|

市場調查報告書

商品編碼

1698229

永續供應鏈區塊鏈市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Blockchain for Sustainable Supply Chains Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

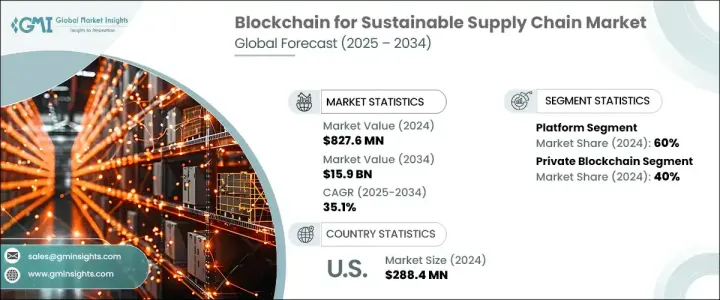

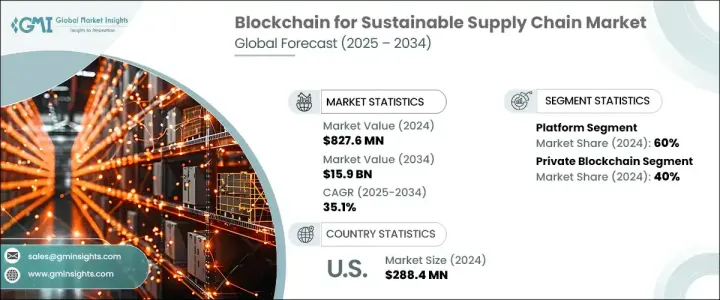

2024 年,全球永續供應鏈區塊鏈市場規模達到 8.276 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 35.1%,這得益於供應鏈營運對透明度、效率和問責性日益成長的需求。隨著企業尋求解決方案以減輕詐欺、增強可追溯性並遵守環境、社會和治理 (ESG) 標準,供應鏈對區塊鏈技術的需求正在激增。企業正在利用區塊鏈來簡化營運、提高對碳中和法規的遵守程度並促進永續的實踐。對負責任的採購和道德商業行為的日益重視也加速了各行各業對區塊鏈的採用。公司正在利用區塊鏈解決方案與利益相關者建立信任、自動化合規性驗證並增強貨物的即時追蹤。此外,該技術提供不可變記錄和確保資料完整性的能力使其成為現代供應鏈不可或缺的一部分。

永續供應鏈區塊鏈市場按組件細分為平台和服務。 2024 年,平台領域佔據市場主導地位,佔有約 60% 的佔有率,預計到 2034 年將超過 90 億美元。區塊鏈平台有助於幫助公司追蹤永續發展工作、減少詐欺並提高供應鏈透明度。這些平台透過提供碳權追蹤和交易等功能,促進遵守 ESG 要求和碳中和目標。企業擴大投資區塊鏈平台來驗證碳補償聲明並創建更永續的供應鏈生態系統。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.276億美元 |

| 預測值 | 159億美元 |

| 複合年成長率 | 35.1% |

根據技術,市場分為公共區塊鏈、私有區塊鏈和聯盟區塊鏈。私有區塊鏈領域在 2024 年佔據了 40% 的市場佔有率,在需要高水準資料保密性和營運控制的商業供應鏈中廣泛應用。與公共區塊鏈不同,私有區塊鏈限制授權參與者的訪問,確保安全且有效率的資料管理。這些區塊鏈提供了更快的交易速度,並廣泛應用於食品和農業、醫療保健和高價值供應鏈等大規模工業應用。奢侈品和製藥等行業擴大部署私有區塊鏈解決方案,以防止假冒並加強來源追蹤,確保真實性和法規遵從性。

北美在永續供應鏈區塊鏈市場中處於領先地位,到 2024 年將佔據 40% 的佔有率。光是美國一國在 2024 年就創造了 2.884 億美元的收入,這得益於持續的技術進步、強力的政府支持和戰略性商業投資。美國政府正在積極探索區塊鏈應用,以增強供應鏈的安全性和透明度。聯邦機構正在評估區塊鏈技術提高營運效率、簡化文件和加強詐欺預防措施的潛力。隨著監管措施和企業對永續發展的承諾不斷增加,區塊鏈有望成為北美及其他地區供應鏈管理不可或缺的一部分。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 人工智慧軟體供應商

- 服務提供者

- 數據提供者

- 系統整合商

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 案例研究

- 衝擊力

- 成長動力

- 電子商務的興起以及消費者對透明和道德產品的需求不斷增加

- 監管框架和心電圖合規性以實現永續性

- 預防詐欺和減少假冒的必要性

- 高效率的供應鏈管理和成本降低

- 產業陷阱與挑戰

- 實施成本高

- 跨產業缺乏互通性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 平台

- 服務

- 維護服務

- 諮詢服務

- 整合服務

第6章:市場估計與預測:依部署模型,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第7章:市場估計與預測:依組織規模,2021 - 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第8章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 公有區塊鏈

