|

市場調查報告書

商品編碼

1698279

學生資訊系統市場機會、成長動力、產業趨勢分析及預測(2025-2034)Student Information System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

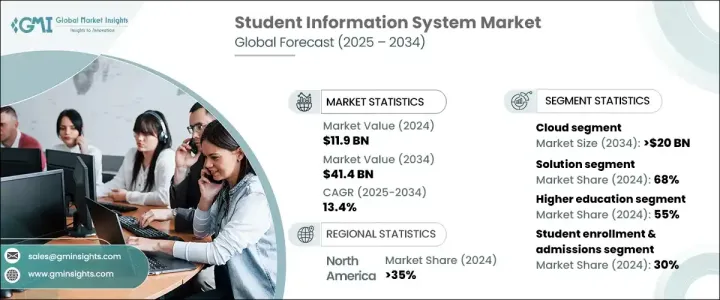

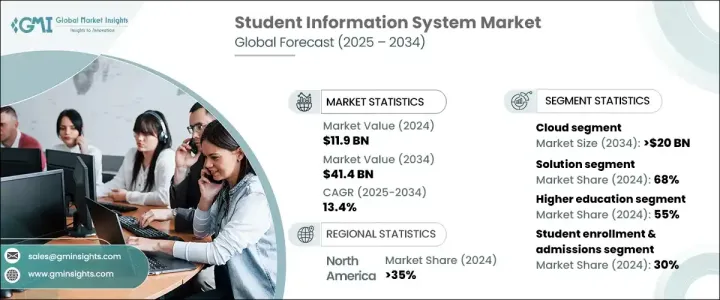

2024 年全球學生資訊系統市場價值為 119 億美元,預計 2025 年至 2034 年期間的複合年成長率為 13.4%。隨著教育機構專注於提高學生的參與度和保留率,對個人化學習解決方案的需求正在推動市場成長。人工智慧和分析技術正在整合到這些系統中,以增強學習體驗、追蹤成就並提供自適應回饋。學校和學院擴大採用基於雲端的平台,因為它們具有可擴展性、成本效益以及即時存取學生記錄的功能。隨著機構向基於雲端的解決方案過渡,安全性和對 FERPA 和 GDPR 等法規的遵守仍然是至關重要的問題。

區塊鏈技術正在改變文憑和成績單等教育記錄的驗證方式。各機構正在利用區塊鏈來確保證書的真實性、簡化管理流程並減少詐欺。行動優先學生資訊系統的興起使得學生、教師和管理人員可以更輕鬆地透過智慧型手機和平板電腦查看成績、課程安排和課程作業。隨著行動裝置的普及,這些解決方案正在增強參與度並最佳化管理功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 119億美元 |

| 預測值 | 414億美元 |

| 複合年成長率 | 13.4% |

學生資訊系統市場依部署模式分為雲端和本地解決方案。 2024 年,基於雲端的 SIS 佔據了 60% 以上的市場佔有率,預計到 2034 年將超過 200 億美元。教育機構更喜歡基於雲端的系統,因為它們具有集中存取、較低的基礎設施成本以及與學習管理系統和財務援助平台的無縫整合。人工智慧驅動的分析在識別有風險的學生、自動評分和個人化學習體驗方面也發揮著重要作用。透過管理學生諮詢和入學,人工智慧聊天機器人的使用進一步簡化了管理流程。

基於訂閱的定價模式使各種規模的機構更容易獲得 SIS 解決方案。基於雲端的 SIS 無需大量的前期投資,使小型學校能夠以可承受的價格利用先進的技術。然而,長期訂閱成本和對第三方提供者的依賴仍然是採用基於雲端的系統的機構的主要考慮因素。

自動化和人工智慧分析正在重塑學生入學、入學和經濟援助管理。 SIS 平台現在能夠分析歷史資料來預測學生的成功率和輟學率,從而幫助機構完善其招募策略。自動聊天機器人和虛擬助理透過即時解答學生的疑問來改善招生流程。此外,透過人工智慧驅動的詐欺預防、透明的贈款分配和數位支付解決方案,財政援助管理變得更有效率。行動應用程式現在允許學生監控財務援助申請並存取安全的即時帳單資訊。

2024 年,高等教育機構約佔 SIS 市場的 55%,其中基於雲端的解決方案推動成長。這些平台為學生、教師和管理員提供對學術資料的無縫訪問,從而實現靈活的學習模式。即時分析正在幫助機構最佳化資源、提高學生保留率並實施數據驅動的決策。到 2024 年,學生招生和入學領域將佔據約 30% 的市場佔有率,自動化將減少行政工作量並提高效率。人工智慧驅動的招生工具正在簡化文件驗證、申請追蹤和學生拓展。

2024 年,北美引領全球 SIS 市場,其中美國佔據主導地位。該地區的機構在採用行動友善 SIS 解決方案的同時,優先考慮遵守資料安全法規。這些平台為學生提供即時存取學術資訊的管道,促進與教師的溝通並簡化管理任務。對行動技術的日益依賴正在推動教育機構提高用戶參與度和營運效率。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 解決方案提供者

