|

市場調查報告書

商品編碼

1685217

柑橘果膠市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Citrus Pectin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

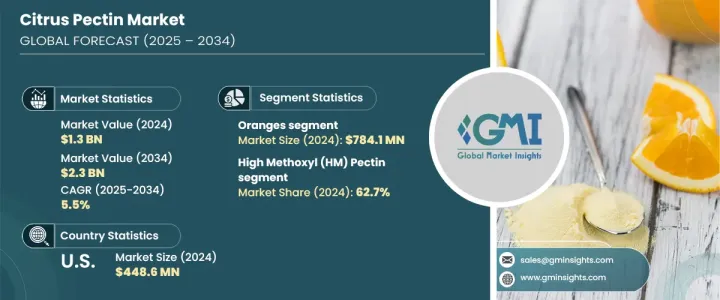

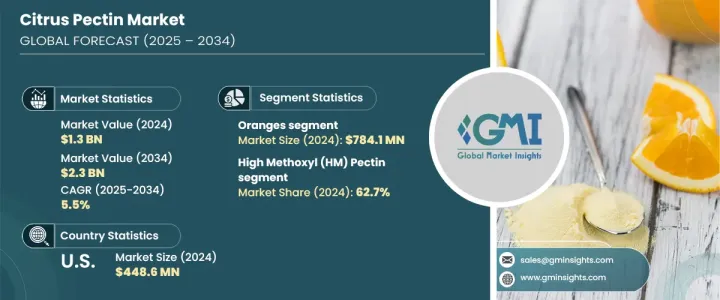

2024 年全球柑橘果膠市場價值為 13 億美元,預計 2025 年至 2034 年期間將以 5.5% 的強勁複合年成長率成長。這一成長主要得益於消費者對柑橘果膠健康益處的認知不斷提高。柑橘果膠因其在飲食和營養應用中的作用而聞名,由於其天然的膠凝和增稠特性而廣受歡迎,尤其是從橙子、檸檬和葡萄柚等柑橘類水果中提取時。對於那些尋求在食品中添加清潔標籤、非基因改造成分的人來說,這是一個理想的解決方案。

隨著越來越多的人傾向於更健康、植物性和永續的選擇,對柑橘果膠的需求持續上升。食品和飲料製造商擴大使用這種多功能成分,因為它能夠改善質地、穩定性和一致性,滿足消費者對清潔、天然成分日益成長的偏好。此外,隨著對更健康食品選擇的需求不斷擴大,柑橘果膠的應用範圍廣泛,從果醬、果凍到飲料,使其成為現代食品工業的重要組成部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 23億美元 |

| 複合年成長率 | 5.5% |

根據來源,市場分為橙子、檸檬、葡萄柚和其他,其中橙子部分引領市場,2024 年創造 7.841 億美元的收入。從橙子中提取的果膠因其卓越的增強質地和稠度的能力而受到食品和飲料行業的青睞。隨著非基因改造植物成分的日益流行,符合注重健康的消費者偏好,這個細分市場也得到了推動。隨著清潔標籤運動的持續發展,橘子果膠的吸引力變得更加明顯。

柑橘果膠市場也按等級分類,高甲氧基 (HM) 果膠和低甲氧基 (LM) 果膠是兩個主要類別。 HM 果膠由於其優異的膠凝特性而在 2024 年佔據了 62.7% 的主導佔有率,這對於生產各種食品,尤其是果醬和果凍至關重要。 HM 果膠能夠在高糖分和低 pH 值的條件下形成堅固的凝膠,使其成為所需質地和稠度的首選,從而推動了其在市場上的成長。

在美國,柑橘果膠市場在 2024 年的收入為 4.486 億美元。這一成長主要歸因於人們對清潔標籤和天然食品成分的偏好日益增加。作為一種從柑橘果皮中提取的植物產品,柑橘果膠完全符合消費者的這一需求,在一系列食品和飲料應用中提供改善質地、穩定性和一致性等功能優勢。

隨著市場不斷發展,人們對健康、永續和植物性食品的關注度不斷提高,這將確保柑橘果膠仍然是食品和飲料產業的關鍵成分。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按來源,2021 年至 2034 年