- 私有區塊鏈

- 聯盟區塊鏈

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 供應鏈可追溯性

- 認證管理

- 碳足跡追蹤

- 廢棄物管理

- 供應商合規性

第10章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 農業和食品

- 時尚與紡織品

- 製藥

- 汽車

- 零售和消費品

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- AgriLedger

- Blockchain Helix

- CargoX

- Circularise

- ConsenSys

- Etherisc

- Everledger

- Food Trust

- Hyperledger

- IBM

- Microsoft

- Oracle

- OriginTrail

- Provenance

- R3

- Ripe.io

- SAP

- TraceLink

- TradeLens

- VeChain

The Global Blockchain For Sustainable Supply Chains Market reached USD 827.6 million in 2024 and is projected to register a robust CAGR of 35.1% between 2025 and 2034, driven by the increasing need for transparency, efficiency, and accountability in supply chain operations. The demand for blockchain technology in supply chains is surging as companies seek solutions to mitigate fraud, enhance traceability, and comply with environmental, social, and governance (ESG) standards. Enterprises are leveraging blockchain to streamline their operations, improve compliance with carbon neutrality regulations, and foster sustainable practices. The growing emphasis on responsible sourcing and ethical business practices is also accelerating blockchain adoption across industries. Companies are utilizing blockchain-powered solutions to establish trust with stakeholders, automate compliance verification, and enhance real-time tracking of goods. Additionally, the technology's ability to provide immutable records and ensure data integrity is making it indispensable for modern supply chains.

The blockchain for sustainable supply chains market is segmented by component into platforms and services. In 2024, the platform segment dominated the market with a share of approximately 60% and is expected to surpass USD 9 billion by 2034. Blockchain platforms are instrumental in helping companies track sustainability efforts, reduce fraud, and enhance supply chain transparency. These platforms facilitate compliance with ESG mandates and carbon neutrality goals by offering features such as carbon credit tracing and trading. Businesses are increasingly investing in blockchain platforms to verify carbon offset claims and create a more sustainable supply chain ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $827.6 Million |

| Forecast Value | $15.9 Billion |

| CAGR | 35.1% |

By technology, the market is classified into public blockchain, private blockchain, and consortium blockchain. The private blockchain segment accounted for 40% of the market in 2024, with strong adoption in business supply chains that require high levels of data confidentiality and operational control. Unlike public blockchains, private blockchains restrict access to authorized participants, ensuring secure and efficient data management. These blockchains offer a faster transaction speed and are widely adopted in large-scale industrial applications, including food and agriculture, healthcare, and high-value supply chains. Industries such as luxury goods and pharmaceuticals are increasingly deploying private blockchain solutions to prevent counterfeiting and enhance provenance tracking, ensuring authenticity and regulatory compliance.

North America is leading the blockchain for sustainable supply chains market, holding a 40% share in 2024. The U.S. alone generated USD 288.4 million in 2024, supported by continuous technological advancements, strong government backing, and strategic business investments. The U.S. government is actively exploring blockchain applications to enhance supply chain security and transparency. Federal agencies are assessing the potential of blockchain technology to improve operational efficiency, streamline documentation, and enhance fraud prevention measures. With increasing regulatory initiatives and corporate commitments toward sustainability, blockchain is poised to become an integral component of supply chain management in North America and beyond.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 AI software providers

- 3.1.2 Service providers

- 3.1.3 Data providers

- 3.1.4 System integrators

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case studies

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in e-commerce and increasing consumer demand for transparent & ethical products

- 3.9.1.2 Regulatory frameworks and ECG compliance to attain sustainability

- 3.9.1.3 Need for fraud prevention and counterfeit reduction

- 3.9.1.4 Efficient supply chain management and cost reduction

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High implementation costs

- 3.9.2.2 Lack of interoperability across industries

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Platform

- 5.3 Services

- 5.3.1 Maintenance services

- 5.3.2 Consulting services

- 5.3.3 Integration services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud-based

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 SME

- 7.3 Large enterprises

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Public blockchain

- 8.3 Private blockchain

- 8.4 Consortium blockchains

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Supply chain traceability

- 9.3 Certification management

- 9.4 Carbon footprint tracking

- 9.5 Waste management

- 9.6 Supplier compliance

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Agriculture & food

- 10.3 Fashion & textiles

- 10.4 Pharmaceuticals

- 10.5 Automotive

- 10.6 Retail & consumer goods

- 10.7 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 AgriLedger

- 12.2 Blockchain Helix

- 12.3 CargoX

- 12.4 Circularise

- 12.5 ConsenSys

- 12.6 Etherisc

- 12.7 Everledger

- 12.8 Food Trust

- 12.9 Hyperledger

- 12.10 IBM

- 12.11 Microsoft

- 12.12 Oracle

- 12.13 OriginTrail

- 12.14 Provenance

- 12.15 R3

- 12.16 Ripe.io

- 12.17 SAP

- 12.18 TraceLink

- 12.19 TradeLens

- 12.20 VeChain