|

市場調查報告書

商品編碼

1685223

芙蓉花粉市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hibiscus Flower Powder Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

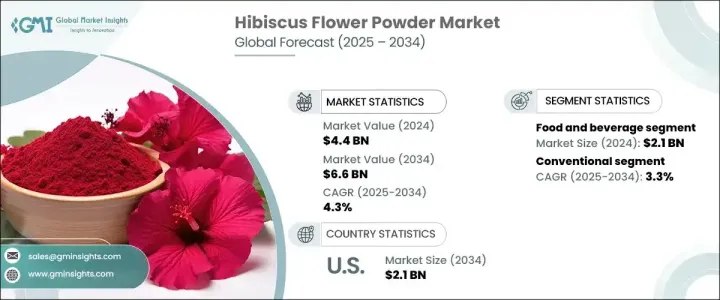

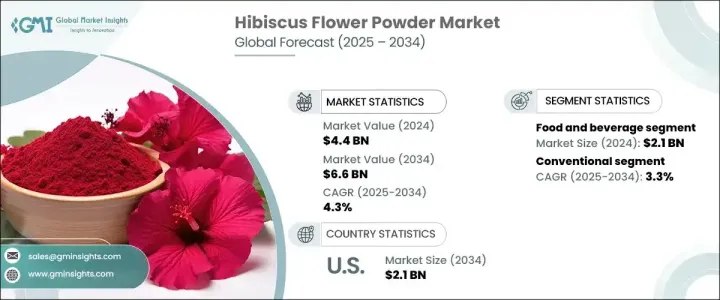

2024 年全球芙蓉花粉市場規模達到了驚人的 44 億美元,預計 2025 年至 2034 年的複合年成長率為 4.3%。這一成長軌跡主要由消費者對芙蓉粉健康益處的認知不斷提高所推動,包括其富含抗氧化劑的特性、潛在的心臟健康益處以及其高維生素 C 含量。隨著消費者越來越青睞天然和草本替代品而非合成替代品,從食品和飲料到補品和護膚品等以芙蓉為基礎的產品的需求正在日益成長。

植物性和有機成分的日益普及也推動了對芙蓉粉的需求。隨著人們越來越注重健康和環保,芙蓉也逐漸成為人們尋求增進健康產品的關鍵成分。這種趨勢不僅體現在食品和飲料領域,也體現在護膚品領域,芙蓉因其恢復活力和抗衰老的功效而備受推崇。芙蓉花粉市場正受益於消費者偏好的改變,隨著越來越多的人選擇整體健康和美容產品,芙蓉花粉將自己定位為注重健康生活方式的重要補充。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 44億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 4.3% |

傳統芙蓉粉市場預計在 2024 年創收 42 億美元,到 2034 年將以 3.3% 的複合年成長率穩定成長。這一成長可歸因於對天然、無化學產品的需求不斷增加。消費者現在更傾向選擇有機芙蓉粉,其原料來自永續種植、無農藥的花朵。隨著人們對健康和環境永續性的認知不斷提高,預計向有機產品的轉變將持續,從而進一步推動市場成長。

在食品和飲料領域,芙蓉粉佔有相當大的市場佔有率,佔 45.8%,2024 年價值 21 億美元。該產業預計將進一步擴張,到 2034 年預計複合年成長率為 4.2%。食品和飲料對芙蓉粉的需求源於其清爽的口感、鮮豔的色澤以及促進健康的功效,例如幫助消化和調節血壓。它正在成為草藥茶、冰沙、飲料和果醬等產品中的流行成分,從而增加了其在整個食品行業的存在。

預計到 2024 年,美國芙蓉花粉市場規模將達到 21 億美元,2025 年至 2034 年的複合年成長率為 3.2%。這一成長主要得益於消費者對天然和健康產品的需求不斷成長,尤其是在飲料領域,芙蓉花粉在涼茶和功能性飲料中越來越受歡迎。此外,化妝品行業也因其抗衰老和舒緩皮膚的功效而青睞芙蓉粉,從而推動其市場佔有率的不斷成長。隨著消費者在食品和護膚品中擴大尋求天然替代品,芙蓉粉將繼續成為備受追捧的成分。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 產業衝擊力

