|

市場調查報告書

商品編碼

1685076

血液學診斷市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Hematology Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

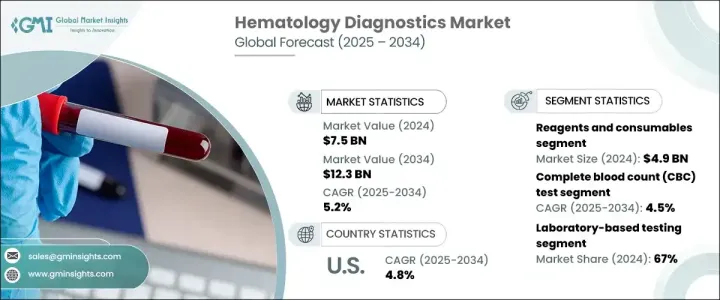

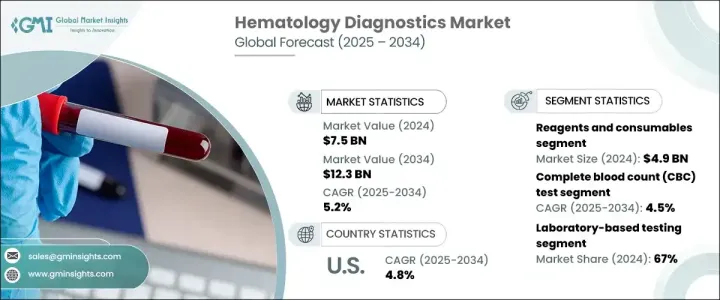

2024 年全球血液學診斷市場價值為 75 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 5.2%。這一成長是由血液病患病率不斷上升、人口快速老化以及慢性病發病率上升所推動的。隨著貧血、白血病和鐮狀細胞疾病等血液相關疾病變得越來越普遍,對準確、有效的診斷解決方案的需求也不斷增加。醫療保健提供者越來越重視早期疾病檢測,從而推動了對先進診斷技術的需求。自動化血液分析儀、人工智慧驅動的診斷工具和分子診斷技術正在改變產業,確保更快、更精確的結果。醫療保健基礎設施和技術創新方面不斷成長的投資進一步支持了市場擴張,使血液學診斷成為現代醫療實踐不可或缺的一部分。

根據產品類型,市場分為試劑和消耗品以及儀器。儀器包括血液分析儀、流式細胞儀和其他診斷設備,而試劑和消耗品對於提供準確的測試結果起著至關重要的作用。 2024 年試劑和耗材部門以 49 億美元的收入引領市場。這種主導地位是由這些產品在測試程序中的重要性質以及高容量實驗室擴大採用自動血液分析儀所推動的。隨著實驗室和醫療機構追求更高的效率和準確性,對高品質試劑和消耗品的需求持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 123億美元 |

| 複合年成長率 | 5.2% |

根據測試類型,市場分為全血球計數 (CBC)、血小板功能、血紅蛋白、血球容積比和其他診斷測試。其中,CBC 測試部分在 2024 年創造了 27 億美元的收入,預計到 2034 年將以 4.5% 的複合年成長率成長。 CBC 測試提供有關紅血球和白血球計數、血紅蛋白水平和血小板計數的關鍵訊息,使其成為常規檢查和預防性醫療保健中不可或缺的一部分。由於醫學界注重早期疾病檢測,CBC 測試的廣泛使用仍然是市場成長的主要驅動力。血液疾病發病率的不斷上升以及對全面血液分析的需求不斷成長進一步促進了該領域的擴張。

美國仍然是血液學診斷市場的主導者,2024 年的收入為 29 億美元。由於該國大量受血液疾病影響的患者,該市場預計到 2034 年將以 4.8% 的複合年成長率成長。醫院和臨床實驗室對精確、高效的診斷解決方案的需求持續推動市場成長。擴大醫療保健基礎設施、增加醫療保健支出以及診斷工具的進步是推動市場擴張的關鍵因素。隨著對早期和準確檢測的日益重視,美國血液學診斷市場有望實現持續成長,確保改善患者的治療效果並提高尖端診斷解決方案的可及性。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 血液及相關疾病盛行率不斷上升

- 發展中國家對即時檢測的需求不斷成長

- 提高認知和篩檢計劃

- 對綜合數位解決方案的需求激增

- 產業陷阱與挑戰

- 進階診斷帶來的高成本

- 缺乏報銷和保險覆蓋不足

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 定價分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 — 2034 年

