|

市場調查報告書

商品編碼

1684586

醫療保健包裝市場機會、成長動力、行業趨勢分析和 2025 - 2034 年預測Healthcare Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

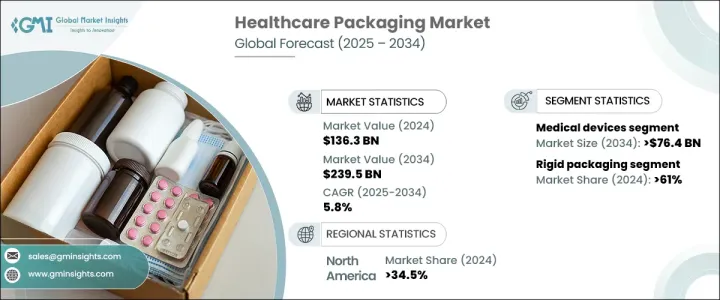

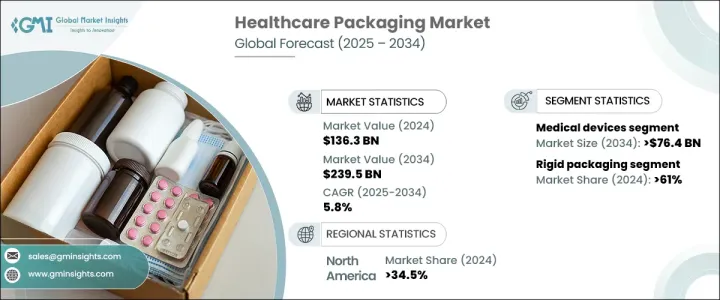

2024 年全球醫療保健包裝市場價值為 1,363 億美元,預計 2025 年至 2034 年期間的複合年成長率將穩定達到 5.8%。該市場主要受對創新、安全和永續包裝解決方案日益成長的需求所推動。近年來,醫療保健產業一直採用先進的包裝技術來滿足生物製劑和特殊藥物的特定需求。此外,發展中地區的醫療保健服務正在改善,推動對有效和高效包裝的需求增加。

此外,醫藥電子商務的興起為支援安全運輸和儲存的包裝解決方案提供了新的機會。智慧包裝的整合透過確保準確的劑量和提供即時資訊進一步提高了患者的依從性。這一趨勢也正在最佳化供應鏈效率、降低成本並提高產品可追溯性。隨著醫療保健產業的不斷發展,包裝市場將在確保藥品和醫療產品的安全和品質方面發揮關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1363億美元 |

| 預測值 | 2395億美元 |

| 複合年成長率 | 5.8% |

醫療保健包裝市場分為兩個主要部分:硬包裝和軟包裝。硬質包裝佔據最大的市場佔有率,到 2024 年將達到 61%。這一領域的主導地位很大程度上歸功於其保護產品和維護敏感醫療產品完整性的能力。硬質包裝通常採用聚丙烯和聚碳酸酯等高性能材料,這對於滿足嚴格的醫療保健合規性規定至關重要。隨著成型技術的不斷進步,製造商能夠生產出輕質而耐用的容器,有助於降低運輸成本,同時保持必要的強度和保護。材料和設計的不斷發展使硬質包裝仍然成為許多醫療保健應用的首選。

在檢查最終用戶應用時,醫療保健包裝市場分為藥品和醫療設備。預計醫療器材領域將經歷最高的成長率,預計複合年成長率為 6.5%。受醫療器材技術創新以及對無菌、耐用和方便用戶使用型包裝解決方案日益成長的需求的推動,預計到 2034 年該領域的市場規模將達到 764 億美元。醫療器械包裝必須滿足從診斷工具、手術器械到植入物等各種產品的無菌性、耐用性和可用性的嚴格要求。隨著越來越多先進的醫療設備進入市場,包裝解決方案也需要相應發展,以確保最大程度的安全性和功能性。

