|

市場調查報告書

商品編碼

1698291

啤酒罐市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Beer Cans Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

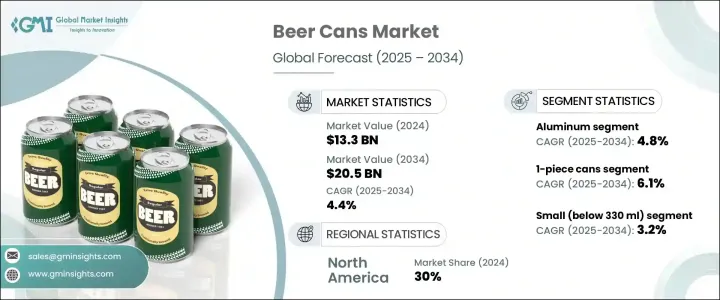

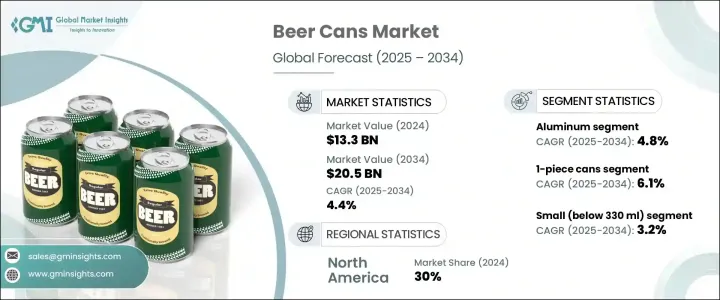

全球啤酒罐市場正在穩步成長,到 2024 年將達到 133 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.4%。啤酒消費量的增加,尤其是精釀啤酒和高階啤酒消費量的增加,是市場擴張的主要驅動力。消費者越來越青睞罐裝啤酒,因為它具有保鮮、阻隔光線和氧氣、便於攜帶等特點。另一方面,啤酒廠正在轉向鋁包裝,因為他們優先考慮永續性、產品保存和成本效益。隨著精釀啤酒產業的持續蓬勃發展,對能夠保留獨特風味和碳酸化的高品質包裝的需求也在激增。

市場參與者也透過關注永續包裝解決方案來應對不斷變化的消費者偏好。鋁罐以其重量輕和可回收性而聞名,正在成為主流的包裝選擇。預計該領域在預測期內的複合年成長率將達到 4.8%,這得益於其能夠提供卓越的保護,抵禦可能影響啤酒品質的外部因素。降低運輸成本和延長產品保存期限使鋁成為大型和小型啤酒廠的首選材料。對環境責任的日益重視進一步強化了這一趨勢,促使啤酒製造商將環保包裝納入其生產策略。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 133億美元 |

| 預測值 | 205億美元 |

| 複合年成長率 | 4.4% |

市場也根據產品類型進行細分,包括一片罐、兩片罐和三片罐。單片罐市場正在經歷強勁成長,預計預測期內複合年成長率將達到 6.1%。這些罐子因其無縫結構而越來越受歡迎,這種結構具有增強的防漏性和耐用性。加壓和充氮啤酒受益於這種形式,使其成為優質和特色啤酒品種的首選。隨著啤酒廠專注於提供高階產品,對單片罐的需求正在加速成長。

北美佔據啤酒罐市場的很大佔有率,佔 2024 年總收入的 30%。高啤酒消費量,尤其是精釀啤酒和高級啤酒,持續推動區域需求。光是在美國,2024 年的市場規模就達 32 億美元,精釀啤酒的日益普及和電子商務管道的不斷擴大支持了市場擴張。發達的鋁回收生態系統和消費者對永續包裝的日益增強的意識促使啤酒廠轉向輕質、環保的罐頭。隨著消費者偏好轉向多樣化的啤酒口味和更高的包裝效率,製造商正在最佳化其生產策略以滿足不斷變化的行業需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 啤酒消費量上升

- 精釀啤酒和高階啤酒市場的成長

- 為實現永續發展,從玻璃瓶轉向鋁罐

- 無酒精和低酒精啤酒的成長

- 成本效率和製造進步

- 產業陷阱與挑戰

- 酒類包裝的監管挑戰與限制

- 來自替代包裝材料的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 鋁

- 鋼

第6章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 單片罐

- 兩片罐

- 三片罐

第7章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 小號(330毫升以下)

