|

市場調查報告書

商品編碼

1684729

長期演進基地台市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Long-Term Evolution Base Station Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

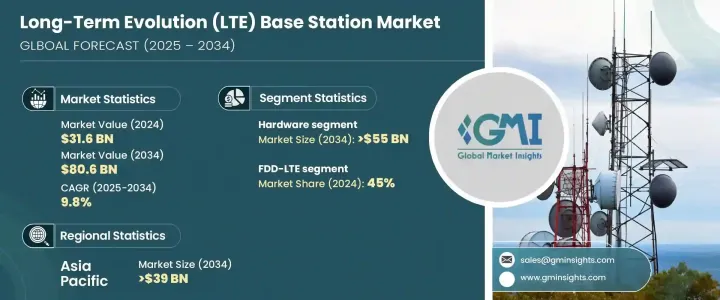

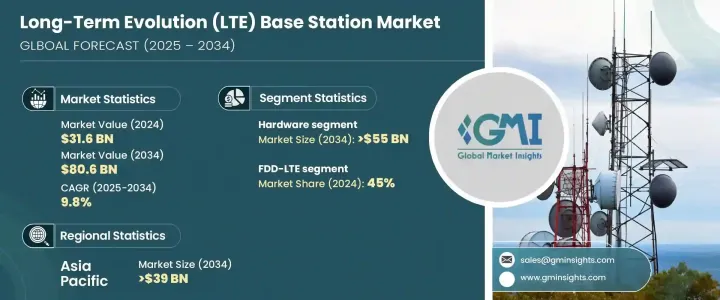

2024 年全球長期演進基地台市場價值為 316 億美元,預計將大幅成長,預計 2025 年至 2034 年期間的複合年成長率為 9.8%。這一快速擴張的動力源於對高速行動網際網路的需求不斷成長、行動資料消費激增以及先進無線網路的廣泛部署。隨著行動用戶不斷期待無縫連接,從過時的 3G 網路過渡到 LTE 及更高版本已成為必要。智慧型設備和物聯網 (IoT) 的日益普及進一步加劇了對更可靠、更有效率的網路基礎設施的需求。世界各國政府的措施也在推動 LTE 基地台部署方面發揮關鍵作用,並在網路升級和 5G 解決方案整合方面投入了大量資金。因此,LTE 基礎設施不再只是一種連接選項;它已成為現代數位生態系統的支柱,支援企業和消費者追求高速、不間斷的通訊。

市場分為硬體和軟體,其中硬體部分在 2024 年佔據 65% 的市場佔有率。隨著技術進步推動效率和效能的提高,預計到 2034 年將達到 550 億美元。影響硬體格局的最顯著趨勢之一是基地台和天線的小型化。這項創新使網路供應商能夠以緊湊且節省空間的形式部署高效能解決方案。此外,製造商優先考慮節能硬體組件,以最佳化功耗,同時保持峰值網路效能。模組化硬體設計正在獲得發展勢頭,提供可擴展的解決方案,簡化網路升級並確保現有基礎設施面向未來。隨著 LTE 網路的擴展,營運商擴大尋求經濟高效、性能卓越的硬體解決方案,以滿足不斷成長的不間斷連接需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 316億美元 |

| 預測值 | 806億美元 |

| 複合年成長率 | 9.8% |

LTE基地台市場分為三個關鍵技術部分:FDD-LTE、TDD-LTE和小型基地台。 FDD-LTE 在 2024 年佔據 45% 的主導佔有率,這主要歸功於它能夠提供均衡的上傳和下載速度。該技術特別適合資料流量大的地區,因為它可以確保城市和郊區的無縫用戶體驗。 FDD-LTE 基礎設施的持續擴張,尤其是在已開發市場,繼續推動其應用。此外,網路供應商正在投資節能基地台,以降低營運成本,同時保持穩定的連線。隨著對可擴展且經濟高效的 LTE 解決方案的需求不斷成長,FDD-LTE 仍然是網路營運商和消費者的首選。

2024 年,亞太地區以 39% 的佔有率領先全球 LTE 基地台市場,預計到 2034 年將超過 390 億美元。在政府支持的網路升級和不斷成長的行動資料需求的支持下,中國等主要市場快速採用 LTE 是這一成長的主要驅動力。 TDD-LTE 技術因其頻譜效率而廣受好評,該技術的日益普及進一步增強了該地區的主導地位。隨著亞太國家繼續投資下一代連接解決方案,LTE 市場將會擴大,縮小當前技術與即將到來的 5G 革命之間的差距。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 零件供應商

- 設備製造商

- 軟體供應商

- 系統整合商

- 電信營運商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 成本明細分析

- 重要新聞及舉措

- 監管格局

- 技術差異化

- FDD-LTE 與 TDD-LTE

- Micro、Pico 和 Femto

- 衝擊力

- 成長動力

- 高速行動寬頻需求不斷成長

- 行動資料流量和消費不斷增加

- 全球 4G 和 LTE 網路的擴展

- 物聯網和連網設備的普及率不斷提高

- 產業陷阱與挑戰

- LTE網路基礎設施部署成本高

- 頻譜分配與管理方面的挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 硬體

- 基頻單元 (BBU)

- 遠程無線電單元 (RRU)

