|

市場調查報告書

商品編碼

1685206

衛星物聯網市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Satellite IoT Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

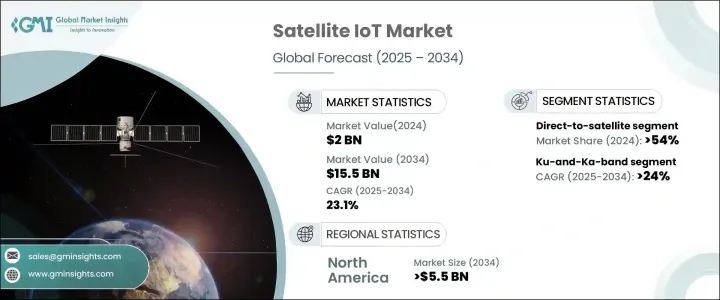

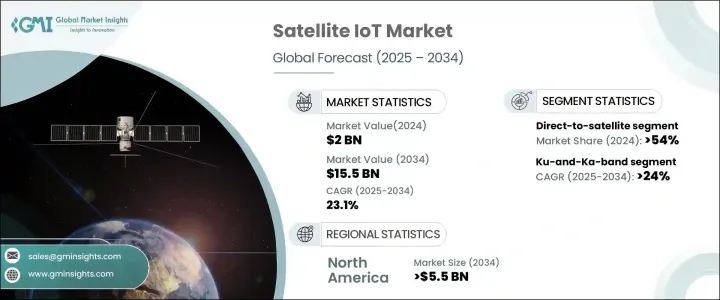

2024 年全球衛星物聯網市場規模達 20 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 23.1%。偏遠和交通不便地區對不間斷物聯網連接的日益依賴是這一成長的主要驅動力。傳統通訊網路通常無法在這些地區提供可靠的覆蓋,因此基於衛星的解決方案對於依賴即時資料傳輸的行業來說是不可或缺的。物流、農業和能源領域的公司正在利用衛星物聯網來最佳化營運、提高效率並透過即時分析改善決策。隨著企業優先考慮資產追蹤、環境監測和緊急應變能力,對無縫通訊的需求不斷增加,進一步推動了市場擴張。

衛星技術的進步、低地球軌道 (LEO) 衛星網路的不斷部署以及基於空間的物聯網連接的日益普及正在加速市場的成長。與傳統衛星網路不同,低地球軌道衛星提供無縫、低延遲的連接,而無需廣泛的地面基礎設施,使其成為希望擴大覆蓋範圍的公司的首選。衛星物聯網解決方案的經濟性和可擴展性使各種規模的企業能夠將先進的通訊系統整合到其營運中。各國政府和私人航太機構正大力投資衛星星座,以增強全球連通性,進一步促進產業成長。此外,結合衛星和地面連接的混合網路模型的興起為在偏遠地區營運的企業創造了新的機會。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 20億美元 |

| 預測值 | 155億美元 |

| 複合年成長率 | 23.1% |

依服務類型,市場分為衛星物聯網回程和直接衛星。 2024 年直達衛星服務佔了 54% 的市場佔有率,預計未來幾年將大幅成長。低地球軌道衛星網路的持續部署正在推動這一趨勢,因為這些衛星提供可靠、不間斷的連接,而無需廣泛的地面基礎設施。包括環境監測、資產追蹤和緊急應變在內的多個行業的企業擴大採用直接衛星服務,以提高效率和成本效益。

根據頻段,市場分為 Ku 和 Ka 波段、L 波段、S 波段和其他。受高速資料傳輸和可靠長距離通訊需求的推動,到 2034 年,Ku 波段和 Ka 波段市場的複合年成長率將達到 24%。海運、航空、石油和天然氣等行業擴大利用這些頻段來確保在充滿挑戰的環境中實現即時監控和無縫運行。增強的頻寬和連接可靠性使這些頻段成為需要不間斷通訊的企業的首選。

預計到 2034 年,北美衛星物聯網市場將創收 55 億美元,其中美國將在推動應用方面發揮主導作用。低地球軌道衛星技術的不斷進步正在提高連接性能,而向混合衛星-地面網路的轉變則確保了跨行業的無縫通訊。人們越來越關注透過下一代衛星網路減少延遲和降低營運成本,這進一步加速了其應用。隨著企業尋求克服地理障礙並擴展其物聯網功能,基於衛星的解決方案正在成為現代通訊基礎設施不可或缺的一部分。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 低地球軌道(LEO)衛星網路的擴展

