|

市場調查報告書

商品編碼

1685199

醫療吊塔市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Medical Pendant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

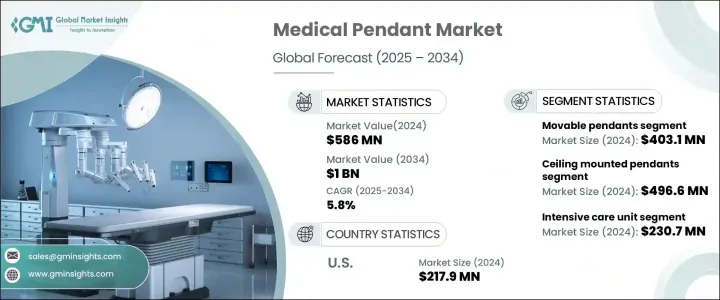

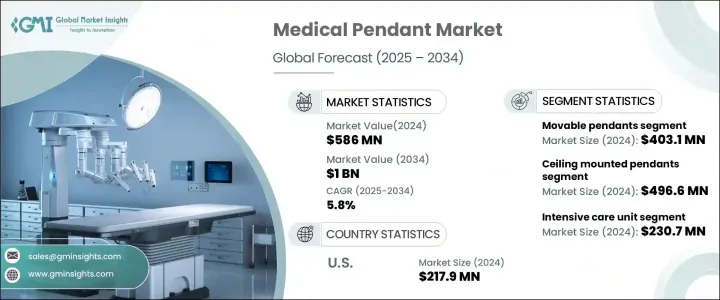

2024 年全球醫用吊塔市場規模達 5.86 億美元,預估 2025 年至 2034 年期間複合年成長率為 5.8%。醫療機構對最佳化空間利用的需求不斷成長,加上吊塔技術的進步,正在推動市場成長。醫院和外科中心擴大採用醫療吊塔系統來提高效率、簡化工作流程並確保快速獲得救生設備。隨著醫療保健產業向數位化和自動化轉變,對先進的吊塔解決方案的需求不斷上升,為醫務人員提供無縫使用基本工具的途徑。

醫療保健基礎設施的擴張,特別是在新興經濟體,創造了新的成長機會。政府和私人投資者正在向醫院建設和現代化項目注入大量資金,進一步推動對醫療吊塔系統的需求。隨著對人體工學和操作靈活性的日益關注,醫療機構優先考慮能夠增強患者護理並最佳化可用空間的解決方案。具有即時監控功能的智慧吊墜等技術創新正在徹底改變市場,為醫療保健專業人員提供更高的精度和控制力。對感染控制和衛生標準的日益重視也推動了對採用抗菌塗層和非接觸式操作功能的先進吊墜系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.86億美元 |

| 預測值 | 10億美元 |

| 複合年成長率 | 5.8% |

2024 年,可移動吊墜佔據了市場主導地位,創造了 4.031 億美元的收入。它們的靈活性和易於移動性使它們成為動態醫療環境中的首選,因為在這種環境中,空間效率和快速使用設備至關重要。這些吊墜經過精心設計,可輕鬆重新定位,幫助醫療保健專業人員最佳化房間佈局,同時減輕身體壓力。透過釋放寶貴的地面空間,可移動吊塔可提高手術室、重症監護室和急診室內的移動性。它們適應不斷發展的醫療程序的能力使其成為現代醫療保健環境中的重要組成部分。

重症監護病房部門在 2024 年引領市場,收入達 2.307 億美元。 ICU 吊塔對於集中訪問生命維持系統、醫用氣體和基本監測設備至關重要,使醫療保健提供者能夠在緊急情況下迅速做出反應。這些吊墜旨在支援各種重症監護設備,例如呼吸機、輸液泵和病人監護儀,可加強病人護理並簡化醫療程序。世界各地的醫院持續投資高性能 ICU 吊塔系統,以提高效率並維持重症監護的有序設置。由於慢性病和人口老化導致重症監護病房入院人數不斷增加,對先進的吊塔解決方案的需求仍然強勁。

2024 年美國醫療吊塔市場價值為 2.179 億美元,預計到 2034 年將以 4.9% 的複合年成長率擴大。心血管疾病、糖尿病和呼吸系統疾病等慢性病的發生率不斷上升,推動了對先進重症監護病房的需求。隨著老齡人口的成長,對高效能 ICU 設置和最先進的醫療吊塔系統的需求也日益增加。醫院正在迅速將智慧吊墜解決方案與即時監控和資料分析功能相結合,以增強患者安全性並改善醫療保健效果。這些技術先進的系統提供精確度、控制力以及與現代醫療設備的無縫整合,使美國成為不斷發展的醫療吊塔市場的關鍵參與者。隨著醫療保健提供者專注於利用最新創新技術升級其設施,對尖端吊塔解決方案的需求持續加速成長。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 醫療機構數量增加

- 住院和手術數量增加

- 臨床工作流程效率的需求不斷成長

- 醫療吊塔的技術進步

- 產業陷阱與挑戰

- 醫療吊墜價格昂貴

- 缺乏熟練的醫療保健人員

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 價值鏈分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 可移動吊墜

