具出色的機動性、燃油效率和成本效益,使其成為送貨車隊、共乘服務和租賃業務的首選。小型企業活動的擴大和電子商務的成長進一步加強了對先進座椅解決方案的需求,製造商專注於增強腰部支撐、改善座椅可調節性和永續材料,以滿足不斷成長的消費者期望。

商用車座椅市場分為OEM和售後市場銷售管道,其中 OEM 到 2024 年將佔據 84% 的市場佔有率。汽車製造商絕大多數青睞符合品牌形象、品質基準和不斷發展的安全法規的原廠安裝座椅。原始設備製造商大力投資高階座椅解決方案,這些解決方案具有人體工學設計、高耐用性布料以及氣候控制座椅、記憶功能和可調式腰部支撐等先進功能。這些創新不僅提高了駕駛舒適度,也提高了車輛的效率和使用壽命。隨著汽車製造商面臨提供卓越內裝功能的壓力,座椅製造商正在開發尖端解決方案,以滿足駕駛員和乘客的需求,同時確保符合嚴格的安全標準。

北美商用車座椅市場佔全球收入的 36%,其中美國在 2024 年的收入為 38 億美元。這一領導地位源自於該國廣泛的生產能力、強勁的汽車銷售以及持續的研發投資。汽車製造商和供應商不斷增強座椅功能,加入加熱、通風和記憶設置,以滿足不斷變化的消費者偏好。美國仍然是市場趨勢的重要推動者,影響著品質標準並塑造商用車座椅的創新。隨著國內需求的不斷發展,產業參與者專注於提供技術先進、符合安全要求且舒適度更高的座椅解決方案,以在全球市場上保持競爭優勢。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 材料供應商

- 製造商

- 經銷商

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 成本細分分析

- 監管格局

- 衝擊力

- 成長動力

- 對輕量和人體工學座椅的需求不斷成長

- 嚴格的安全和排放法規

- 電子商務和物流的成長

- 永續材料的進步

- 產業陷阱與挑戰

- 先進座椅技術成本高

- 供應鏈中斷

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按座位,2021 - 2034

- 主要趨勢

- 駕駛座椅

- 乘客座椅

- 後座

- 折疊座椅

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 織物

- 乙烯基塑膠

- 皮革

- 合成材料

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 輕型商用車(LCV)

- 重型商用車(HCV)

- 巴士和長途客車

第8章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 標準/常規座位

- 電動座椅

- 加熱和通風座椅

- 記憶座椅

- 按摩座椅

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Adient

- Brose Fahrzeugteile

- Daimler

- Faurecia

- Hyundai Dymos

- Iveco

- Kongsberg Automotive

- Kongsberg Gruppen

- Lear

- Magna International

- RECARO Automotive Seating

- Seoyon E-Hwa

- Sogefi Group

- Sumitomo Riko

- Sundaram Clayton

- Tachi-S

- Toyota Boshoku

- TS Tech

- Yanfeng Automotive Interiors

- Zhejiang Panyu-Jeep Vehicle

The Global Commercial Vehicle Seat Market reached USD 12.8 billion in 2024, with projections indicating steady growth at a CAGR of 4.4% from 2025 to 2034. The increasing demand for commercial vehicles, particularly within the logistics and transportation sectors, continues to drive the need for durable, ergonomic seating solutions. Automakers and fleet operators prioritize high-quality seats that enhance comfort, safety, and longevity, ensuring vehicles meet the evolving expectations of drivers and passengers alike.

