|

市場調查報告書

商品編碼

1684871

船舶船上通訊與控制系統市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Marine Onboard Communication and Control Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

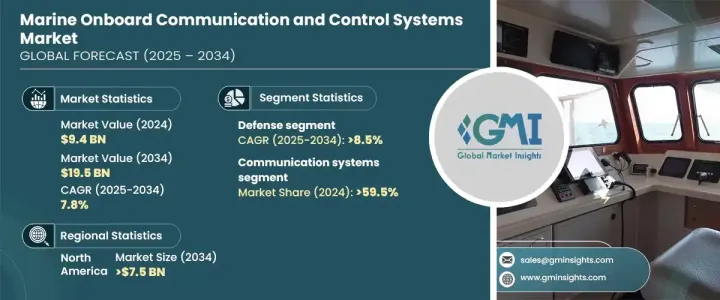

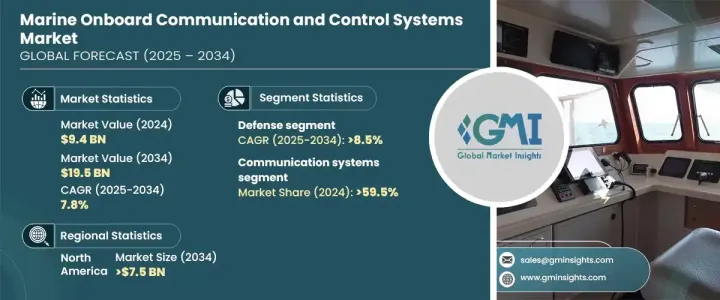

2024 年全球船舶船上通訊和控制系統市場價值為 94 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.8%。這一令人印象深刻的成長軌跡是由越來越依賴先進技術來最佳化海上作業所推動的。隨著全球貿易的快速發展和對安全、高效海上運輸的需求不斷成長,採用最先進的通訊和控制系統已變得至關重要。這些系統實現了無縫協調、即時監控和資料交換,確保了海事部門的營運安全和效率。此外,該行業正在經歷向環保創新和基於衛星的解決方案的轉變,這有望徹底改變船上通訊和控制流程。

儘管前景樂觀,但市場仍面臨挑戰。高昂的安裝成本、惡劣的海洋環境所導致的維護困難以及與現有基礎設施的兼容性問題阻礙了其廣泛採用。此外,缺乏能夠管理和操作這些複雜系統的熟練專業人員也是另一個重大障礙。然而,衛星通訊的進步和對永續自動化技術的投資不斷增加正在開闢新的成長途徑,並為其中的一些障礙提供解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 94億美元 |

| 預測值 | 195億美元 |

| 複合年成長率 | 7.8% |

根據類型,市場分為通訊系統和控制系統。通訊系統領域在 2024 年佔據 59.5% 的主導佔有率,並有望在 2034 年穩步成長。增強的連接解決方案(例如更快、更可靠的資料傳輸)正在推動這一領域的成長。這些進步對於確保順利協調並實現船舶和岸基設施之間的即時資料共享對於改善海上作業至關重要。隨著海上活動越來越依賴數位連接,對創新通訊解決方案的需求持續成長。

市場也根據平台細分為商業應用和國防應用。由於軍事行動對安全、高效通訊系統的迫切需求,預計到 2034 年國防部門的複合年成長率將達到 8.5%。這些系統確保有效的協調和安全的資料傳輸,尤其是在高風險情境中。對國家安全的日益關注以及尖端技術與國防行動的融合是該領域快速成長的主要驅動力。

從地區來看,北美船舶船上通訊和控制系統市場規模預計到 2034 年將達到 75 億美元。該地區的成長歸因於控制系統採用自動化和人工智慧,從而提高了營運效率並最大限度地減少了人為干預。此外,衛星通訊技術的進步大大提高了偏遠海洋地區的連結性,鞏固了北美作為全球市場主要參與者的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 自主船舶需求不斷成長

- 物聯網與人工智慧技術的融合

- 增加對智慧航運的投資

- 衛星通訊的進步

- 航運業數位化日益受關注

- 產業陷阱與挑戰

- 初期投資高

- 與遺留系統整合

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 通訊系統

- 機載衛星通訊系統

- 無線電系統

- 機載寬頻系統

- 其他通訊系統

- 控制系統

- 導航定位控制系統

- 引擎和推進控制系統

- 監控和監視控制系統

- 其他控制系統

第 6 章:市場估計與預測:按平台,2021-2034 年

- 主要趨勢

- 商業的

- 客船

- 遊艇

- 渡輪

- 郵輪

- 貨船

- 貨櫃船

- 散貨船

- 油輪

- 天然氣運輸車

- 乾貨船

- 駁船

- 其他船舶

- 專用船舶

- 近海船舶

- 研究船

- 客船

- 防禦

- 航空母艦

- 護衛艦

- 護衛艦

- 潛水艇

- 驅逐艦

- 兩棲艦船

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 原始設備製造商(OEM)

