|

市場調查報告書

商品編碼

1684720

自行車機械碟式煞車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bicycle Mechanical Disc Brake Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

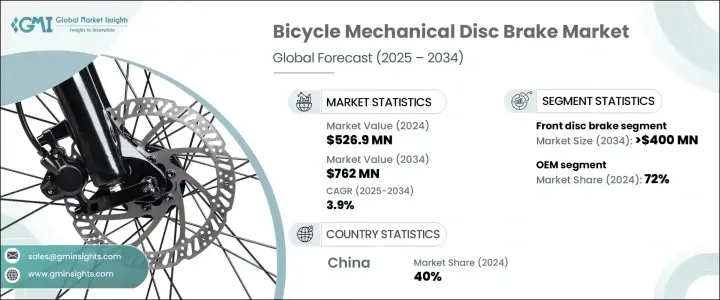

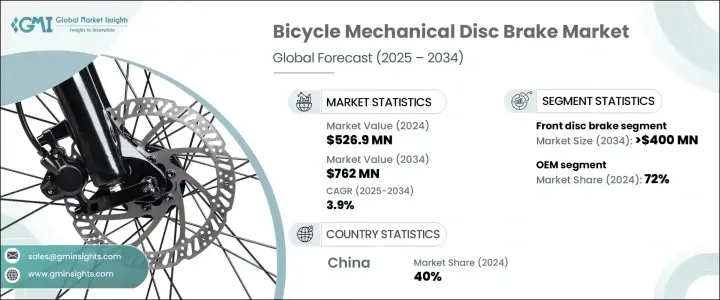

2024 年全球自行車機械碟式煞車市場規模達到 5.269 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.9%。日益轉向永續交通是推動該市場向前發展的主要因素。世界各國政府都在投資自行車基礎設施,推廣自行車作為汽車的可行替代品。專用自行車道、對騎自行車者的稅收優惠以及對電動自行車的補貼使騎自行車變得更加容易,最終推動了對機械碟式煞車的需求。隨著城市化進程的加速和人們對環境問題的日益關注,自行車已經成為人們日常旅行的首選方式。隨著越來越多的人開始騎自行車,對可靠煞車系統的需求也隨之成長。

越來越多的消費者選擇配備機械式碟式煞車的自行車,因為它們高效、耐用、經濟實惠。與液壓煞車不同,機械式碟式煞車需要的維護較少,並且在各種地形和天氣條件下提供一致的性能。這種可靠性使其成為休閒和通勤騎乘者的理想選擇。騎自行車健身和休閒的日益普及也促進了市場的擴張,因為騎士們尋求能夠確保安全和控制的煞車系統。此外,輕質材料和改進的煞車片複合材料等煞車技術的進步提高了性能,進一步推動了煞車片的採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.269 億美元 |

| 預測值 | 7.62億美元 |

| 複合年成長率 | 3.9% |

電動自行車在推動自行車機械碟式煞車市場方面發揮著重要作用。機械式碟式煞車是電動自行車的首選,因為它們能在不同的速度和負載下提供可靠的煞車力道。許多政府,特別是歐洲政府,都將電動自行車的普及作為綠色交通計畫的一部分。這些激勵措施加上人們對電動車的日益青睞,推動了對機械碟式煞車的需求。隨著電動自行車成為主流交通工具,製造商不斷整合先進的煞車系統,確保騎乘者的安全和性能。

市場根據煞車類型分為前碟式煞車和後碟式煞車。前碟式煞車在 2024 年佔據了 60% 的市場佔有率,預計到 2034 年將創造 4 億美元的市場價值。消費者對高性能自行車的需求推動了這一成長,因為前碟式煞車在具有挑戰性的條件下提供了卓越的煞車力道和更好的控制。無論是在陡峭的地形上行駛還是在潮濕的天氣騎行,這些煞車都能增強騎乘者的穩定性和安全性。山地自行車和越野自行車的興起進一步推動了對確保耐用性和控制力的高精度煞車技術的需求。

自行車機械碟式煞車的分銷管道分為OEM和售後市場,其中 OEM 到 2024 年佔據 72% 的主導佔有率。自行車製造商擴大與OEM煞車供應商合作,為其車型配備來自工廠的最新煞車技術。這些合作關係使品牌能夠將高性能機械碟式煞車整合到其生產線中,確保新自行車符合現代安全和效率標準。隨著消費者對高級自行車的期望不斷提高, OEM銷售預計將保持強勁勢頭,鞏固市場成長。

中國仍然是全球自行車機械碟式煞車市場的主導者,到 2024 年將佔 40% 的佔有率。中國對永續出行和減少車輛排放的重視導致了自行車的廣泛採用,尤其是在城市地區。中國有著強大的自行車文化,無論是通勤還是休閒,都推動著對高品質煞車系統的持續需求。政府推行的環保運輸解決方案的政策進一步支持了這個市場,使中國成為機械碟式煞車生產和創新的重要樞紐。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 最終客戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 定價分析

