|

市場調查報告書

商品編碼

1684757

鎳錳鈷 (NMC) 電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nickel Manganese Cobalt (NMC) Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

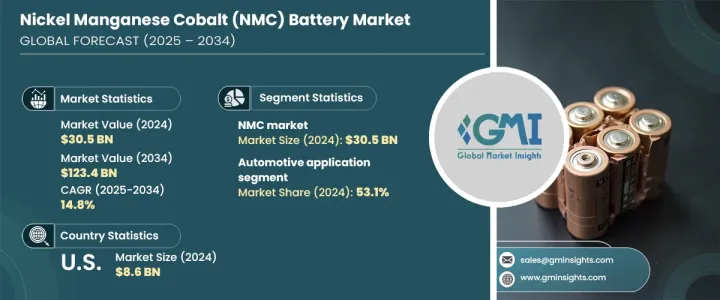

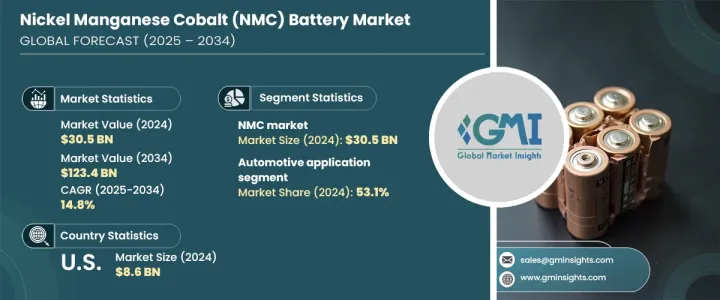

2024 年全球鎳錳鈷電池市場價值為 305 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 14.8%。這些電池以其高能量密度、長壽命和適應性而聞名,處於能源解決方案創新的前沿。隨著世界走向永續的未來,對清潔能源技術的需求正在激增,而 NMC 電池在這一轉變中發揮關鍵作用。世界各國政府都在實施支持性政策,而消費者也越來越青睞節能環保的解決方案。這些趨勢進一步鞏固了NMC電池在全球市場的地位。

科技的不斷進步正在改變NMC電池的格局。研究人員和製造商正致力於提高能量密度、改善安全性能和降低生產成本。透過最佳化鎳、錳和鈷的成分,公司可以實現更好的性能和成本效率,解決供應鏈中的關鍵挑戰。這些創新不僅滿足了對可靠、高效能能源儲存日益成長的需求,而且還使 NMC 電池成為汽車、再生能源和消費性電子產品等各個行業的遊戲規則改變者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 305億美元 |

| 預測值 | 1234億美元 |

| 複合年成長率 | 14.8% |

尤其是汽車產業,預計將顯著成長,到 2034 年複合年成長率將達到 12.9%。汽車製造商和消費者都青睞這些電池,因為它們能夠提供更長的行駛里程、更高的能源效率和長期的耐用性。隨著電動車技術的不斷進步,NMC 電池正在成為驅動下一代電動車的關鍵組件。

到 2034 年,美國鎳錳鈷電池市場預計將創下 352 億美元的產值,反映出電動車和儲能系統需求不斷成長推動的強勁成長。聯邦和州一級的激勵措施,加上嚴格的環境法規,正在推動全國採用 NMC 電池。能源電網的現代化和再生能源的整合進一步擴大了其需求。此外,為提高電池性能和降低材料成本而進行的大量研發投資確保了尖端解決方案的穩定供應。隨著永續性成為能源政策的基石,NMC 電池正成為美國清潔能源革命的關鍵推動因素

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 汽車

- 儲能

- 工業的

第6章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- A123 Systems

- Clarios

- Contemporary Amperex Technology

- Ding Tai Battery Company

- Duracell

- Energon

- Exide Technologies

- Lithiumwerks

- Philips

- Prologium Technology

- Saft

- Tesla

The Global Nickel Manganese Cobalt Battery Market, valued at USD 30.5 billion in 2024, is projected to grow at an impressive CAGR of 14.8% between 2025 and 2034. This growth is driven by the surging adoption of NMC batteries across electric vehicles (EVs), energy storage systems (ESS), and consumer electronics. Renowned for their high energy density, extended lifespan, and adaptability, these batteries are at the forefront of innovation in energy solutions. As the world moves toward a sustainable future, the demand for clean energy technologies is surging, with NMC batteries playing a pivotal role in this transition. Governments worldwide are implementing supportive policies, while consumers increasingly prefer energy-efficient and eco-friendly solutions. These trends are further solidifying the position of NMC batteries in the global market.

The ongoing advancements in technology are transforming the NMC battery landscape. Researchers and manufacturers are focusing on enhancing energy density, improving safety features, and reducing production costs. By optimizing the composition of nickel, manganese, and cobalt, companies are unlocking better performance and cost efficiency, addressing key challenges in the supply chain. These innovations not only cater to the growing need for reliable and efficient energy storage but also position NMC batteries as a game-changer in various industries, including automotive, renewable energy, and consumer electronics.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $30.5 Billion |

| Forecast Value | $123.4 Billion |

| CAGR | 14.8% |

The automotive sector, in particular, is expected to witness remarkable growth, registering a CAGR of 12.9% through 2034. The global push for EV adoption, supported by rising fuel prices, stricter emission regulations, and government incentives, is accelerating the demand for NMC batteries. Automakers and consumers alike are turning to these batteries for their ability to provide extended driving ranges, superior energy efficiency, and long-term durability. As EV technology continues to advance, NMC batteries are becoming a crucial component in powering the next generation of electric mobility.

The U.S. nickel manganese cobalt battery market is poised to generate USD 35.2 billion by 2034, reflecting robust growth fueled by the increasing demand for EVs and energy storage systems. Federal and state-level incentives, combined with stringent environmental regulations, are driving the adoption of NMC batteries across the country. The modernization of energy grids and the integration of renewable energy sources are further amplifying their demand. Additionally, significant investments in R&D aimed at improving battery performance and reducing material costs are ensuring a steady supply of cutting-edge solutions. As sustainability becomes a cornerstone of energy policies, NMC batteries are emerging as a critical enabler of the clean energy revolution in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Automotive

- 5.3 Energy storage

- 5.4 Industrial

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 France

- 6.3.3 Germany

- 6.3.4 Italy

- 6.3.5 Russia

- 6.3.6 Spain

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 A123 Systems

- 7.2 Clarios

- 7.3 Contemporary Amperex Technology

- 7.4 Ding Tai Battery Company

- 7.5 Duracell

- 7.6 Energon

- 7.7 Exide Technologies

- 7.8 Lithiumwerks

- 7.9 Philips

- 7.10 Prologium Technology

- 7.11 Saft

- 7.12 Tesla