|

市場調查報告書

商品編碼

1685233

再處理醫療器材市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Reprocessed Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

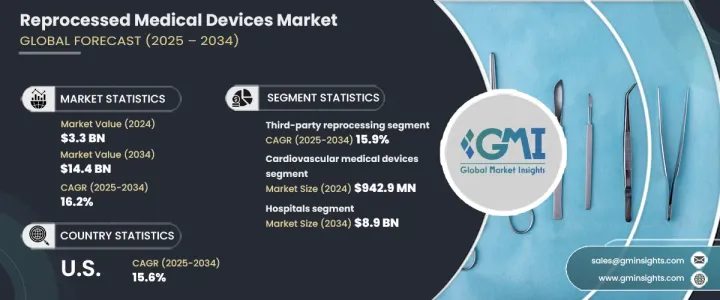

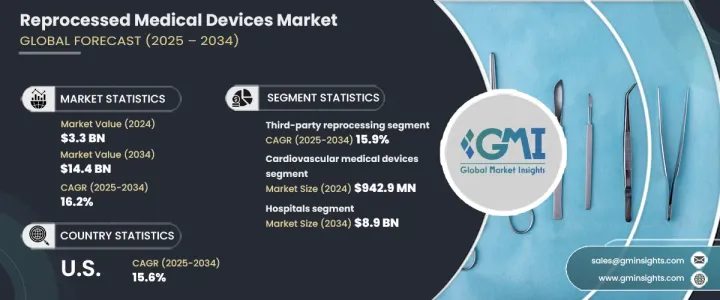

2024 年全球再處理醫療器材市場規模達到 33 億美元,預計 2025 年至 2034 年期間的複合年成長率為 16.2%。這一成長得益於再處理技術的進步、一次性設備再處理需求的不斷成長以及對感染控制的高度關注。發展中地區醫療保健服務的拓展也對市場成長發揮至關重要的作用。強調再處理設備的安全性、效率和環境效益的教育計畫得到了醫療保健提供者和患者的廣泛認可,從而進一步推動了市場擴張。

環境問題是影響市場的另一個關鍵因素。減少醫療廢棄物的需求日益增加,促使醫療保健提供者採取永續的做法。再處理醫療器材可最大限度地減少浪費,符合全球永續發展努力,並確保遵守嚴格的環境法規。這些因素持續推動全球對再處理設備的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 144億美元 |

| 複合年成長率 | 16.2% |

再處理醫療器械最初設計為一次性使用,在重新使用前要經過徹底清潔、消毒、滅菌和測試,以滿足高安全和性能標準。市場按產品類型細分,其中心血管醫療設備的收入最高,2024 年為 9.429 億美元。

市場還根據再加工類型進行分類,包括第三方再加工和內部再加工。 2024 年第三方再處理的市場規模為 27 億美元,預計到 2034 年複合年成長率將達到 15.9%。這些專業服務為醫院和醫療中心節省了大量成本,確保設備符合嚴格的安全和監管要求。第三方再處理商的專業知識可協助醫療機構維持合規性,同時降低營運成本。

在最終用戶方面,醫院佔據主導地位,預計到 2034 年將達到 89 億美元。醫療保健產業的成本壓力持續上升,使得再處理醫療器材成為新設備的有吸引力的替代品。醫院可以透過重複使用設備來最佳化預算,同時又不損害病患的安全。此外,醫療保健產業對永續發展的推動正在增加再加工設備的採用,減少對一次性塑膠的需求,並降低對環境的影響。

2024 年美國再處理醫療器材市場價值為 14 億美元,預計到 2034 年複合年成長率將達到 15.6%。醫療成本的上漲促使醫院和醫療中心尋求具有成本效益的解決方案。 FDA 制定了明確的監管指南,確保再處理設備符合嚴格的安全和性能標準,從而增強醫療保健提供者的信心並推動全國範圍內的採用。

。目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 永續廢棄物處理方法的有利監管環境

- 價格實惠,加上新興經濟體經銷商網路不斷加強

- 再加工產品在眾多心臟手術和血壓監測的應用日益增多

- 產業陷阱與挑戰

- 手術部位感染的風險

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 波特的分析

- PESTEL 分析

- 差距分析

- 醫療器材再處理涉及的步驟

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 — 2034 年

- 主要趨勢

- 心血管醫療器材

- 血壓袖帶/止血帶袖帶

- 診斷電生理導管

- 電生理學電纜

- 心臟穩定和定位裝置

- 深部靜脈壓迫袖套(DVT)

