|

市場調查報告書

商品編碼

1684727

Wi-Fi 擴展器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Wi-Fi Extender Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

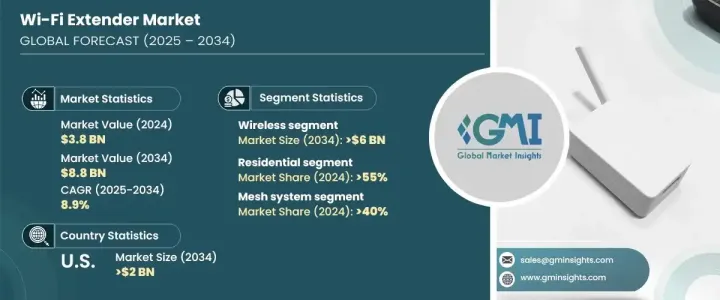

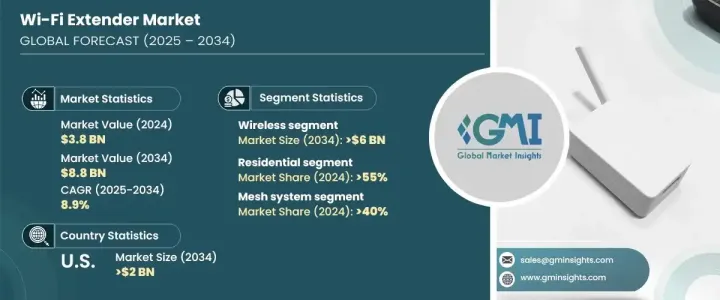

2024 年全球 Wi-Fi 擴展器市場規模達到 38 億美元,預計 2025 年至 2034 年期間將以 8.9% 的複合年成長率實現顯著成長。隨著越來越多的消費者將安全攝影機、智慧恆溫器、聲控揚聲器和其他連網裝置引入家中,對可靠網路連線的需求激增。這些智慧型裝置需要穩定、不間斷的網路連接,而傳統的 Wi-Fi 路由器通常難以提供這種連接,尤其是在較大或多層的住宅中。隨著網路連線對於視訊串流、線上遊戲和遠端工作等日常活動變得越來越重要,Wi-Fi 擴展器對於擴大覆蓋範圍和消除死角至關重要。這種對持續、無縫連接的需求是推動 Wi-Fi 擴展器需求的關鍵因素,尤其是在智慧家庭生態系統不斷發展和演變的情況下。

Wi-Fi 擴展器市場主要分為兩種:有線擴展器和無線擴展器。 2024年,無線領域將佔據主導地位,佔65%的市場。預計該領域將經歷大幅成長,到 2034 年將達到 60 億美元。它們的靈活性和簡單性使其成為擴展家庭和企業 Wi-Fi 覆蓋範圍的完美解決方案,吸引了廣泛的消費者,尤其是那些沒有技術專業知識的消費者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 38億美元 |

| 預測值 | 88億美元 |

| 複合年成長率 | 8.9% |

從應用領域來看,Wi-Fi 擴展器市場分為住宅、商業和工業用途。受智慧家庭設備的使用日益成長以及串流媒體、遊戲和視訊會議等高頻寬活動的需求不斷成長的推動,住宅領域將在 2024 年佔據 55% 的市場佔有率。隨著越來越多的設備連接到網際網路,家庭需要增強的 Wi-Fi 覆蓋範圍,可以覆蓋多個房間,確保在大面積範圍內實現穩定、不間斷的連接。 Wi-Fi 擴展器透過消除覆蓋範圍差距並確保用戶在整個家庭中保持一致、高速的網路存取來滿足此需求。

在北美,Wi-Fi 擴展器市場在 2024 年佔據了 80% 的主導市場佔有率。美國主要科技公司不斷開發先進的解決方案,促進了Wi-Fi擴展器的廣泛普及和需求。隨著家庭和企業對網路連線的需求不斷成長,Wi-Fi 擴展器已成為現代數位生活方式不可或缺的一部分。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 製造商

- 經銷商

- 零售商

- 服務提供者

- OEM合作夥伴

- 最終用戶

- 供應商概況

- 價格趨勢

- 利潤率分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 智慧家庭設備的普及率不斷提高

- 網路普及率和資料消費量不斷上升

- 遠距工作和線上教育的成長

- Wi-Fi 技術的進步(Wi-Fi 6 和 6E)

- 產業陷阱與挑戰

- 訊號衰減和干擾問題

- 激烈的競爭導致定價壓力

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 插入式 Wi-Fi 擴充器

- 桌面 Wi-Fi 擴充器

- 網狀系統

第6章:市場估計與預測:依技術,2021 - 2034 年

- 主要趨勢

- Wi-Fi 5

- Wi-Fi 6

- Wi-Fi 6E

- 其他

第7章:市場估計與預測:依連結性,2021 - 2032 年

- 主要趨勢

- 有線擴展器

- 無線擴展器

第 8 章:市場估計與預測:按應用,2021 - 2032 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 9 章:市場估計與預測:按頻段,2021 - 2032 年

