|

市場調查報告書

商品編碼

1684764

膽道支架市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biliary Stents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球膽道支架市場規模達到 4.553 億美元,預計到 2034 年將以 5.2% 的複合年成長率穩定成長。這一成長很大程度上可歸因於肝臟和膽管疾病盛行率的不斷上升,以及支架技術的不斷進步。膽道支架主要用於治療導致膽管阻塞的疾病,例如膽管炎、胰臟炎和某些癌症。這些情況會導致阻塞,擾亂膽汁流動,需要使用支架來緩解和治療。

隨著全球人口老化和生活方式相關的健康問題的增加,對膽道支架的需求預計將大幅增加。此外,隨著支架技術的創新,包括藥物洗脫和可生物分解材料的開發,這些設備變得更加有效,可確保更好的患者治療結果和更持久的解決方案。這種擴張也受到醫療保健機會的增加和程序技術的改進的推動,使得支架置入更加有效,從而促進了市場的積極發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.553億美元 |

| 預測值 | 7.704 億美元 |

| 複合年成長率 | 5.2% |

市場主要分為兩個關鍵部分:金屬支架和聚合物支架。 2024 年,金屬支架部分價值為 2.928 億美元。金屬支架,尤其是自膨脹式支架,因其能夠治療惡性阻塞並提供持久的解決方案,從而減少更換頻率而受到青睞。這些支架對於癌症患者的安寧療護至關重要,並透過完全和部分覆蓋的版本提供額外的好處,例如防止腫瘤生長和遷移。可生物分解和藥物洗脫金屬支架的引入增加了它們的吸引力,並因其先進的特性進一步推動了它們在醫療領域的應用。

醫院部門是膽道支架的主要終端用戶,預計到預測期末將達到 5.434 億美元。醫院擁有必要的基礎設施和專業知識來執行 ERCP 和 PTC 等複雜程序,這對於診斷和治療膽道疾病至關重要。這些程序對於確保膽道支架的準確放置起著至關重要的作用,最終有助於改善患者的治療效果。隨著支架技術和置入技術的不斷進步,醫院有望繼續引領市場,為患有膽道疾病的患者提供最佳護理。

在美國,2024 年膽道支架市場價值為 1.472 億美元,預計 2025 年至 2034 年期間的成長率為 4.9%。這一成長主要得益於膽道疾病發病率的上升和醫療保健機會的增強。保險覆蓋(包括醫療保險和醫療補助等計劃)對於讓更廣泛的患者群體能夠接受支架手術至關重要,從而進一步加速了對膽道支架的需求。這項資金支持確保患者得到必要的治療,以有效治療膽管阻塞。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 膽管疾病和慢性肝病盛行率不斷上升

