|

市場調查報告書

商品編碼

1684643

捲菸設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Cigarette Making Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

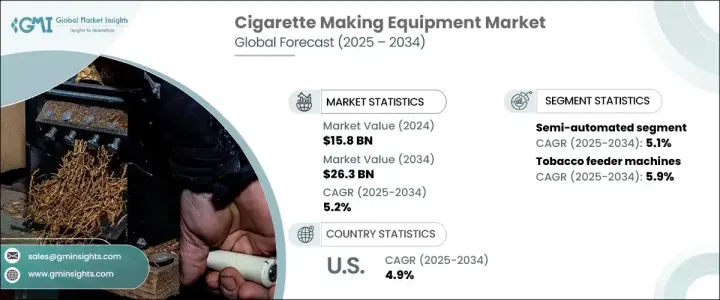

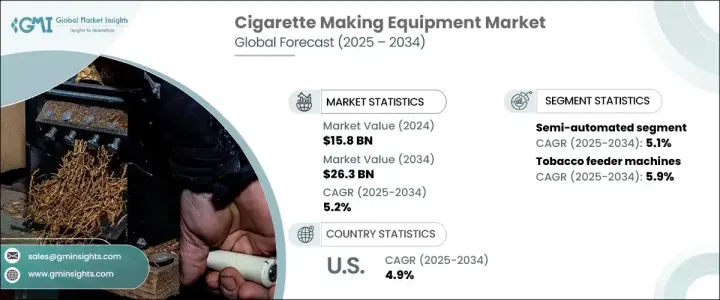

2024 年全球捲菸製造設備市場價值為 158 億美元,預估 2025 年至 2034 年期間複合年成長率為 5.2%。這一成長是由捲菸生產自動化需求的不斷成長所推動的。製造商擴大轉向先進的自動化機械來提高生產效率、降低成本、滿足日益成長的大規模生產需求,同時保持一致的品質。特別是,透過自動化減少體力勞動的趨勢很明顯,這使企業能夠簡化營運並提高整體生產力。這種轉變不僅解決了勞動力短缺的問題,也滿足了消費者對以更具成本效益的方式生產高品質產品的期望。隨著自動化技術日益複雜,製造商正在投資能夠提高產量和精度的設備,進一步推動市場的擴張。

推動這一市場發展的關鍵細分市場之一是菸草送料機,它在 2024 年為市場貢獻了 36 億美元。預計這些機器將繼續呈上升趨勢,到 2034 年預計複合年成長率為 5.9%。菸草送料機對於確保準確、一致地將菸草送入捲菸系統至關重要。它們在提高營運效率、減少材料浪費和維持高產品品質方面發揮著重要作用,使其成為現代香菸生產線中不可或缺的一部分。由於採用模組化設計,這些機器可以輕鬆升級以滿足不斷變化的生產需求,從而進一步推動其應用。儘管它們具有先進的自動化功能,但對於某些任務(例如過濾器的放置和包裝)來說,可能仍需要一些手動或半自動化步驟。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 158億美元 |

| 預測值 | 263億美元 |

| 複合年成長率 | 5.2% |

半自動化領域也佔有相當大的市場佔有率,到 2024 年將佔 45%,預計在 2025 年至 2034 年期間的複合年成長率為 5.1%。半自動化機器因其價格實惠和靈活性而特別受到新興市場的中小型製造商的青睞。這些機器在成本效益和自動化之間取得了平衡,可以執行菸草進料、紙張切割和煙桿形成等核心任務,同時允許在某些區域進行人工干預。它們的模組化使企業能夠根據需要擴展營運規模,而無需預先實現全面自動化。

2024 年,美國捲菸製造設備市場價值為 19 億美元,預計 2025 年至 2034 年的複合年成長率為 4.9%。這一成長主要歸功於該國注重採用先進的自動化技術和精密工程。美國擁有多家以創新方式和高品質標準而聞名的領先製造商,它們不僅滿足國內需求,也迎合全球市場。這些製造商致力於維持高監管標準,進一步推動美國市場的成長

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高生產流程的自動化程度。

- 對自產香菸和客製化香菸的需求不斷增加。

- 新興市場的擴張。

- 採用永續的生產實踐。

- 產業陷阱與挑戰

- 政府對菸草產品的嚴格管制。

- 由於健康意識增強,已開發地區香菸消費量下降

- 成長動力

- 科技與創新格局

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- 菸草進料機

- 香菸包裝機

- 初級包裝機(包裝、密封)

- 二次包裝機(裝箱、捆紮)

- 棒材成型機

- 香煙過濾嘴製造機

- 切割機

- 調味和混合機械

- 物料搬運設備

- 其他(滾壓機、硫化機等)

第6章:市場估計與預測:按自動化水平,2021 – 2034 年

- 主要趨勢

- 手動的

- 半自動化

- 全自動

第 7 章:市場估計與預測:按產能,2021 年至 2034 年

- 主要趨勢

- 低速機器(低於 4000 支/分鐘)

- 中速機(4000-8000支/分鐘)

- 高速機(8000支/分鐘以上)

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 煙草製造商

- 小規模生產者

- 合約製造商

- 其他

第 9 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接的

- 間接

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- CBK

- Cipta Bena Kencana

- Decouflé

- Dynamic Tools Pvt Ltd.

