|

市場調查報告書

商品編碼

1684659

自行車前輪圈市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Bicycle Front Hub Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

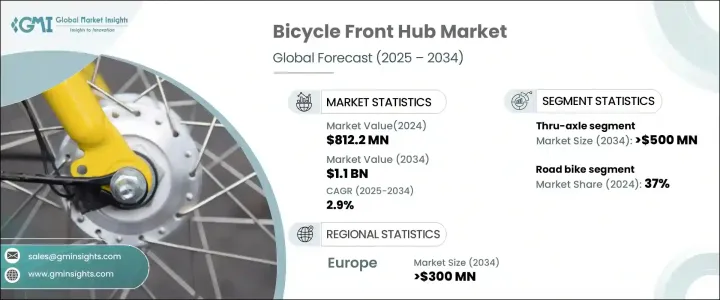

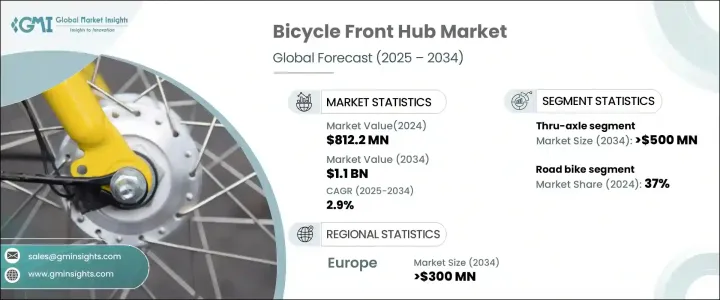

2024 年全球自行車前輪轂市場價值為 8.122 億美元,預計 2025 年至 2034 年的複合年成長率為 2.9%。這一成長是由對高性能自行車的需求不斷成長所推動的,這得益於輪轂技術的進步以及電動自行車 (e-bikes) 和城市交通解決方案的普及。市場受益於輕質材料、先進嚙合系統和密封軸承等創新,這些創新顯著提高了輪轂的性能和耐用性。隨著世界各國政府持續支持自行車基礎設施的改善,對自行車(尤其是電動自行車)的需求持續成長。除此之外,售後市場客製化和更換的日益成長的趨勢進一步促進了市場的擴張。這些因素為更活躍和不斷發展的市場鋪平了道路。

對更永續交通的追求,加上騎自行車作為一種休閒活動越來越受歡迎,推動了對更先進的自行車輪轂的需求。隨著城市交通趨勢向電動自行車轉變,對於能夠處理這些車輛增加的功率和負載的前輪轂的需求持續上升。電動自行車前輪轂不僅必須支撐馬達的重量,還必須提供長期使用的耐用性和性能。這種轉變正在改變整個行業,越來越多的騎乘者選擇能夠提高騎乘效率和舒適度的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.122億美元 |

| 預測值 | 11億美元 |

| 複合年成長率 | 2.9% |

自行車前輪轂市場按產品類型分為快速拆式輪轂、通軸式輪轂和螺栓式輪轂。 2024 年,通軸領域佔了 47% 的市場佔有率,預計到 2034 年將創造 5 億美元的市場價值。通軸輪轂因其出色的剛性、強度和車輪安全性而越來越受到關注,尤其是在高性能自行車中。這些特點使它們特別適合山地自行車、碎石自行車和電動自行車,因為穩定性和精確度至關重要。隨著人們對增強操控性和更穩定駕駛的追求,向通軸系統的轉變正在成為行業標準。

就自行車類型而言,市場分為混合動力自行車、山地自行車、電動自行車和公路自行車。 2024 年,公路車佔據了 37% 的市場佔有率,對輕型、高性能輪轂的需求不斷增加。碳纖維和鋁等材料的進步推動了這些趨勢,而改進的軸承系統和快速接合機制現在已成為標準。公路自行車騎士越來越注重空氣動力學和速度,尋求摩擦力更小、反應速度更快的輪轂。

2024 年,歐洲佔全球自行車前輪圈市場的 29%,預計到 2034 年將創收 3 億美元。儘管面臨經濟波動和消費者偏好不斷變化的等挑戰,但對前輪轂等高性能自行車零件的需求仍然強勁。該地區電動自行車的普及率不斷提高,進一步推動了輪圈技術的創新,以滿足現代騎乘者不斷變化的需求。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 輪轂製造商

