|

市場調查報告書

商品編碼

1684549

固體雷射器市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Solid-State Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

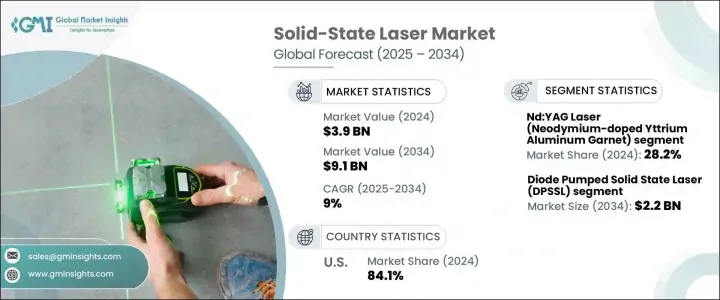

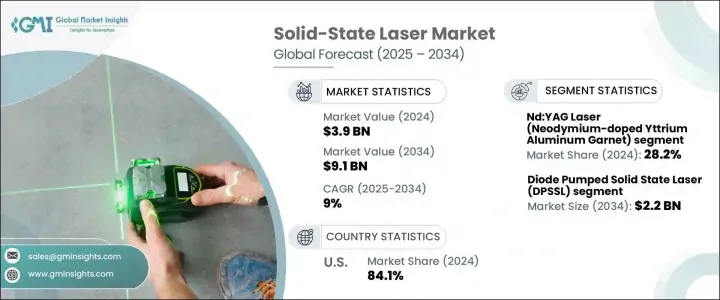

全球固體雷射市場正在快速成長,2024 年估值為 39 億美元,預計 2025 年至 2034 年的複合年成長率為 9%。研究人員不斷致力於突破雷射能力的界限,專注於提高功率輸出、縮小雷射尺寸和提高精度。

由於企業被更高性能和更具成本效益的解決方案所吸引,這些進步正在為醫療保健、電信和製造業等各個行業帶來大量新應用。固體雷射的創新不僅使得能夠以較低的成本生產出高品質、可靠的雷射器,而且還擴大了其在以前未開發的市場的使用範圍。因此,由於固體雷射的多功能性和尖端應用,其需求呈現急劇上升趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 91億美元 |

| 複合年成長率 | 9% |

與傳統雷射技術相比,固體雷射具有眾多優勢,包括更快的加工速度、更高的精度和減少的材料浪費。隨著各行各業不斷關注自動化和對高品質生產標準的需求,製造業對固體雷射的需求正在上升。對更精確、更有效率的生產流程的日益成長的需求是推動市場快速成長的關鍵因素之一。此外,這些雷射的經濟高效及其改進的性能使其對於希望在不斷發展的市場中保持競爭力的企業具有極大的吸引力。

就材料類型而言,市場細分為不同的類別,包括 Nd:YAG 雷射(摻釹釔鋁石榴石)、Er:YAG 雷射(摻鉺釔鋁石榴石)、紫翠玉雷射、Ti:藍寶石雷射(摻鈦藍寶石)等。截至 2024 年,Nd:YAG 雷射領域佔據主導地位,佔 28.2% 的市場佔有率。這些雷射因其多功能性而受到青睞,能夠在連續波和脈衝模式下工作,其有效波長為 1064 nm,非常適合深層材料穿透。

在技術方面,市場分為二極體泵浦固體雷射 (DPSSL)、光纖雷射、盤片雷射、薄板雷射和光泵浦半導體雷射 (OPSL) 等細分市場。其中,DPSSL 預計將成為領先技術,到 2034 年其價值估計將達到 22 億美元。

美國固體雷射市場佔據了全球市場的很大一部分,到 2024 年將佔據高達 84.1 %的佔有率。中國蓬勃發展的研發生態系統加上政府對尖端技術的大量投資,刺激了該領域的持續創新。此外,汽車、電子等產業對精密製造的需求不斷成長,進一步鞏固了美國在全球固體雷射市場的領導地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 技術進步和小型化

- 對基於雷射的製造和加工的需求增加

- 醫療保健應用激增

- 通訊系統中的應用日益增多

- 產業陷阱與挑戰

- 初始成本高且整合複雜

- 來自替代技術的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- Nd:YAG 雷射(摻釹釔鋁石榴石)

- Er:YAG 雷射(摻鉺釔鋁石榴石)

- 紫翠玉雷射

- Ti:藍寶石雷射(摻雜鈦的藍寶石)。

- 其他

第 6 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 二極體泵浦固體雷射 (DPSSL)

- 光纖雷射

- 碟式雷射

- 薄板條雷射器

- 光泵浦半導體雷射 (OPSL)

- 其他

第 7 章:市場估計與預測:按功率範圍,2021 年至 2034 年

- 主要趨勢

- 低功率(<100W)

- 中等功率(100 W - 1 kW)

- 高功率(>1kW)

第 8 章:市場估計與預測:依波長範圍,2021 年至 2034 年

- 主要趨勢

- 紫外線(UV)

- 可見的

- 紅外線 (IR)

- 中紅外線 (MIR)

第 9 章:市場估計與預測:按營運類型,2021 年至 2034 年

- 主要趨勢

- 脈衝操作

- 連續波操作

第 10 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 汽車

- 工業的

- 資料儲存

- 醫療的

- 國防和航太

- 電信

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- ALPHALAS GmbH

- AMS Technologies Ltd.

- Coherent Inc.

- CrystaLaser, LLC

- Daheng New Epoch Technology, Inc.

