|

市場調查報告書

商品編碼

1684784

車載診斷 (OBD) 售後市場規模 - 按產品、按車輛、按應用、按組件、成長預測,2025 - 2034 年On-Board Diagnostics (OBD) Aftermarket Size - By Product, By Vehicle, By Application, By Component, Growth Forecast, 2025 - 2034 |

||||||

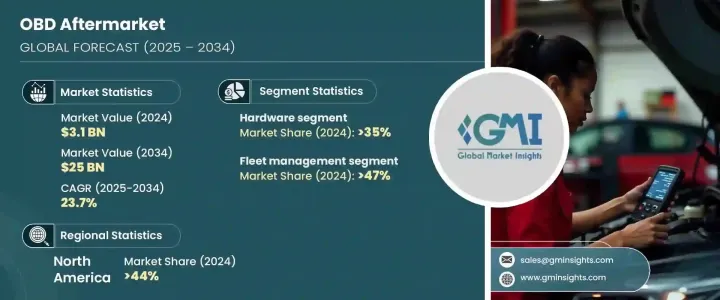

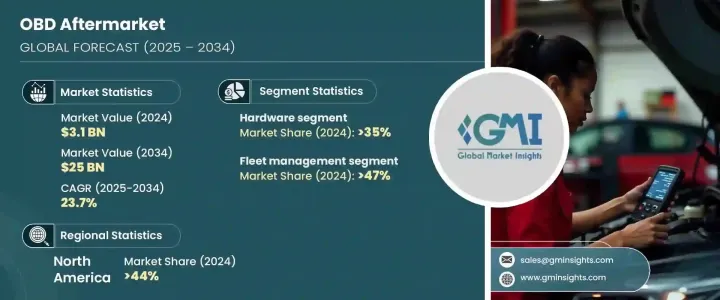

全球車載診斷售後市場將於 2024 年實現 31 億美元的價值,並將經歷顯著成長,預計 2025 年至 2034 年的複合年成長率為 23.7%。這項快速擴張的動力來自於人們對數據驅動技術的遠端車輛診斷系統的日益依賴。這些先進的解決方案可即時存取車輛的運行資料,實現遠端監控和主動維護。透過提供車輛性能的即時洞察,OBD 系統可以提高安全性、防止意外故障並確保及時維修。隨著汽車產業不斷擁抱數位轉型,OBD 售後市場解決方案在延長車輛壽命、最佳化性能和維持嚴格的安全標準方面發揮關鍵作用。

智慧汽車解決方案需求激增、法規合規要求以及消費者對增強型車輛管理工具的偏好是市場成長的主要驅動力。 OBD 解決方案具有預測性維護、即時分析以及與現代連接協議的無縫整合等功能,正在不斷發展以滿足內燃機、混合動力和電動車的多樣化需求。這些先進的系統對於改善診斷、確保車輛平穩運行以及向用戶提供可操作的見解至關重要。尖端車輛連接技術的採用進一步推動了市場的發展,使其成為現代車輛管理的基石。隨著汽車製造商和售後服務供應商不斷投資於創新,OBD 解決方案將繼續處於汽車進步的前沿。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 31億美元 |

| 預測值 | 250億美元 |

| 複合年成長率 | 23.7% |

硬體部分在 2024 年佔據了 35% 的市場佔有率,預計到 2034 年將佔據 30%。先進診斷工具的穩定推出正在推動這一領域的發展,為分析車輛資料和提供即時洞察提供了增強的能力。這些創新正在徹底改變汽車診斷,使用戶能夠更有效地評估車輛性能。隨著技術的進步,下一代 OBD 硬體將提供更高的準確性,使用戶能夠在問題惡化之前檢測並解決問題。這一轉變強調了業界對預測性和預防性維護的關注,確保車輛長期保持最佳狀態。

OBD 售後市場根據應用分為消費者遠端資訊處理、車隊管理、汽車共享和基於使用情況的保險。車隊管理領域在 2024 年佔據主導地位,佔據 47% 的市場。車隊營運商擴大利用 OBD 技術來監控車輛移動、最佳化路線並即時追蹤駕駛行為。透過將 OBD 與數位地圖和先進的追蹤功能相結合,車隊經理可以更好地控制車輛使用率,從而提高效率並節省成本。此外,OBD 系統與車隊管理平台的無縫整合提高了營運透明度,減少了未經授權的活動並最大限度地減少了停機時間,使其成為物流和運輸行業的重要工具。

由於汽車行業的成熟和車輛診斷技術的不斷進步,北美在 2024 年佔據了 OBD 售後市場的 44% 的佔有率。該地區高度重視法規遵循、預防性維護和汽車創新,加速了 OBD 解決方案的廣泛採用。憑藉領先汽車製造商的強大影響力和成熟的售後市場生態系統,北美已成為全球市場的領導者。對連網汽車技術和車隊最佳化解決方案的需求不斷成長,進一步推動了區域成長,確保了未來幾年市場的持續擴張。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 零件供應商

- 技術提供者

- 經銷商

- 最終用戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 將重點轉向遠端診斷技術

- 汽車物聯網(IoT)日益成長的趨勢

- 全球汽車產量不斷增加

- 越來越重視排放控制標準

- 產業陷阱與挑戰

- 網路安全威脅和隱私問題

- 相容性和互通性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 消費者遠端資訊處理

- 車隊管理

- 汽車共享

- 基於使用情況的保險 (UBI)

