|

市場調查報告書

商品編碼

1698280

腸促胰島素藥物市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Incretin-based Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

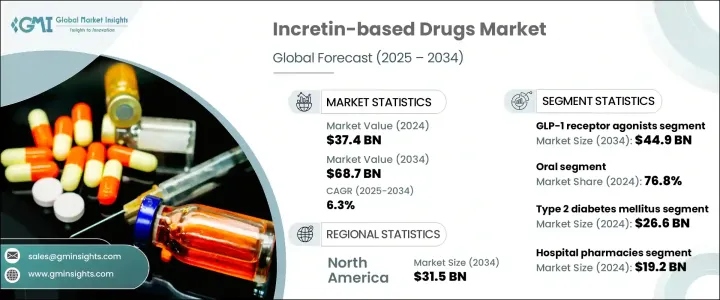

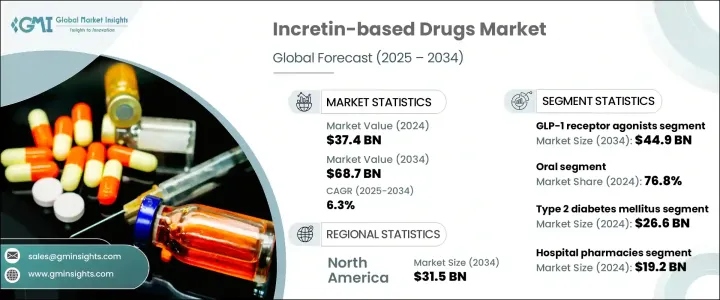

2024 年全球腸促胰島素藥物市值為 374 億美元,預計 2025 年至 2034 年的複合年成長率為 6.3%。腸促胰島素藥物透過刺激腸道荷爾蒙分泌胰島素來幫助控制第 2 型糖尿病,進而調節餐後血糖值。糖尿病盛行率不斷上升,主要是由於肥胖、人口老化和久坐不動的生活方式,這是推動市場擴張的關鍵因素。患者意識的提高、藥物配方的進步以及糖尿病治療的可及性的提高進一步支持了這一成長。

市場按藥物類型分為 GLP-1 受體激動劑和 DPP-4 抑制劑,2023 年市場規模為 355 億美元。 GLP-1 受體激動劑的需求不斷成長,是因為它們能夠增強胰島素分泌、抑制胰高血糖素水平,從而有效控制血糖。這些藥物還可以透過控制食慾和減緩消化來促進減肥,因此成為糖尿病患者的首選。緩釋製劑(例如每週注射一次)可提高患者的依從性並擴大市場範圍。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 374億美元 |

| 預測值 | 687億美元 |

| 複合年成長率 | 6.3% |

根據給藥途徑,市場也分為口服藥物和注射藥物。 2024 年口服藥物市場規模將達到 287 億美元,市佔率為 76.8%。口服製劑提供了一種比注射更方便的替代方法,從而提高了患者的依從性。持續的研究努力提高了療效和安全性,使得口服藥物越來越受歡迎。這些配方易於分發、儲存和管理,減輕了醫療保健提供者的負擔,並提高了各個醫療保健機構的可近性。

根據適應症,市場包括第 2 型糖尿病、肥胖症和體重管理以及其他代謝紊亂。 2 型糖尿病領域佔最大佔有率,2024 年創造收入 266 億美元。由於不良的飲食習慣和生活方式因素,全球 2 型糖尿病發生率不斷上升,刺激了對腸促胰島素類藥物的需求。這些藥物有效降低血糖水平,同時降低低血糖的風險,為老年族群和血糖波動較大的人提供更安全的治療選擇。

配銷通路部分包括醫院藥房、零售藥房和電子商務。醫院藥局在 2024 年以 192 億美元的收入領先市場。這些設定確保了安全獲得藥物,特別是對於新診斷的患者或需要專門護理的患者。藥師提供有關劑量、副作用和配方差異的指導,增強治療順從性。全面的支援服務(包括藥物管理計劃和密切監測治療反應)進一步促進了市場成長。

北美佔據市場主導地位,2024 年市場規模將達 171 億美元,其中美國市場規模最高,為 155 億美元。糖尿病、心血管疾病和肥胖症的盛行率不斷上升,持續推動對腸促胰島素類藥物的需求。支持性的監管框架和藥物開發的快速進步促進了該地區市場的擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 2型糖尿病盛行率上升