- 多臂活動吊墜

- 單臂活動吊墜

- 固定吊墜

第 6 章:市場估計與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 天花板吊燈

- 壁掛式吊燈

- 其他安裝類型

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 重症加護病房(ICU)

- 手術

- 麻醉

- 內視鏡檢查

- 其他應用

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用戶

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AEONMED

- Amico

- BeaconMedaes

- Brandon Medical

- Drager

- EMALED

- Heal Force

- mindray

- NOVAIR MEDICAL

- pneumatik berlin medical systems

- COMEN

- Silbermann

- STERIS

- SURGIRIS

- TRIVITRON HEALTHCARE

The Global Medical Pendant Market reached USD 586 million in 2024 and is on track to expand at a CAGR of 5.8% from 2025 to 2034. The rising demand for optimized space utilization in healthcare facilities, coupled with advancements in pendant technology, is driving market growth. Hospitals and surgical centers are increasingly adopting medical pendant systems to enhance efficiency, streamline workflows, and ensure quick access to life-saving equipment. As the healthcare industry shifts toward digitalization and automation, the need for advanced pendant solutions continues to rise, providing medical staff with seamless access to essential tools.

The expansion of healthcare infrastructure, particularly in emerging economies, creates new growth opportunities. Governments and private investors are injecting significant funds into hospital construction and modernization projects, further propelling the demand for medical pendant systems. With an increasing focus on ergonomics and operational flexibility, healthcare facilities prioritize solutions that enhance patient care while optimizing available space. Technological innovations such as smart pendants with real-time monitoring capabilities are revolutionizing the market, offering healthcare professionals greater precision and control. The growing emphasis on infection control and improved hygiene standards is also fueling demand for advanced pendant systems designed with antimicrobial coatings and touchless operation features.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $586 Million |

| Forecast Value | $1 Billion |

| CAGR | 5.8% |

Movable pendants dominated the market in 2024, generating USD 403.1 million in revenue. Their flexibility and ease of movement make them the preferred choice in dynamic medical settings where space efficiency and quick accessibility to equipment are critical. Designed for effortless repositioning, these pendants help healthcare professionals optimize room layouts while reducing physical strain. By freeing up valuable floor space, movable pendants improve mobility within operating rooms, intensive care units, and emergency departments. Their ability to adapt to evolving medical procedures makes them an essential component in modern healthcare environments.

The intensive care unit segment led the market in 2024, accounting for USD 230.7 million in revenue. ICU pendants are crucial in centralizing access to life-support systems, medical gases, and essential monitoring equipment, enabling healthcare providers to respond swiftly during emergencies. Designed to support a variety of critical care devices such as ventilators, infusion pumps, and patient monitors, these pendants enhance patient care and streamline medical procedures. Hospitals worldwide continue investing in high-performance ICU pendant systems to improve efficiency and maintain an organized setup for critical care. With a rising number of ICU admissions due to chronic illnesses and aging populations, the demand for advanced pendant solutions remains strong.

The U.S. medical pendant market was valued at USD 217.9 million in 2024 and is expected to expand at a CAGR of 4.9% through 2034. The increasing prevalence of chronic conditions such as cardiovascular diseases, diabetes, and respiratory disorders is driving the need for advanced intensive care units. As the aging population grows, the demand for efficient ICU setups and state-of-the-art medical pendant systems is rising. Hospitals are rapidly integrating smart pendant solutions with real-time monitoring and data analytics capabilities to enhance patient safety and improve healthcare outcomes. These technologically advanced systems offer precision, control, and seamless integration with modern medical equipment, positioning the U.S. as a key player in the evolving medical pendant market. As healthcare providers focus on upgrading their facilities with the latest innovations, demand for cutting-edge pendant solutions continues to accelerate.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in number of healthcare facilities

- 3.2.1.2 Increasing number of hospital admission & surgeries

- 3.2.1.3 Rising demand for clinical workflow efficiency

- 3.2.1.4 Technological advancements in medical pendants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of medical pendants

- 3.2.2.2 Lack of skilled healthcare workforce

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Value chain analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Movable pendants

- 5.2.1 Multi-arm movable pendants

- 5.2.2 Single-arm movable pendants

- 5.3 Fixed pendants

Chapter 6 Market Estimates and Forecast, By Installation, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ceiling mounted pendants

- 6.3 Wall mounted pendants

- 6.4 Other installation types

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Intensive care unit (ICU)

- 7.3 Surgery

- 7.4 Anesthesia

- 7.5 Endoscopy

- 7.6 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory surgical centers

- 8.4 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AEONMED

- 10.2 Amico

- 10.3 BeaconMedaes

- 10.4 Brandon Medical

- 10.5 Drager

- 10.6 EMALED

- 10.7 Heal Force

- 10.8 mindray

- 10.9 NOVAIR MEDICAL

- 10.10 pneumatik berlin medical systems

- 10.11 COMEN

- 10.12 Silbermann

- 10.13 STERIS

- 10.14 SURGIRIS

- 10.15 TRIVITRON HEALTHCARE