- 主要趨勢

- 橘子

- 檸檬

- 柚子

- 其他

第6章:市場估計與預測:依等級,2021-2034 年

- 主要趨勢

- 高甲氧基(HM)果膠

- 低甲氧基(LM)果膠

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食品和飲料

- 麵包和糖果

- 製藥

- 化妝品和個人護理產品

- 膳食補充劑

- 功能性食品

- 其他

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 直接銷售

- 分銷商和批發商

- 網路零售

- 便利商店

- 專賣店

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Cargill

- DuPont de Nemours

- Herbstreith & Fox KG Pektin-Fabriken

- Naturex (Givaudan)

- CP Kelco

- Compañía Española de Algas Marinas (CEAMSA)

- Silvateam

- Quadra Chemicals

- B&V

- Lucid Colloids

- Classic Gum Company

- SA Citrique Belge (Citrique Belge)

- Florida Food Products

- Yantai Andre Pectin

- Fiberstar

The Global Citrus Pectin Market, valued at USD 1.3 billion in 2024, is expected to grow at a robust CAGR of 5.5% from 2025 to 2034. This growth is primarily driven by the increasing consumer awareness surrounding the health benefits of citrus pectin. Known for its role in dietary and nutritional applications, citrus pectin has gained popularity due to its natural gelling and thickening properties, especially when extracted from citrus fruits like oranges, lemons, and grapefruits. It is an ideal solution for those seeking clean-label, non-GMO ingredients in their food products.

As more people gravitate towards healthier, plant-based, and sustainable options, the demand for citrus pectin continues to rise. Food and beverage manufacturers are increasingly turning to this versatile ingredient for its ability to enhance texture, stability, and consistency, meeting the growing consumer preference for clean, natural ingredients. Moreover, as the demand for healthier food options continues to expand, citrus pectin's wide range of applications, from jams and jellies to beverages, makes it an essential part of the modern food industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.3 Billion |

| CAGR | 5.5% |

By source, the market is segmented into oranges, lemons, grapefruits, and others, with the oranges segment leading the market, generating USD 784.1 million in 2024. Pectin derived from oranges is particularly favored in the food and beverage industry due to its exceptional ability to enhance texture and consistency. This segment is also boosted by the growing trend for non-GMO, plant-based ingredients that align with health-conscious consumer preferences. As the clean-label movement continues to gain momentum, the appeal of orange-derived pectin becomes even more pronounced.

The citrus pectin market is also divided by grade, with High Methoxyl (HM) Pectin and Low Methoxyl (LM) Pectin being the two primary categories. The HM Pectin segment held a dominant share of 62.7% in 2024, owing to its superior gelling properties, which are crucial for producing various food products, particularly jams and jellies. HM Pectin's ability to form robust gels in the presence of high sugar content and low pH levels makes it the preferred choice for achieving the desired texture and consistency, driving its growth in the market.

In the U.S., the citrus pectin market generated USD 448.6 million in 2024. This growth is largely attributed to the increasing preference for clean-label and natural food ingredients. As a plant-based product derived from citrus fruit peels, citrus pectin aligns perfectly with this consumer demand, offering functional benefits such as improved texture, stability, and consistency in a range of food and beverage applications.

As the market continues to evolve, the increasing focus on health-conscious, sustainable, and plant-based food products will ensure that citrus pectin remains a key ingredient in the food and beverage industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oranges

- 5.3 Lemon

- 5.4 Grapefruit

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Grade, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 High Methoxyl (HM) Pectin

- 6.3 Low Methoxyl (LM) Pectin

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Bakery and confectionery

- 7.4 Pharmaceutical

- 7.5 Cosmetic and personal care products

- 7.6 Dietary supplements

- 7.7 Functional food

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Distribution channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Distributors and wholesalers

- 8.4 Online retail

- 8.5 Convenience stores

- 8.6 Specialty stores

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Cargill

- 10.2 DuPont de Nemours

- 10.3 Herbstreith & Fox KG Pektin-Fabriken

- 10.4 Naturex (Givaudan)

- 10.5 CP Kelco

- 10.6 Compañía Española de Algas Marinas (CEAMSA)

- 10.7 Silvateam

- 10.8 Quadra Chemicals

- 10.9 B&V

- 10.10 Lucid Colloids

- 10.11 Classic Gum Company

- 10.12 S.A. Citrique Belge (Citrique Belge)

- 10.13 Florida Food Products

- 10.14 Yantai Andre Pectin

- 10.15 Fiberstar