- 其他心血管醫療器材

- 腹腔鏡

- 內視鏡套管針及零件

- 超音波刀

- 骨科/關節鏡

- 胃腸病學和泌尿科

- 胃腸病學切片設備

- 泌尿科切片設備

- 一般外科手術設備

- 點滴壓力袋

- 氣球充氣裝置

- 其他產品

第6章:市場估計與預測:依類型,2021 — 2034 年

- 主要趨勢

- 第三方再處理

- 內部再處理

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Arjo

- Boston Scientific

- Cardinal Health

- GE Healthcare

- Halomedicals Systems

- INNOVATIVE HEALTH

- Johnson & Johnson

- MEDLINE

- Medtronic

- SOMA TECH

- STERIS

- Stryker

- SURETECH MEDICAL

- Teleflex

- VANGUARD

The Global Reprocessed Medical Devices Market reached USD 3.3 billion in 2024 and is set to expand at a CAGR of 16.2% from 2025 to 2034. This growth is driven by advancements in reprocessing technology, rising demand for single-use device reprocessing, and a strong focus on infection control. The expansion of healthcare services in developing regions also plays a crucial role in market growth. Educational programs highlighting the safety, efficiency, and environmental benefits of reprocessed devices have led to greater acceptance among healthcare providers and patients, further boosting market expansion.

Environmental concerns are another key factor influencing the market. The need to reduce medical waste is increasing, prompting healthcare providers to adopt sustainable practices. Reprocessing medical devices minimizes waste, aligns with global sustainability efforts, and ensures compliance with strict environmental regulations. These factors continue to drive the demand for reprocessed devices worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $14.4 Billion |

| CAGR | 16.2% |

Reprocessed medical devices, originally designed for single use, undergo thorough cleaning, disinfection, sterilization, and testing to meet high safety and performance standards before reuse. The market is segmented by product type, with cardiovascular medical devices generating the highest revenue of USD 942.9 million in 2024.

The market is also categorized by reprocessing type, which includes third-party reprocessing and in-house reprocessing. Third-party reprocessing accounted for USD 2.7 billion in 2024 and is projected to grow at a CAGR of 15.9% through 2034. These specialized services provide significant cost savings for hospitals and medical centers, ensuring devices meet rigorous safety and regulatory requirements. The expertise of third-party reprocessors helps healthcare facilities maintain compliance while reducing operational costs.

In terms of end users, hospitals represent the dominant market segment, expected to reach USD 8.9 billion by 2034. Cost pressures in the healthcare industry continue to rise, making reprocessed medical devices an attractive alternative to new equipment. Hospitals can optimize budgets by reusing devices without compromising patient safety. Additionally, the healthcare sector's push for sustainability is increasing the adoption of reprocessed devices, reducing the demand for single-use plastics, and lowering the environmental impact.

The U.S. reprocessed medical devices market was valued at USD 1.4 billion in 2024 and is expected to grow at a CAGR of 15.6% through 2034. Rising healthcare costs have led hospitals and medical centers to seek cost-effective solutions. The presence of clear regulatory guidelines set by the FDA ensures that reprocessed devices meet strict safety and performance standards, fostering confidence among healthcare providers and driving adoption across the country.

.Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Favorable regulatory landscape regarding sustainable waste disposal methods

- 3.2.1.2 Affordable costs coupled with the strengthening network of distributors in emerging economies

- 3.2.1.3 Growing use of reprocessed products in numerous cardiac surgeries and blood pressure monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Risk of surgical site infections

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Steps involved in medical device reprocessing

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cardiovascular medical devices

- 5.2.1 Blood pressure cuffs/tourniquet cuffs

- 5.2.2 Diagnostic electrophysiology catheters

- 5.2.3 Electrophysiology cables

- 5.2.4 Cardiac stabilization and positioning devices

- 5.2.5 Deep vein compression sleeves (DVT)

- 5.2.6 Other cardiovascular medical devices

- 5.3 Laparoscopic

- 5.3.1 Endoscopic trocars and components

- 5.3.2 Harmonic scalpels

- 5.4 Orthopedic/arthroscopic

- 5.5 Gastroenterology and urology

- 5.5.1 Gastroenterology biopsy devices

- 5.5.2 Urology biopsy devices

- 5.6 General surgery equipment

- 5.6.1 Infusion pressure bags

- 5.6.2 Balloon inflation devices

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Third-party reprocessing

- 6.3 In-house reprocessing

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arjo

- 9.2 Boston Scientific

- 9.3 Cardinal Health

- 9.4 GE Healthcare

- 9.5 Halomedicals Systems

- 9.6 INNOVATIVE HEALTH

- 9.7 Johnson & Johnson

- 9.8 MEDLINE

- 9.9 Medtronic

- 9.10 SOMA TECH

- 9.11 STERIS

- 9.12 Stryker

- 9.13 SURETECH MEDICAL

- 9.14 Teleflex

- 9.15 VANGUARD