|

市場調查報告書

商品編碼

1684855

止血帶系統市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Tourniquet Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

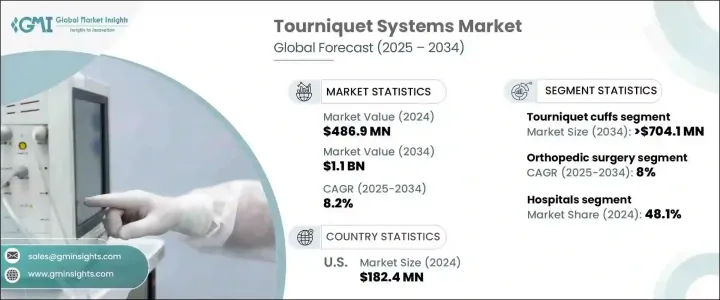

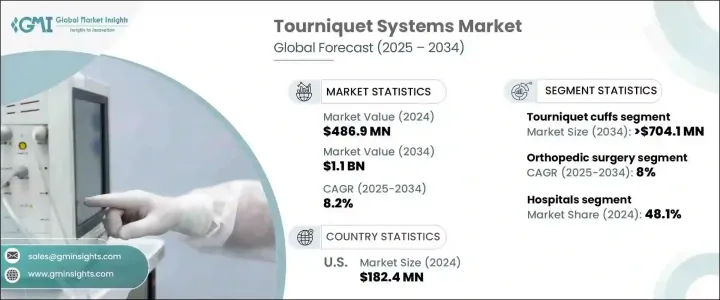

2024 年全球止血帶系統市場價值達到 4.869 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.2%。創傷性損傷發生率的上升,加上全球外科手術數量的增加,正在推動對這些基本醫療設備的需求。由於醫療保健提供者優先考慮手術期間有效的失血管理,因此先進止血帶解決方案的採用持續受到關注。氣動和自動止血帶系統設計精確、安全且易於使用,廣泛應用於各種醫療環境。對最佳化手術技術的日益重視,加上智慧醫療設備的優惠報銷政策,進一步加速了市場擴張。改善病患治療效果和手術效率的技術創新是產業進步的核心,塑造了止血帶系統的未來。

醫療基礎設施的改善、人口老化以及選擇性手術的增加是影響市場趨勢的其他因素。隨著老年人口的不斷成長,對外科手術的需求也不斷增加,特別是與骨科和血管疾病相關的手術需求。需要手術治療的肌肉骨骼疾病、慢性病和生活方式疾病的增加凸顯了止血帶系統在現代醫學中的重要角色。此外,醫院和門診手術中心擴大採用自動化和配備感測器的止血帶裝置,以最大限度地減少併發症並提高病患安全性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.869 億美元 |

| 預測值 | 11億美元 |

| 複合年成長率 | 8.2% |

從組件來看,市場由止血帶袖帶和器械組成,其中袖帶預計將對市場擴張做出重大貢獻。用於實現無血手術領域的止血帶袖帶預計將以 8% 的複合年成長率成長,到 2034 年將達到 7.041 億美元。止血帶袖帶在提高手術準確性和減少術中失血方面發揮著重要作用,使其成為多個醫學專業領域不可或缺的一部分。影響血液循環和肌肉骨骼健康的疾病發生率不斷上升,增加了醫院和專科診所對止血帶袖帶的需求。醫療保健提供者越來越認知到使用高品質、可調節袖帶的優勢,以確保更好的手術精度和患者安全。

該市場還按應用進行細分,包括外科手術和緊急護理,其中骨科手術預計將大幅成長。預計該領域將以 8% 的複合年成長率擴張,到 2034 年將達到 5.284 億美元。肌肉骨骼疾病的盛行率不斷上升以及需要關節置換和骨折治療的老年人口不斷增加是主要的成長動力。隨著骨科手術變得越來越複雜,對止血帶系統等高精準度工具的需求也隨之增加,以確保可控的手術環境和更好的病患治療效果。

美國止血帶系統市值在 2024 年將達到 1.824 億美元,預計到 2034 年將以 7.4% 的複合年成長率成長。創傷病例、工作場所傷害和道路事故數量的增加導致需求不斷增加,尤其是在緊急情況下。此外,需要手術干預的慢性病的流行也推動了市場擴張。該國完善的醫療保健基礎設施和不斷引進的先進醫療技術支撐了持續的成長。隨著對病人安全和效率的日益關注,美國醫療機構對下一代止血帶系統的採用持續加速。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 創傷和事故案例不斷增加