- 主要趨勢

- 試劑和耗材

- 儀器

- 血液學分析儀

- 流式細胞儀

- 其他工具

第6章:市場估計與預測:按測試類型,2021 年至 2034 年

- 主要趨勢

- 全血球計數 (CBC) 檢測

- 血小板功能檢測

- 血紅素檢測

- 血球容積比檢測

- 其他測試類型

第 7 章:市場估計與預測:按方式,2021 年至 2034 年

- 主要趨勢

- 實驗室檢測

- 即時診斷(POC)檢測

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 腫瘤學

- 貧血

- 傳染病

- 心血管疾病

- 其他應用

第 9 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷實驗室

- 其他最終用戶

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Abbott

- BAG DIAGNOSTICS

- BECKMAN COULTER

- BIO-RAD

- BioSystems

- Boule

- diatron

- HemoCue

- HORIBA Medical

- mindray

- NIHON KOHDEN

- Roche

- SIEMENS Healthineers

- sysmex

- Thermo Fisher Scientific

The Global Hematology Diagnostics Market, valued at USD 7.5 billion in 2024, is set to expand at a CAGR of 5.2% between 2025 and 2034. This growth is fueled by the increasing prevalence of hematological disorders, a rapidly aging population, and the rising incidence of chronic diseases. As blood-related conditions such as anemia, leukemia, and sickle cell disease become more common, the need for accurate and efficient diagnostic solutions continues to rise. Healthcare providers are increasingly prioritizing early disease detection, driving demand for advanced diagnostic technologies. Automated hematology analyzers, artificial intelligence-driven diagnostic tools, and molecular diagnostic techniques are transforming the industry, ensuring faster and more precise results. Growing investments in healthcare infrastructure and technological innovation further support market expansion, making hematology diagnostics an integral part of modern medical practice.

By product type, the market is divided into reagents and consumables and instruments. Instruments include hematology analyzers, flow cytometers, and other diagnostic devices, while reagents and consumables play a crucial role in delivering accurate test results. The reagents and consumables segment led the market in 2024 with USD 4.9 billion in revenue. This dominance is driven by the essential nature of these products in testing procedures and the increasing adoption of automated hematology analyzers in high-volume laboratories. As laboratories and healthcare facilities aim for greater efficiency and accuracy, the demand for high-quality reagents and consumables continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.2% |

The market is segmented by test type into complete blood count (CBC), platelet function, hemoglobin, hematocrit, and other diagnostic tests. Among these, the CBC test segment generated USD 2.7 billion in revenue in 2024 and is projected to grow at a CAGR of 4.5% through 2034. CBC tests provide critical information about red and white blood cell counts, hemoglobin levels, and platelet counts, making them indispensable in routine check-ups and preventive healthcare. As the medical community focuses on early disease detection, the widespread use of CBC tests remains a key driver of market growth. The increasing incidence of blood disorders and the rising demand for comprehensive blood analysis further contribute to the segment's expansion.

The United States remains a dominant player in the hematology diagnostics market, generating USD 2.9 billion in revenue in 2024. The market is expected to grow at a CAGR of 4.8% through 2034, driven by the country's substantial patient population affected by hematological disorders. The need for precise and efficient diagnostic solutions in hospitals and clinical laboratories continues to propel market growth. Expanding healthcare infrastructure, rising healthcare expenditure and advancements in diagnostic tools are key factors contributing to the market's expansion. With an increasing emphasis on early and accurate detection, the U.S. hematology diagnostics market is poised for sustained growth, ensuring improved patient outcomes and greater accessibility to cutting-edge diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of blood & related disorders

- 3.2.1.2 Rising demand for point-of-care testing in developing countries

- 3.2.1.3 Growing awareness and screening programs

- 3.2.1.4 Surging need for integrated digital solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced diagnostics

- 3.2.2.2 Lack of reimbursement and inadequate insurance coverage

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and consumables

- 5.3 Instruments

- 5.3.1 Hematology analyzers

- 5.3.2 Flow cytometers

- 5.3.3 Other instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Complete blood count (CBC) test

- 6.3 Platelet function test

- 6.4 Hemoglobin test

- 6.5 Hematocrit test

- 6.6 Other test types

Chapter 7 Market Estimates and Forecast, By Modality, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Laboratory-based testing

- 7.3 Point-of-care (POC) testing

Chapter 8 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Anemia

- 8.4 Infectious diseases

- 8.5 Cardiovascular disorders

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 BAG DIAGNOSTICS

- 11.3 BECKMAN COULTER

- 11.4 BIO-RAD

- 11.5 BioSystems

- 11.6 Boule

- 11.7 diatron

- 11.8 HemoCue

- 11.9 HORIBA Medical

- 11.10 mindray

- 11.11 NIHON KOHDEN

- 11.12 Roche

- 11.13 SIEMENS Healthineers

- 11.14 sysmex

- 11.15 Thermo Fisher Scientific