|

市場調查報告書

商品編碼

1684652

醫療鞋類市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Medical Footwear Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

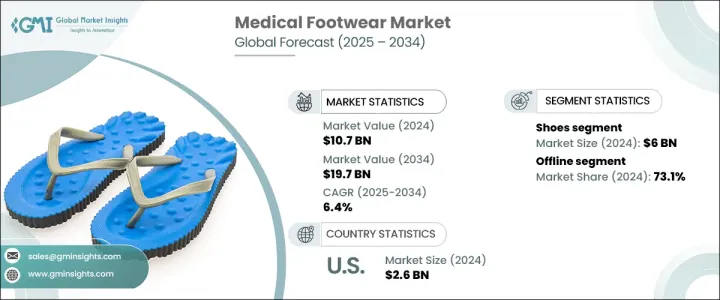

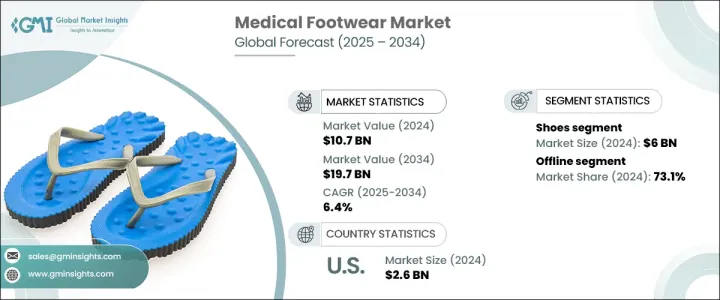

2024 年全球醫用鞋類市場價值 107 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 6.4%。隨著越來越多的人尋求緩解痛苦的足部疾病,醫用鞋已成為他們日常生活中必不可少的一部分。技術進步也促進了市場擴張,3D 列印、智慧鞋墊和環保材料等創新改善了醫用鞋的設計和功能。

這些技術突破不僅提高了鞋子的舒適性和耐用性,也滿足了消費者對永續和高性能產品日益成長的需求。此外,電子商務平台的興起使得醫用鞋類更容易取得,消費者能夠在網路上購買滿足他們特定需求的產品。人們對足部健康和預防保健重要性的認知不斷提高,進一步推動了市場的發展,特別是隨著越來越多的人尋求能夠提供額外支撐和保護以避免慢性疾病的鞋類。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 107億美元 |

| 預測值 | 197億美元 |

| 複合年成長率 | 6.4% |

醫用鞋類市場分為不同的產品類型,包括鞋子、涼鞋和其他鞋類。僅鞋類市場在 2024 年的價值就達到 60 億美元。隨著足部健康成為整體健康中越來越重要的一個方面,消費者越來越傾向於選擇具有最佳緩衝、足弓支撐和保護功能的鞋子。人們對預防和舒適性的日益重視進一步增加了對專門設計用於緩解疼痛和支持足部健康的鞋子的需求。

在分銷管道方面,醫用鞋類市場分為線上和線下銷售。 2024年,線下市場佔據73.1%的主導市場。實體零售店在醫用鞋類領域繼續蓬勃發展,因為它們提供個人化的購物體驗,讓顧客試穿鞋子以確保合腳和舒適——這是購買醫用鞋類的關鍵因素。許多實體店也僱用知識淵博的員工,他們可以指導顧客完成選擇過程,確保他們找到適合其特定足部問題的產品。這種親力親為的方法可以建立信任並鼓勵重複業務,使離線通路成為市場上強大的參與者。

美國醫用鞋類市場也正在經歷顯著成長,到 2024 年價值將達到 26 億美元。此外,美國老齡化人口更容易出現足部問題,這進一步促進了市場成長。隨著越來越多的人尋求鞋子的舒適性和醫療支持,美國仍然是這個快速擴張的市場的主要參與者。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 足部疾病盛行率上升

- 老齡人口不斷增加

- 鞋類設計的技術進步

- 產業陷阱與挑戰

- 醫用鞋成本高

- 發展中地區缺乏意識

- 成長動力

- 成長潛力分析

- 原料分析

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 偏好價格範圍

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 鞋

- 涼鞋

- 其他

第 6 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 男性

- 女性

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 糖尿病鞋

- 關節炎鞋

- 拇趾外翻鞋

- 平腳鞋

- 其他

第 8 章:市場估計與預測:按價格,2021 年至 2034 年

- 主要趨勢

- 少於 50 美元

- 50-100 美元

- 100 美元以上

第 9 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 離線

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 馬來西亞

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aetrex Worldwide, Inc.

