|

市場調查報告書

商品編碼

1685188

內分泌檢測市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Endocrine Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

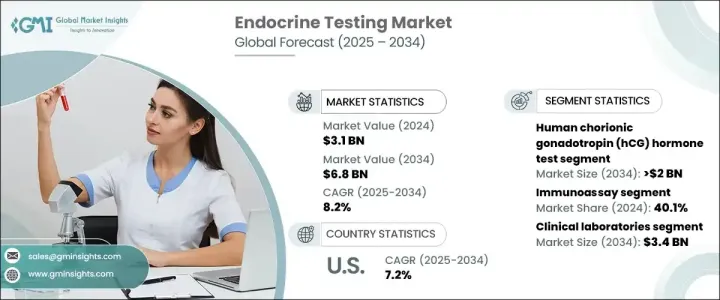

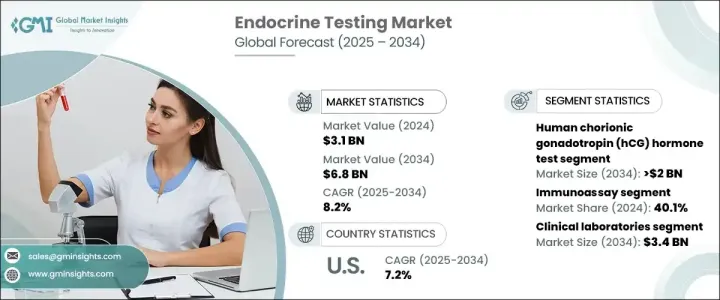

2024 年全球內分泌檢測市場價值為 31 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 8.2%。推動這一成長的因素有很多,包括內分泌疾病患病率上升、常規健康檢查意識增強,以及政府支持的旨在改善醫療保健可及性的舉措。人們對預防性醫療保健的日益重視導致對內分泌測試的需求激增,特別是對於管理糖尿病和甲狀腺疾病等慢性病的個人而言。

診斷工具的技術進步和檢測服務的改善正在進一步加速市場擴張。即時診斷和個人化醫療解決方案等創新檢測方法的整合也正在重塑醫療格局,使內分泌檢測更加方便、高效。由於全球醫療保健系統優先考慮內分泌相關疾病的早期發現和管理,預計市場在預測期內將實現持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 68億美元 |

| 複合年成長率 | 8.2% |

在各種測試類型中,人類絨毛膜促性腺激素 (hCG) 測試預計將以 7.6% 的複合年成長率成長,到 2034 年將達到 20 億美元。 hCG 測試廣泛用於妊娠檢測,因其準確性和易用性而受到青睞。這些測試可在臨床環境和家庭環境中輕鬆使用,對於尋求可靠妊娠確認的個人來說是一種方便的選擇。這些測試的日益普及反映了對方便用戶使用且精確的診斷解決方案日益成長的需求。

市場按最終用途進行細分,其中臨床實驗室在 2024 年佔據最大佔有率。預計到 2034 年,該細分市場將達到 34 億美元。臨床實驗室配備了先進的診斷技術並配備了熟練的專業人員,使其成為準確荷爾蒙檢測的首選。這些機構專門為糖尿病、甲狀腺功能障礙和腎上腺疾病等需要詳細而精確的檢測的疾病提供全面的診斷服務。臨床實驗室提供的專業知識和可靠性繼續推動其在市場上佔據主導地位。

美國內分泌檢測市場在 2024 年創下了 12 億美元的產值,預計到 2034 年將以 7.2% 的複合年成長率成長。領先的診斷公司和實驗室提供最先進的檢測解決方案,支持了美國市場的成長。政府旨在解決慢性病和促進預防保健的措施進一步促進了市場的擴張。此外,即時診斷和個人化醫療解決方案的日益普及正在推動全國對內分泌檢測的需求。隨著對早期診斷和客製化治療方案的關注度不斷提高,預計美國市場將繼續成為全球內分泌檢測產業的主要貢獻者。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 糖尿病、甲狀腺疾病和肥胖症盛行率不斷上升