- 原始設備製造商

- 分銷商和批發商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 技術差異化

- 軸承技術

- 材料創新

- 參與系統

- 衝擊力

- 成長動力

- 電動自行車使用率上升推動樞紐需求

- 騎自行車休閒越來越受歡迎

- 輕量耐用材質的進步

- 轉向使用筒軸輪轂以提高性能

- 產業陷阱與挑戰

- 先進材料和製造成本高昂

- 不同自行車標準的相容性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 快速釋放

- 通軸

- 螺栓固定

第 6 章:市場估計與預測:按材料,2021 - 2034 年

- 主要趨勢

- 鋁

- 鋼

- 碳纖維

- 其他

第7章:市場估計與預測:依自行車分類,2021 - 2034 年

- 主要趨勢

- 公路自行車

- 登山車

- 油電混合自行車

- 電動自行車

第 8 章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Campagnolo

- Chris King

- DT Swiss

- Easton Cycling

- Extralite

- Formula

- Hope Technology

- Industry Nine

- Joytech

- Mavic

- Novatec

- Onyx Racing Products

- Paul Component Engineering

- Phil Wood

- Shimano

- Spank Industries

- SRAM

- Stans NoTubes

- Tune

- White Industries

The Global Bicycle Front Hub Market was valued at USD 812.2 million in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2034. This growth is driven by increasing demand for high-performance bicycles, spurred by advancements in hub technology and the surge in popularity of electric bikes (e-bikes) and urban mobility solutions. The market benefits from innovations such as lightweight materials, advanced engagement systems, and sealed bearings, which significantly enhance hub performance and durability. As governments worldwide continue to support cycling infrastructure improvements, the demand for bicycles-especially e-bikes-continues to grow. Alongside this, a growing trend toward aftermarket customization and replacement further contributes to the market's expansion. These factors are paving the way for a more dynamic and evolving market.

The push for more sustainable transportation, coupled with the rising popularity of cycling as a recreational activity, is driving the need for more advanced bicycle hubs. As urban mobility trends shift in favor of e-bikes, the demand for front hubs capable of handling the increased power and load of these vehicles continues to rise. E-bike front hubs must not only support the weight of the motor but also provide durability and performance for extended usage. This shift is changing the industry, with more cyclists opting for solutions that enhance both the efficiency and comfort of their riding experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $812.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 2.9% |

The bicycle front hub market is segmented by product type into quick-release, thru-axle, and bolt-on hubs. In 2024, the thru-axle segment captured 47% of the market share and is expected to generate USD 500 million by 2034. Thru-axle hubs are gaining traction, particularly in high-performance bicycles, thanks to their superior stiffness, strength, and wheel security. These features make them especially suitable for mountain bikes, gravel bikes, and e-bikes, where stability and precision are crucial. The shift toward thru-axle systems is becoming the industry standard, driven by the desire for enhanced handling and more stable rides.

In terms of bicycle types, the market is divided into hybrid bikes, mountain bikes, e-bikes, and road bikes. Road bikes held a 37% market share in 2024, with demand rising for lightweight, high-performance hubs. Advancements in materials such as carbon fiber and aluminum are driving these trends, while improved bearing systems and quick engagement mechanisms are now standard. Road cyclists, increasingly focused on aerodynamics and speed, seek hubs that offer lower friction and greater responsiveness.

Europe accounted for 29% of the global bicycle front hub market share in 2024 and is projected to generate USD 300 million by 2034. Despite challenges like economic fluctuations and evolving consumer preferences, demand for high-performance bicycle components, including front hubs, remains resilient. The growing adoption of e-bikes in the region is further driving innovation in hub technology to meet the evolving demands of modern cyclists.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Hub manufacturers

- 3.2.3 OEMs

- 3.2.4 Distributors and wholesalers

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Technology differentiators

- 3.8.1 Bearing technology

- 3.8.2 Material innovations

- 3.8.3 Engagement systems

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising e-bike adoption boosting hub demand

- 3.9.1.2 Increasing popularity of cycling for recreation

- 3.9.1.3 Advancements in lightweight and durable materials

- 3.9.1.4 Shift towards thru-axle hubs for performance

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High costs of advanced materials and manufacturing

- 3.9.2.2 Compatibility issues across diverse bicycle standards

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Quick-release

- 5.3 Thru-axle

- 5.4 Bolt-on

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Aluminum

- 6.3 Steel

- 6.4 Carbon fiber

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Bicycle, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Road bikes

- 7.3 Mountain bikes

- 7.4 Hybrid bikes

- 7.5 E-bikes

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Campagnolo

- 10.2 Chris King

- 10.3 DT Swiss

- 10.4 Easton Cycling

- 10.5 Extralite

- 10.6 Formula

- 10.7 Hope Technology

- 10.8 Industry Nine

- 10.9 Joytech

- 10.10 Mavic

- 10.11 Novatec

- 10.12 Onyx Racing Products

- 10.13 Paul Component Engineering

- 10.14 Phil Wood

- 10.15 Shimano

- 10.16 Spank Industries

- 10.17 SRAM

- 10.18 Stans NoTubes

- 10.19 Tune

- 10.20 White Industries