第7章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- OBD 掃描儀

- OBD 適配器

- 軟體

- 基於 PC 的 OBD 掃描工具

- 應用程式(OBD 遠端資訊處理平台)

- 服務

- 培訓和諮詢

- 整合與管理

- 託管服務

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Autel

- Agilis Systems

- AVL DiTEST

- Bridgestone

- CalAmp Corporation

- Continental

- Danlaw

- ERM Electronic Systems LTD (Ituran)

- Geotab

- Hella

- Innova Electronics

- Launch Tech

- Nexar

- Robert Bosch

- ScanTool

- TomTom Telematics

- Verizon Connect

- Xirgo Technologies

- ZF Friedrichshafen

- Zubie

The global on-board diagnostics aftermarket, valued at USD 3.1 billion in 2024, is set to experience remarkable growth, with projections indicating a CAGR of 23.7% from 2025 to 2034. This rapid expansion is fueled by the increasing reliance on remote vehicle diagnostic systems powered by data-driven technologies. These advanced solutions provide real-time access to a vehicle's operational data, enabling remote monitoring and proactive maintenance. By offering instant insights into vehicle performance, OBD systems enhance safety, prevent unexpected breakdowns, and ensure timely servicing. As the automotive industry continues to embrace digital transformation, OBD aftermarket solutions are playing a critical role in vehicle longevity, optimizing performance, and maintaining stringent safety standards.

The Surge In Demand For Smart Automotive Solutions, Regulatory Compliance Requirements, And Consumer Preferences For Enhanced Vehicle Management Tools Are Key Drivers Of Market growth. With features such as predictive maintenance, real-time analytics, and seamless integration with modern connectivity protocols, OBD solutions are evolving to meet the diverse needs of internal combustion, hybrid, and electric vehicles. These advanced systems are essential for improving diagnostics, ensuring smooth vehicle operations, and delivering actionable insights to users. The adoption of cutting-edge vehicle connectivity technologies has further propelled the market, making it a cornerstone of modern vehicle management. As automakers and aftermarket service providers continue investing in innovation, OBD solutions will remain at the forefront of automotive advancements.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $25 Billion |

| CAGR | 23.7% |

The hardware segment, which accounted for 35% of the market share in 2024, is expected to hold 30% by 2034. The steady introduction of advanced diagnostic tools is driving this segment, offering enhanced capabilities for analyzing vehicle data and delivering real-time insights. These innovations are revolutionizing automotive diagnostics, enabling users to assess vehicle performance more efficiently. As technology advances, next-generation OBD hardware will provide even greater accuracy, allowing users to detect and address issues before they escalate. This shift underscores the industry's focus on predictive and preventive maintenance, ensuring vehicles remain in optimal condition for extended periods.

The OBD aftermarket is categorized based on application into consumer telematics, fleet management, car sharing, and usage-based insurance. The fleet management segment dominated in 2024, capturing 47% of the market share. Fleet operators are increasingly leveraging OBD technology to monitor vehicle movement, optimize routes, and track driving behavior in real time. By integrating OBD with digital mapping and advanced tracking features, fleet managers gain greater control over vehicle utilization, leading to improved efficiency and cost savings. Additionally, the seamless integration of OBD systems with fleet management platforms enhances operational transparency, reduces unauthorized activities, and minimizes downtime, making it an essential tool for logistics and transportation industries.

North America held a commanding 44% share of the OBD aftermarket in 2024, driven by a well-established automotive industry and continuous advancements in vehicle diagnostics technology. The region's strong emphasis on regulatory compliance, preventive maintenance, and automotive innovation has accelerated the widespread adoption of OBD solutions. With a robust presence of leading automotive manufacturers and a mature aftermarket ecosystem, North America has positioned itself as a leader in the global market. The growing demand for connected vehicle technologies and fleet optimization solutions is further fueling regional growth, ensuring sustained market expansion in the years to come.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component suppliers

- 3.1.2 Technology providers

- 3.1.3 Distributors

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Shifting focus toward remote diagnostics technology

- 3.7.1.2 Growing trend of automotive Internet of Things (IoT)

- 3.7.1.3 Increasing global automotive production

- 3.7.1.4 Rising emphasis on emission control standards

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Cybersecurity threats and privacy concerns

- 3.7.2.2 Compatibility and interoperability issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Consumer telematics

- 6.3 Fleet management

- 6.4 Car sharing

- 6.5 Usage-based insurance (UBI)

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Hardware

- 7.2.1 OBD scanners

- 7.2.2 OBD dongles

- 7.3 Software

- 7.3.1 PC-based OBD scanning tools

- 7.3.2 Apps (OBD telematics platforms)

- 7.4 Service

- 7.4.1 Training and consulting

- 7.4.2 Integration and management

- 7.4.3 Managed service

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Autel

- 9.2 Agilis Systems

- 9.3 AVL DiTEST

- 9.4 Bridgestone

- 9.5 CalAmp Corporation

- 9.6 Continental

- 9.7 Danlaw

- 9.8 ERM Electronic Systems LTD (Ituran)

- 9.9 Geotab

- 9.10 Hella

- 9.11 Innova Electronics

- 9.12 Launch Tech

- 9.13 Nexar

- 9.14 Robert Bosch

- 9.15 ScanTool

- 9.16 TomTom Telematics

- 9.17 Verizon Connect

- 9.18 Xirgo Technologies

- 9.19 ZF Friedrichshafen

- 9.20 Zubie