- 政府支持性資金舉措

- 技術進步

- 日常健康監測意識不斷增強

- 產業陷阱與挑戰

- 測試技術開發成本高

- 缺乏意識

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 人類絨毛膜促性腺激素 (hCG) 檢測

- 促甲狀腺激素 (TSH) 檢測

- 胰島素測試

- 黃體酮檢測

- 黃體生成素 (LH) 檢測

- 催乳素測試

- 其他測試類型

第6章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- 免疫分析

- 質譜

- 色譜法

- 基於核酸

- 其他技術

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 臨床實驗室

- 醫院

- 診斷中心

- 其他最終用途

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- Agilent

- BECKMAN COULTER

- BIO RAD

- biomedical TECHNOLOGIES

- BIOMERIEUX

- DH TECH

- Diasorin

- labcorp

- QuidelOrtho

- QIAGEN

- Quest Diagnostics

- Roche

- SCIEX

- SIEMENS Healthineers

- Thermo Fisher SCIENTIFIC

The Global Endocrine Testing Market, valued at USD 3.1 billion in 2024, is poised for significant growth, with a projected CAGR of 8.2% from 2025 to 2034. This growth is driven by several factors, including the rising prevalence of endocrine disorders, increasing awareness of routine health check-ups, and government-backed initiatives aimed at improving healthcare accessibility. The growing emphasis on preventive healthcare has led to a surge in demand for endocrine tests, particularly among individuals managing chronic conditions such as diabetes and thyroid disorders.

Technological advancements in diagnostic tools and improved access to testing services are further accelerating market expansion. The integration of innovative testing methods, such as point-of-care diagnostics and personalized healthcare solutions, is also reshaping the landscape, making endocrine testing more accessible and efficient. As healthcare systems worldwide prioritize early detection and management of endocrine-related conditions, the market is expected to witness sustained growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 8.2% |

Among the various test types, the human chorionic gonadotropin (hCG) hormone test is anticipated to grow at a CAGR of 7.6%, reaching USD 2 billion by 2034. Widely used for pregnancy detection, hCG tests are favored for their accuracy and ease of use. These tests are readily available in both clinical settings and for at-home use, making them a convenient option for individuals seeking reliable pregnancy confirmation. The increasing adoption of these tests reflects the growing demand for user-friendly and precise diagnostic solutions.

The market is segmented by end-use, with clinical laboratories holding the largest share in 2024. This segment is projected to reach USD 3.4 billion by 2034. Clinical laboratories are equipped with advanced diagnostic technologies and staffed by skilled professionals, making them the preferred choice for accurate hormone testing. These facilities specialize in comprehensive diagnostic services for conditions such as diabetes, thyroid dysfunction, and adrenal disorders, which require detailed and precise testing. The expertise and reliability offered by clinical laboratories continue to drive their dominance in the market.

The U.S. endocrine testing market generated USD 1.2 billion in 2024 and is forecast to grow at a CAGR of 7.2% through 2034. The presence of leading diagnostic firms and laboratories offering state-of-the-art testing solutions supports the market's growth in the United States. Government initiatives aimed at addressing chronic illnesses and promoting preventive care further contribute to the market's expansion. Additionally, the increasing adoption of point-of-care testing and personalized healthcare solutions is driving demand for endocrine testing across the country. As the focus on early diagnosis and tailored treatment options intensifies, the U.S. market is expected to remain a key contributor to the global endocrine testing industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes, thyroid, and obesity

- 3.2.1.2 Supportive government funding initiatives

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing awareness of routine health monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost for the development of testing technologies

- 3.2.2.2 Lack of awareness

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Human chorionic gonadotropin (hCG) hormone test

- 5.3 Thyroid stimulating hormone (TSH) test

- 5.4 Insulin test

- 5.5 Progesterone test

- 5.6 Luteinizing hormone (LH) test

- 5.7 Prolactin test

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immunoassay

- 6.3 Mass spectroscopy

- 6.4 Chromatography

- 6.5 Nucleic acid based

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical laboratories

- 7.3 Hospitals

- 7.4 Diagnostic centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Agilent

- 9.3 BECKMAN COULTER

- 9.4 BIO RAD

- 9.5 biomedical TECHNOLOGIES

- 9.6 BIOMERIEUX

- 9.7 DH TECH

- 9.8 Diasorin

- 9.9 labcorp

- 9.10 QuidelOrtho

- 9.11 QIAGEN

- 9.12 Quest Diagnostics

- 9.13 Roche

- 9.14 SCIEX

- 9.15 SIEMENS Healthineers

- 9.16 Thermo Fisher SCIENTIFIC