- 轉向非胰島素療法

- 藥物傳輸技術的進步

- 心血管和體重管理益處

- 產業陷阱與挑戰

- 治療費用高

- 不良反應和禁忌症

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類型,2021 年至 2034 年

- 主要趨勢

- GLP-1受體激動劑

- DPP-4抑制劑

第6章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

第7章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 2型糖尿病

- 肥胖和體重管理

- 其他代謝紊亂

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AstraZeneca

- Boehringer Ingelheim

- Eli Lilly and Company

- GlaxoSmithKline

- Lupin Limited

- Merck

- Novo Nordisk

- Pfizer

- Sanofi

- Takeda Pharmaceutical Company

- Viatris

The Global Incretin-Based Drugs Market was valued at USD 37.4 billion in 2024 and is predicted to grow at a CAGR of 6.3% from 2025 to 2034. Incretin-based drugs help manage type 2 diabetes by stimulating insulin secretion through gut hormones, which regulate blood sugar levels after meals. The growing prevalence of diabetes, primarily due to obesity, aging populations, and sedentary lifestyles, is a key factor driving market expansion. Increasing patient awareness, advancements in drug formulations, and improved accessibility to diabetes treatments further support this growth.

The market is categorized by drug type into GLP-1 receptor agonists and DPP-4 inhibitors, with a market size of USD 35.5 billion in 2023. The rising demand for GLP-1 receptor agonists is driven by their ability to enhance insulin secretion and suppress glucagon levels, effectively managing blood sugar. These drugs also promote weight loss by controlling appetite and slowing digestion, making them a preferred option for diabetes patients. Extended-release formulations, such as once-weekly injections, improve patient adherence and expand market reach.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $37.4 Billion |

| Forecast Value | $68.7 Billion |

| CAGR | 6.3% |

The market is also segmented by the route of administration into oral and injectable drugs. The oral segment accounted for USD 28.7 billion in 2024, with a market share of 76.8%. Oral formulations offer a convenient alternative to injections, leading to higher patient compliance. Continuous research efforts have led to improved efficacy and safety profiles, making oral medications increasingly preferred. These formulations are easy to distribute, store, and administer, reducing the burden on healthcare providers and enhancing accessibility across various healthcare settings.

By indication, the market includes type 2 diabetes mellitus, obesity and weight management, and other metabolic disorders. The type 2 diabetes mellitus segment held the largest share, generating USD 26.6 billion in revenue in 2024. The rising global incidence of type 2 diabetes, attributed to poor dietary habits and lifestyle factors, fuels the demand for incretin-based drugs. These medications effectively lower blood sugar levels while reducing the risk of hypoglycemia, offering a safer treatment option for aging populations and those prone to severe blood sugar fluctuations.

The distribution channel segment comprises hospital pharmacies, retail pharmacies, and e-commerce. Hospital pharmacies led the market with USD 19.2 billion in revenue in 2024. These settings ensure secure access to medications, particularly for newly diagnosed patients or those requiring specialized care. Pharmacists provide guidance on dosage, side effects, and formulation differences, enhancing treatment adherence. Comprehensive support services, including medication management programs and close monitoring of treatment responses, further contribute to market growth.

North America dominated the market, accounting for USD 17.1 billion in 2024, with the U.S. leading at USD 15.5 billion. The rising prevalence of diabetes, cardiovascular diseases, and obesity continues to drive demand for incretin-based drugs. Supportive regulatory frameworks and rapid advancements in drug development contribute to the region's market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of type 2 diabetes mellitus

- 3.2.1.2 Shift toward non-insulin therapies

- 3.2.1.3 Advancements in drug delivery technologies

- 3.2.1.4 Cardiovascular and weight management benefits

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Adverse effects and contraindications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 GLP-1 receptor agonists

- 5.3 DPP-4 inhibitors

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 2 diabetes mellitus

- 7.3 Obesity and weight management

- 7.4 Other metabolic disorders

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Boehringer Ingelheim

- 10.3 Eli Lilly and Company

- 10.4 GlaxoSmithKline

- 10.5 Lupin Limited

- 10.6 Merck

- 10.7 Novo Nordisk

- 10.8 Pfizer

- 10.9 Sanofi

- 10.10 Takeda Pharmaceutical Company

- 10.11 Viatris