|

市場調查報告書

商品編碼

1685081

屋頂太陽能光電模組市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Rooftop Solar PV Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

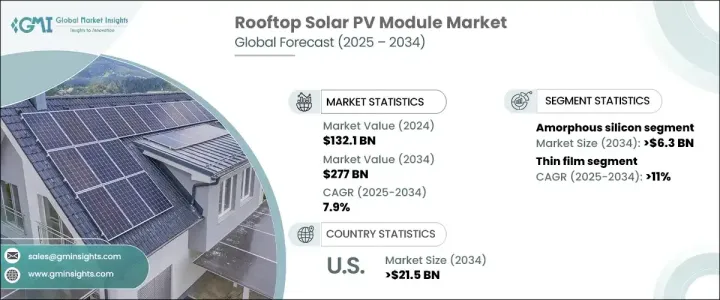

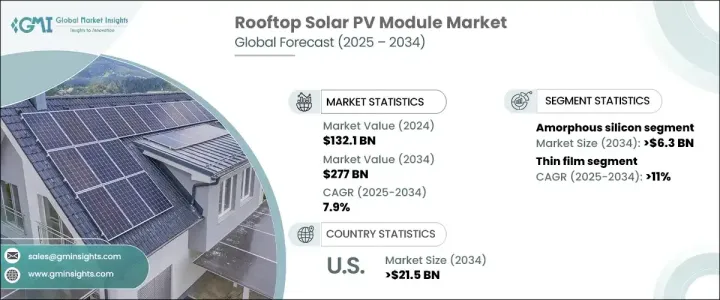

2024 年全球屋頂太陽能光電模組市場規模將達到 1,321 億美元,預計 2025 年至 2034 年的複合年成長率為 7.9%。屋頂太陽能光伏 (PV) 組件利用矽等半導體材料將陽光轉化為電能,擴大被住宅、商業和工業領域採用。這些系統提供再生能源供現場消費,或將多餘的能源回饋到電網。人們對氣候變遷的認知日益增強以及減少溫室氣體排放的迫切需求正在推動再生能源解決方案的採用。世界各國政府都在推出獎勵措施和補貼措施來推廣太陽能,進一步加速市場成長。

此外,太陽能技術的進步正在提高能源轉換效率,使得屋頂太陽能光電系統更具成本效益且更易於存取。對永續能源解決方案的需求不斷成長,加上對能源獨立的需求,使得屋頂太陽能光電模組成為消費者和企業的首選。市場也受益於人們對分散式能源系統的日益關注,該系統增強了停電和自然災害期間的能源彈性。隨著全球能源格局向更清潔的替代能源轉變,屋頂太陽能光電模組市場預計將在預測期內見證顯著成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1321億美元 |

| 預測值 | 2770億美元 |

| 複合年成長率 | 7.9% |

市場按產品類型細分,預計到 2034 年非晶矽模組將產生 63 億美元的收入。與傳統的晶體矽板相比,這些模組更輕、更靈活,適用於各種結構。他們提供分散能源解決方案的能力是一個關鍵的成長動力,因為他們在緊急情況下提高了能源可靠性。人們對靈活、適應性強的能源系統的日益青睞,推動了對非晶矽模組的需求,尤其是在自然災害多發地區。

在技術方面,屋頂太陽能光電模組市場的薄膜部分預計到 2034 年將以驚人的 11% 的複合年成長率成長。薄膜技術因其輕量化的設計、易於安裝和靈活性而受到青睞,這使得它能夠安裝在具有非常規形狀(例如曲面)的屋頂上。薄膜技術的最新進展旨在提高能源轉換效率和融入先進材料,進一步推動了這一領域的成長。這些創新使薄膜模組成為住宅和商業應用的熱門選擇。

預計到 2034 年,美國屋頂太陽能光電模組市場將創收 215 億美元。政府措施在推動這一成長方面發揮著重要作用,例如投資稅收抵免 (ITC),為太陽能系統安裝提供 30% 的稅收抵免。此外,供應鏈中斷和自然災害加劇了人們對能源安全的擔憂,促使消費者採用更可靠、更持久的能源解決方案。對永續性和能源獨立的日益關注進一步推動了美國對屋頂太陽能光電模組的需求。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:依技術,2021 – 2034 年

