|

市場調查報告書

商品編碼

1684648

雷達模擬器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Radar Simulators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

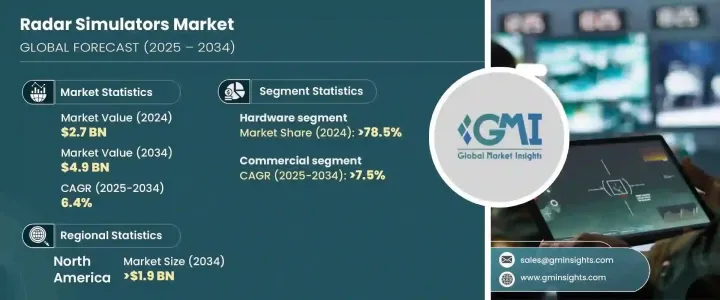

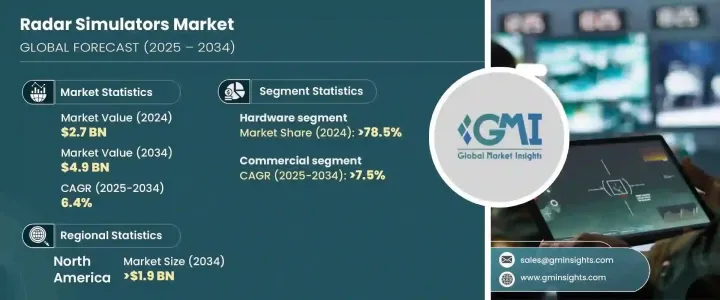

2024 年全球雷達模擬器市場價值為 27 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.4%。隨著世界各國政府和國防組織尋求提高其雷達系統的準確性、效率和操作能力,採用雷達模擬器變得至關重要。這些模擬器可以進行即時虛擬測試,有助於模擬各種操作場景,而沒有與現場試驗相關的風險。除此之外,人工智慧 (AI) 和邊緣運算與雷達系統的整合使這些模擬更加智慧、更有效率,從而提高了整體系統性能。這些領域的技術進步確保了雷達模擬器對於國防戰略和人員培訓計畫的現代化至關重要。

雷達模擬器市場分為硬體和軟體組件,其中硬體部分在 2024 年佔據 78.5% 的主導佔有率。這些創新使得生產更小、更便攜的雷達模擬器成為可能,同時仍能提供高性能。這一趨勢在國防和汽車等領域尤其重要,因為這些領域需要緊湊、移動的系統來確保操作的靈活性和有效性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 6.4% |

根據應用,市場分為商業和軍事及國防領域。到 2034 年,商業領域的複合年成長率預計將達到驚人的 7.5%。隨著車輛的自動化程度不斷提高,自適應巡航控制、自動緊急煞車和車道維持輔助等 ADAS 功能在很大程度上依賴雷達模擬器技術進行測試和驗證。汽車應用領域不斷成長的需求是推動商業領域擴張的重要因素。

北美,尤其是美國,預計將主導雷達模擬器市場,預計到 2034 年市場價值將達到 19 億美元。此外,人工智慧和機器學習的創新正在增強雷達模擬器的功能,特別是在自動駕駛汽車測試和下一代防禦系統等領域。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 自動駕駛技術的需求不斷增加

- 國防和軍事現代化

- 人工智慧與機器學習的融合

- 5G 網路的推出和基於雷達的通訊技術的進步

- 高級駕駛輔助系統 (ADAS) 需求不斷成長

- 產業陷阱與挑戰

- 開發成本高

- 模擬精度的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021-2034 年

- 主要趨勢

- 系統測試

- 固定的

- 便攜的

- 操作員培訓

- 固定的

- 便攜的

第6章:市場估計與預測:依組件,2021-2034 年

- 主要趨勢

- 硬體

- 軟體

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 商業的

- 軍事與國防

- 空降

- 海洋

- 地面

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Acewavetech

- Adacel Technologies

- ARI Simulation

- Buffalo Computer Graphics

- Cambridge Pixel

- L3Harris Technologies

- Mercury Systems

- Mistral Solutions

- RTX

- Textron Systems

- Ultra Intelligence & Communications

The Global Radar Simulators Market was valued at USD 2.7 billion in 2024 and is forecasted to expand at a CAGR of 6.4% from 2025 to 2034. This growth is primarily driven by the escalating demand for advanced defense systems and cutting-edge missile technology. As governments and defense organizations around the world seek to enhance the accuracy, efficiency, and operational capabilities of their radar systems, the adoption of radar simulators has become crucial. These simulators allow for real-time virtual testing, helping to simulate various operational scenarios without the risks associated with live trials. Alongside this, the integration of artificial intelligence (AI) and edge computing into radar systems is making these simulations smarter and more efficient, improving overall system performance. The combination of technological advancements in these areas ensures that radar simulators are essential for modernizing both defense strategies and personnel training programs.

The radar simulators market is segmented into hardware and software components, with the hardware segment holding a dominant share of 78.5% in 2024. This segment is projected to continue growing at a rapid pace, driven by ongoing advancements in semiconductor technology. These innovations enable the production of smaller, more portable radar simulators that still deliver high-performance capabilities. This trend is especially critical in sectors like defense and automotive, where compact, mobile systems are necessary for operational flexibility and effectiveness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 6.4% |

In terms of application, the market is divided into commercial and military & defense segments. The commercial segment is set to grow at an impressive CAGR of 7.5% through 2034. A major driver of this growth is the increasing adoption of radar simulators in the automotive industry, particularly for testing advanced driver-assistance systems (ADAS). As vehicles become more autonomous, ADAS features such as adaptive cruise control, automatic emergency braking, and lane-keeping assistance rely heavily on radar simulator technologies for their testing and validation. This growing demand in automotive applications is a significant factor pushing the commercial segment's expansion.

North America, particularly the United States, is poised to dominate the radar simulators market, with a projected market value of USD 1.9 billion by 2034. The region's rapid adoption of radar simulation technologies in defense, automotive, and telecommunications sectors is a key factor in this growth. Additionally, innovations in AI and machine learning are enhancing radar simulators' capabilities, especially in areas like autonomous vehicle testing and next-generation defense systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for autonomous driving technologies

- 3.6.1.2 Defense and military modernization

- 3.6.1.3 Integration of AI and machine learning

- 3.6.1.4 Rollout of 5G networks and advancements in radar-based communication technologies

- 3.6.1.5 Rising demand for Advanced Driver Assistance Systems (ADAS)

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High development costs

- 3.6.2.2 Complexity in simulation accuracy

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 System testing

- 5.2.1 Fixed

- 5.2.2 Portable

- 5.3 Operator training

- 5.3.1 Fixed

- 5.3.2 Portable

Chapter 6 Market Estimates & Forecast, By Component, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Hardware

- 6.3 Software

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Military & defense

- 7.3.1 Airborne

- 7.3.2 Marine

- 7.3.3 Ground

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acewavetech

- 9.2 Adacel Technologies

- 9.3 ARI Simulation

- 9.4 Buffalo Computer Graphics

- 9.5 Cambridge Pixel

- 9.6 L3Harris Technologies

- 9.7 Mercury Systems

- 9.8 Mistral Solutions

- 9.9 RTX

- 9.10 Textron Systems

- 9.11 Ultra Intelligence & Communications