- 中號(330 毫升 – 500 毫升)

- 大杯(500毫升以上)

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Ardagh Group

- Asahi Group

- Baixicans

- Ball

- Canpack

- Ceylon Beverage Can

- Crown

- Daiwa Can

- Erjin Packaging

- G3 Enterprises

- Hainan Zhenxi

- Nampak

- Orora Packaging

- Scan Holdings

- Shining Aluminum

- Thai Beverage Can

- Toyo Seikan

- Visy

The Global Beer Cans Market is witnessing steady growth, reaching USD 13.3 billion in 2024, with projections indicating a CAGR of 4.4% between 2025 and 2034. Rising beer consumption, particularly in the craft and premium segments, is a key driver of market expansion. Consumers are increasingly gravitating toward canned beer for its ability to maintain freshness, block light and oxygen exposure, and enhance portability. Breweries, on the other hand, are shifting toward aluminum packaging as they prioritize sustainability, product preservation, and cost efficiency. With the craft beer industry continuing to thrive, demand for high-quality packaging that preserves unique flavors and carbonation is surging.

Market players are also responding to changing consumer preferences by focusing on sustainable packaging solutions. Aluminum cans, known for their lightweight nature and recyclability, are emerging as the dominant packaging choice. This segment is projected to grow at a CAGR of 4.8% during the forecast period, driven by its ability to provide superior protection against external elements that can impact beer quality. Reduced transportation costs and extended product shelf life make aluminum the preferred material for both large and small-scale breweries. The increasing emphasis on environmental responsibility is further reinforcing this trend, prompting beer manufacturers to integrate eco-friendly packaging into their production strategies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.3 Billion |

| Forecast Value | $20.5 Billion |

| CAGR | 4.4% |

The market is also segmented by product type, with 1-piece, 2-piece, and 3-piece cans available. The 1-piece can segment is experiencing robust growth, projected to register a CAGR of 6.1% over the forecast timeline. These cans are gaining popularity due to their seamless structure, which offers enhanced leak protection and durability. Pressurized and nitrogen-infused beers benefit from this format, making it a preferred choice for premium and specialty beer varieties. With breweries focusing on delivering high-end offerings, the demand for 1-piece cans is accelerating.

North America holds a significant share of the beer cans market, accounting for 30% of the total revenue in 2024. High beer consumption, particularly in craft and premium segments, continues to fuel regional demand. The United States alone generated USD 3.2 billion in 2024, with rising craft beer popularity and expanding e-commerce channels supporting market expansion. A well-developed aluminum recycling ecosystem and growing consumer awareness of sustainable packaging are prompting breweries to transition to lightweight, eco-friendly cans. As consumer preferences shift toward diverse beer flavors and improved packaging efficiency, manufacturers are optimizing their production strategies to meet evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising beer consumption

- 3.2.1.2 Growth of craft beer and premium segments

- 3.2.1.3 Shift from glass bottles to aluminum cans for sustainability

- 3.2.1.4 Growth of non-alcoholic & low-alcohol beer

- 3.2.1.5 Cost efficiency & manufacturing advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and restrictions on alcohol packaging

- 3.2.2.2 Competition from alternative packaging materials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Aluminum

- 5.3 Steel

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 1-piece cans

- 6.3 2-piece cans

- 6.4 3-piece cans

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Small (Below 330 ml)

- 7.3 Medium (330 ml – 500 ml)

- 7.4 Large (Above 500 ml)

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 ANZ

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ardagh Group

- 9.2 Asahi Group

- 9.3 Baixicans

- 9.4 Ball

- 9.5 Canpack

- 9.6 Ceylon Beverage Can

- 9.7 Crown

- 9.8 Daiwa Can

- 9.9 Erjin Packaging

- 9.10 G3 Enterprises

- 9.11 Hainan Zhenxi

- 9.12 Nampak

- 9.13 Orora Packaging

- 9.14 Scan Holdings

- 9.15 Shining Aluminum

- 9.16 Thai Beverage Can

- 9.17 Toyo Seikan

- 9.18 Visy