|

市場調查報告書

商品編碼

1685205

靜電放電封裝市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Electrostatic Discharge Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

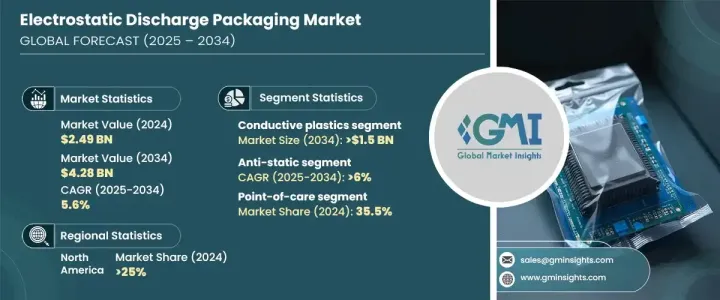

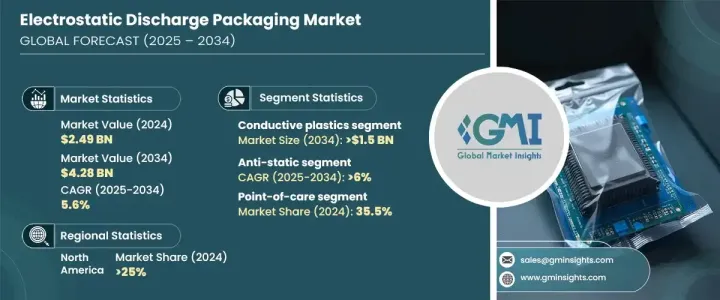

2024 年全球靜電放電 (ESD) 封裝市場價值為 24.9 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.6%。隨著產業更加重視永續性,向環保材料的轉變在推動市場成長方面發揮著至關重要的作用。越來越多的公司採用再生材料和資源高效的解決方案來遵守環境法規和企業永續發展目標。對更環保的 ESD 保護產品的需求不斷成長,這促進了創新,鼓勵了既環保又高效的新包裝解決方案。隨著技術的快速進步以及保護敏感電子元件免受靜電損壞的需求不斷成長,ESD 封裝市場將在未來十年內大幅擴張。

ESD 包裝內的細分市場包括導電塑膠、金屬、耗散塑膠和其他材料。特別是導電塑膠領域,預計到 2034 年將達到 15 億美元。這些材料由注入導電填料的聚合物基物質製成,確保靜電保護、耐用性和成本效益的最佳平衡。它們重量輕但堅固,為保護半導體和電子等領域的敏感元件提供了重要解決方案,因為即使是微小的靜電放電也可能導致代價高昂的故障。導電塑膠的需求不斷成長,證明了其在保護貴重電子產品方面的多功能性和有效性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 24.9 億美元 |

| 預測值 | 42.8億美元 |

| 複合年成長率 | 5.6% |

市場也分為防靜電、導電和靜電耗散類別。防靜電領域預計將以最快的速度成長,預計 2025 年至 2034 年的複合年成長率為 6%。防靜電材料因其價格低廉和用途廣泛而受到青睞,成為多個行業的熱門選擇。這些材料可以防止靜電積聚,這對於包裝各種電子元件和消費品至關重要。隨著企業不斷尋求經濟高效、可靠的解決方案來降低靜電放電的風險,防靜電材料的採用預計將激增。

2024 年,北美佔據全球靜電放電封裝市場的 25%。尤其是美國,對 ESD 封裝解決方案的需求顯著成長。中國不斷擴張的電子、半導體和製造業是這一趨勢的主要驅動力。作為全球技術和創新的領導者,美國電子元件的生產和分銷量很大,因此需要強力的 ESD 保護措施。嚴格的行業法規和對防止靜電相關損害的日益關注進一步促進了北美 ESD 包裝市場的快速擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 電子產品和零件需求不斷成長

- ESD 封裝材料的進步

- 更加重視產品保護

- 越來越重視永續環保材料

- 電子商務擴張推動包裝需求

- 產業陷阱與挑戰

- 先進 ESD 材料成本高昂

- 防靜電包裝回收基礎設施有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:依材料類型,2021-2034 年

- 主要趨勢

- 導電塑膠

- 金屬

- 耗散塑膠

- 其他

第 6 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 袋子和小袋

- 托盤

- 盒子和容器

- 膠帶和標籤

- 泡棉

- 其他

第 7 章:市場估計與預測:依 ESD 分類,2021 年至 2034 年

- 主要趨勢

- 防靜電

- 靜電耗散

- 導電

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 積體電路

- 印刷電路板 (PCB)

