|

市場調查報告書

商品編碼

1698255

液體包裝紙盒市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Liquid Packaging Cartons Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

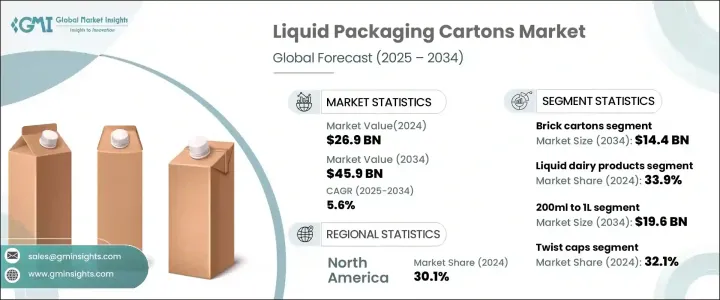

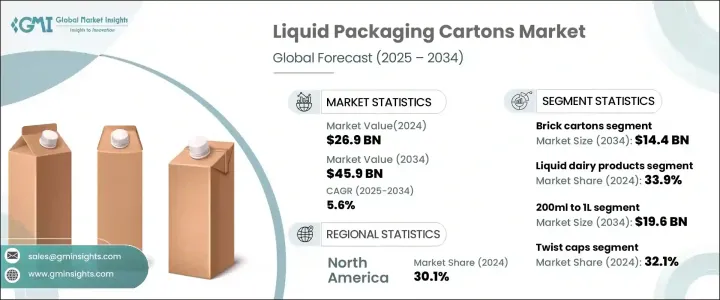

2024 年全球液體包裝紙盒市場價值為 269 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.6%。包裝飲料需求的不斷成長和電子商務行業的蓬勃發展正在推動市場擴張。隨著消費者尋求方便、持久、安全的液體包裝解決方案,市場持續穩定成長。人們對永續包裝的認知不斷提高也促進了市場樂觀的前景,各大品牌紛紛投資環保替代品以減少塑膠垃圾。

無菌包裝是推動這一成長的關鍵因素,它可以讓液體產品保持其品質和安全,同時延長保存期限。對乳製品、果汁、植物飲料和液體食品的偏好繼續加速液體包裝紙盒的採用。此外,行動消費趨勢的興起也推動飲料製造商採用緊湊、易於使用的紙盒解決方案。食品配送服務的擴張以及對強化飲料和有機飲料的日益成長的偏好進一步促進了市場發展勢頭。隨著監管機構加強對塑膠包裝的限制,製造商正在迅速創新,提供可回收和可生物分解的紙盒解決方案,確保符合環境標準。隨著這些趨勢的不斷發展,液體包裝紙盒市場將在未來幾年持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 269億美元 |

| 預測值 | 459億美元 |

| 複合年成長率 | 5.6% |

市場按類型細分,其中磚紙箱、山牆頂紙箱、異形紙箱和其他紙箱佔據行業領先地位。磚盒因其耐用性、高效的空間利用率和較長的保存期限而佔據主導地位。這些紙盒廣泛用於乳製品和果汁包裝,提供無菌保護,確保產品無菌和安全。它們無需冷藏即可延長保存期限,因此成為迎合全球市場的品牌的首選。隨著注重健康的消費者對無防腐劑產品的需求,無菌磚盒正在成為行業標準,確保更長時間的新鮮度,同時保持產品的完整性。

市場也按應用分類,主要細分市場包括液體食品、液體乳製品、非碳酸軟性飲料和酒精飲料。 2024年,受全球乳製品消費量成長的推動,液態乳製品領域佔據了相當大的市場佔有率。強化和調味乳製品尤其刺激了先進包裝解決方案的需求。採用高阻隔塗層的無菌紙盒在乳製品行業中越來越受歡迎,無需冷藏即可保持品質並延長保存期限。

美國液體包裝紙盒市場預計將大幅成長,到 2034 年將達到 143 億美元。健康意識的增強以及杏仁奶和燕麥奶等植物飲料的日益普及是主要的成長動力。製造商正在迅速採用無菌包裝解決方案來延長保存期限並保持產品新鮮度。這種向更持久、更永續的包裝解決方案的轉變預計將推動美國及其他地區液體包裝紙盒市場的成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 包裝飲料消費量增加