- 主要趨勢

- 單波段(2.4 GHz)

- 雙頻(2.4 GHz 和 5 GHz)

- 三頻

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Netgear

- Actiontec Electronics

- Amazon

- Amped Wireless

- ASUS

- Belkin International

- Cisco Systems

- Comtrend

- Devolo

- D-Link

- Edimax Technology

- Hewlett Packard Enterprise

- Linksys

- Mercusys

- Tenda Technology

- TP-Link

- TRENDnet

- Ubiquiti Networks

- Zyxel Communications

The Global Wi-Fi Extender Market reached USD 3.8 billion in 2024 and is expected to record significant growth at a CAGR of 8.9% from 2025 to 2034. This expansion is primarily driven by the increasing adoption of smart home technologies. As more consumers incorporate devices like security cameras, smart thermostats, voice-activated speakers, and other connected gadgets into their homes, the demand for reliable internet connectivity has surged. These smart devices require a stable and uninterrupted internet connection, which traditional Wi-Fi routers often struggle to provide, particularly in larger or multi-story homes. With internet connectivity becoming more critical for everyday activities like video streaming, online gaming, and remote work, Wi-Fi extenders are essential for expanding coverage areas and eliminating dead zones. This need for constant, seamless connectivity is a key factor fueling the demand for Wi-Fi extenders, especially as the smart home ecosystem continues to grow and evolve.

The Wi-Fi extender market is primarily divided into two types: wired and wireless extenders. In 2024, the wireless segment dominated, accounting for 65% of the market share. This segment is projected to experience substantial growth, reaching USD 6 billion by 2034. Wireless extenders are particularly appealing because they are easy to install, requiring no additional cables or complex setup. Their flexibility and simplicity make them a perfect solution for extending Wi-Fi coverage in homes and businesses, appealing to a broad range of consumers-especially those without technical expertise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.8 billion |

| Forecast Value | $8.8 billion |

| CAGR | 8.9% |

Looking at the application sectors, the Wi-Fi extender market is segmented into residential, commercial, and industrial uses. The residential sector represented 55% of the market share in 2024, driven by the growing use of smart home devices and the rising demand for high-bandwidth activities such as streaming, gaming, and video conferencing. With more devices connecting to the internet, households require enhanced Wi-Fi coverage that can span multiple rooms, ensuring strong, uninterrupted connections across large areas. Wi-Fi extenders meet this need by eliminating coverage gaps and ensuring users maintain consistent, high-speed internet access throughout their homes.

In North America, the Wi-Fi extender market held a dominant 80% market share in 2024. The US market, in particular, is set to generate USD 2 billion by 2034. Factors driving this market's growth include the widespread adoption of home internet connections, further accelerated by the work-from-home trend and the growing reliance on smart home technology. The presence of major tech companies in the US, which continue to develop advanced solutions, has contributed to the widespread availability and demand for Wi-Fi extenders. With the increasing demand for internet connectivity in households and businesses, Wi-Fi extenders have become an indispensable part of the modern digital lifestyle.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Manufacturers

- 3.1.2 Distributors

- 3.1.3 Retailers

- 3.1.4 Service providers

- 3.1.5 OEM partners

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Price trend

- 3.4 Profit margin analysis

- 3.5 Patent landscape

- 3.6 Cost breakdown

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing adoption of smart home devices

- 3.10.1.2 Rising internet penetration and data consumption

- 3.10.1.3 Growth in remote work and online education

- 3.10.1.4 Advancements in Wi-Fi technology (Wi-Fi 6 and 6E)

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Signal degradation and interference issues

- 3.10.2.2 High competition leading to pricing pressures

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Plug-in Wi-Fi extenders

- 5.3 Desktop Wi-Fi extenders

- 5.4 Mesh system

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Wi-Fi 5

- 6.3 Wi-Fi 6

- 6.4 Wi-Fi 6E

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Wired extenders

- 7.3 Wireless extenders

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Band, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Single band (2.4 GHz)

- 9.3 Dual band (2.4 GHz and 5 GHz)

- 9.4 Tri-band

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Netgear

- 11.2 Actiontec Electronics

- 11.3 Amazon

- 11.4 Amped Wireless

- 11.5 ASUS

- 11.6 Belkin International

- 11.7 Cisco Systems

- 11.8 Comtrend

- 11.9 Devolo

- 11.10 D-Link

- 11.11 Edimax Technology

- 11.12 Google

- 11.13 Hewlett Packard Enterprise

- 11.14 Linksys

- 11.15 Mercusys

- 11.16 Tenda Technology

- 11.17 TP-Link

- 11.18 TRENDnet

- 11.19 Ubiquiti Networks

- 11.20 Zyxel Communications