- 關節置換手術數量不斷增加

- 成年人口中退化性骨病和肌肉骨骼疾病的盛行率不斷上升

- 失血管理意識不斷增強

- 止血帶系統的技術進步

- 產業陷阱與挑戰

- 缺乏熟練的專業人員

- 重複使用袖口導致傳染病傳播

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按組件,2021 年至 2034 年

- 主要趨勢

- 止血袖口

- 氣動

- 可重複使用的

- 一次性的

- 非氣動

- 氣動

- 止血帶器械

第6章:市場估計與預測:按應用,2021 — 2034 年

- 主要趨勢

- 骨科手術

- 創傷護理

- 其他應用

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Anetic Aid

- CAT Resources

- Delfi

- Hpm Hammarplast Medical

- Huaxin

- OHK Medical Devices

- Pyng Medical

- Riester

- Sam Medical

- Stryker

- Teleflex

- ulrich Medical

- VBM

- Zimmer Biomet

The Global Tourniquet Systems Market reached a valuation of USD 486.9 million in 2024 and is projected to grow at a CAGR of 8.2% between 2025 and 2034. The rising incidence of traumatic injuries, coupled with a growing number of surgical procedures worldwide, is fueling demand for these essential medical devices. As healthcare providers prioritize effective blood loss management during surgeries, the adoption of advanced tourniquet solutions continues to gain traction. Pneumatic and automatic tourniquet systems, designed for precision, safety, and ease of use, are being widely integrated into various medical settings. The growing emphasis on optimizing surgical techniques, along with favorable reimbursement policies for smart medical devices, is further accelerating market expansion. Technological innovations that improve patient outcomes and surgical efficiency are at the core of industry advancements, shaping the future of tourniquet systems.

Healthcare infrastructure improvements, an aging population, and an increase in elective surgeries are additional factors influencing market trends. As the elderly demographic continues to grow, so does the demand for surgical interventions, particularly those related to orthopedic and vascular conditions. The rise in musculoskeletal disorders, chronic illnesses, and lifestyle diseases requiring surgical treatment underscores the critical role of tourniquet systems in modern medicine. Furthermore, hospitals and ambulatory surgical centers are increasingly adopting automated and sensor-equipped tourniquet devices that minimize complications and enhance patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 486.9 Million |

| Forecast Value | $ 1.1 Billion |

| CAGR | 8.2% |

By component, the market consists of tourniquet cuffs and instruments, with cuffs anticipated to contribute significantly to market expansion. Tourniquet cuffs, used to create a bloodless surgical field, are expected to grow at a CAGR of 8%, reaching USD 704.1 million by 2034. Their role in improving surgical accuracy and reducing intraoperative blood loss makes them indispensable across multiple medical specialties. The rising prevalence of conditions that affect blood circulation and musculoskeletal health has amplified the demand for tourniquet cuffs in hospitals and specialized clinics. Healthcare providers are increasingly recognizing the advantages of using high-quality, adjustable cuffs to ensure better surgical precision and patient safety.

The market is also segmented by application, including surgical procedures and emergency care, with orthopedic procedures expected to witness substantial growth. This segment is projected to expand at a CAGR of 8%, generating USD 528.4 million by 2034. The increasing prevalence of musculoskeletal disorders and the growing elderly population requiring joint replacements and fracture treatments are primary growth drivers. As orthopedic surgeries become more sophisticated, the demand for high-precision tools like tourniquet systems rises, ensuring a controlled surgical environment and better patient outcomes.

The U.S. tourniquet systems market, valued at USD 182.4 million in 2024, is forecasted to grow at a CAGR of 7.4% through 2034. A rising number of trauma cases, workplace injuries, and road accidents is increasing demand, particularly in emergency settings. Additionally, the prevalence of chronic conditions requiring surgical intervention is fueling market expansion. The country's well-developed healthcare infrastructure, alongside the steady introduction of advanced medical technologies, supports sustained growth. With an increasing focus on patient safety and efficiency, the adoption of next-generation tourniquet systems in U.S. healthcare facilities continues to accelerate.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of trauma and accident cases

- 3.2.1.2 Rising number of joint replacement surgeries

- 3.2.1.3 Increasing prevalence of degenerative bone disorders and musculoskeletal diseases among adult population

- 3.2.1.4 Rising awareness of blood loss management

- 3.2.1.5 Technological advancements in tourniquet systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 Transmission of infectious diseases associated with increasing use of reusable cuffs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Component, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Tourniquet cuffs

- 5.2.1 Pneumatic

- 5.2.1.1 Reusable

- 5.2.1.2 Disposable

- 5.2.2 Non-pneumatic

- 5.2.1 Pneumatic

- 5.3 Tourniquet instruments

Chapter 6 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Orthopedic surgery

- 6.3 Trauma care

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anetic Aid

- 9.2 C.A.T Resources

- 9.3 Delfi

- 9.4 Hpm Hammarplast Medical

- 9.5 Huaxin

- 9.6 OHK Medical Devices

- 9.7 Pyng Medical

- 9.8 Riester

- 9.9 Sam Medical

- 9.10 Stryker

- 9.11 Teleflex

- 9.12 ulrich Medical

- 9.13 VBM

- 9.14 Zimmer Biomet