- 對永續和環保包裝解決方案的需求不斷成長

- 乳製品消費量成長

- 擴大電子商務和送貨上門服務

- 即飲(RTD)飲料市場的成長

- 產業陷阱與挑戰

- 初始生產和回收成本高

- 碳酸飲料適用性有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 磚紙箱

- 山牆式液體紙盒

- 異形紙盒

- 其他

第6章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 最多 200 毫升

- 200毫升至1公升

- 1公升以上

第7章:市場估計與預測:按關閉類型,2021 年至 2034 年

- 主要趨勢

- 剪開或撕開

- 旋蓋

- 拉環

- 草洞

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 液態乳製品

- 非碳酸軟性飲料

- 流質食物

- 酒精飲料

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Adam Pack

- Atlas Packaging

- Elopak

- Graphic Packaging International

- Lami Packaging

- Mondi

- Nippon Paper Industries

- Oji Holdings

- Pactiv Evergreen

- Refresco Group

- Rotopacking Materials

- SIG Combibloc Group

- Smurfit Kappa Group

- Stora Enso

- Tetra Pak International

- UFlex (Asepto)

The Global Liquid Packaging Cartons Market was valued at USD 26.9 billion in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. The rising demand for packaged beverages and the booming e-commerce sector are fueling market expansion. As consumers seek convenient, long-lasting, and safe packaging solutions for liquids, the market continues to grow at a steady pace. Increasing awareness of sustainable packaging is also contributing to the market's positive outlook, with brands investing in eco-friendly alternatives to reduce plastic waste.

Aseptic packaging is a key factor driving this growth, allowing liquid products to retain their quality and safety while extending shelf life. The preference for dairy, juices, plant-based beverages, and liquid foods continues to accelerate the adoption of liquid packaging cartons. In addition, the rise of on-the-go consumption trends is pushing beverage manufacturers to adopt compact, easy-to-use carton solutions. The expansion of food delivery services and the increasing preference for fortified and organic beverages further contribute to market momentum. With regulatory bodies tightening restrictions on plastic packaging, manufacturers are rapidly innovating to provide recyclable and biodegradable carton solutions, ensuring compliance with environmental standards. As these trends gain traction, the liquid packaging cartons market is positioned for sustained growth in the years ahead.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $26.9 Billion |

| Forecast Value | $45.9 Billion |

| CAGR | 5.6% |

The market is segmented by type, with brick cartons, gable top cartons, shaped cartons, and others leading the industry. Brick cartons dominate due to their durability, efficient space utilization, and long shelf life. These cartons are widely used in dairy and juice packaging, offering aseptic protection that ensures product sterility and safety. Their ability to extend shelf life without refrigeration makes them a preferred choice for brands catering to global markets. As health-conscious consumers demand preservative-free options, aseptic brick cartons are becoming an industry standard, ensuring longer freshness while maintaining product integrity.

The market is also categorized by application, with key segments including liquid foods, liquid dairy products, non-carbonated soft drinks, and alcoholic beverages. In 2024, the liquid dairy products segment held a significant market share, driven by increasing global dairy consumption. Fortified and flavored dairy products are particularly fueling demand for advanced packaging solutions. Aseptic cartons, which feature high-barrier coatings, are gaining traction in the dairy sector, preserving quality and extending shelf life without the need for refrigeration.

The U.S. liquid packaging cartons market is set to grow significantly, reaching USD 14.3 billion by 2034. Rising health awareness and the growing popularity of plant-based beverages, such as almond and oat milk, are key growth drivers. Manufacturers are rapidly adopting aseptic packaging solutions to improve shelf life and maintain product freshness. This transition toward longer-lasting and sustainable packaging solutions is expected to propel the growth of the liquid packaging cartons market across the U.S. and beyond.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing consumption of packaged beverages

- 3.2.1.2 Rising demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Growth in dairy product consumption

- 3.2.1.4 Expansion of e-commerce and home delivery services

- 3.2.1.5 Growth in the ready-to-drink (RTD) beverage market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial production and recycling costs

- 3.2.2.2 Limited suitability for carbonated beverages

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 5.1 Key trends

- 5.2 Brick cartons

- 5.3 Gable top liquid cartons

- 5.4 Shaped cartons

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Bn & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 200ml

- 6.3 200ml to 1l

- 6.4 Above 1l

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 – 2034 (USD Bn & Kilo Tons)

- 7.1 Key trends

- 7.2 Cut or tear-open

- 7.3 Twist caps

- 7.4 Pull tabs

- 7.5 Straw hole

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 Liquid dairy products

- 8.3 Non-carbonated soft drinks

- 8.4 Liquid foods

- 8.5 Alcoholic drinks

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adam Pack

- 10.2 Atlas Packaging

- 10.3 Elopak

- 10.4 Graphic Packaging International

- 10.5 Lami Packaging

- 10.6 Mondi

- 10.7 Nippon Paper Industries

- 10.8 Oji Holdings

- 10.9 Pactiv Evergreen

- 10.10 Refresco Group

- 10.11 Rotopacking Materials

- 10.12 SIG Combibloc Group

- 10.13 Smurfit Kappa Group

- 10.14 Stora Enso

- 10.15 Tetra Pak International

- 10.16 UFlex (Asepto)