|

市場調查報告書

商品編碼

1685225

經皮血氧測定系統市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Transcutaneous Oximetry Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

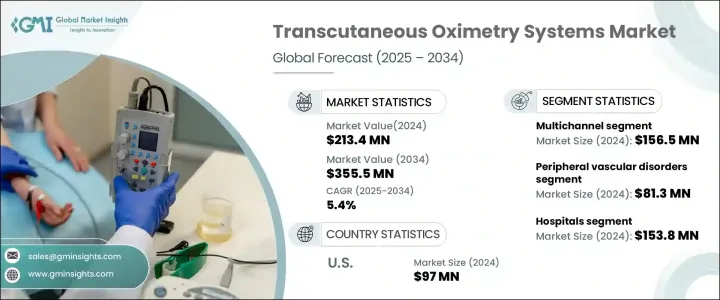

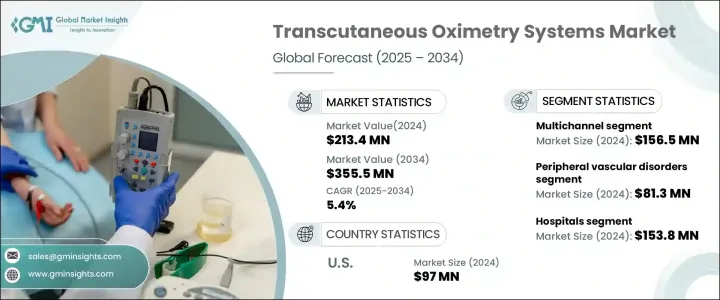

到 2024 年,全球經皮血氧測定系統市場規模將達到 2.134 億美元,預計 2025 年至 2034 年期間將呈現 5.4% 的穩定成長率。這一市場成長是由多種因素推動的,包括周邊動脈疾病盛行率的不斷上升、非侵入性監測技術的快速發展以及人口老化。隨著對有效傷口護理的需求不斷增加,越來越多的醫療保健提供者開始採用經皮血氧測定系統來監測組織中的氧氣水平。這些系統可以及時準確地讀數,這對於早期檢測和預防護理至關重要。

感測器技術和無線連接的創新使這些系統更加高效,並可在廣泛的醫療保健環境中輕鬆使用。從醫院到門診設施,經皮血氧測定系統的日益普及反映了精準醫療和以患者為中心的護理的大趨勢。隨著醫療保健提供者專注於提高診斷準確性和最佳化工作流程,對這些先進監控解決方案的投資正在增加。此外,監管變化和對血管和呼吸系統疾病的認知不斷提高也有助於塑造市場動態。隨著患者和照護者尋求即時、在家中監測血氧水平,對家庭醫療保健和遠端監控解決方案的需求不斷成長,進一步推動了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.134 億美元 |

| 預測值 | 3.555 億美元 |

| 複合年成長率 | 5.4% |

根據通路類型,市場分為多通路系統和單通路系統。 2024 年,多通道系統預計將產生 1.565 億美元的收入。它們能夠同時測量多個部位的氧氣水平,從而提高診斷的準確性和效率,特別是對於健康狀況複雜的患者。透過消除多次單獨讀數的需要,這些系統簡化了臨床工作流程並提供了有關組織氧合的全面資料,從而推動了它們在高容量醫療機構中的普及。

在最終用途方面,醫院將在 2024 年佔據最大的市場佔有率,預計到 2034 年收入將達到 1.538 億美元。醫院擴大採用經皮血氧儀系統來監測患有周邊血管疾病、糖尿病和呼吸系統疾病等慢性疾病的患者。這些系統提供持續、非侵入性的組織氧合評估,以便及時干預,改善患者的治療效果。這些設備在醫院專門部門(如傷口管理、術後監測和血管評估)中的日益整合,進一步刺激了需求。

2024 年,美國經皮血氧測定系統市場價值 9,700 萬美元,預計到 2034 年複合年成長率為 4.1%。美國仍然是醫療技術創新領域的全球領導者,推動經皮血氧測定系統在各個醫療保健領域的廣泛應用。感測器精度、便攜性和無線連接的改進使得這些系統更加方便用戶使用且高效。隨著美國醫療保健系統向預防保健轉變,這些設備的需求預計將大幅成長,從而促進區域市場擴張。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 周邊血管疾病和傷口癒合障礙的盛行率不斷上升