- 售後市場

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ABB

- Emerson

- Furuno

- Honeywell

- Japan Radio

- Kongsberg

- L3Harris

- Navico

- Northrop Grumman

- Raymarine

- Saab

- ST Engineering

- Viasat

- Wartsila

The Global Marine Onboard Communication And Control Systems Market was valued at USD 9.4 billion in 2024 and is anticipated to grow at a CAGR of 7.8% between 2025 and 2034. This impressive growth trajectory is fueled by the increasing reliance on advanced technologies to optimize maritime operations. With the rapid evolution of global trade and heightened demand for safe, efficient maritime transportation, the adoption of state-of-the-art communication and control systems has become essential. These systems enable seamless coordination, real-time monitoring, and data exchange, ensuring operational safety and efficiency in the maritime sector. Furthermore, the industry is witnessing a shift toward eco-friendly innovations and satellite-based solutions, which are expected to revolutionize onboard communication and control processes.

Despite this promising outlook, the market faces challenges. High installation costs, maintenance difficulties due to harsh marine environments, and compatibility issues with existing infrastructure hinder widespread adoption. Additionally, the shortage of skilled professionals capable of managing and operating these sophisticated systems poses another significant hurdle. However, advancements in satellite communication and growing investments in sustainable, automated technologies are opening new avenues for growth, offering solutions to some of these barriers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $19.5 Billion |

| CAGR | 7.8% |

By type, the market is divided into communication systems and control systems. The communication systems segment held a dominant 59.5% share in 2024 and is poised to grow steadily through 2034. Enhanced connectivity solutions, such as faster and more reliable data transmission, are driving this segment's growth. These advancements are critical for improving maritime operations by ensuring smooth coordination and enabling real-time data sharing between vessels and shore-based facilities. As maritime activities become increasingly dependent on digital connectivity, the demand for innovative communication solutions continues to grow.

The market is also segmented based on platform into commercial and defense applications. The defense segment is expected to register a robust CAGR of 8.5% by 2034, driven by the critical need for secure, efficient communication systems in military operations. These systems ensure effective coordination and secure data transmission, especially in high-stakes scenarios. The increasing focus on national security and the integration of cutting-edge technologies within defense operations are key drivers for this segment's rapid growth.

Regionally, the North America marine onboard communication and control systems market is projected to reach USD 7.5 billion by 2034. The region's growth is attributed to the adoption of automation and artificial intelligence in control systems, which enhance operational efficiency and minimize human intervention. Additionally, advancements in satellite communication technologies have significantly improved connectivity in remote oceanic areas, solidifying North America's position as a major player in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for autonomous vessels

- 3.6.1.2 Integration of IoT and AI technologies

- 3.6.1.3 Increased investment in smart shipping

- 3.6.1.4 Advancements in satellite communication

- 3.6.1.5 Rising focus on maritime industry digitalization

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment

- 3.6.2.2 Integration with legacy systems

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Communication systems

- 5.2.1 Onboard satellite communication systems

- 5.2.2 Radio systems

- 5.2.3 Onboard broadband systems

- 5.2.4 Other communication systems

- 5.3 Control systems

- 5.3.1 Navigation and positioning control systems

- 5.3.2 Engine and propulsion control systems

- 5.3.3 Monitoring and surveillance control systems

- 5.3.4 Other control systems

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Commercial

- 6.2.1 Passenger vessels

- 6.2.1.1 Yachts

- 6.2.1.2 Ferries

- 6.2.1.3 Cruise ships

- 6.2.2 Cargo vessels

- 6.2.2.1 Container vessels

- 6.2.2.2 Bulk carrier

- 6.2.2.3 Tankers

- 6.2.2.4 Gas tankers

- 6.2.2.5 Dry cargo ship

- 6.2.2.6 Barges

- 6.2.3 Other ships

- 6.2.3.1 Specialized vessels

- 6.2.3.2 Offshore vessels

- 6.2.3.3 Research vessels

- 6.2.1 Passenger vessels

- 6.3 Defense

- 6.3.1 Aircraft carrier

- 6.3.2 Corvettes

- 6.3.3 Frigates

- 6.3.4 Submarines

- 6.3.5 Destroyers

- 6.3.6 Amphibious ships

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Original Equipment Manufacturer (OEM)

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Emerson

- 9.3 Furuno

- 9.4 Honeywell

- 9.5 Japan Radio

- 9.6 Kongsberg

- 9.7 L3Harris

- 9.8 Navico

- 9.9 Northrop Grumman

- 9.10 Raymarine

- 9.11 Saab

- 9.12 ST Engineering

- 9.13 Viasat

- 9.14 Wartsila