- Edgewave

- Hamamatsu Photonics KK

- IPG Photonics

- Jenoptik Laser GmbH

- JENOPTIK

- Jiangsu Lumispot Technology Co., Ltd.

- Laserglow Technologies

- LASEROPTEK Co., Ltd.

- LUMIBIRD

- Lumentum Operations LLC

- Maxphotonics

- nLight

- Northrop Grumman Corporation

- Photonic Solutions Ltd.

- Quanta System SP

The Global Solid-State Laser Market is experiencing rapid growth, with a valuation of USD 3.9 billion in 2024 and a projected CAGR of 9% from 2025 to 2034. This impressive expansion can be attributed to groundbreaking technological advancements, particularly in the areas of miniaturization, energy efficiency, and performance enhancement. Researchers are constantly working to push the boundaries of laser capabilities, focusing on increasing power output, shrinking laser sizes, and enhancing precision.

These advancements are unlocking a multitude of new applications across various industries, such as healthcare, telecommunications, and manufacturing, as businesses are drawn to the promise of higher performance and cost-effective solutions. Innovations in solid-state lasers are not only enabling the production of high-quality, reliable lasers at a lower cost but also expanding the scope of their use in previously untapped markets. As a result, the demand for solid-state lasers is on a steep upward trajectory, driven by their versatility and cutting-edge applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 9% |

Solid-state lasers offer a wide array of benefits when compared to traditional laser technologies, including faster processing speeds, higher precision, and reduced material waste. As industries continue to focus on automation and the need for high-quality production standards, the demand for solid-state lasers in manufacturing is on the rise. This growing need for more precise and efficient production processes is one of the key factors contributing to the market's rapid growth. Additionally, the cost-effective nature of these lasers, along with their improved performance, makes them highly attractive to businesses looking to stay competitive in an ever-evolving marketplace.

In terms of material type, the market is segmented into various categories, including Nd:YAG lasers (Neodymium-doped Yttrium Aluminum Garnet), Er:YAG lasers (Erbium-doped Yttrium Aluminum Garnet), Alexandrite lasers, Ti:Sapphire lasers (Titanium-doped Sapphire), and others. As of 2024, the Nd:YAG laser segment is the dominant force, accounting for 28.2% of the market share. These lasers are favored for their versatility, being able to operate in both continuous-wave and pulsed modes, and their effective wavelength of 1064 nm, which is ideal for deep material penetration.

On the technology front, the market is divided into segments such as Diode Pumped Solid State Lasers (DPSSL), fiber lasers, disk lasers, thin slab lasers, and Optically Pumped Semiconductor Lasers (OPSL). Of these, DPSSLs are expected to be the leading technology, reaching an estimated value of USD 2.2 billion by 2034. Known for their high efficiency, compact design, and stability, DPSSLs are increasingly sought after by industries that require precise, reliable laser beams for their operations.

The U.S. solid-state laser market commands a significant portion of the global market, holding an impressive 84.1% share in 2024. This dominance is fueled by the widespread adoption of solid-state lasers in healthcare, aerospace, and defense sectors. The country's thriving research and development ecosystem, coupled with substantial government investments in cutting-edge technologies, has spurred continued innovation in the field. Furthermore, the growing demand for precision manufacturing in industries such as automotive and electronics further bolsters the U.S.'s leadership position in the global solid-state laser market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements and miniaturization

- 3.6.1.2 Increased demand for laser-based manufacturing and processing

- 3.6.1.3 Surge in medical and healthcare applications

- 3.6.1.4 Rising application in communication systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs and complex integration

- 3.6.2.2 Competition from alternative technologies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Nd:YAG Laser (Neodymium-doped Yttrium Aluminum Garnet)

- 5.3 Er:YAG Laser (Erbium-doped Yttrium Aluminum Garnet)

- 5.4 Alexandrite Laser

- 5.5 Ti:Sapphire Laser (Titanium-doped Sapphire).

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Diode Pumped Solid State Laser (DPSSL)

- 6.3 Fiber laser

- 6.4 Disk laser

- 6.5 Thin slab laser

- 6.6 Optically Pumped Semiconductor Laser (OPSL)

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Power Range, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 Low power (< 100 W)

- 7.3 Medium power (100 W - 1 kW)

- 7.4 High power (> 1 kW)

Chapter 8 Market Estimates & Forecast, By Wavelength Range, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Ultraviolet (UV)

- 8.3 Visible

- 8.4 Infrared (IR)

- 8.5 Mid-Infrared (MIR)

Chapter 9 Market Estimates & Forecast, By Operation Type, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Pulsed operation

- 9.3 Continuous wave operation

Chapter 10 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Industrial

- 10.4 Data storage

- 10.5 Medical

- 10.6 Defense and aerospace

- 10.7 Telecommunications

- 10.8 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 ALPHALAS GmbH

- 12.2 AMS Technologies Ltd.

- 12.3 Coherent Inc.

- 12.4 CrystaLaser, LLC

- 12.5 Daheng New Epoch Technology, Inc.

- 12.6 Edgewave

- 12.7 Hamamatsu Photonics K.K.

- 12.8 IPG Photonics

- 12.9 Jenoptik Laser GmbH

- 12.10 JENOPTIK

- 12.11 Jiangsu Lumispot Technology Co., Ltd.

- 12.12 Laserglow Technologies

- 12.13 LASEROPTEK Co., Ltd.

- 12.14 LUMIBIRD

- 12.15 Lumentum Operations LLC

- 12.16 Maxphotonics

- 12.17 nLight

- 12.18 Northrop Grumman Corporation

- 12.19 Photonic Solutions Ltd.

- 12.20 Quanta System SP