- 診斷和治療期間患者監測受到越來越多的關注

- 技術進步

- 人們對早產兒使用經皮血氧測定系統的認知不斷提高

- 產業陷阱與挑戰

- 嚴格的監理政策

- 經皮血氧測定系統成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 定價分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按通路類型,2021 年至 2034 年

- 主要趨勢

- 多通道

- 單通道

第6章:市場估計與預測:按應用,2021 — 2034 年

- 主要趨勢

- 周圍血管疾病

- 糖尿病足潰瘍

- 早產

- 其他應用

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 診斷中心

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ADVIN

- Cephalon

- Drager

- ELCAT

- medicap

- PERIMED

- PHILIPS

- RADIOMETER

- sentec

The Global Transcutaneous Oximetry Systems Market reached USD 213.4 million by 2024 and is expected to exhibit a steady growth rate of 5.4% CAGR from 2025 to 2034. This market growth is driven by a combination of factors, including the increasing prevalence of peripheral artery disease, the rapid advancements in non-invasive monitoring technologies, and the aging population. As the need for effective wound care continues to rise, more healthcare providers are turning to transcutaneous oximetry systems to monitor oxygen levels in tissues. These systems allow for timely and accurate readings, essential for early detection and preventive care.

Innovations in sensor technology and wireless connectivity are making these systems more efficient and accessible across a wide range of healthcare settings. From hospitals to outpatient facilities, the growing adoption of transcutaneous oximetry systems reflects a larger trend toward precision medicine and patient-centered care. With healthcare providers focused on improving diagnostic accuracy and optimizing workflows, investments in these advanced monitoring solutions are increasing. Additionally, regulatory changes and growing awareness about vascular and respiratory conditions are helping to shape market dynamics. The rising demand for home healthcare and remote monitoring solutions further fuels the growth of the market, as patients and caregivers seek real-time, at-home monitoring of oxygenation levels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $213.4 Million |

| Forecast Value | $355.5 Million |

| CAGR | 5.4% |

By channel type, the market is divided into multichannel and single-channel systems. In 2024, multichannel systems are projected to generate USD 156.5 million in revenue. Their ability to measure oxygen levels at multiple sites simultaneously boosts diagnostic accuracy and enhances efficiency, especially for patients with complex health conditions. By eliminating the need for multiple individual readings, these systems streamline clinical workflows and provide comprehensive data on tissue oxygenation, driving their popularity in high-volume healthcare facilities.

In terms of end use, hospitals lead the market with the largest share in 2024, with revenue expected to reach USD 153.8 million by 2034. Hospitals are increasingly adopting transcutaneous oximetry systems to monitor patients with chronic conditions such as peripheral vascular disease, diabetes, and respiratory disorders. These systems offer continuous, non-invasive assessments of tissue oxygenation, enabling timely interventions that improve patient outcomes. The growing integration of these devices in specialized hospital departments, such as wound management, post-surgical monitoring, and vascular assessments, is further fueling demand.

The U.S. transcutaneous oximetry systems market generated USD 97 million in 2024, with a projected CAGR of 4.1% through 2034. The U.S. remains a global leader in medical technology innovation, driving the widespread adoption of transcutaneous oximetry systems across various healthcare sectors. Improvements in sensor precision, portability, and wireless connectivity are making these systems more user-friendly and efficient. As the U.S. healthcare system shifts towards preventive care, the demand for these devices is expected to grow significantly, contributing to regional market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of peripheral vascular disorders and wound healing disorders

- 3.2.1.2 Rising focus towards patient monitoring during diagnosis and treatment

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing awareness regarding use of transcutaneous oximetry systems for preterm infants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory policies

- 3.2.2.2 High cost associated with transcutaneous oximetry systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Channel Type, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Multichannel

- 5.3 Single channel

Chapter 6 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Peripheral vascular disorders

- 6.3 Diabetic foot ulcers

- 6.4 Preterm births

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Diagnostic centers

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ADVIN

- 9.2 Cephalon

- 9.3 Drager

- 9.4 ELCAT

- 9.5 medicap

- 9.6 PERIMED

- 9.7 PHILIPS

- 9.8 RADIOMETER

- 9.9 sentec