|

市場調查報告書

商品編碼

1684656

非類固醇抗發炎藥 (NSAID) 市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Non-steroidal Anti-inflammatory Drugs (NSAIDs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

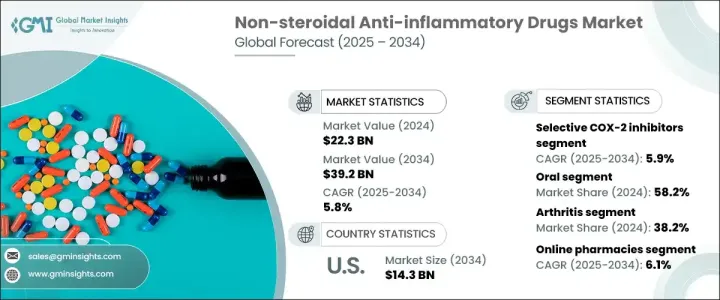

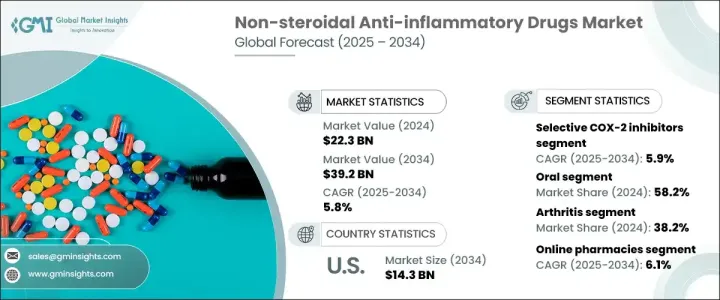

2024 年全球非類固醇抗發炎藥市場價值 223 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 5.8%。他們透過抑制產生疼痛前列腺素的環氧合酶 (COX) 來實現這一點。這些藥物的需求上升主要是由於慢性疼痛疾病的盛行率不斷上升,包括關節炎、肌肉骨骼疾病和背痛,這些疾病都需要持續治療。隨著全球人口不斷老化,對非類固醇抗發炎藥的需求變得更加明顯。老年人更容易患炎症,這種人口結構的變化預計將進一步推動市場成長。

近年來,市場日益青睞那些既有效又不傷胃的藥物。選擇性 COX-2 抑制劑預計將成為 NSAID 市場中成長最快的領域,到 2034 年的複合年成長率預計為 5.9%。這使得選擇性 COX-2 抑制劑成為長期疼痛管理的首選,尤其是對於患有骨關節炎和類風濕性關節炎等慢性疾病的患者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 223億美元 |

| 預測值 | 392億美元 |

| 複合年成長率 | 5.8% |

從給藥途徑來看,口服藥物佔據最大的市場佔有率,到 2024 年將達到 58.2%。它們為患者和醫療保健提供者提供了便利,特別是在用於需要每日服藥的情況時。

預計到 2034 年,美國 NSAID 市場規模將達到 143 億美元。因此,美國將在全球 NSAID 市場擴張中發揮關鍵作用。隨著對有效抗發炎治療的需求不斷增加,這將為藥物配方的進一步創新打開大門。

總之,受人口結構變化、慢性疼痛盛行率上升以及藥物開發技術進步等因素的推動,NSAID 市場將實現穩定、持續的成長。無論是透過新配方還是改進的給藥方法,NSAID 治療的創新機會將繼續塑造市場的未來。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性疼痛和發炎性疾病盛行率上升

- 藥物輸送系統的技術進步

- 對非處方非類固醇抗發炎藥的認知度和可及性

- 產業陷阱與挑戰

- 副作用和安全問題

- 嚴格的監管環境

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 選擇性 COX-2 抑制劑

- 非選擇性 COX 抑制劑

第 6 章:市場估計與預測:按管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 腸外

- 主題

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 關節炎

- 偏頭痛

- 眼科疾病

- 其他應用

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abbott Laboratories

- Bayer AG

- Cipla

- Dr. Reddy's Laboratories

- Glenmark Pharmaceuticals

- Hikma Pharmaceuticals

- Johnson & Johnson

- Lupin

- Novartis

- Pfizer

- Sun Pharmaceutical Industries

- Teva Pharmaceuticals

- Torrent Pharmaceuticals

- Viatris

- Zydus Healthcare

The Global Non-Steroidal Anti-Inflammatory Drugs Market was valued at USD 22.3 billion in 2024, with expectations to expand at a robust CAGR of 5.8% from 2025 to 2034. NSAIDs are widely recognized for their effectiveness in reducing inflammation, alleviating pain, and controlling fever. They achieve this by inhibiting cyclooxygenase (COX) enzymes that produce pain-causing prostaglandins. The rise in demand for these drugs is largely driven by the increasing prevalence of chronic pain conditions, including arthritis, musculoskeletal disorders, and back pain, all of which require ongoing management. As the global population continues to age, the need for NSAIDs becomes even more significant. Older adults are more susceptible to inflammatory conditions, and this demographic shift is expected to further fuel market growth.

In recent years, the market has seen an increasing shift toward drugs that are both effective and easier on the stomach. Selective COX-2 inhibitors are predicted to be the fastest-growing segment within the NSAID market, with a projected CAGR of 5.9% through 2034. These drugs target the COX-2 enzyme, which is primarily responsible for inflammation and pain while minimizing the gastrointestinal issues commonly seen with non-selective COX inhibitors. This makes selective COX-2 inhibitors a preferred choice for long-term pain management, especially in patients suffering from chronic conditions such as osteoarthritis and rheumatoid arthritis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.3 Billion |

| Forecast Value | $39.2 Billion |

| CAGR | 5.8% |

Looking at the route of administration, the oral segment holds the largest market share, capturing 58.2% in 2024. Oral NSAIDs are favored for their ease of use, cost-effectiveness, and wide availability, making them the go-to solution for managing both acute and chronic pain. They offer convenience for patients and healthcare providers, particularly when used for conditions that require daily medication.

The U.S. market for NSAIDs is expected to reach USD 14.3 billion by 2034. This growth is driven by the aging population, which is rapidly increasing and creating a growing demand for treatments for age-related inflammatory diseases. As a result, the U.S. is set to play a pivotal role in the expansion of the global NSAID market. As the need for effective anti-inflammatory treatments continues to rise, this will open doors for further innovations in drug formulations.

In conclusion, the NSAID market is set for steady and sustained growth, fueled by a combination of demographic shifts, the increasing prevalence of chronic pain, and technological advancements in drug development. Whether through new formulations or improved delivery methods, opportunities for innovation in NSAID treatments will continue to shape the market's future.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic pain and inflammatory diseases

- 3.2.1.2 Technological advancement in drug delivery systems

- 3.2.1.3 Awareness and accessibility of OTC NSAIDs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Selective COX-2 inhibitors

- 5.3 Non-selective COX inhibitors

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Topical

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Arthritis

- 7.3 Migraine

- 7.4 Ophthalmic diseases

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Bayer AG

- 10.3 Cipla

- 10.4 Dr. Reddy’s Laboratories

- 10.5 Glenmark Pharmaceuticals

- 10.6 Hikma Pharmaceuticals

- 10.7 Johnson & Johnson

- 10.8 Lupin

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sun Pharmaceutical Industries

- 10.12 Teva Pharmaceuticals

- 10.13 Torrent Pharmaceuticals

- 10.14 Viatris

- 10.15 Zydus Healthcare