|

市場調查報告書

商品編碼

1685209

增黏劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Tackifier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

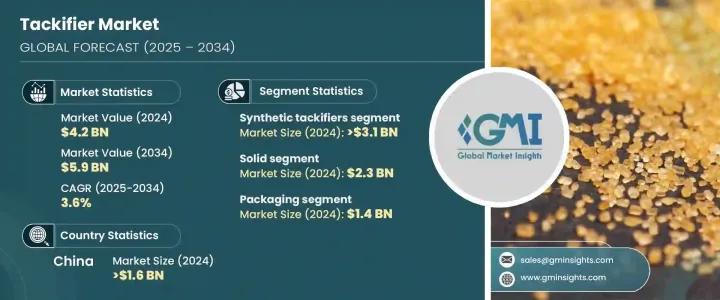

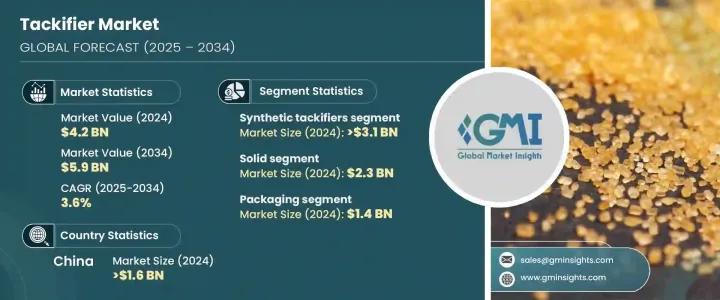

2024 年全球增黏劑市場規模達到 42 億美元,並有望穩定成長,預計 2025 年至 2034 年期間的複合年成長率為 3.6%。增粘劑在黏合劑配方中起著至關重要的作用,可增強其黏性並提高各行業的附著力。隨著對高性能黏合劑的需求不斷成長,特別是在包裝、汽車、建築和衛生領域,對先進增粘劑解決方案的需求也在增加。市場對熱熔膠 (HMA) 的需求激增,特別是在不織布衛生產品和軟包裝領域,進一步推動了產業擴張。

市場成長的主要驅動力包括黏合劑技術的不斷進步和向環保解決方案的轉變。隨著產業越來越重視永續性,向生物基增黏劑的轉變正在加速。這些來自可再生資源的替代品具有較低的揮發性有機化合物(VOC)排放量,因此成為致力於遵守嚴格環境法規的公司的首選。此外,電子商務的快速擴張和對高效包裝黏合劑的日益成長的需求正在推動全球的需求。在黏合劑性能至關重要的行業中,例如汽車組裝和醫療應用,增粘劑提供卓越的黏合能力,增強了其在現代製造業中不可或缺的作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 3.6% |

合成增黏劑領域在 2024 年的價值為 31 億美元,佔市場主導地位,預計在預測期內的複合年成長率為 3.5%。合成增粘劑來自脂肪族烴、C9芳烴和合成多萜等石油基來源,因其出色的熱穩定性、強的粘合性能以及與各種粘合劑的兼容性而受到廣泛青睞。包裝、建築和汽車等行業都嚴重依賴這些增粘劑在極端條件下的耐用性和效率。它們能夠在高溫和各種環境條件下保持黏合力,使其成為尋求持久黏合解決方案的製造商的首選。

固體增黏劑領域在 2024 年創造了 23 億美元的收入,預計到 2034 年將以 3.4% 的複合年成長率成長。固體增粘劑因其成本效益高、易於操作以及在壓敏膠和熱熔膠應用中的卓越性能而備受追捧。它們具有很強的聚合物相容性和熱穩定性,是需要耐用、靈活的黏合解決方案的行業的理想選擇。從工業包裝和建築到衛生產品和汽車應用,固體增黏劑繼續成為不斷發展的黏合劑領域的基本組成部分。

2024 年中國增黏劑市場價值為 16 億美元,預計到 2034 年將以 3.4% 的複合年成長率擴大。作為全球製造業強國,中國憑藉其強大的工業基礎和各種應用對黏合劑不斷成長的需求在市場上佔據主導地位。包裝、建築和汽車行業的快速成長大大增加了對增粘劑的需求。此外,中國蓬勃發展的電子商務產業正在推動對高品質包裝黏合劑的需求,進一步鞏固了中國在全球市場的領導地位。隨著工業化和基礎設施的持續發展,中國仍然是塑造增黏劑產業未來的關鍵參與者。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 各行業對膠黏劑的需求增加

