|

市場調查報告書

商品編碼

1685213

電氣絕緣材料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electrical Insulation Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

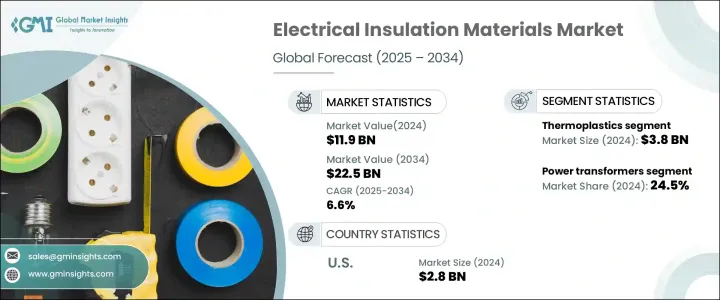

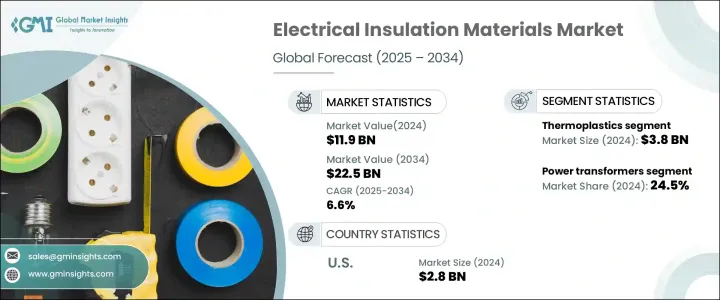

2024 年全球電氣絕緣材料市場規模將達到 119 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.6%。這一成長是由各行各業對高效、可靠和安全電氣系統日益成長的需求所推動的。電氣絕緣材料在商業和工業應用中保護電氣元件、確保使用壽命以及提高系統性能方面發揮關鍵作用。

隨著產業的發展,對創新、耐用和永續的絕緣解決方案的需求日益增加,以滿足更嚴格的法規和性能標準。材料技術的進步以及對能源效率和永續性的日益重視進一步推動了需求。基礎設施的持續擴張,特別是再生能源和現代化電網,也為積極的市場前景做出了貢獻。隨著人們不斷向環保解決方案轉變,製造商正致力於提供不僅能提高性能而且對環境負責的產品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 119億美元 |

| 預測值 | 225億美元 |

| 複合年成長率 | 6.6% |

根據材料類型,市場細分包括熱固性塑膠、玻璃纖維、雲母、陶瓷、熱塑性塑膠、纖維素、棉花等。 2024 年,熱塑性塑膠部門的收入為 38 億美元。熱固性塑膠以其出色的耐用性和耐高溫性而聞名,使其成為要求苛刻的應用中的熱門選擇。陶瓷因其優異的介電性能而備受推崇,非常適合高壓操作,而玻璃纖維則具有強度和出色的絕緣能力。雲母仍然是高壓環境中的首選材料,既具有耐熱性又具有電氣保護性。此外,纖維素和棉花正在成為具有防火特性的環保材料,符合電氣領域永續和安全解決方案日益成長的趨勢。

電氣絕緣材料的應用範圍非常廣泛,服務於電力變壓器、配電變壓器、電動馬達和發電機、電線電纜、開關設備、電池和斷路器等行業。電力變壓器在 2024 年佔據了 24.5% 的市場佔有率,預計到 2034 年將保持強勁成長。絕緣材料對於最佳化配電變壓器和電動馬達的性能和效率至關重要,將進一步推動發電、輸電和工業自動化等關鍵領域的需求。

在美國,電氣絕緣材料市場規模將在 2024 年達到 28 億美元,並且由於基礎設施的大量投資,預計將大幅成長。對過時的電網進行現代化改造和擴大再生能源計劃正在推動先進絕緣材料的採用。透過專注於永續性和節能解決方案,美國將繼續成為區域市場的主要參與者,確保在整個預測期內持續成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車產業需求不斷成長

