|

市場調查報告書

商品編碼

1684641

零食加工機械市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Snacks Processing Machinery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

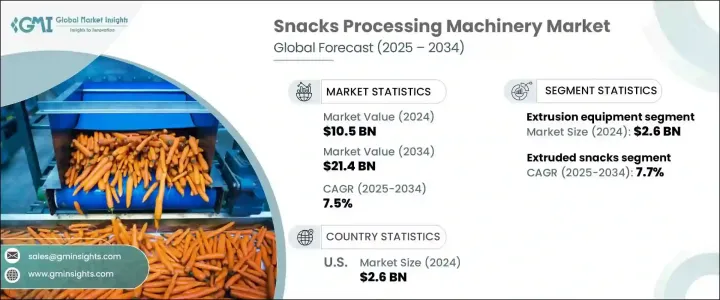

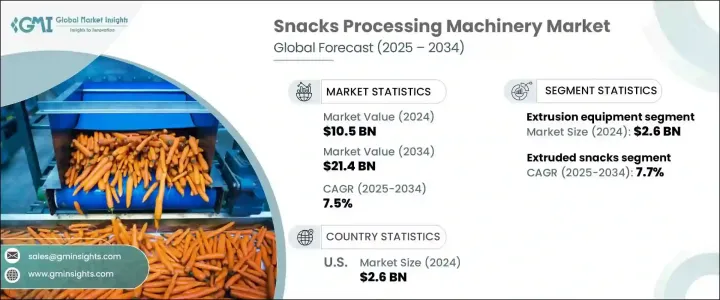

2024 年全球零食加工機械市場價值為 105 億美元,預計 2025 年至 2034 年期間將以 7.5% 的強勁複合年成長率成長。消費者擴大尋求符合現代生活方式偏好的產品,例如無麩質、植物性和低熱量的產品。為了應對這一變化,製造商開發了先進的機械,以提高靈活性、效率和客製化水平,從而能夠滿足不斷變化的市場趨勢。此外,自 21 世紀初以來,食品加工技術的創新和包裝零食的日益普及進一步促進了市場的發展。已開發經濟體和新興經濟體的城市化進程加快、可支配收入提高和飲食習慣的不斷變化,加速了對創新零食解決方案的需求,推動製造商投資最先進的加工設備。

擠壓設備在 2024 年成為領先的產品類型,創造了 26 億美元的收入,預計在 2025 年至 2034 年期間的複合年成長率為 6.9%。 這一領域的主導地位歸功於擠壓機的多功能性和效率,這對於生產各種各樣的零食產品至關重要。擠壓機械擅長對原料進行成型、烹飪和紋理處理,使其成為製作膨化零食、穀物棒和植物性蛋白質製品的首選。它的適應性支持生產符合消費者對更健康、創新選擇的需求的零食,包括無麩質和高蛋白替代品。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 105億美元 |

| 預測值 | 214億美元 |

| 複合年成長率 | 7.5% |

擠壓式零食在 2024 年佔據了應用領域的 30% 佔有率,預計到 2034 年將以 7.7% 的複合年成長率成長。從傳統的膨化零食到尖端的植物產品,擠壓零食正在重新定義市場。該技術還能整合各種成分、風味和形狀,使製造商在提供能同時滿足傳統和現代消費者需求的產品方面具有競爭優勢。人們對健康和保健的日益關注,加上擠壓支持持續創新的能力,使這一領域成為市場發展的基石。

美國零食加工機械市場規模在 2024 年將達到 26 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長。美國仍然處於零食創新的前沿,利用技術進步開發出滿足零食產業不斷變化的需求的高效機械。這些進步不僅提高了生產效率,而且還支持創造吸引全球觀眾的新的、令人興奮的零食選擇。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測參數

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 技術格局

- 衝擊力

- 成長動力

- 包裝零食需求不斷增加

- 技術創新

- 拓展新興市場

- 產業陷阱與挑戰

- 高資本投入

- 監理與合規挑戰

- 成長動力

- 消費者購買行為分析

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 偏好價格範圍

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備類型,2021 年至 2034 年

- 主要趨勢

- 烘焙設備

- 塗裝設備

- 擠壓設備

- 成型設備

- 油炸和烘烤設備

- 攪拌設備

- 包裝設備

- 其他(調味設備等)

第6章:市場估計與預測:按產能,2021 – 2034 年

- 主要趨勢

- 產量低(最高 100 公斤/小時)

- 中等產能(100 - 500 公斤/小時)

- 高產量(500 公斤/小時以上)

第 7 章:市場估計與預測:按自動化水平,2021 年至 2034 年

- 主要趨勢

- 自動的

- 半自動

- 手動的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 擠壓零食

- 薯片和薯片

- 堅果和種子

- 爆米花

- 鹹味和甜味小吃

- 其他(健康小吃和酒吧等)

第 9 章:市場估計與預測:按最終用途產業規模,2021 年至 2034 年

- 主要趨勢

- 中小企業

- 大型企業

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直接銷售

- 間接銷售

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- AC Horn Manufacturing

- Baker Perkins

- Bettcher Industries

- Brambati SpA

- Egan Food Technologies

- Grace Food Processing & Packaging Machinery

- Heat and Control

- Hobart Food Equipment

- Interfood Technology Ltd

- JBT FoodTech

- Lyco Manufacturing

- Marchant Schmidt, Inc.