- 環保增黏劑需求上升

- 亞太地區工業成長

- 產業陷阱與挑戰

- 限制合成增黏劑的環境法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 合成增黏劑

- 天然增黏劑

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 堅硬的

- 液體

- 樹脂分散體

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 包裝

- 建造

- 非織物

- 裝訂

- 汽車

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Arkema

- BASF SE

- Eastman Chemical

- Exxon Mobil

- HB Fuller

- Henkel AG & Co. KGaA

- Kolon Industries

- KRATON

- SI Group

- ZEON

The Global Tackifier Market reached USD 4.2 billion in 2024 and is poised for steady growth, projected to expand at a CAGR of 3.6% between 2025 and 2034. Tackifiers play a crucial role in adhesive formulations by enhancing their stickiness and improving adhesion across various industries. With the growing demand for high-performance adhesives, particularly in the packaging, automotive, construction, and hygiene sectors, the need for advanced tackifier solutions is on the rise. The market is witnessing a surge in demand for hot-melt adhesives (HMAs), particularly in nonwoven hygiene products and flexible packaging, further propelling industry expansion.

Key drivers of market growth include continuous advancements in adhesive technologies and a rising shift toward environmentally friendly solutions. As industries increasingly prioritize sustainability, the transition to bio-based tackifiers is accelerating. These alternatives, derived from renewable sources, offer lower volatile organic compound (VOC) emissions, making them a preferred choice for companies aiming to comply with stringent environmental regulations. Additionally, the rapid expansion of e-commerce and the growing need for efficient packaging adhesives are fueling demand across the globe. In industries where adhesive performance is critical, such as automotive assembly and medical applications, tackifiers provide superior bonding capabilities, reinforcing their indispensable role in modern manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 3.6% |

The synthetic tackifiers segment, valued at USD 3.1 billion in 2024, dominates the market and is projected to grow at a CAGR of 3.5% over the forecast period. Derived from petroleum-based sources such as aliphatic hydrocarbons, C9 aromatics, and synthetic polyterpenes, synthetic tackifiers are widely favored for their outstanding thermal stability, strong adhesion properties, and compatibility with various adhesives. Industries such as packaging, construction, and automotive heavily rely on these tackifiers for their durability and efficiency in extreme conditions. Their ability to maintain adhesion under high temperatures and diverse environmental conditions makes them a top choice for manufacturers seeking long-lasting adhesive solutions.

The solid tackifier segment generated USD 2.3 billion in 2024 and is expected to grow at a 3.4% CAGR through 2034. Solid tackifiers are highly sought after due to their cost-effectiveness, ease of handling, and exceptional performance in pressure-sensitive and hot-melt adhesive applications. Their strong polymer compatibility and thermal stability make them ideal for industries that require durable and flexible bonding solutions. From industrial packaging and construction to hygiene products and automotive applications, solid tackifiers continue to be a fundamental component in the evolving adhesive landscape.

China tackifier market was valued at USD 1.6 billion in 2024 and is anticipated to expand at a CAGR of 3.4% through 2034. As a global manufacturing powerhouse, China dominates the market due to its strong industrial base and rising demand for adhesives across various applications. The rapid growth of the packaging, construction, and automotive industries has significantly increased the need for tackifiers. Additionally, China's booming e-commerce sector is driving demand for high-quality packaging adhesives, further solidifying the country's leadership in the global market. With continued industrialization and infrastructure development, China remains a key player in shaping the future of the tackifier industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increased adhesive demand across industries

- 3.6.1.2 Rise in eco-friendly tackifier demand

- 3.6.1.3 Growth in Asia-Pacific’s industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Environmental regulations limiting synthetic tackifiers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Synthetic tackifiers

- 5.3 Natural tackifiers

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Liquid

- 6.4 Resin dispersions

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Packaging

- 7.3 Construction

- 7.4 Non-woven

- 7.5 Bookbinding

- 7.6 Automotive

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 BASF SE

- 9.3 Eastman Chemical

- 9.4 Exxon Mobil

- 9.5 H.B. Fuller

- 9.6 Henkel AG & Co. KGaA

- 9.7 Kolon Industries

- 9.8 KRATON

- 9.9 SI Group

- 9.10 ZEON