|

市場調查報告書

商品編碼

1685179

動脈粥狀硬化切除設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Atherectomy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

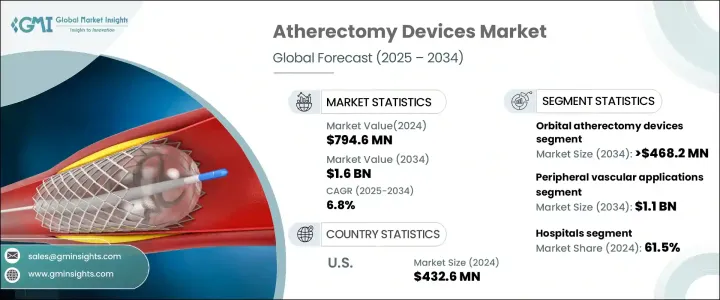

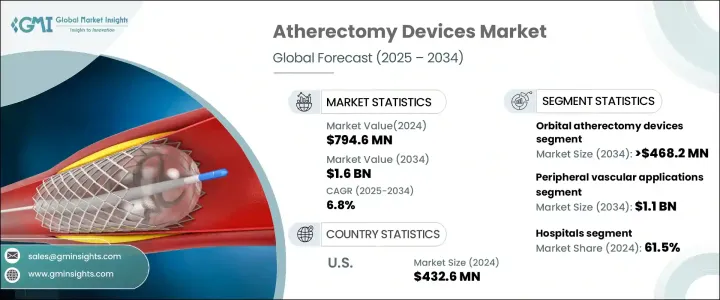

2024 年全球動脈粥狀硬化切除設備市場規模達到 7.946 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.8%。周邊動脈疾病 (PAD) 和冠狀動脈疾病 (CAD) 盛行率的上升推動了對先進治療方案的需求。隨著老齡人口的增加和久坐生活方式的日益普遍,糖尿病和肥胖症病例激增,進一步推動了對微創手術的需求。醫療保健提供者正在尋求精準驅動的解決方案,以增強斑塊去除效果,同時最大限度地減少併發症,使動脈粥狀硬化切除設備成為心血管治療的重要工具。

以患者為中心的醫療保健日益成為趨勢,推動醫院和醫療中心採用可改善臨床結果的技術。與傳統治療方法相比,微創動脈粥狀硬化斑塊切除術可縮短恢復時間、減少住院時間並降低術後併發症的風險。這種轉變正在促進醫生和患者的更高採用率。持續的技術進步、監管部門的批准和正在進行的臨床試驗正在增強人們對這些設備的信心,為其更廣泛的應用鋪平道路。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.946 億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 6.8% |

不斷成長的研發投入也推動了市場擴張。各公司正在推出具有卓越效率、精準度和安全性的創新動脈粥狀硬化切除系統。自動化和人工智慧整合設備正在湧現,使臨床醫生能夠最佳化治療方法,同時縮短手術時間。優惠的報銷政策和不斷增加的門診心血管手術數量進一步推動了市場成長。隨著醫療機構優先考慮具有高成功率且經濟有效的解決方案,動脈粥狀硬化斑塊切除設備的使用勢頭持續增強。

根據產品類型,市場分為軌道式、雷射式、定向式和旋轉式動脈粥狀硬化切除術設備。眼眶動脈粥狀硬化切除設備將經歷大幅成長,預計到 2034 年市場價值將達到 4.682 億美元,複合年成長率為 6.6%。這些裝置利用高速旋轉的冠或鑽頭去除斑塊同時保持動脈完整性,從而提高了程序的準確性。他們在治療周邊動脈和冠狀動脈方面的持續成功使他們成為處理複雜病例的醫療保健專業人員的首選。隨著醫院和外科中心優先考慮創新有效的治療方案,對眼眶動脈粥狀硬化切除設備的需求持續上升。

根據應用,市場分為周邊血管和冠狀動脈手術。預計周邊血管領域將大幅擴張,到 2034 年將達到 11 億美元,複合年成長率為 6.3%。周邊動脈疾病嚴重影響活動能力和生活品質,迫切需要有效的治療替代方案。與傳統手術相比,動脈粥狀硬化斑塊切除術具有顯著的優勢,包括恢復期短、併發症少、住院時間短。隨著對這些益處的認知不斷提高,越來越多的患者和醫療保健提供者選擇微創干預,從而增加了對動脈粥狀硬化切除設備的需求。

2024 年美國動脈粥狀硬化切除設備市場規模為 4.326 億美元,預計 2025 年至 2034 年的複合年成長率為 6.2%。美國周邊動脈疾病 (PAD) 和冠狀動脈疾病 (CAD) 等心血管疾病負擔日益加重,推動了對先進治療方案的需求。老年人口的不斷成長,加上肥胖和糖尿病的高發生率,進一步加速了市場的成長。醫療機構擴大採用先進的動脈粥狀硬化切除設備,以提高手術精度、改善患者安全性並確保更快的康復。隨著對微創心血管手術的需求不斷成長,美國市場預計將在全球保持主導地位。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創手術的受歡迎程度增加