- 航太應用的採用率不斷提高

- 不斷成長的化學加工工業

- 產業陷阱與挑戰

- 電氣絕緣材料成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:按材料,2021-2034 年

- 主要趨勢

- 氟碳彈性體 (FKM)

- 全電絕緣材料(FFKM)

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 密封件和墊圈

- O 型環

- 軟管和管子

- 其他

第 7 章:市場規模與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 汽車

- 航太

- 石油和天然氣

- 化學加工

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M

- AGC (Asahi Glass)

- Chemours

- Daikin Industries

- DowDuPont

- DuPont (EI du Pont de Nemours and Company)

- Gujarat Fluorochemicals

- HaloPolymer

- Mitsui Chemicals

- Momentive Performance Materials

- Saint-Gobain Performance Plastics

- Shin-Etsu Chemical

- Solvay

- Wacker Chemie

- Zeon Corporation

The Global Electrical Insulation Materials Market reached USD 11.9 billion in 2024 and is set to expand at a CAGR of 6.6% from 2025 to 2034. This growth is driven by the increasing demand for efficient, reliable, and safe electrical systems across various industries. Electrical insulation materials play a critical role in protecting electrical components, ensuring longevity, and enhancing system performance in both commercial and industrial applications.

As industries evolve, there is a rising need for innovative, durable, and sustainable insulation solutions to meet stricter regulations and performance standards. Advancements in material technology, along with a growing emphasis on energy efficiency and sustainability, are further fueling demand. The continued expansion of infrastructure, particularly in renewable energy and modernized electrical grids, is also contributing to the positive market outlook. With the ongoing shift toward eco-friendly solutions, manufacturers are focusing on providing products that not only improve performance but are also environmentally responsible.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 6.6% |

Based on material type, the market segments include thermosets, fiberglass, mica, ceramics, thermoplastics, cellulose, cotton, and others. In 2024, the thermoplastics segment generated USD 3.8 billion. Thermosets are known for their exceptional durability and high-temperature resistance, making them a popular choice in demanding applications. Ceramics are highly valued for their superior dielectric properties, ideal for high-voltage operations, while fiberglass provides strength and excellent insulation capabilities. Mica remains a preferred material in high-voltage environments, providing both heat resistance and electrical protection. Additionally, cellulose and cotton are emerging as eco-friendly materials that offer fire resistance, aligning with the growing trend of sustainable and safe solutions in the electrical sector.

The applications of electrical insulation materials are wide-ranging, serving industries like power transformers, distribution transformers, electrical motors and generators, wires and cables, switchgear, batteries, and circuit breakers. Power transformers accounted for 24.5% of the market share in 2024, with strong growth expected through 2034. Insulation materials are crucial for optimizing the performance and efficiency of distribution transformers and electrical motors, further boosting demand across critical sectors such as power generation, transmission, and industrial automation.

In the U.S., the electrical insulation materials market reached USD 2.8 billion in 2024 and is expected to grow significantly due to substantial investments in infrastructure. Modernizing outdated electrical grids and expanding renewable energy initiatives are driving the adoption of advanced insulation materials. With a focus on sustainability and energy-efficient solutions, the U.S. is poised to remain a major player in the regional market, ensuring continued growth throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in automotive industry

- 3.6.1.2 Rising adoption in aerospace applications

- 3.6.1.3 Growing chemical processing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of electrical insulation materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fluorocarbon elastomers (FKM)

- 5.3 Perelectrical insulation materials (FFKM)

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Seals and gaskets

- 6.3 O-rings

- 6.4 Hoses and tubings

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use Industries, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Oil & gas

- 7.5 Chemical processing

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AGC (Asahi Glass)

- 9.3 Chemours

- 9.4 Daikin Industries

- 9.5 DowDuPont

- 9.6 DuPont (E. I. du Pont de Nemours and Company)

- 9.7 Gujarat Fluorochemicals

- 9.8 HaloPolymer

- 9.9 Mitsui Chemicals

- 9.10 Momentive Performance Materials

- 9.11 Saint-Gobain Performance Plastics

- 9.12 Shin-Etsu Chemical

- 9.13 Solvay

- 9.14 Wacker Chemie

- 9.15 Zeon Corporation