|

市場調查報告書

商品編碼

1698293

耳垢清除產品市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Earwax Removal Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

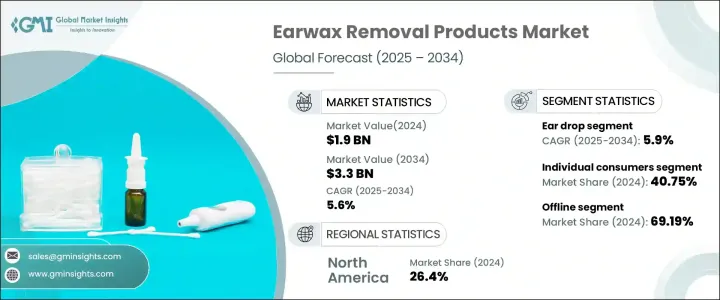

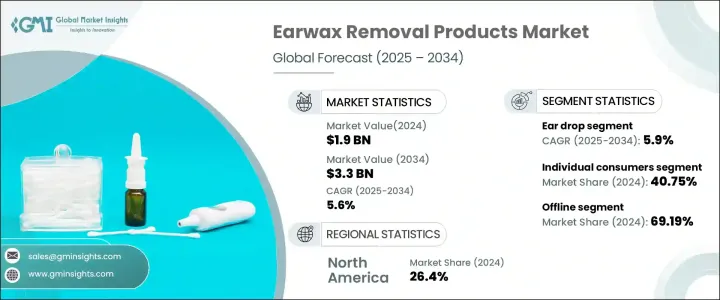

2024 年全球耳垢清除產品市場價值為 19 億美元,預計 2025 年至 2034 年的複合年成長率為 5.6%。隨著越來越多的人出現耳垢堆積、感染、耳鳴和聽力損失,耳部相關疾病的盛行率不斷上升,推動了這個市場的擴張。頻繁使用耳塞和耳機、人口老化以及生活習慣的改變等因素導致耳垢過度堆積,從而推動了對家庭耳垢清除解決方案的需求。消費者越來越注重耳部衛生,因此更傾向於選擇非侵入性、易於使用且無需專業干預即可有效緩解耳部不適的產品。隨著非處方耳垢清除產品越來越普及,人們開始轉向自我照護解決方案,這進一步推動了市場的成長。智慧耳垢清除工具和自動灌溉系統等耳朵清潔技術的進步也越來越受到關注,尤其是在尋求創新和更安全替代品的技術嫻熟的消費者中。

市場涵蓋一系列產品,包括滴耳液、耳燭、耳噴霧劑、棉花棒以及微型吸力裝置和耳勺等先進工具。滴耳液市場在 2024 年創造了 8 億美元的收入,預計在預測期內的複合年成長率為 5.9%。滴耳液的強勁需求是由於其易於使用、價格實惠且廣泛可用。醫療專業人員(包括醫生和藥劑師)經常建議使用滴耳液,作為治療反覆出現耳垢堆積的安全有效的解決方案。老年人和助聽器使用者尤其依賴這些產品進行定期的耳部衛生維護。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 19億美元 |

| 預測值 | 33億美元 |

| 複合年成長率 | 5.6% |

市場根據最終用戶進行分類,包括個人消費者、醫療保健專業人員、醫院和診所以及療養院等其他設施。 2024年,個人消費者佔了40%的市場佔有率,反映出人們對耳部衛生的意識不斷增強,並且更傾向於自我照顧。隨著與老化相關的聽力問題、遺傳傾向以及助聽器和耳塞的使用增加,越來越多的人開始轉向家庭耳垢清除解決方案。遠距醫療諮詢和線上藥局購買的興起趨勢進一步增強了消費者對這些產品的獲取,使他們無需專業醫療訪問即可更輕鬆地解決耳垢問題。

北美耳垢清除產品市場佔有 26.4% 的佔有率,2024 年產值達 5.1 億美元。耳垢相關問題在該地區尤其普遍,尤其是在老年人群體中。許多消費者不喜歡尋求臨床治療,而是喜歡使用滴耳液、沖洗套件和高科技清潔工具等家庭解決方案。包括內視鏡清潔器在內的智慧耳垢清除設備的採用正在增加,為使用者提供了更精確、更有效的方法來管理耳垢堆積。非處方藥的供應不受嚴格的監管限制,進一步鼓勵消費者根據醫療保健提供者的建議嘗試這些解決方案,從而促進整體市場的擴張。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 衝擊力

- 成長動力

- 耳朵問題

- 人們對耳朵健康的認知不斷提高

- 耳垢清除產品的創新

- 產業陷阱與挑戰

- 使用這些產品可能造成的損害風險

- 競爭激烈

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年(十億美元)

- 主要趨勢

- 滴耳液

- 油基

- 水性

- 化學基

- 耳燭

- 耳噴霧

- 棉花棒和棉花棒

- 其他(微型吸力裝置、耳匙/刮匙等)

第6章:市場估計與預測:以價格,2021-2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場估計與預測:按最終用途,2021 - 2034 年(十億美元)

- 主要趨勢

- 個人消費者

- 醫療保健專業人員

- 耳鼻喉科專家

- 全科醫生

- 聽力學家

- 醫院和診所

- 其他(安養院、輔助生活設施等)

第8章:市場估計與預測:按配銷通路,2021 - 2034 年(十億美元)

- 主要趨勢

- 線上

- 電子商務網站

- 公司網站

- 離線

- 專賣店

- 大型零售商店

- 製藥

- 其他(個別店舖等)

第9章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 瑪米亞

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Bausch + Lomb

- Black Wolf Nation

- Cerumol (Reckitt Benckiser)

- Doctor Easy Medical Products

- Eosera Inc.