The market is undergoing a transformation fueled by advancements in materials, design, and safety regulations. Lightweight and energy-efficient seat solutions are gaining traction, particularly as the industry pivots toward electric and autonomous vehicles. Manufacturers are integrating high-performance materials, smart cushioning, and adaptive designs to improve user experience while optimizing vehicle weight and fuel efficiency. The adoption of modular seating structures is also rising, allowing for greater flexibility and customization based on application needs. Additionally, stringent safety standards necessitate continuous innovation, compelling automakers to develop impact-resistant, ergonomic seating that complies with global regulatory frameworks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.8 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 4.4% |

The Light Commercial Vehicle (LCV) segment remains a dominant force in the commercial vehicle seat market, accounting for a 55% share in 2024. This segment is projected to generate USD 10 billion by 2034, driven by the surging demand for compact, fuel-efficient vehicles used in urban transport and last-mile delivery services. As urbanization accelerates, businesses and logistics providers seek agile transportation solutions capable of navigating congested cityscapes with ease. LCVs offer a compelling combination of maneuverability, fuel efficiency, and cost-effectiveness, making them the preferred choice for delivery fleets, ride-sharing services, and rental operations. Expanding small business activities and the growth of e-commerce further reinforce the need for advanced seating solutions, with manufacturers focusing on enhanced lumbar support, improved seat adjustability, and sustainable materials to meet the rising consumer expectations.

The commercial vehicle seat market is segmented into OEM and aftermarket sales channels, with OEMs securing an 84% market share in 2024. Automakers overwhelmingly favor factory-installed seats that align with brand identity, quality benchmarks, and evolving safety regulations. OEMs invest heavily in premium seating solutions featuring ergonomic designs, high-durability fabrics, and advanced features such as climate-controlled seating, memory functions, and adjustable lumbar support. These innovations not only enhance driving comfort but also improve vehicle efficiency and longevity. As automakers face mounting pressure to offer superior interior features, seat manufacturers are developing cutting-edge solutions that cater to both driver and passenger needs while ensuring compliance with stringent safety standards.

North America Commercial Vehicle Seat Market accounted for 36% of the global revenue, with the United States generating USD 3.8 billion in 2024. This leadership position stems from the country's expansive production capabilities, robust vehicle sales, and ongoing investment in research and development. Automakers and suppliers continuously enhance seat functionality, incorporating heating, ventilation, and memory settings to meet shifting consumer preferences. The US remains a critical driver of market trends, influencing quality standards and shaping innovation in commercial vehicle seating. As domestic demand continues to evolve, industry players focus on delivering technologically advanced, safety-compliant, and comfort-enhancing seating solutions to maintain a competitive edge in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Material providers

- 3.1.1.2 Manufacturers

- 3.1.1.3 Distributors

- 3.1.1.4 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Cost breakdown analysis

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for lightweight and ergonomic seating

- 3.6.1.2 Stringent safety and emission regulations

- 3.6.1.3 Growth in e-commerce and logistics

- 3.6.1.4 Advancements in sustainable materials

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of advanced seating technologies

- 3.6.2.2 Supply chain disruptions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Seat, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Driver seat

- 5.3 Passenger seat

- 5.4 Rear seat

- 5.5 Folding seat

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Fabric

- 6.3 Vinyl

- 6.4 Leather

- 6.5 Synthetic materials

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Light Commercial Vehicles (LCV)

- 7.3 Heavy Commercial Vehicles (HCV)

- 7.4 Buses & Coaches

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Standard/conventional seats

- 8.3 Powered/electric seats

- 8.4 Heated & ventilated seats

- 8.5 Memory seats

- 8.6 Massage seats

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Adient

- 11.2 Brose Fahrzeugteile

- 11.3 Daimler

- 11.4 Faurecia

- 11.5 Hyundai Dymos

- 11.6 Iveco

- 11.7 Kongsberg Automotive

- 11.8 Kongsberg Gruppen

- 11.9 Lear

- 11.10 Magna International

- 11.11 RECARO Automotive Seating

- 11.12 Seoyon E-Hwa

- 11.13 Sogefi Group

- 11.14 Sumitomo Riko

- 11.15 Sundaram Clayton

- 11.16 Tachi-S

- 11.17 Toyota Boshoku

- 11.18 TS Tech

- 11.19 Yanfeng Automotive Interiors

- 11.20 Zhejiang Panyu-Jeep Vehicle