在北美,醫療保健包裝市場預計將保持主導地位,到 2024 年將佔據 34.5% 的市場佔有率。受醫療產品技術進步和對病人安全的日益重視推動,美國醫療保健領域對先進包裝解決方案的需求顯著增加。防篡改和兒童安全包裝等創新技術對藥品和非處方產品的需求很高。家庭醫療保健的興起也推動了對更方便、方便用戶使用的包裝形式的需求,例如預充式注射器和泡殼包裝。這些發展反映了整個醫療保健產業朝著更有效率、更有效的包裝解決方案發展的更廣泛趨勢。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 中斷

- 未來展望

- 製造商

- 經銷商

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 可回收和永續醫療包裝的創新

- 家庭醫療保健和自我管理趨勢不斷擴大

- 提高對病人安全和合規包裝的認知

- 生物製劑和生物相似藥的成長需要先進的包裝解決方案

- 慢性病發病率上升推動對專業包裝解決方案的需求

- 產業陷阱與挑戰

- 開發新興生物療法包裝的挑戰

- 醫療包裝法規的地區差異

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 塑膠

- 紙和紙板

- 金屬

- 玻璃

第 6 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 硬包裝

- 瓶子

- 盒子和紙箱

- 托盤

- 預填充吸入器

- 預灌封注射器

- 小瓶和安瓿瓶

- 罐子和罐子

- 其他

- 軟包裝

- 包包和小袋

- 管

- 薄膜和層壓板

- 其他

第 7 章:市場估計與預測:依封裝類型,2021-2034 年

- 主要趨勢

- 初級包裝

- 二次包裝

- 三級包裝

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 藥品

- 口服藥物

- 注射劑

- 外用藥物

- 鼻腔用藥

- 其他

- 醫療設備

- 免洗耗材

- 治療設備

- 監測和診斷設備

- 其他

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- 3M

- Adelphi Group

- Amcor

- Aptar CSP Technologies

- Berry Global

- CCL Industries

- Constantia Flexibles

- DS Smith

- DuPont

- Eastman Chemical

- Gerresheimer

- Graphic Packaging

- Huhtamaki

- Mayr-Melnhof Karton

- Nelipak

- Oliver Healthcare

- Printpack

- ProAmpac

- Schott Pharma

- Sealed Air

- SGD Pharma

- Solventum

- Sonoco Products

- West Pharmaceutical

- WestRock

The Global Healthcare Packaging Market was valued at USD 136.3 billion in 2024, with projections indicating a steady growth rate of 5.8% CAGR from 2025 to 2034. This market is primarily fueled by the growing need for innovative, secure, and sustainable packaging solutions. In recent years, the healthcare industry has been embracing advanced packaging technologies to meet the specific needs of biologics and specialty drugs. Alongside this, access to healthcare in developing regions is improving, driving an increase in demand for effective and efficient packaging.

Additionally, the rise of pharmaceutical e-commerce is providing new opportunities for packaging solutions that support safe transportation and storage. The integration of smart packaging is further enhancing patient compliance by ensuring accurate dosing and providing real-time information. This trend is also optimizing supply chain efficiency, reducing costs, and improving product traceability. As the healthcare sector continues to evolve, the packaging market will play a critical role in ensuring the safety and quality of pharmaceutical and medical products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $136.3 Billion |

| Forecast Value | $239.5 Billion |

| CAGR | 5.8% |

The healthcare packaging market is divided into two main segments: rigid and flexible packaging. Rigid packaging accounts for the largest market share, holding 61% in 2024. The dominance of this segment is largely due to its ability to protect products and maintain the integrity of sensitive healthcare products. Rigid packaging often employs high-performance materials like polypropylene and polycarbonate, essential for meeting stringent healthcare compliance regulations. With ongoing advancements in molding technologies, manufacturers are able to produce lightweight yet durable containers, helping reduce transportation costs while maintaining the necessary strength and protection. This continued evolution in materials and design is helping rigid packaging remain the preferred choice for many healthcare applications.

