|

市場調查報告書

商品編碼

1685090

醫療器材測試服務市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Medical Devices Testing Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

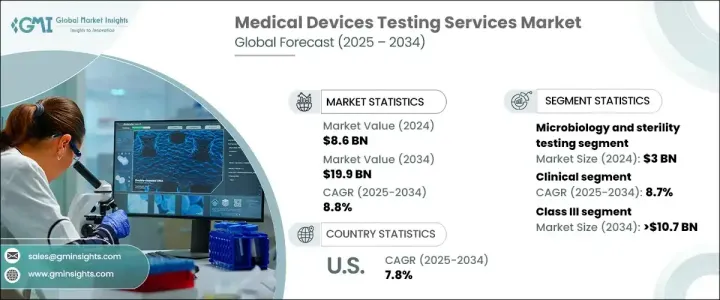

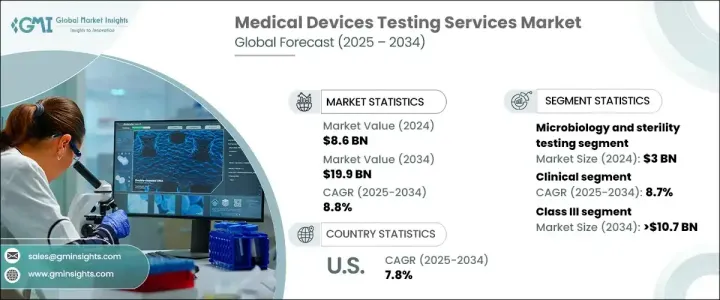

2024 年全球醫療器材測試服務市場價值為 86 億美元,預計 2025 年至 2034 年期間將以 8.8% 的強勁複合年成長率成長。這一成長主要得益於滿足嚴格監管要求的需求日益成長,以確保醫療器材的安全性、性能和功效。隨著醫療技術的不斷創新,對全面、嚴格的檢測服務的需求比以往任何時候都更加重要。醫療器材製造商優先進行測試以符合國際監管標準並避免代價高昂的產品召回或安全問題。隨著穿戴式裝置、植入式科技和診斷工具等醫療設備的複雜性不斷增加,對先進測試方法的需求也隨之增加。透過臨床和臨床前試驗以及微生物測試來確保安全性和有效性的需求將繼續影響市場的未來。

在各種檢測服務中,微生物學和無菌檢測在 2024 年佔據了市場主導地位,創收 30 億美元。這項服務對於檢測微生物污染和驗證滅菌技術至關重要,對於確保設備符合安全標準至關重要。醫療機構對感染控制的日益重視進一步推動了對這些服務的需求。鑑於醫療相關感染仍然是人們最關心的問題,無菌測試的需求預計將繼續上升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 86億美元 |

| 預測值 | 199億美元 |

| 複合年成長率 | 8.8% |

醫療器材測試服務市場也分為臨床測試和臨床前測試。臨床測試領域預計將以 8.7% 的複合年成長率成長,到 2034 年預計將達到 131 億美元。臨床試驗對於在現實條件下驗證醫療器材的安全性和有效性至關重要,確保它們符合監管和市場預期。隨著醫療技術的進步,臨床測試在評估穿戴式裝置和植入物等裝置的可用性、生物相容性和整體安全性方面變得更加重要。這些設備日益複雜,需要更詳細的臨床評估方法,尤其是對於可以無縫融入人體的新創新設備。

美國醫療器材測試服務市場在 2024 年達到 22 億美元,預計 2025 年至 2034 年的複合年成長率為 7.8%。在先進的醫療基礎設施和強大的監管框架的推動下,北美仍然在全球市場佔據主導地位。該地區受益於 FDA 等完善的監管機構網路,這些機構實施全面的測試協議,以確保醫療器械的最高安全和品質標準。這種嚴格的監管環境,加上對研發和測試服務的大量投資,使得北美成為醫療器材測試的中心。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 越來越重視嚴格的審核規範