- 電動車 (EV) 零件

- 醫療設備

- 航太零件

- 感測器和模組

- 其他

第 9 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 航太和國防

- 汽車

- 消費性電子產品

- 衛生保健

- 工業機械

- 半導體

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- ACL

- Botron Company

- Conductive Containers

- Delphon

- Desco Industries

- Dou Yee Enterprises

- DS Smith

- Elcom

- GWP Conductive

- Indepak

- Nefab Group

- Novapor Hans Lau

- PoliCell

- Protective Packaging

- RS Components and Controls

- Smurfit Kappa

- Statclean Technology

- Swissplast

- Tegatai

- Teknis

- TRICOR

- XpertPack

The Global Electrostatic Discharge (ESD) Packaging Market was valued at USD 2.49 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. As industries focus more on sustainability, the shift toward eco-friendly materials is playing a crucial role in driving market growth. Companies are increasingly adopting recycled materials and resource-efficient solutions to comply with environmental regulations and corporate sustainability goals. This growing demand for greener ESD protection products is fostering innovation, encouraging new packaging solutions that are both environmentally responsible and highly effective. With the rapid advancements in technology and the rising need to protect sensitive electronic components from static damage, the ESD packaging market is set for significant expansion over the coming decade.

Market segments within ESD packaging include conductive plastics, metal, dissipative plastics, and other materials. The conductive plastics segment, in particular, is expected to reach USD 1.5 billion by 2034. These materials are made from polymer-based substances infused with conductive fillers, ensuring an optimal balance of electrostatic protection, durability, and cost efficiency. They are lightweight yet robust, offering an essential solution for protecting sensitive components in sectors such as semiconductors and electronics, where even a small electrostatic discharge can lead to costly failures. The growing demand for conductive plastics is a testament to their versatility and effectiveness in safeguarding valuable electronics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.49 Billion |

| Forecast Value | $4.28 Billion |

| CAGR | 5.6% |

The market is also divided into anti-static, conductive, and static dissipative categories. The anti-static segment is expected to grow at the fastest rate, with a projected CAGR of 6% from 2025 to 2034. Anti-static materials are favored for their affordability and versatility, making them a popular choice across multiple industries. These materials prevent static buildup, which is essential for packaging a wide range of electronic components and consumer goods. As businesses continue to look for cost-effective, reliable solutions to mitigate the risks of electrostatic discharge, the adoption of anti-static materials is expected to surge.

North America held a 25% share of the global electrostatic discharge packaging market in 2024. The United States, in particular, is experiencing significant growth in demand for ESD packaging solutions. The country's expanding electronics, semiconductor, and manufacturing industries are key drivers of this trend. As a global leader in technology and innovation, the U.S. has high production and distribution volumes of electronic components, necessitating robust ESD protection measures. Stringent industry regulations and an increasing focus on preventing static-related damage are further contributing to the rapid expansion of the ESD packaging market in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for electronics and components

- 3.4.1.2 Advancements in ESD packaging materials

- 3.4.1.3 Increased focus on product protection

- 3.4.1.4 Increasing emphasis on sustainable and eco-friendly materials

- 3.4.1.5 Expansion of e-commerce drives packaging needs

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High costs of advanced ESD materials

- 3.4.2.2 Limited recycling infrastructure for ESD packaging

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Conductive plastics

- 5.3 Metal

- 5.4 Dissipative plastics

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Bags and pouches

- 6.3 Trays

- 6.4 Boxes and containers

- 6.5 Tapes and labels

- 6.6 Foams

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By ESD Classification, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Anti-static

- 7.3 Static dissipative

- 7.4 Conductive

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Integrated circuits

- 8.3 Printed circuit boards (PCBs)

- 8.4 Electric vehicle (EV) components

- 8.5 Medical devices

- 8.6 Aerospace components

- 8.7 Sensors and modules

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 Aerospace and defense

- 9.3 Automotive

- 9.4 Consumer electronics

- 9.5 Healthcare

- 9.6 Industrial machinery

- 9.7 Semiconductors

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ACL

- 11.2 Botron Company

- 11.3 Conductive Containers

- 11.4 Delphon

- 11.5 Desco Industries

- 11.6 Dou Yee Enterprises

- 11.7 DS Smith

- 11.8 Elcom

- 11.9 GWP Conductive

- 11.10 Indepak

- 11.11 Nefab Group

- 11.12 Novapor Hans Lau

- 11.13 PoliCell

- 11.14 Protective Packaging

- 11.15 RS Components and Controls

- 11.16 Smurfit Kappa

- 11.17 Statclean Technology

- 11.18 Swissplast

- 11.19 Tegatai

- 11.20 Teknis

- 11.21 TRICOR

- 11.22 XpertPack