|

市場調查報告書

商品編碼

1685190

儀表電纜市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Instrumentation Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

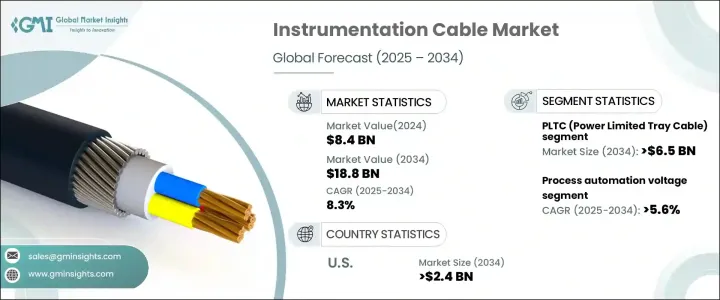

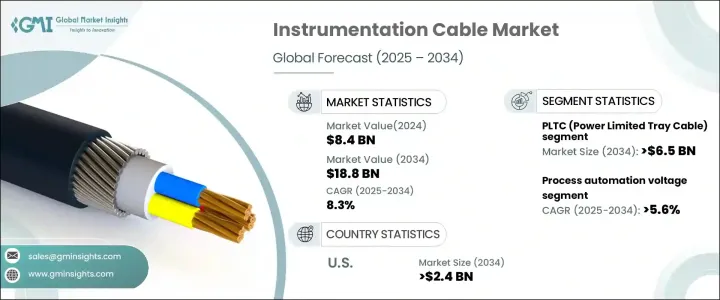

2024 年全球儀器電纜市場價值為 84 億美元,預計 2025 年至 2034 年的複合年成長率為 8.3%。這一令人印象深刻的擴張歸因於工業自動化和製程控制系統對精確訊號傳輸的需求激增。儀器電纜以其可靠性和效率而聞名,在石油和天然氣、發電、製造和再生能源等行業中變得至關重要。這些行業越來越依賴先進的佈線解決方案來最佳化營運、最大限度地減少停機時間並確保在苛刻的條件下實現無縫性能。

此外,全球對再生能源專案和智慧電網基礎設施投資的推動進一步推動了對儀器電纜的需求。亞太地區和中東地區的新興經濟體是特別值得關注的市場,這些市場受到重大基礎設施發展措施的推動。同時,隨著製造商優先考慮環保解決方案(包括低菸、無鹵電纜),以滿足嚴格的法規並符合全球永續發展目標,該行業正在經歷快速創新。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 84億美元 |

| 預測值 | 188億美元 |

| 複合年成長率 | 8.3% |

技術進步正在改變儀器電纜市場,使這些產品更加耐用、緊湊和多功能。這些創新為各產業的擴展應用打開了大門。對基礎設施現代化和自動化技術的日益關注進一步加速了市場的成長。在工業環境中,可靠、高效的儀器電纜對於精確傳輸資料和訊號、確保有效的監控和控制是必不可少的。物聯網(IoT)和人工智慧(AI)等尖端技術的整合正在推動對高效能佈線系統的大量投資,為長期產業擴張奠定了基礎。

按產品類型分類,限功率托盤電纜 (PLTC) 正獲得廣泛關注,預計到 2034 年將產生 65 億美元的產值。 PLTC 專為滿足限功率電路的需求而設計,可在工業環境中提供卓越的安全性和效能。這些電纜表現出卓越的耐濕氣、耐化學品和其他惡劣條件的能力,使其成為關鍵應用的理想選擇。它們嚴格遵守安全標準,在提高可靠性的同時最大程度地降低了風險,而其簡單的安裝過程則為大型基礎設施專案提供了經濟高效的解決方案。

受各行各業自動化技術日益普及的推動,到 2034 年,製程自動化電壓領域預計將實現 5.6% 的穩定複合年成長率。這些電纜透過確保無縫監控、控制和資料傳輸,在維持複雜工業過程中的效率和準確性方面發揮關鍵作用。隨著公司擴大實施物聯網和人工智慧驅動的解決方案,對可靠儀器電纜的需求正在激增,支援向自動化操作的持續轉變。

在美國,隨著多個行業廣泛採用先進技術,儀器電纜市場預計到 2034 年將達到 24 億美元。工業和商業應用對高效監控和控制系統的需求不斷成長,推動了對高品質佈線解決方案的需求。此外,對基礎設施升級的大量投資,特別是能源領域的投資,對市場擴張發揮關鍵作用。這一上升趨勢凸顯了儀表電纜在支援全球技術進步和現代基礎設施發展方面發揮的重要作用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- PLTC電纜