- 醫療科技的持續快速進步

- 醫療器材驗證和確認的需求不斷成長

- 產業陷阱與挑戰

- 缺乏熟練的專業人員和測試設施

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按服務,2021 - 2034 年

- 主要趨勢

- 微生物學和無菌測試

- 抗菌測試

- 熱原和內毒素檢測

- 無菌測試和驗證

- 生物負荷測定

- 其他微生物學和無菌測試

- 生物相容性測試

- 化學測試

- 包驗證

第6章:市場估計與預測:依階段,2021 - 2034 年

- 主要趨勢

- 臨床

- 臨床前

第 7 章:市場估計與預測:按設備類別,2021 - 2034 年

- 主要趨勢

- III 級

- II 類

- 一級

第 8 章:市場估計與預測:按模式,2021 - 2034 年

- 主要趨勢

- 外包

- 內部

第 9 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 醫療器材製造商

- 臨床研究組織 (CRO)

- 學術及研究機構

- 其他最終用戶

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- charles river

- element

- eurofins

- intertek

- labcorp

- NAMSA

- Pace

- SGS

- Sterigenics

- TUV SUD

- WuXiAppTec

The Global Medical Devices Testing Services Market, valued at USD 8.6 billion in 2024, is projected to grow at a robust CAGR of 8.8% from 2025 to 2034. This growth is largely driven by an increasing need to meet stringent regulatory requirements that ensure medical devices' safety, performance, and efficacy. With continuous innovations in healthcare technology, the demand for comprehensive and rigorous testing services is more essential than ever. Medical device manufacturers are prioritizing testing to comply with international regulatory standards and avoid costly product recalls or safety issues. As the complexity of medical devices such as wearables, implantable technologies, and diagnostic tools rises, so does the need for advanced testing methods. The need to ensure safety and effectiveness through clinical and preclinical trials, as well as microbiological testing, will continue to shape the future of the market.

Among the various testing services, microbiology and sterility testing dominated the market in 2024, generating USD 3 billion. This service is critical in detecting microbial contamination and validating sterilization techniques, which is crucial for ensuring that devices meet safety standards. The growing emphasis on infection control in healthcare facilities further drives the demand for these services. Given that healthcare-associated infections remain a top concern, the need for sterility testing is expected to continue its upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.6 Billion |

| Forecast Value | $19.9 Billion |

| CAGR | 8.8% |

The medical devices testing services market is also segmented into clinical and preclinical testing. The clinical testing segment, which is expected to grow at a CAGR of 8.7%, is projected to reach USD 13.1 billion by 2034. Clinical trials are essential for validating the safety and efficacy of medical devices under real-world conditions, ensuring they meet both regulatory and market expectations. As medical technology advances, clinical testing is becoming even more critical in assessing the usability, biocompatibility, and overall safety of devices like wearables and implants. The increasing complexity of these devices requires a more detailed approach to clinical evaluations, especially with newer innovations that integrate seamlessly into the human body.

The U.S. medical devices testing services market garnered USD 2.2 billion in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2034. North America, driven by its advanced healthcare infrastructure and strong regulatory framework, remains a dominant player in the global market. The region benefits from a well-established network of regulatory bodies, such as the FDA, that enforce comprehensive testing protocols to ensure the highest safety and quality standards for medical devices. This rigorous regulatory landscape, combined with considerable investments in R&D and testing services, makes North America a hub for medical devices testing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing focus on strict approval norms

- 3.2.1.2 Consistent and rapid advancements in medical technologies

- 3.2.1.3 Rising need for verification and validation of medical devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals and testing facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microbiology and sterility testing

- 5.2.1 Antimicrobial testing

- 5.2.2 Pyrogen and endotoxin testing

- 5.2.3 Sterility test and validation

- 5.2.4 Bioburden determination

- 5.2.5 Other microbiology and sterility testings

- 5.3 Biocompatibility tests

- 5.4 Chemistry test

- 5.5 Package validation

Chapter 6 Market Estimates and Forecast, By Phase, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Clinical

- 6.3 Preclinical

Chapter 7 Market Estimates and Forecast, By Device Class, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Class III

- 7.3 Class II

- 7.4 Class I

Chapter 8 Market Estimates and Forecast, By Mode, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Outsourced

- 8.3 In-house

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Medical device manufacturers

- 9.3 Clinical research organizations (CROs)

- 9.4 Academic and research institutions

- 9.5 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 charles river

- 11.2 element

- 11.3 eurofins

- 11.4 intertek

- 11.5 labcorp

- 11.6 NAMSA

- 11.7 Pace

- 11.8 SGS

- 11.9 Sterigenics

- 11.10 TUV SUD

- 11.11 WuXiAppTec