- Focke & Co.

- GD SpA

- Hauni Maschinenbau GmbH

- HK UPPERBOND INDUSTRIAL LIMITED

- ITM Group

- Körber Technologies

- Makepak International

- Molins

- Orchid Tobacco Machinery

- Sasib SpA

- Tianjin Pioneering Machinery

The Global Cigarette Making Equipment Market was valued at USD 15.8 billion in 2024, with projections indicating a steady growth at a CAGR of 5.2% from 2025 to 2034. This growth is driven by the rising demand for automation within cigarette production. Manufacturers are increasingly turning to advanced automated machinery to enhance production efficiency, minimize costs, and meet the increasing demand for large-scale production while upholding consistent quality. In particular, there is a noticeable trend toward reducing manual labor through automation, which allows businesses to streamline operations and improve overall productivity. This shift not only addresses labor shortages but also responds to consumer expectations for high-quality products produced more cost-effectively. As automation technologies become more sophisticated, manufacturers are investing in equipment that can increase output and precision, further fueling the market's expansion.

One of the key segments driving this market is the tobacco feeder machines, which contributed USD 3.6 billion to the market in 2024. These machines are expected to continue their upward trajectory, with a forecasted CAGR of 5.9% through 2034. Tobacco feeder machines are integral to ensuring the accurate and consistent feeding of tobacco into rolling systems. Their role in enhancing operational efficiency, reducing material waste, and maintaining high product quality has made them essential in modern cigarette production lines. With their modular design, these machines can be easily upgraded to meet evolving production demands, further driving their adoption. Despite their advanced automation capabilities, some manual or semi-automated steps may still be necessary for certain tasks, such as filter placement and packaging.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $15.8 Billion |

| Forecast Value | $26.3 Billion |

| CAGR | 5.2% |

The semi-automated segment also holds a significant market share, accounting for 45% in 2024, and is set to grow at a CAGR of 5.1% between 2025 and 2034. Semi-automated machines are particularly favored by small- and medium-scale manufacturers in emerging markets due to their affordability and flexibility. These machines offer a balance between cost-effectiveness and automation, performing core tasks like tobacco feeding, paper cutting, and rod formation while allowing for manual intervention in certain areas. Their modularity enables businesses to scale operations as needed without committing to full automation upfront.

The U.S. cigarette-making equipment market generated USD 1.9 billion in 2024, and it is projected to grow at a CAGR of 4.9% from 2025 to 2034. This growth is largely attributed to the country's focus on adopting advanced automation technologies and precision engineering. The U.S. is home to several leading manufacturers known for their innovative approaches and high-quality standards, which not only serve domestic needs but also cater to global markets. These manufacturers are committed to maintaining high regulatory standards, further propelling the growth of the market within the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing automation in production processes.

- 3.6.1.2 Rising demand for RYO and customizable cigarettes.

- 3.6.1.3 Expansion in emerging markets.

- 3.6.1.4 Adoption of sustainable manufacturing practices.

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent government regulations on tobacco products.

- 3.6.2.2 Declining cigarette consumption in developed regions due to health awareness

- 3.6.1 Growth drivers

- 3.7 Technological & innovation landscape

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Thousand units)

- 5.1 Key trends

- 5.2 Tobacco feeder machines

- 5.3 Cigarette packaging machines

- 5.3.1 Primary packaging machines (Wrapping, Sealing)

- 5.3.2 Secondary packaging machines(Cartooning, Bundling)

- 5.4 Rod forming machinery

- 5.5 Cigarette filter making machines

- 5.6 Cutting machines

- 5.7 Flavoring & blending machinery

- 5.8 Material handling equipment

- 5.9 Others (rolling machines, curing machines, etc.)

Chapter 6 Market Estimates and Forecast, By Automation level, 2021 – 2034 (USD Billion) (Thousand units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-Automated

- 6.4 Fully automated

Chapter 7 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Thousand units)

- 7.1 Key trends

- 7.2 Low-speed machines (under 4000 cigarettes/min)

- 7.3 Medium-speed machines (4000-8000 cigarettes/min)

- 7.4 High-speed machines (above 8000 cigarettes/min)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 (USD Billion) (Thousand units)

- 8.1 Key trends

- 8.2 Tobacco manufacturers

- 8.3 Small-Scale producers

- 8.4 Contract manufacturers

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Thousand units)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Thousand units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 CBK

- 11.2 Cipta Bena Kencana

- 11.3 Decouflé

- 11.4 Dynamic Tools Pvt Ltd.

- 11.5 Focke & Co.

- 11.6 G.D S.p.A.

- 11.7 Hauni Maschinenbau GmbH

- 11.8 HK UPPERBOND INDUSTRIAL LIMITED

- 11.9 ITM Group

- 11.10 Körber Technologies

- 11.11 Makepak International

- 11.12 Molins

- 11.13 Orchid Tobacco Machinery

- 11.14 Sasib S.p.A.

- 11.15 Tianjin Pioneering Machinery