- ITC電纜

- TC電纜

- 其他

第 6 章:市場規模與預測:按最終用戶,2021 – 2034 年

- 主要趨勢

- 石油和天然氣

- 化學

- 流程自動化

- 製造業

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Belden

- CommScope

- Elsewedy Electric

- Fujikura

- Furukawa Electric

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- Lapp Group

- Leoni

- LS Cable & Systems

- Nexans

- NKT

- Polycab

- Prysmian Group

- Shawcor

- Sumitomo

- Technikabel

- TFKable

The Global Instrumentation Cable Market, valued at USD 8.4 billion in 2024, is poised for robust growth, with a projected CAGR of 8.3% from 2025 to 2034. This impressive expansion is attributed to the surging demand for precise signal transmission in industrial automation and process control systems. Instrumentation cables, known for their reliability and efficiency, are becoming essential in industries such as oil and gas, power generation, manufacturing, and renewable energy. These sectors increasingly rely on advanced cabling solutions to optimize operations, minimize downtime, and ensure seamless performance under demanding conditions.

Moreover, the global push toward renewable energy projects and smart grid infrastructure investments is further driving the demand for instrumentation cables. Emerging economies in Asia-Pacific and the Middle East are particularly noteworthy markets fueled by significant infrastructure development initiatives. Meanwhile, the sector is witnessing rapid innovation as manufacturers prioritize environmentally friendly solutions, including low-smoke, halogen-free cables, to meet stringent regulations and align with global sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.4 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 8.3% |

Technological advancements are transforming the instrumentation cable market, making these products more durable, compact, and versatile. These innovations are opening doors to expanded applications across a variety of industries. The increasing focus on modernizing infrastructure and adopting automation technologies is further accelerating market growth. In industrial settings, reliable and efficient instrumentation cables are indispensable for transmitting data and signals with precision, ensuring effective monitoring and control. The integration of cutting-edge technologies like the Internet of Things (IoT) and artificial intelligence (AI) is driving significant investment in high-performance cabling systems, setting the stage for long-term industry expansion.

By product type, Power Limited Tray Cable (PLTC) is gaining substantial traction and is forecasted to generate USD 6.5 billion by 2034. PLTC is specifically engineered to meet the demands of power-limited circuits, delivering superior safety and performance in industrial environments. These cables exhibit exceptional resistance to moisture, chemicals, and other harsh conditions, making them an ideal choice for critical applications. Their adherence to safety standards enhances reliability while minimizing risks, and their straightforward installation process offers cost-effective solutions for large-scale infrastructure projects.

The process automation voltage segment is projected to experience a steady CAGR of 5.6% through 2034, driven by the growing adoption of automation technologies across industries. These cables play a pivotal role in maintaining efficiency and accuracy in complex industrial processes by ensuring seamless monitoring, control, and data transmission. As companies increasingly implement IoT and AI-driven solutions, the demand for reliable instrumentation cables is skyrocketing, supporting the ongoing shift toward automated operations.

In the United States, the instrumentation cable market is expected to reach USD 2.4 billion by 2034, driven by the widespread adoption of advanced technologies across multiple industries. The rising need for efficient monitoring and control systems in industrial and commercial applications is fueling demand for high-quality cabling solutions. Additionally, significant investments in upgrading infrastructure, particularly within the energy sector, are playing a critical role in the market's expansion. This upward trajectory underscores the instrumental role instrumentation cables play in supporting technological advancement and modern infrastructure development worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 PLTC cable

- 5.3 ITC cable

- 5.4 TC cable

- 5.5 Others

Chapter 6 Market Size and Forecast, By End User, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Oil & gas

- 6.3 Chemical

- 6.4 Process automation

- 6.5 Manufacturing

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Belden

- 8.2 CommScope

- 8.3 Elsewedy Electric

- 8.4 Fujikura

- 8.5 Furukawa Electric

- 8.6 Helukabel

- 8.7 Hellenic Group

- 8.8 Kabelwerk Eupen

- 8.9 Lapp Group

- 8.10 Leoni

- 8.11 LS Cable & Systems

- 8.12 Nexans

- 8.13 NKT

- 8.14 Polycab

- 8.15 Prysmian Group

- 8.16 Shawcor

- 8.17 Sumitomo

- 8.18 Technikabel

- 8.19 TFKable