- 支架的技術進步

- 手術過程中採用微創方法

- 全球老年人口不斷成長

- 產業陷阱與挑戰

- 膽管支架相關的併發症和風險

- 塑膠膽管支架成本高

- 成長動力

- 成長潛力分析

- 2024 年定價分析

- 監管格局

- 報銷場景

- 技術格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 金屬支架

- 聚合物支架

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 膽結石

- 胰腺癌

- 膽胰漏

- 良性膽道狹窄

- 其他應用

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診手術中心

- 專科診所

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- B Braun

- Becton, Dickinson & Company

- Boston Scientific

- Cardinal Health

- CONMED Corporation

- Cook Group

- ENDO-FLEX GmbH

- MI Tech

- Mediwood

- Medtronic

- Merit Medical System

- Olympus Corporation

- S & G Biotech

- TAEWOONG

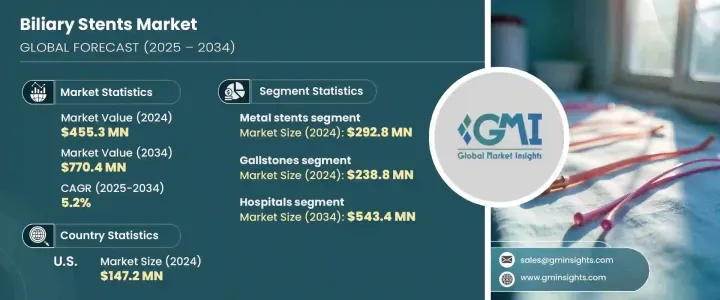

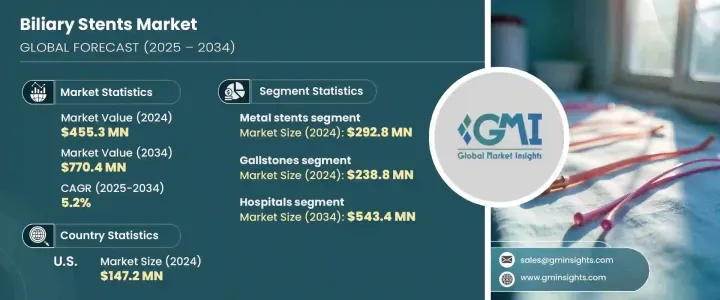

The Global Biliary Stents Market reached USD 455.3 million in 2024 and is projected to grow at a steady CAGR of 5.2% through 2034. This growth can largely be attributed to the increasing prevalence of liver and bile duct diseases, in line with ongoing advancements in stent technologies. Biliary stents are primarily used to manage conditions that cause bile duct blockages, such as cholangitis, pancreatitis, and certain cancers. These conditions can result in obstructions that disrupt bile flow, necessitating the use of stents for relief and treatment.

As the global population ages and lifestyle-related health issues rise, the demand for biliary stents is expected to surge significantly. Moreover, with innovations in stent technology, including the development of drug-eluting and biodegradable materials, these devices have become more effective, ensuring better patient outcomes and longer-lasting solutions. This expansion is also driven by increasing healthcare access and improvements in procedural techniques that allow more efficient stent placements, contributing to the market's positive trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $455.3 Million |

| Forecast Value | $770.4 Million |

| CAGR | 5.2% |

The market is primarily divided into two key segments: metal and polymer stents. In 2024, the metal stents segment was worth USD 292.8 million. Metal stents, particularly self-expanding versions, are favored for their ability to treat malignant obstructions and provide long-lasting solutions, reducing the frequency of replacements. These stents are critical in palliative care for cancer patients, offering additional benefits such as the prevention of tumor ingrowth and migration through fully and partially covered versions. The introduction of biodegradable and drug-eluting metal stents has increased their appeal, further driving their adoption across medical settings due to their advanced features.

The hospitals segment, the primary end-user of biliary stents, is expected to reach USD 543.4 million by the end of the forecast period. Hospitals have necessary infrastructure and expertise to perform complex procedures like ERCP and PTC, essential for diagnosing and treating biliary conditions. These procedures play a crucial role in ensuring the accurate placement of biliary stents, which ultimately contributes to improved treatment outcomes for patients. With continuous advancements in stent technology and placement techniques, hospitals are expected to continue leading the market, offering optimal care for individuals suffering from biliary disorders.

In the U.S., the biliary stents market was valued at USD 147.2 million in 2024, with an anticipated growth rate of 4.9% between 2025 and 2034. This growth is primarily driven by the rising incidence of biliary diseases and enhanced access to healthcare. Insurance coverage, including programs such as Medicare and Medicaid, are vital in making stent procedures more accessible to a broader patient base, further accelerating the demand for biliary stents. This financial support ensures that patients receive the necessary treatment to manage bile duct obstructions effectively.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of bile duct and chronic liver disease

- 3.2.1.2 Technological advancements in stents

- 3.2.1.3 Adoption of minimally invasive approach during the procedure

- 3.2.1.4 Growing geriatric population globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications and risks related to bile duct stents

- 3.2.2.2 High cost of the plastic bile duct stents

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Regulatory landscape

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Metal stents

- 5.3 Polymer stents

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gallstones

- 6.3 Pancreatic cancer

- 6.4 Bilio-pancreatic leakages

- 6.5 Benign biliary strictures

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Other end-users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Becton, Dickinson & Company

- 9.3 Boston Scientific

- 9.4 Cardinal Health

- 9.5 CONMED Corporation

- 9.6 Cook Group

- 9.7 ENDO-FLEX GmbH

- 9.8 M.I Tech

- 9.9 Mediwood

- 9.10 Medtronic

- 9.11 Merit Medical System

- 9.12 Olympus Corporation

- 9.13 S & G Biotech

- 9.14 TAEWOONG