|

市場調查報告書

商品編碼

1684844

維生素 B12 成分市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Vitamin B12 ingredient Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

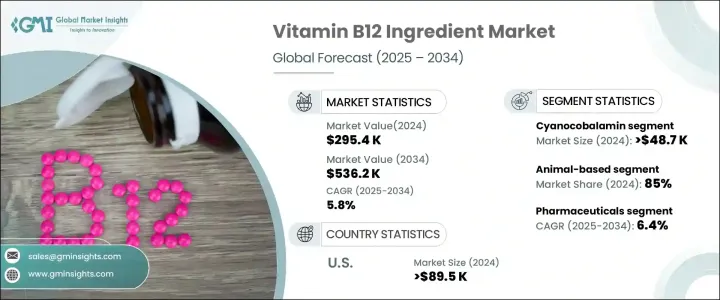

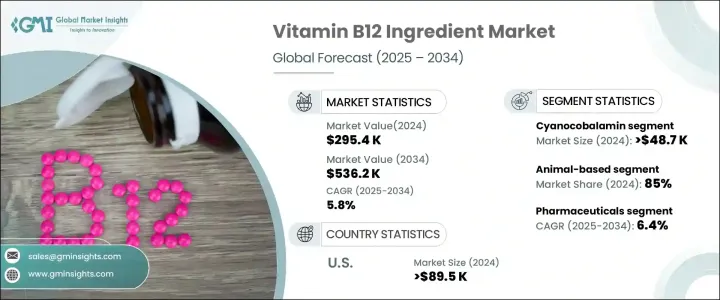

2024 年全球維生素 B12 成分市場價值為 295.4 萬美元,預計 2025 年至 2034 年期間將以 5.8% 的強勁複合年成長率成長。隨著消費者的健康意識日益增強,他們越來越意識到維生素和礦物質在維持整體健康方面發揮的關鍵作用,這大大增加了對維生素 B12 等必需營養素的需求。此外,全球轉向植物性和純素飲食,而這些飲食通常缺乏維生素 B12 的天然來源,這加劇了對強化食品和膳食補充劑的需求。飲食習慣的不斷轉變,加上健康意識的不斷增強,使得維生素 B12 成為全球食品和補充劑中的關鍵成分。

人們對植物性飲食的偏好日益成長,加上純素食者和素食者的數量增加,為維生素 B12 在補充營養缺乏方面發揮更大作用創造了機會。許多人,尤其是城市地區的人們,都將強化食品納入日常營養方案中。由於消費者正在尋找方便的方法來確保滿足他們的營養需求,市場對維生素 B12 補充劑的需求也顯著增加。這些因素,加上富含維生素 B12 的產品的普及,預計將在未來十年繼續推動市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 295.4 千美元 |

| 預測值 | 536.2 千美元 |

| 複合年成長率 | 5.8% |

2024 年,氰鈷胺素領域創收 48.7 萬美元,鞏固了其作為市場上最重要的維生素 B12 形式之一的地位。氰鈷胺素因價格便宜、保存期限長、易於大規模生產而受到製造商的青睞。這些因素促使它在食品和補充品行業中廣泛應用。此外,其在儲存和運輸過程中的穩定性以及成本效益鞏固了其作為強化用途最受歡迎的維生素 B12 形式的地位。

市場仍嚴重依賴動物來源,動物來源佔 2024 年維生素 B12 成分市場總量的 85%。這一細分市場受益於傳統上使用肉類、乳製品和雞蛋作為維生素 B12 的主要來源。這些動物性產品在強化牛奶、優格和肉類等主食方面發揮著不可或缺的作用,而這些主食是不同人群的常見消費品。儘管植物性飲食越來越受歡迎,但動物性維生素 B12 仍然佔據主導地位,因為它在傳統飲食習慣中長期存在,並且在食品強化中發揮重要作用。

在美國,受消費者對健康和保健產品的需求激增的推動,維生素 B12 成分市場在 2024 年創下了 89.5 萬美元的產值。膳食補充劑和強化食品的日益普及進一步加速了北美市場的成長。消費者越來越意識到適當營養的好處,並繼續優先考慮富含維生素 B12 的食品和補充劑,這使得美國成為全球最有利可圖的市場之一。由於該地區注重健康的人群比例很高,預計未來幾年對富含維生素 B12 的產品的需求將持續存在。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 強化食品的需求不斷增加