- 衝擊力

- 成長動力

- 全球自行車普及率上升

- 環保意識推動人們轉向環保交通

- 煞車部件的技術進步

- 政府推出措施支持自行車基礎建設

- 產業陷阱與挑戰

- 競爭激烈,價格敏感

- 轉向液壓碟式煞車

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按制動器,2021 - 2034 年

- 主要趨勢

- 前碟式煞車

- 後碟式煞車

第6章:市場估計與預測:按供應量,2021 - 2034 年

- 主要趨勢

- 單活塞

- 雙活塞

- 四活塞

- 多活塞

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公路自行車

- 登山車

- 賽車

- 礫石自行車

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Box Components

- Campagnolo

- Cane Creek

- Clarks Cycle Systems

- Formula

- Funn Components

- Hayes

- Hope Technology

- Jagwire

- KMC

- Magura

- Nutt

- Promax

- RockShox

- Shimano

- SRAM

- SunRace

- Tektro

- XLC

- Zoom

The Global Bicycle Mechanical Disc Brake Market reached USD 526.9 million in 2024 and is set to grow at a CAGR of 3.9% between 2025 and 2034. The increasing shift toward sustainable transportation is a major factor driving this market forward. Governments worldwide are investing in cycling infrastructure, promoting bicycles as a viable alternative to cars. Dedicated bike lanes, tax incentives for cyclists, and subsidies for electric bicycles are making cycling more accessible, ultimately boosting demand for mechanical disc brakes. With urbanization accelerating and environmental concerns on the rise, bicycles have become a preferred mode of daily travel. As more people turn to cycling, the need for reliable braking systems continues to grow.

Consumers are increasingly opting for bicycles equipped with mechanical disc brakes due to their efficiency, durability, and cost-effectiveness. Unlike hydraulic brakes, mechanical disc brakes require less maintenance and offer consistent performance across various terrains and weather conditions. This reliability makes them an ideal choice for both recreational and commuter cyclists. The growing popularity of cycling for fitness and leisure also contributes to market expansion, as riders seek braking systems that ensure safety and control. Additionally, advancements in brake technology, such as lightweight materials and improved pad compounds, enhance performance, further driving adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $526.9 Million |

| Forecast Value | $762 Million |

| CAGR | 3.9% |

Electric bicycles are playing a significant role in propelling the bicycle mechanical disc brake market. Mechanical disc brakes are the preferred choice for e-bikes because they deliver dependable stopping power under varying speeds and loads. Many governments, particularly in Europe, are incentivizing e-bike adoption as part of their green transportation initiatives. These incentives, coupled with an increasing preference for electric mobility, are fueling demand for mechanical disc brakes. As e-bikes transition into mainstream transportation, manufacturers continue to integrate advanced braking systems, ensuring safety and performance for riders.

The market is segmented by brake type into front and rear disc brakes. Front disc brakes accounted for 60% of the market share in 2024 and are projected to generate USD 400 million by 2034. Consumer demand for high-performance bicycles is driving this growth, as front disc brakes provide superior stopping power and better control in challenging conditions. Whether navigating steep terrain or cycling in wet weather, these brakes enhance rider stability and safety. The rise in mountain biking and off-road cycling further fuels the demand for high-precision braking technology that ensures durability and control.

Distribution channels for bicycle mechanical disc brakes are divided into OEM and aftermarket, with OEMs capturing a dominant 72% share in 2024. Bicycle manufacturers are increasingly collaborating with OEM brake suppliers to equip their models with the latest braking technology straight from the factory. These partnerships allow brands to integrate high-performance mechanical disc brakes into their production lines, ensuring that new bicycles meet modern safety and efficiency standards. With rising consumer expectations for premium bicycles, OEM sales are expected to maintain strong momentum, solidifying market growth.

China remains a dominant player in the global bicycle mechanical disc brake market, accounting for 40% of the share in 2024. The country's emphasis on sustainable mobility and reducing vehicle emissions has led to widespread bicycle adoption, particularly in urban areas. China's strong cycling culture, both for commuting and recreation, drives consistent demand for high-quality braking systems. Government policies promoting eco-friendly transport solutions further support this market, positioning China as a critical hub for mechanical disc brake production and innovation.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increase in bicycle adoption across the world

- 3.9.1.2 Environmental awareness encourages the shift to eco-friendly transport

- 3.9.1.3 Technological advancements in brake components

- 3.9.1.4 Government initiatives supporting cycling infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High competition and price sensitivity

- 3.9.2.2 Shift toward hydraulic disc brakes

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Brake, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Front disc brake

- 5.3 Rear disc brake

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Single piston

- 6.3 Dual piston

- 6.4 Four piston

- 6.5 Multi-piston

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Road bike

- 7.3 Mountain bike

- 7.4 Racing bike

- 7.5 Gravel bikes

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 North America

- 9.1.1 U.S.

- 9.1.2 Canada

- 9.2 Europe

- 9.2.1 UK

- 9.2.2 Germany

- 9.2.3 France

- 9.2.4 Italy

- 9.2.5 Spain

- 9.2.6 Russia

- 9.2.7 Nordics

- 9.3 Asia Pacific

- 9.3.1 China

- 9.3.2 India

- 9.3.3 Japan

- 9.3.4 Australia

- 9.3.5 South Korea

- 9.3.6 Southeast Asia

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.2 Mexico

- 9.4.3 Argentina

- 9.5 MEA

- 9.5.1 UAE

- 9.5.2 South Africa

- 9.5.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Box Components

- 10.2 Campagnolo

- 10.3 Cane Creek

- 10.4 Clarks Cycle Systems

- 10.5 Formula

- 10.6 Funn Components

- 10.7 Hayes

- 10.8 Hope Technology

- 10.9 Jagwire

- 10.10 KMC

- 10.11 Magura

- 10.12 Nutt

- 10.13 Promax

- 10.14 RockShox

- 10.15 Shimano

- 10.16 SRAM

- 10.17 SunRace

- 10.18 Tektro

- 10.19 XLC

- 10.20 Zoom