- 目標患者群體不斷成長

- 最近的技術進步

- 周邊動脈疾病盛行率上升

- 產業陷阱與挑戰

- 產品成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 報銷場景

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 眼眶動脈粥狀硬化切除裝置

- 雷射旋切設備

- 定向旋切裝置

- 旋磨裝置

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 周邊血管應用

- 冠狀動脈應用

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott

- angiodynamics

- AVINGER

- B. Braun

- BD (Becton, Dickinson and Company)

- BIOMERICS

- Boston Scientific

- Cardinal Health

- Cardiovascular Systems

- Cordis

- Philips

- Medtronic

- Nipro

- Rex Medical

- TERUMO

The Global Atherectomy Devices Market reached USD 794.6 million in 2024 and is projected to grow at a CAGR of 6.8% between 2025 and 2034. The rising prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD) is fueling demand for advanced treatment solutions. As aging populations increase and sedentary lifestyles become more common, cases of diabetes and obesity are surging, further driving the need for minimally invasive procedures. Healthcare providers are seeking precision-driven solutions to enhance plaque removal while minimizing complications, making atherectomy devices an essential tool in cardiovascular treatment.

The increasing shift toward patient-centric healthcare is pushing hospitals and medical centers to adopt technologies that improve clinical outcomes. Minimally invasive atherectomy procedures offer faster recovery times, reduced hospital stays, and lower risks of post-surgical complications compared to traditional treatment methods. This shift is encouraging higher adoption rates among physicians and patients. Continuous technological advancements, regulatory approvals, and ongoing clinical trials are strengthening confidence in these devices, paving the way for their broader implementation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 794.6 Million |

| Forecast Value | $ 1.6 Billion |

| CAGR | 6.8% |

Market expansion is also being driven by growing investment in research and development. Companies are introducing innovative atherectomy systems that provide superior efficiency, precision, and safety. Automated and AI-integrated devices are emerging, allowing clinicians to optimize treatment approaches while reducing procedure times. Favorable reimbursement policies and an increasing number of outpatient cardiovascular procedures are further propelling market growth. As medical institutions prioritize cost-effective solutions that deliver high success rates, atherectomy devices continue to gain momentum.

By product type, the market is segmented into orbital, laser, directional, and rotational atherectomy devices. Orbital atherectomy devices are set to experience substantial growth, with market value expected to reach USD 468.2 million by 2034 at a CAGR of 6.6%. These devices improve procedural accuracy by utilizing a high-speed spinning crown or burr to remove plaque while preserving arterial integrity. Their consistent success in treating both peripheral and coronary arteries has positioned them as a preferred choice among healthcare professionals managing complex cases. As hospitals and surgical centers prioritize innovative and efficient treatment options, the demand for orbital atherectomy devices continues to rise.

Based on application, the market is divided into peripheral vascular and coronary procedures. The peripheral vascular segment is expected to expand significantly, projected to reach USD 1.1 billion by 2034 at a CAGR of 6.3%. Peripheral artery disease severely impacts mobility and quality of life, creating an urgent need for effective treatment alternatives. Atherectomy procedures offer notable advantages, including reduced recovery periods, fewer complications, and shorter hospital stays compared to traditional surgery. As awareness of these benefits grows, more patients and healthcare providers are opting for minimally invasive interventions, boosting the demand for atherectomy devices.

The U.S. atherectomy devices market accounted for USD 432.6 million in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2034. The country's increasing burden of cardiovascular diseases, including PAD and CAD, is driving demand for advanced treatment solutions. A growing elderly population, coupled with high obesity and diabetes rates, is further accelerating market growth. Medical institutions are increasingly adopting cutting-edge atherectomy devices that enhance procedural precision, improve patient safety, and ensure faster recoveries. As the demand for minimally invasive cardiovascular procedures rises, the U.S. market is expected to maintain its dominant position in the global landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in preference for minimally invasive procedures

- 3.2.1.2 Growing target patient population

- 3.2.1.3 Recent technological advancements

- 3.2.1.4 Rising prevalence of peripheral arterial diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Orbital atherectomy devices

- 5.3 Laser atherectomy devices

- 5.4 Directional atherectomy devices

- 5.5 Rotational atherectomy devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Peripheral vascular applications

- 6.3 Coronary applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 angiodynamics

- 9.3 AVINGER

- 9.4 B. Braun

- 9.5 BD (Becton, Dickinson and Company)

- 9.6 BIOMERICS

- 9.7 Boston Scientific

- 9.8 Cardinal Health

- 9.9 Cardiovascular Systems

- 9.10 Cordis

- 9.11 Philips

- 9.12 Medtronic

- 9.13 Nipro

- 9.14 Rex Medical

- 9.15 TERUMO