- Hear Right Technologies LLC

- Hydro-Clean (EarTech)

- Johnson & Johnson

- Murine Ear

- Neil Med Pharmaceuticals, Inc.

- Prestige Consumer Healthcare Inc.

- Shenzhen Bebird Technology Co., Ltd.

- Similasan AG

- WaxBGone

The Global Earwax Removal Products Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. The increasing prevalence of ear-related conditions is driving this market expansion as more individuals experience earwax buildup, infections, tinnitus, and hearing loss. Factors such as frequent use of earbuds and headphones, an aging population, and evolving lifestyle habits are contributing to excessive earwax accumulation, fueling the demand for at-home earwax removal solutions. Consumers are becoming increasingly aware of ear hygiene, leading to a strong preference for non-invasive, easy-to-use products that offer effective relief without requiring professional intervention. The shift toward self-care solutions, supported by greater accessibility of over-the-counter (OTC) earwax removal products, is further propelling market growth. Advancements in ear-cleaning technologies, such as smart earwax removal tools and automated irrigation systems, are also gaining traction, particularly among tech-savvy consumers seeking innovative and safer alternatives.

The market encompasses a range of products, including ear drops, ear candles, ear sprays, cotton swabs, and advanced tools like micro-suction devices and ear picks. The ear drops segment generated USD 800 million in 2024 and is expected to grow at a CAGR of 5.9% during the forecast period. The strong demand for ear drops is driven by their ease of use, affordability, and widespread availability. Medical professionals, including doctors and pharmacists, frequently recommend ear drops as a safe and effective solution for individuals who suffer from recurrent earwax buildup. Older adults and hearing aid users are particularly reliant on these products for regular ear hygiene maintenance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 billion |

| Forecast Value | $3.3 billion |

| CAGR | 5.6% |

The market is categorized based on end-users, including individual consumers, healthcare professionals, hospitals and clinics, and other facilities such as nursing homes. In 2024, individual consumers accounted for 40% of the market share, reflecting a growing awareness of ear hygiene and a preference for self-care. With aging-related hearing concerns, genetic predispositions, and increased use of hearing aids and earbuds, more individuals are turning to at-home earwax removal solutions. The rising trend of telehealth consultations and online pharmacy purchases has further enhanced consumer access to these products, making it easier to manage earwax concerns without professional medical visits.

North America earwax removal products market held a 26.4% share, generating USD 510 million in 2024. Earwax-related issues are particularly prevalent in the region, especially among the elderly population. Instead of seeking clinical treatments, many consumers prefer home-based solutions such as ear drops, irrigation kits, and high-tech cleaning tools. The adoption of smart earwax removal devices, including endoscopic cleaners, is on the rise, providing users with a more precise and effective way to manage earwax accumulation. The availability of OTC products without stringent regulatory restrictions further encourages consumers to try these solutions based on recommendations from healthcare providers, boosting overall market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising ear related issues

- 3.9.1.2 Growing awareness of ear health

- 3.9.1.3 Innovations in ear wax removal products

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Risks of damage associated with the use of these products

- 3.9.2.2 High Competition

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Consumer buying behavior

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Ear drops

- 5.2.1 Oil-based

- 5.2.2 Water-based

- 5.2.3 Chemical-based

- 5.3 Ear candles

- 5.4 Ear spray

- 5.5 Cotton Swabs & Buds

- 5.6 Others (Micro suction Devices, Ear Picks/Curettes, etc.)

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End-use, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Individual consumers

- 7.3 Healthcare professionals

- 7.3.1 ENT specialists

- 7.3.2 General practitioners

- 7.3.3 Audiologists

- 7.4 Hospitals and Clinics

- 7.5 Others (Nursing Homes, Assisted Living Facilities, etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-Commerce site

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Mega retail stores

- 8.3.3 Pharma

- 8.3.4 Others (Individual Stores, etc.)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MAMEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Bausch + Lomb

- 10.2 Black Wolf Nation

- 10.3 Cerumol (Reckitt Benckiser)

- 10.4 Doctor Easy Medical Products

- 10.5 Eosera Inc.

- 10.6 Hear Right Technologies LLC

- 10.7 Hydro-Clean (EarTech)

- 10.8 Johnson & Johnson

- 10.9 Murine Ear

- 10.10 Neil Med Pharmaceuticals, Inc.

- 10.11 Prestige Consumer Healthcare Inc.

- 10.12 Shenzhen Bebird Technology Co., Ltd.

- 10.13 Similasan AG

- 10.14 WaxBGone