- 維生素 B12 缺乏症盛行率

- 健康意識不斷增強

- 不斷擴張的製藥業

- 產業陷阱與挑戰

- 維生素B12成分

- 品質控制和純度

- 監理合規性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:依形式,2021-2034 年

- 主要趨勢

- 氰鈷胺

- 甲鈷胺

- 羥鈷胺

- 腺苷鈷胺

第 6 章:市場規模與預測:依來源,2021-2034 年

- 主要趨勢

- 動物性

- 植物性

第 7 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 藥品

- 膳食補充劑

- 藥物

- 食品和飲料

- 強化食品

- 能量飲料和能量飲料

- 嬰兒配方奶粉

- 化妝品和個人護理

- 保養產品

- 護髮產品

- 口腔護理產品

- 動物飼料和營養

第 8 章:市場規模與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 人類營養

- 動物營養

第 9 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Adisseo

- BASF SE

- DSM Nutritional Products

- Gnosis by Lesaffre

- Jubilant Life Sciences

- Lonza

- Merck KGaA

- NOW Foods

- NutraGenesis

- Nutrilo

- Pharmavit

- Rousselot

- Spectrum Chemical Manufacturing

- Thermo Fisher Scientific

- Zhejiang Shengda Bio-Pharm

The Global Vitamin B12 Ingredient Market was valued at USD 295.4 thousand in 2024 and is projected to grow at a robust CAGR of 5.8% from 2025 to 2034. As consumers become increasingly health-conscious, there is a rising awareness of the critical role vitamins and minerals play in maintaining overall well-being, which has significantly boosted the demand for essential nutrients like Vitamin B12. Additionally, the global shift towards plant-based and vegan diets, which often lack natural sources of Vitamin B12, has intensified the demand for fortified foods and dietary supplements. This growing shift in dietary habits, combined with increasing health awareness, is positioning Vitamin B12 as a key ingredient in food and supplements across the world.

The growing preference for plant-based diets, coupled with a rise in the number of vegans and vegetarians, has created an opportunity for Vitamin B12 to play a larger role in supplementing nutrient deficiencies. Many people, especially in urbanized regions, are incorporating fortified foods into their daily nutrition regimen. The market is also witnessing a significant increase in demand for Vitamin B12 supplements, as consumers are looking for convenient ways to ensure they meet their nutritional needs. These factors, combined with greater access to Vitamin B12-enriched products, are expected to continue driving the market's expansion over the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $295.4 Thousand |

| Forecast Value | $536.2 Thousand |

| CAGR | 5.8% |

In 2024, the cyanocobalamin segment generated USD 48.7 thousand, solidifying its position as one of the most crucial forms of Vitamin B12 in the market. Cyanocobalamin is favored by manufacturers due to its affordability, long shelf life, and ease of large-scale production. These factors contribute to its widespread adoption across the food and supplement industries. Moreover, its stable nature during storage and transportation, along with its cost-effectiveness, has solidified its status as the most popular form of Vitamin B12 for fortification purposes.

The market remains heavily reliant on animal-based sources, which accounted for 85% of the total Vitamin B12 ingredient market share in 2024. This segment benefits from the traditional use of meat, dairy, and eggs as primary sources of Vitamin B12. These animal-based products play an integral role in fortifying staple foods such as milk, yogurt, and meat, which are commonly consumed across diverse populations. Despite the increasing popularity of plant-based diets, animal-derived Vitamin B12 remains a dominant player due to its long-standing presence in conventional dietary habits and its essential role in food fortification.

In the U.S., the Vitamin B12 ingredient market generated USD 89.5 thousand in 2024, driven by a surge in consumer demand for health and wellness products. The growing popularity of dietary supplements and fortified foods is further accelerating market growth in North America. Consumers, increasingly aware of the benefits of proper nutrition, continue to prioritize foods and supplements rich in Vitamin B12, making the U.S. one of the most lucrative markets globally. With a high percentage of health-conscious individuals, the region is expected to see sustained demand for Vitamin B12-rich products in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for fortified foods

- 3.6.1.2 Prevalence of Vitamin B12 deficiency

- 3.6.1.3 Rising health & wellness consciousness

- 3.6.1.4 Expanding pharmaceutical industry

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Vitamin B12 ingredient

- 3.6.2.2 Quality control and purity

- 3.6.2.3 Regulatory compliance

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Thousand) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cyanocobalamin

- 5.3 Methylcobalamin

- 5.4 Hydroxocobalamin

- 5.5 Adenosylcobalamin

Chapter 6 Market Size and Forecast, By Source, 2021-2034 (USD Thousand) (Kilo Tons)

- 6.1 Key trends

- 6.2 Animal-Based

- 6.3 Plant-Based

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Thousand) (Kilo Tons)

- 7.1 Key trends

- 7.2 Pharmaceuticals

- 7.3 Dietary supplements

- 7.4 Medications

- 7.5 Food and beverages

- 7.6 Fortified foods

- 7.7 Energy drinks and shots

- 7.8 Infant formula

- 7.9 Cosmetics and personal care

- 7.10 Skin care products

- 7.11 Hair care products

- 7.12 Oral care products

- 7.13 Animal feed and nutrition

Chapter 8 Market Size and Forecast, By End-Use Industries, 2021-2034 (USD Thousand) (Kilo Tons)

- 8.1 Key trends

- 8.2 Human nutrition

- 8.3 Animal nutrition

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Thousand) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adisseo

- 10.2 BASF SE

- 10.3 DSM Nutritional Products

- 10.4 Gnosis by Lesaffre

- 10.5 Jubilant Life Sciences

- 10.6 Lonza

- 10.7 Merck KGaA

- 10.8 NOW Foods

- 10.9 NutraGenesis

- 10.10 Nutrilo

- 10.11 Pharmavit

- 10.12 Rousselot

- 10.13 Spectrum Chemical Manufacturing

- 10.14 Thermo Fisher Scientific

- 10.15 Zhejiang Shengda Bio-Pharm