- 衛星物聯網與地面網路的融合實現無縫連接

- 全球連結性需求不斷成長

- 人工智慧和邊緣運算擴大融入衛星物聯網系統

- 物聯網設備普及率上升

- 產業陷阱與挑戰

- 資料安全問題

- 維護成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按服務類型,2021-2034 年

- 主要趨勢

- 衛星物聯網回程

- 直接衛星

第 6 章:市場估計與預測:按頻段,2021-2034 年

- 主要趨勢

- L 波段

- Ku和Ka波段

- S波段

- 其他

第 7 章:市場估計與預測:按組織規模,2021 年至 2034 年

- 主要趨勢

- 大型企業

- 中小企業

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 海上

- 石油和天然氣

- 能源與公用事業

- 運輸與物流

- 衛生保健

- 農業

- 軍事與國防

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AAC Clyde Space

- Airbus

- BAE Systems

- Blue Origin

- China Aerospace Science and Technology Corporation

- Exolaunch

- GomSpace

- Lockheed Martin

- Maxar Technologies

- Millennium Space Systems

- Mitsubishi Electric

- Northrop Grumman

- OHB

- OneWeb

- RTX

- Sierra Nevada

- SpaceX

- Thales Alenia Space

The Global Satellite IoT Market reached USD 2 billion in 2024 and is projected to grow at a remarkable CAGR of 23.1% between 2025 and 2034. The increasing reliance on uninterrupted IoT connectivity in remote and inaccessible regions is a key driver of this growth. Traditional communication networks often fail to provide reliable coverage in such areas, making satellite-based solutions indispensable for industries that depend on real-time data transmission. Companies in logistics, agriculture, and energy are leveraging satellite IoT to optimize operations, enhance efficiency, and improve decision-making through real-time analytics. The demand for seamless communication is rising as businesses prioritize asset tracking, environmental monitoring, and emergency response capabilities, further fueling market expansion.

Advancements in satellite technology, the increasing deployment of Low Earth Orbit (LEO) satellite networks, and the growing adoption of space-based IoT connectivity are accelerating the market's growth. Unlike conventional satellite networks, LEO satellites offer seamless, low-latency connectivity without requiring extensive ground infrastructure, making them a preferred choice for companies looking to expand coverage. The affordability and scalability of satellite IoT solutions are enabling enterprises of all sizes to integrate advanced communication systems into their operations. Governments and private space agencies are investing heavily in satellite constellations to enhance global connectivity, further boosting industry growth. Additionally, the rise of hybrid network models that combine satellite and terrestrial connectivity is creating new opportunities for businesses operating in remote locations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $15.5 Billion |

| CAGR | 23.1% |

The market is segmented by service type into satellite IoT backhaul and direct-to-satellite. Direct-to-satellite services accounted for 54% of the market share in 2024 and are expected to grow significantly in the coming years. The growing deployment of LEO satellite networks is driving this trend, as these satellites provide reliable, uninterrupted connectivity without the need for extensive ground-based infrastructure. Businesses across multiple industries, including environmental monitoring, asset tracking, and emergency response, are increasingly adopting direct-to-satellite services for their efficiency and cost-effectiveness.

By frequency band, the market is categorized into Ku-and-Ka-band, L-band, S-band, and others. The Ku-and-Ka-band segment is poised to grow at a CAGR of 24% through 2034, driven by the need for high-speed data transfer and reliable long-distance communication. Industries such as maritime, aviation, and oil and gas are increasingly utilizing these frequency bands to ensure real-time monitoring and seamless operations in challenging environments. Enhanced bandwidth and connectivity reliability are making these bands the preferred choice for businesses that require uninterrupted communication.

North America satellite IoT market is expected to generate USD 5.5 billion by 2034, with the United States playing a leading role in driving adoption. The continuous advancements in LEO satellite technology are enhancing connectivity performance, while the shift toward hybrid satellite-terrestrial networks is ensuring seamless communication across industries. The growing focus on reducing latency and lowering operational costs through next-generation satellite networks is further accelerating adoption. As enterprises seek to overcome geographic barriers and expand their IoT capabilities, satellite-based solutions are becoming an integral part of modern communication infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Expansion of Low Earth Orbit (LEO) satellite networks

- 3.6.1.2 Integration of satellite IoT with terrestrial networks enables seamless connectivity

- 3.6.1.3 Increasing demand for global connectivity

- 3.6.1.4 Growing incorporation of AI and edge computing into satellite IoT systems

- 3.6.1.5 Rise in IoT device penetration

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Data security concerns

- 3.6.2.2 High cost of maintenance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Services Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Satellite IoT backhaul

- 5.3 Direct-to-Satellite

Chapter 6 Market Estimates & Forecast, By Frequency Band, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 L-Band

- 6.3 Ku-and-Ka-Band

- 6.4 S-Band

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Maritime

- 8.3 Oil & gas

- 8.4 Energy & utilities

- 8.5 Transportation & logistics

- 8.6 Healthcare

- 8.7 Agriculture

- 8.8 Military & defense

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AAC Clyde Space

- 10.2 Airbus

- 10.3 BAE Systems

- 10.4 Blue Origin

- 10.5 China Aerospace Science and Technology Corporation

- 10.6 Exolaunch

- 10.7 GomSpace

- 10.8 Lockheed Martin

- 10.9 Maxar Technologies

- 10.10 Millennium Space Systems

- 10.11 Mitsubishi Electric

- 10.12 Northrop Grumman

- 10.13 OHB

- 10.14 OneWeb

- 10.15 RTX

- 10.16 Sierra Nevada

- 10.17 SpaceX

- 10.18 Thales Alenia Space