- Clearwell Mobility Ltd

- DARCO International, Inc.

- Duna Srl

- Dr. Comfort

- Dr. Foot Inc.

- Drewshoe, Incorporated

- Foot Shop Limited

- Gravity Defyer Corp.

- Horng Shin Footwear Co.

- Kinetec Medical Products Ltd

- Mephisto

- New Balance

- Orthofeet Inc.

- Watts Footwear

The Global Medical Footwear Market was valued at USD 10.7 billion in 2024, with projections to grow at a robust CAGR of 6.4% from 2025 to 2034. The market growth can be attributed to the rising incidence of foot-related conditions such as plantar fasciitis, bunions, and diabetic foot ulcers, which are driving a surge in demand for specialized footwear. As more individuals seek relief from painful foot ailments, medical footwear has become an essential part of their daily lives. Technological advancements are also contributing to market expansion, with innovations like 3D printing, smart insoles, and eco-friendly materials improving the design and functionality of medical footwear.

These technological breakthroughs not only increase the comfort and durability of shoes but also cater to the growing consumer demand for sustainable and high-performance products. Additionally, the rise of e-commerce platforms has made medical footwear more accessible, giving consumers the ability to shop online for products that meet their specific needs. The growing awareness of foot health and the importance of preventative care is further driving the market, particularly as more people look for footwear that offers added support and protection to avoid chronic conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.7 Billion |

| Forecast Value | $19.7 Billion |

| CAGR | 6.4% |

The medical footwear market is segmented into different product types, including shoes, sandals, and other footwear. The shoes segment alone was valued at USD 6 billion in 2024. This segment is particularly benefiting from the increasing prevalence of chronic health conditions such as diabetes and arthritis, which often result in foot complications. With foot health becoming an increasingly important aspect of overall well-being, consumers are gravitating toward shoes that offer optimal cushioning, arch support, and protection. The growing emphasis on prevention and comfort has further amplified demand for shoes specifically designed to alleviate pain and support foot health.

When it comes to distribution channels, the medical footwear market is split between online and offline sales. In 2024, the offline segment held a dominant 73.1% market share. Physical retail stores continue to thrive in the medical footwear sector because they offer a personalized shopping experience, allowing customers to try on shoes for proper fit and comfort-a crucial factor when purchasing medical footwear. Many brick-and-mortar stores also employ knowledgeable staff who can guide customers through the selection process, ensuring they find the right product for their specific foot issues. This hands-on approach builds trust and encourages repeat business, making the offline channel a strong player in the market.

The U.S. medical footwear market is also experiencing significant growth, valued at USD 2.6 billion in 2024. The prevalence of chronic diseases such as diabetes and obesity, which contribute to foot problems, has fueled the demand for specialized footwear. Additionally, the aging U.S. population is more prone to foot issues, further boosting market growth. With an increasing number of individuals seeking comfort and medical support in their footwear, the U.S. remains a key player in this rapidly expanding market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising prevalence of foot-related disorders

- 3.6.1.2 Growing aging population

- 3.6.1.3 Technological advancements in footwear design

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of medical footwear

- 3.6.2.2 Lack of awareness in developing regions

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Raw material analysis

- 3.9 Consumer buying behavior analysis

- 3.9.1 Demographic trends

- 3.9.2 Factors affecting buying decision

- 3.9.3 Consumer product adoption

- 3.9.4 Preferred distribution channel

- 3.9.5 Preferred price range

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Shoes

- 5.3 Sandals

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Men

- 6.3 Women

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Diabetic shoes

- 7.3 Arthritis shoes

- 7.4 Bunions & hallux valgus shoes

- 7.5 Flat feet shoes

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Price, 2021-2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Less than 50 USD

- 8.3 50-100 USD

- 8.4 Above 100 USD

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Malaysia

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aetrex Worldwide, Inc.

- 11.2 Clearwell Mobility Ltd

- 11.3 DARCO International, Inc.

- 11.4 Duna Srl

- 11.5 Dr. Comfort

- 11.6 Dr. Foot Inc.

- 11.7 Drewshoe, Incorporated

- 11.8 Foot Shop Limited

- 11.9 Gravity Defyer Corp.

- 11.10 Horng Shin Footwear Co.

- 11.11 Kinetec Medical Products Ltd

- 11.12 Mephisto

- 11.13 New Balance

- 11.14 Orthofeet Inc.

- 11.15 Watts Footwear