- 成長動力

- 健康意識不斷增強

- 健康和天然產品越來越受歡迎

- 芙蓉在化妝品和護膚品行業中越來越受歡迎

- 市場挑戰

- 生產的季節性

- 成長動力

- 法規和市場影響

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:按來源,2021-2034 年

- 主要趨勢

- 有機的

- 傳統的

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 食品和飲料

- 化妝品和個人護理

- 營養保健品和膳食補充劑

- 製藥

第 7 章:市場規模與預測:按功能,2021-2034 年

- 主要趨勢

- 茶和草藥沖劑

- 食品

- 飲料

第 8 章:市場規模及預測:按配銷通路,2021-2034 年

- 主要趨勢

- 網路零售

- 超市/大賣場

- 專賣店

- 保健食品商店

- 其他

第 9 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Danone

- Fage

- General Mills

- Greek Gods

- La Yogurt

- Lifeway Foods

- Nestle

- Stonyfield Farms

- Valio

- Yakult

- Yoplait

- Chobani

The Global Hibiscus Flower Powder Market reached an impressive USD 4.4 billion in 2024 and is projected to grow at a CAGR of 4.3% from 2025 to 2034. This growth trajectory is primarily driven by the increasing consumer awareness surrounding the health benefits of hibiscus powder, including its antioxidant-rich properties, potential heart health benefits, and its high vitamin C content. As consumers continue to favor natural and herbal alternatives over synthetic options, the demand for hibiscus-based products, ranging from food and beverages to supplements and skincare, is gaining momentum.

The rising popularity of plant-based and organic ingredients is also boosting the demand for hibiscus powder. With people becoming more health-conscious and eco-friendly, hibiscus is emerging as a key ingredient for those seeking wellness-boosting products. This trend is evident not only in food and beverages but also in skincare, where hibiscus is prized for its rejuvenating and anti-aging properties. The hibiscus flower powder market is benefiting from these changing consumer preferences, and as more individuals opt for holistic health and beauty products, hibiscus powder is positioning itself as an essential addition to a health-conscious lifestyle.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.4 Billion |

| Forecast Value | $6.6 Billion |

| CAGR | 4.3% |

The conventional hibiscus powder segment, which is expected to generate USD 4.2 billion in 2024, is set to grow at a steady 3.3% CAGR through 2034. This growth can be attributed to the increasing demand for natural, chemical-free products. Consumers are now more inclined to choose organic hibiscus powder, which is sourced from sustainably grown, pesticide-free flowers. With rising awareness about health and environmental sustainability, the shift toward organic products is expected to continue, further propelling market growth.

In the food and beverage sector, hibiscus powder holds a significant market share, accounting for 45.8% and valued at USD 2.1 billion in 2024. The sector is poised for further expansion, with a projected CAGR of 4.2% through 2034. The demand for hibiscus powder in food and beverages is fueled by its refreshing taste, vibrant color, and health-promoting benefits, such as aiding digestion and regulating blood pressure. It is becoming a popular ingredient in products like herbal teas, smoothies, beverages, and jams, thus increasing its presence across the food industry.

The U.S. hibiscus flower powder market is expected to reach USD 2.1 billion in 2024, with a CAGR of 3.2% from 2025 to 2034. This growth is largely driven by the rising consumer demand for natural and health-focused products, particularly in the beverage sector, where hibiscus powder is gaining popularity in herbal teas and functional drinks. Additionally, the cosmetics sector is embracing hibiscus powder for its anti-aging and skin-soothing properties, contributing to its growing market presence. As consumers increasingly seek natural alternatives in both food and skincare, hibiscus powder is poised to remain a highly sought-after ingredient.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Growing health awareness

- 3.7.1.2 Rising popularity of health and natural products

- 3.7.1.3 Growing popularity of hibiscus in the cosmetic and skincare industry

- 3.7.2 Market challenges

- 3.7.2.1 Seasonal nature of production

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic

- 5.3 Conventional

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Food and beverages

- 6.3 Cosmetics and personal care

- 6.4 Nutraceuticals and dietary supplements

- 6.5 Pharmaceutical

Chapter 7 Market Size and Forecast, By Function, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Tea and herbal infusions

- 7.3 Food products

- 7.4 Beverages

Chapter 8 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Online retail

- 8.3 Supermarkets/Hypermarkets

- 8.4 Specialty stores

- 8.5 Health food stores

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Danone

- 10.2 Fage

- 10.3 General Mills

- 10.4 Greek Gods

- 10.5 La Yogurt

- 10.6 Lifeway Foods

- 10.7 Nestle

- 10.8 Stonyfield Farms

- 10.9 Valio

- 10.10 Yakult

- 10.11 Yoplait

- 10.12 Chobani