When examining end-user applications, the healthcare packaging market is categorized into pharmaceuticals and medical devices. The medical devices segment is expected to experience the highest growth rate, with a projected CAGR of 6.5%. This segment is expected to reach USD 76.4 billion by 2034, driven by innovations in medical device technology and the increasing demand for sterile, durable, and user-friendly packaging solutions. Medical device packaging must meet the demanding requirements of sterility, durability, and usability for a wide array of products, from diagnostic tools and surgical instruments to implants. As more advanced medical devices enter the market, the packaging solutions will need to evolve accordingly to ensure maximum safety and functionality.

In North America, the healthcare packaging market is expected to maintain its dominance, accounting for 34.5% of the market share in 2024. The U.S. is experiencing a significant increase in the demand for advanced packaging solutions within the healthcare sector, driven by technological advancements in medical products and a growing emphasis on patient safety. Innovations like tamper-evident and child-resistant packaging are seeing high demand for both pharmaceutical and over-the-counter products. The rise of home healthcare is also fueling the need for more convenient, user-friendly packaging formats, such as prefilled syringes and blister packs. These developments reflect a broader trend toward more efficient and effective packaging solutions across the healthcare industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Disruptions

- 3.1.3 Future outlook

- 3.1.4 Manufacturers

- 3.1.5 Distributors

- 3.2 Profit margin analysis

- 3.3 Key news & initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Innovation in recyclable and sustainable medical packaging

- 3.5.1.2 Expanding home healthcare and self-administration trends

- 3.5.1.3 Rising awareness about patient safety and compliance packaging

- 3.5.1.4 Growth in biologics and biosimilars requiring advanced packaging solutions

- 3.5.1.5 Rising prevalence of chronic diseases boosting demand for specialized packaging solutions

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Challenges in developing packaging for emerging biologic therapies

- 3.5.2.2 Regional disparities in healthcare packaging regulations

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Plastic

- 5.3 Paper & paperboard

- 5.4 Metal

- 5.5 Glass

Chapter 6 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Rigid packaging

- 6.2.1 Bottles

- 6.2.2 Boxes & cartons

- 6.2.3 Trays

- 6.2.4 Pre-fillable inhalers

- 6.2.5 Pre-fillable syringes

- 6.2.6 Vials & ampoules

- 6.2.7 Jars & canisters

- 6.2.8 Others

- 6.3 Flexible packaging

- 6.3.1 Bags & pouches

- 6.3.2 Tubes

- 6.3.3 Films & laminates

- 6.3.4 Others

Chapter 7 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Primary packaging

- 7.3 Secondary packaging

- 7.4 Tertiary packaging

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion & Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceuticals

- 8.2.1 Oral drug

- 8.2.2 Injectables

- 8.2.3 Topical drug

- 8.2.4 Nasal drug

- 8.2.5 Others

- 8.3 Medical devices

- 8.3.1 Disposable consumables

- 8.3.2 Therapeutic equipment

- 8.3.3 Monitoring & diagnostic equipment

- 8.3.4 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 3M

- 10.2 Adelphi Group

- 10.3 Amcor

- 10.4 Aptar CSP Technologies

- 10.5 Berry Global

- 10.6 CCL Industries

- 10.7 Constantia Flexibles

- 10.8 DS Smith

- 10.9 DuPont

- 10.10 Eastman Chemical

- 10.11 Gerresheimer

- 10.12 Graphic Packaging

- 10.13 Huhtamaki

- 10.14 Mayr-Melnhof Karton

- 10.15 Nelipak

- 10.16 Oliver Healthcare

- 10.17 Printpack

- 10.18 ProAmpac

- 10.19 Schott Pharma

- 10.20 Sealed Air

- 10.21 SGD Pharma

- 10.22 Solventum

- 10.23 Sonoco Products

- 10.24 West Pharmaceutical

- 10.25 WestRock