- 主要趨勢

- 薄膜

- 晶體矽

第 6 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 單晶矽

- 多晶矽

- 碲化鎘

- 非晶矽

- 銅銦鎵二硒

第 7 章:市場規模及預測:依連結性,2021 – 2034 年

- 主要趨勢

- 並網

- 離網

第 8 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 住宅

- 商業和工業

- 公用事業

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 奧地利

- 挪威

- 丹麥

- 芬蘭

- 法國

- 德國

- 英國

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 約旦

- 阿曼

- 非洲

- 南非

- 埃及

- 阿爾及利亞

- 奈及利亞

- 摩洛哥

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

- 秘魯

第10章:公司簡介

- Canadian Solar

- EMMVEE SOLAR

- Hanwha Group

- Indosolar

- JA Solar Technology

- JinkoSolar

- LONGi

- Motech Industries

- REC Solar Holdings

- RENESOLA

- Risen Energy

- Shunfeng International Clean Energy

- SunPower Corporation

- Trina Solar

- Vikram Solar

- Yingli Solar

The Global Rooftop Solar PV Module Market reached USD 132.1 billion in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2034. Rooftop solar photovoltaic (PV) modules, which convert sunlight into electricity using semiconductor materials like silicon, are increasingly being adopted across residential, commercial, and industrial sectors. These systems provide renewable energy for on-site consumption or can feed surplus energy back into the grid. The growing awareness of climate change and the urgent need to reduce greenhouse gas emissions are driving the adoption of renewable energy solutions. Governments worldwide are introducing incentives and subsidies to promote solar energy, further accelerating market growth.

Additionally, advancements in solar technology are improving energy conversion efficiency, making rooftop solar PV systems more cost-effective and accessible. The rising demand for sustainable energy solutions, coupled with the need for energy independence, is positioning rooftop solar PV modules as a preferred choice for consumers and businesses alike. The market is also benefiting from the increasing focus on decentralized energy systems, which enhance energy resilience during power outages and natural disasters. As the global energy landscape shifts towards cleaner alternatives, the rooftop solar PV module market is expected to witness significant growth during the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $132.1 Billion |

| Forecast Value | $277 Billion |

| CAGR | 7.9% |

The market is segmented by product type, with amorphous silicon modules projected to generate USD 6.3 billion by 2034. These modules are lighter and more flexible compared to traditional crystalline silicon panels, making them suitable for a wide range of structures. Their ability to provide decentralized energy solutions is a key growth driver, as they enhance energy reliability during emergencies. The growing preference for flexible and adaptable energy systems is fueling the demand for amorphous silicon modules, particularly in regions prone to natural disasters.

In terms of technology, the thin film segment of the rooftop solar PV module market is expected to grow at an impressive 11% CAGR through 2034. Thin film technology is gaining traction due to its lightweight design, ease of installation, and flexibility, which allows it to be installed on rooftops with unconventional shapes, such as curved surfaces. Recent advancements in thin film technology, aimed at improving energy conversion efficiency and incorporating advanced materials, are further driving the growth of this segment. These innovations are making thin film modules a popular choice for both residential and commercial applications.

The U.S. rooftop solar PV module market is projected to generate USD 21.5 billion by 2034. Government initiatives, such as the Investment Tax Credit (ITC), which offers a 30% tax credit for solar system installations, are playing a significant role in driving this growth. Additionally, concerns over energy security, heightened by supply chain disruptions and natural disasters, are pushing consumers to adopt more reliable and durable energy solutions. The increasing focus on sustainability and energy independence is further boosting the demand for rooftop solar PV modules in the United States.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 Thin film

- 5.3 Crystalline silicon

Chapter 6 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 Monocrystalline

- 6.3 Polycrystalline

- 6.4 Cadmium telluride

- 6.5 Amorphous silicon

- 6.6 Copper indium gallium Di-Selenide

Chapter 7 Market Size and Forecast, By Connectivity, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 On-Grid

- 7.3 Off-Grid

Chapter 8 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial & Industrial

- 8.4 Utility

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Austria

- 9.3.2 Norway

- 9.3.3 Denmark

- 9.3.4 Finland

- 9.3.5 France

- 9.3.6 Germany

- 9.3.7 UK

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East

- 9.5.1 Israel

- 9.5.2 Saudi Arabia

- 9.5.3 UAE

- 9.5.4 Jordan

- 9.5.5 Oman

- 9.6 Africa

- 9.6.1 South Africa

- 9.6.2 Egypt

- 9.6.3 Algeria

- 9.6.4 Nigeria

- 9.6.5 Morocco

- 9.7 Latin America

- 9.7.1 Brazil

- 9.7.2 Chile

- 9.7.3 Argentina

- 9.7.4 Peru

Chapter 10 Company Profiles

- 10.1 Canadian Solar

- 10.2 EMMVEE SOLAR

- 10.3 Hanwha Group

- 10.4 Indosolar

- 10.5 JA Solar Technology

- 10.6 JinkoSolar

- 10.7 LONGi

- 10.8 Motech Industries

- 10.9 REC Solar Holdings

- 10.10 RENESOLA

- 10.11 Risen Energy

- 10.12 Shunfeng International Clean Energy

- 10.13 SunPower Corporation

- 10.14 Trina Solar

- 10.15 Vikram Solar

- 10.16 Yingli Solar