- 天線

- 功率放大器

- 冷卻系統

- 軟體

- 基地台控制器

- 網路管理軟體

- 最佳化工具

第6章:市場估計與預測:依技術,2021 - 2034 年

- 主要趨勢

- LTE-FDD

- 時分雙工

- 小細胞

第 7 章:市場估計與預測:按供應量,2021 - 2034 年

- 主要趨勢

- 城市的

- 郊區

- 鄉村的

第 8 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 住宅及 SOHO

- 企業

- 電信營運商

- 政府和公共部門

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Airspan

- Alpha Wireless

- AT&T

- Baicells

- Blinq Networks

- Cassava Technologies

- Cisco

- CommScope

- Ericsson

- Fujitsu

- Huawei

- Motorola

- NEC

- Nokia

- NuRAN Solutions

- Qualcomm

- Samsung

- Tektelic Communications

- ZTE

The Global Long-Term Evolution Base Station Market, valued at USD 31.6 billion in 2024, is poised for significant growth, with projections indicating a CAGR of 9.8% between 2025 and 2034. This rapid expansion is fueled by the increasing demand for high-speed mobile internet, surging mobile data consumption, and the widespread deployment of advanced wireless networks. As mobile users continue to expect seamless connectivity, the transition from outdated 3G networks to LTE and beyond has become a necessity. The growing penetration of smart devices and the Internet of Things (IoT) is further intensifying the need for more reliable and efficient network infrastructure. Government initiatives worldwide are also playing a crucial role in advancing LTE base station deployment, with substantial investments in network upgrades and the integration of 5G-ready solutions. As a result, LTE infrastructure is no longer just a connectivity option; it has become the backbone of modern digital ecosystems, supporting businesses and consumers alike in their quest for high-speed, uninterrupted communication.

The market is segmented into hardware and software, with the hardware segment accounting for 65% of the market share in 2024. This segment is expected to reach USD 55 billion by 2034 as technological advancements drive efficiency and performance improvements. One of the most notable trends shaping the hardware landscape is the miniaturization of base stations and antennas. This innovation allows network providers to deploy high-performance solutions in compact and space-efficient formats. Additionally, manufacturers are prioritizing energy-efficient hardware components to optimize power consumption while maintaining peak network performance. Modular hardware designs are gaining momentum, offering scalable solutions that simplify network upgrades and future-proof existing infrastructure. As LTE networks expand, operators are increasingly looking for cost-effective, high-performance hardware solutions to meet the ever-growing demand for uninterrupted connectivity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $31.6 billion |

| Forecast Value | $80.6 billion |

| CAGR | 9.8% |

The LTE base station market is divided into three key technology segments: FDD-LTE, TDD-LTE, and small cells. FDD-LTE held a dominant 45% share in 2024, primarily due to its ability to deliver balanced upload and download speeds. This technology is particularly well-suited for regions with high data traffic, as it ensures a seamless user experience across urban and suburban areas. The sustained expansion of FDD-LTE infrastructure, especially in developed markets, continues to drive its adoption. Additionally, network providers are investing in energy-efficient base stations that lower operational costs while maintaining robust connectivity. With the growing need for scalable and cost-effective LTE solutions, FDD-LTE remains a preferred choice for both network operators and consumers.

Asia Pacific led the global LTE base station market with a 39% share in 2024 and is projected to surpass USD 39 billion by 2034. Rapid LTE adoption in key markets like China is a major driving force behind this growth, supported by government-backed network upgrades and a rising demand for mobile data. The increasing deployment of TDD-LTE technology, known for its spectrum efficiency, further strengthens the region's dominance. As Asia Pacific nations continue investing in next-generation connectivity solutions, the LTE market is set to expand, bridging the gap between current technologies and the upcoming 5G revolution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Equipment manufacturers

- 3.2.3 Software providers

- 3.2.4 System integrators

- 3.2.5 Telecom operators

- 3.2.6 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Technology differentiators

- 3.9.1 FDD-LTE vs TDD-LTE

- 3.9.2 Micro vs Pico vs Femto

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for high-speed mobile broadband

- 3.10.1.2 Increasing mobile data traffic and consumption

- 3.10.1.3 Expansion of 4G and LTE networks worldwide

- 3.10.1.4 Growing adoption of IoT and connected devices

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of LTE network infrastructure deployment

- 3.10.2.2 Challenges in spectrum allocation and management

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Baseband units (BBU)

- 5.2.2 Remote radio units (RRU)

- 5.2.3 Antennas

- 5.2.4 Power amplifiers

- 5.2.5 Cooling systems

- 5.3 Software

- 5.3.1 Base station controllers

- 5.3.2 Network management software

- 5.3.3 Optimization tools

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 FDD-LTE

- 6.3 TDD-LTE

- 6.4 Small cells

Chapter 7 Market Estimates & Forecast, By Provision, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Urban

- 7.3 Suburban

- 7.4 Rural

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Residential & SOHO

- 8.3 Enterprise

- 8.4 Telecom operators

- 8.5 Government and public sector

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Number of base stations)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airspan

- 10.2 Alpha Wireless

- 10.3 AT&T

- 10.4 Baicells

- 10.5 Blinq Networks

- 10.6 Cassava Technologies

- 10.7 Cisco

- 10.8 CommScope

- 10.9 Ericsson

- 10.10 Fujitsu

- 10.11 Huawei

- 10.12 Motorola

- 10.13 NEC

- 10.14 Nokia

- 10.15 NuRAN Solutions

- 10.16 Qualcomm

- 10.17 Samsung

- 10.18 Tektelic Communications

- 10.19 ZTE