- 服務提供者

- 技術提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 教育機構採用雲端的系統

- 教育領域對數據驅動決策的需求日益成長

- 個人化學習體驗的需求不斷成長

- 整合人工智慧進行學生資料分析

- 產業陷阱與挑戰

- 基於雲端的學生資訊系統的資料安全問題

- 系統實施和維護成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 註冊

- 學者

- 經濟援助

- 計費

- 服務

- 專業的

- 託管

第6章:市場估計與預測:依部署模式,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- K-12 教育

- 高等教育

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 學生入學和錄取

- 出勤追蹤和監控

- 財務管理

- 通訊和通知

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Anthology

- Anubavam

- Arth Infosoft

- Blackboard

- Campus Management

- Canvas by Instructure

- ComSpec International

- Ellucian

- Focus School Software

- Illuminate Education

- ITG America

- Jenzabar

- Moodle

- Oracle

- SAP

- Skyward

- Tribal Group

- Unit4

- Veracross

- Workday

The Global Student Information System Market was valued at USD 11.9 billion in 2024 and is expected to grow at a CAGR of 13.4% between 2025 and 2034. The demand for personalized learning solutions is driving market growth as educational institutions focus on improving student engagement and retention. AI and analytics are being integrated into these systems to enhance the learning experience, track achievements, and provide adaptive feedback. Schools and colleges are increasingly adopting cloud-based platforms for their scalability, cost-effectiveness, and real-time access to student records. Security and compliance with regulations such as FERPA and GDPR remain crucial concerns as institutions transition to cloud-based solutions.

Blockchain technology is transforming how educational records, including diplomas and transcripts, are verified. Institutions are leveraging blockchain to ensure credential authenticity, streamline administrative processes, and reduce fraud. The rise of mobile-first student information systems is making it easier for students, faculty, and administrators to access grades, schedules, and coursework from smartphones and tablets. As mobile adoption increases, these solutions are enhancing engagement and optimizing administrative functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $41.4 Billion |

| CAGR | 13.4% |

The student information system market is segmented by deployment mode into cloud and on-premises solutions. In 2024, cloud-based SIS held over 60% of the market and is projected to surpass USD 20 billion by 2034. Educational institutions prefer cloud-based systems due to their centralized access, lower infrastructure costs, and seamless integration with learning management systems and financial aid platforms. AI-driven analytics are also playing a significant role in identifying at-risk students, automating grading, and personalizing learning experiences. The use of AI-powered chatbots is further streamlining administrative processes by managing student inquiries and enrollment.

Subscription-based pricing models are making SIS solutions more accessible for institutions of all sizes. Cloud-based SIS eliminates the need for significant upfront investments, enabling smaller schools to leverage advanced technology affordably. However, long-term subscription costs and reliance on third-party providers remain key considerations for institutions adopting cloud-based systems.

Automation and AI-powered analytics are reshaping student enrollment, admissions, and financial aid management. SIS platforms are now capable of analyzing historical data to predict student success and dropout rates, thereby assisting institutions in refining their recruitment strategies. Automated chatbots and virtual assistants are improving the admissions process by addressing student inquiries in real-time. Additionally, financial aid management is becoming more efficient through AI-driven fraud prevention, transparent grant distribution, and digital payment solutions. Mobile applications now allow students to monitor financial aid applications and access secure, real-time billing information.

Higher education institutions accounted for approximately 55% of the SIS market in 2024, with cloud-based solutions driving growth. These platforms enable flexible learning models by providing seamless access to academic data for students, faculty, and administrators. Real-time analytics are helping institutions optimize resources, improve student retention, and implement data-driven decision-making. The student enrollment and admissions segment held around 30% of the market in 2024, with automation reducing administrative workload and improving efficiency. AI-driven enrollment tools are streamlining document verification, application tracking, and student outreach.

North America led the global SIS market in 2024, with the United States holding a dominant share. Institutions in the region are prioritizing compliance with data security regulations while adopting mobile-friendly SIS solutions. These platforms provide students with instant access to academic information, facilitating communication with faculty and simplifying administrative tasks. The increasing reliance on mobile technology is driving greater user engagement and operational efficiency across educational institutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution provider

- 3.1.2 Services provider

- 3.1.3 Technology provider

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Adoption of cloud-based systems in educational institutions

- 3.7.1.2 Increasing need for data-driven decision-making in education

- 3.7.1.3 Rising demand for personalized learning experiences

- 3.7.1.4 Integration of AI for student data analysis

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data security concerns with cloud-based student information systems

- 3.7.2.2 High costs associated with system implementation and maintenance

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Enrollment

- 5.2.2 Academics

- 5.2.3 Financial Aid

- 5.2.4 Billing

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 K-12 Education

- 7.3 Higher Education

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Student enrollment & admissions

- 8.3 Attendance tracking & monitoring

- 8.4 Financial management

- 8.5 Communication & notifications

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Anthology

- 10.2 Anubavam

- 10.3 Arth Infosoft

- 10.4 Blackboard

- 10.5 Campus Management

- 10.6 Canvas by Instructure

- 10.7 ComSpec International

- 10.8 Ellucian

- 10.9 Focus School Software

- 10.10 Illuminate Education

- 10.11 ITG America

- 10.12 Jenzabar

- 10.13 Moodle

- 10.14 Oracle

- 10.15 SAP

- 10.16 Skyward

- 10.17 Tribal Group

- 10.18 Unit4

- 10.19 Veracross

- 10.20 Workday