- Marel

- Marlen International

- Provisur Technologies Inc

- Rademaker BV

- Reiser

- Urschel

The Global Snacks Processing Machinery Market was valued at USD 10.5 billion in 2024 and is projected to expand at a robust CAGR of 7.5% between 2025 and 2034. This significant growth is fueled by the dynamic expansion of the food and beverage industry, driven by rising demand for snacks that are not only convenient but also healthier and more diverse. Consumers increasingly seek products that align with modern lifestyle preferences, such as gluten-free, plant-based, and low-calorie options. Manufacturers are responding by developing advanced machinery designed for greater flexibility, efficiency, and customization, enabling them to cater to these shifting market trends. Additionally, innovations in food processing technologies and the rising popularity of packaged snacks since the early 2000s have further bolstered the market. Increasing urbanization, higher disposable incomes, and evolving dietary habits in both developed and emerging economies are accelerating the demand for innovative snack solutions, driving manufacturers to invest in state-of-the-art processing equipment.

Extrusion equipment emerged as the leading product type in 2024, generating USD 2.6 billion in revenue, and is projected to grow at a CAGR of 6.9% between 2025 and 2034. This segment's dominance is attributed to the versatility and efficiency of extruders, which are critical in producing a wide variety of snack products. Extrusion machinery excels at shaping, cooking, and texturing ingredients, making it a preferred choice for creating puffed snacks, cereal bars, and plant-based protein items. Its adaptability supports the production of snacks that align with consumer demands for healthier, innovative options, including gluten-free and high-protein alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.5 Billion |

| Forecast Value | $21.4 Billion |

| CAGR | 7.5% |

Extruded snacks commanded a 30% share of the application segment in 2024 and are expected to grow at a CAGR of 7.7% through 2034. Their popularity is tied to the unique benefits of extrusion technology, which allows manufacturers to create diverse, health-conscious snack offerings. From traditional puffed snacks to cutting-edge plant-based products, extruded snacks are redefining the market. This technology also enables the integration of various ingredients, flavors, and shapes, giving manufacturers a competitive edge in delivering products that resonate with both traditional and modern consumers. The growing focus on health and wellness, coupled with the ability of extrusion to support continuous innovation, makes this segment a cornerstone of the market's evolution.

The U.S. snacks processing machinery market reached USD 2.6 billion in 2024 and is forecasted to grow at a CAGR of 6.8% through 2034. This growth is propelled by the nation's leadership in snack innovation, strong domestic and international demand, and ongoing investment in advanced processing technologies. The U.S. remains at the forefront of snack food innovation, leveraging technological advancements to develop highly efficient machinery that meets the evolving needs of the snack industry. These advancements not only enhance production efficiency but also support the creation of new, exciting snack options that appeal to a global audience.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.5 Secondary

- 1.5.1.1 Paid sources

- 1.5.1.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for packaged snacks

- 3.7.1.2 Technological innovations

- 3.7.1.3 Expanding emerging markets

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High capital investment

- 3.7.2.2 Regulatory and compliance challenges

- 3.7.1 Growth drivers

- 3.8 Consumer buying behavior analysis

- 3.8.1 Demographic trends

- 3.8.2 Factors affecting buying decision

- 3.8.3 Consumer product adoption

- 3.8.4 Preferred distribution channel

- 3.8.5 Preferred price range

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 – 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Baking equipment

- 5.3 Coating equipment

- 5.4 Extrusion equipment

- 5.5 Forming equipment

- 5.6 Frier and Roaster equipment

- 5.7 Mixing equipment

- 5.8 Packaging equipment

- 5.9 Others (Seasoning Equipment, etc.)

Chapter 6 Market Estimates and Forecast, By Capacity, 2021 – 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Low capacity (Upto 100 Kg/hr)

- 6.3 Mid capacity (100 - 500 Kg/hr)

- 6.4 High capacity (Above 500 Kg/hr)

Chapter 7 Market Estimates and Forecast, By Automation Level, 2021 – 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Automatic

- 7.3 Semi-automatic

- 7.4 Manual

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Extruded snacks

- 8.3 Chips and crisps

- 8.4 Nuts and seeds

- 8.5 Popcorn

- 8.6 Savory & Sweet snacks

- 8.7 Others (Healthy Snacks & Bar, etc.)

Chapter 9 Market Estimates and Forecast, By End Use Industry Size, 2021 – 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Small and Medium enterprises

- 9.3 Large enterprises

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021 – 2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 A.C. Horn Manufacturing

- 12.2 Baker Perkins

- 12.3 Bettcher Industries

- 12.4 Brambati SpA

- 12.5 Egan Food Technologies

- 12.6 Grace Food Processing & Packaging Machinery

- 12.7 Heat and Control

- 12.8 Hobart Food Equipment

- 12.9 Interfood Technology Ltd

- 12.10 JBT FoodTech

- 12.11 Lyco Manufacturing

- 12.12 Marchant Schmidt, Inc.

- 12.13 Marel

- 12.14 Marlen International

- 12.15 Provisur Technologies Inc

- 12.16 Rademaker BV

- 12.17 Reiser

- 12.18 Urschel