|

市場調查報告書

商品編碼

1684197

PVC 保鮮膜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測PVC Cling Film Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

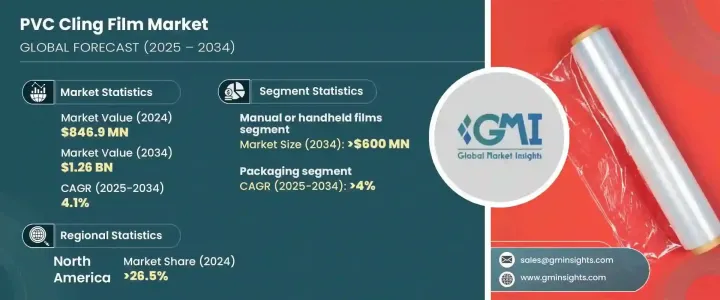

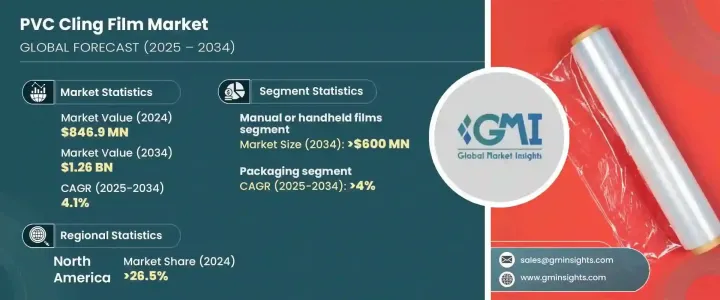

2024 年全球 PVC 保鮮膜市場規模達到 8.469 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.1%。隨著人們對環境挑戰的認知不斷提高和塑膠廢物法規越來越嚴格,人們明顯轉向可回收材料,以符合全球永續發展的努力。消費者和製造商都優先考慮減少碳足跡並滿足不斷發展的回收標準的更環保的選擇。對永續包裝的日益成長的偏好在食品和非食品包裝等領域尤為明顯,這些領域中環保選擇正在成為常態。隨著這些趨勢繼續影響消費者行為,對 PVC 保鮮膜(尤其是其更永續形式)的需求預計將激增。

市場分為機器薄膜和手動或手持薄膜,其中手動部分在成長方面成為強力的競爭者。到 2034 年,手排 PVC 保鮮膜市場預計將創收 6 億美元。這種成長很大程度上歸因於手工薄膜在食品儲存中的廣泛使用,特別是在家庭和小規模包裝業務中。手動保鮮膜為保持食物新鮮提供了實用且經濟實惠的解決方案。這些薄膜的簡單性、成本效益和易於使用使其成為尋求高效且經濟實惠的食品保鮮方法的消費者的首選。它們的廣泛可用性和多功能性進一步增強了它們在該領域的主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.469 億美元 |

| 預測值 | 12.6億美元 |

| 複合年成長率 | 4.1% |

當談到最終用途應用時,PVC 保鮮膜市場主要分為食品包裝和非食品包裝。食品包裝領域正處於領先地位,預計 2025 年至 2034 年期間的複合年成長率為 4%。隨著人們越來越關注新鮮、方便的食品和更小的包裝尺寸,尤其是快節奏的生活方式,對 PVC 保鮮膜作為基本食品儲存工具的需求正在上升。外帶餐點、即食產品和網路食品配送的流行進一步增強了對高品質、有效包裝解決方案的需求。

2024 年,北美,尤其是美國佔據了 PVC 保鮮膜市場的 26.5%。即食食品的興起、網路食品配送服務的繁榮以及對運輸過程中保持產品品質的重視,是推動對耐用和有效包裝選擇需求的關鍵因素。此外,薄膜生產的技術創新提高了透明度和耐用性,促進了市場的擴張,確保製造商能夠滿足食品包裝領域對高品質保鮮膜日益成長的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對永續包裝解決方案的需求不斷成長

- 薄膜技術和性能的進步

- 透過更輕、更薄的薄膜實現成本效益

- 消費者對保鮮的偏好日益增加

- 遵守不斷變化的監管要求

- 產業陷阱與挑戰

- 先進薄膜生產成本高

- PVC 替代品的市佔率強勁

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 機用薄膜

- 手動或手持膠片

第 6 章:市場估計與預測:按厚度,2021-2034 年

- 主要趨勢

- 高達 10 微米

- 10 至 15 微米

- 15-20微米

- 20微米以上

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 食品包裝

- 肉類、家禽和海鮮

- 新鮮農產品

- 冷凍食品

- 麵包和糖果

- 其他

- 非食品包裝

- 工業品

- 電子產品

- 醫療和製藥

- 其他

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- BenKai

- Berry Global

- Boston Polymers

- Changzhou Plastics Researching and Manufacturing

- CL Industries India

- Divya Plastic Industries

- Galaxy Converting

- IPG

- Jiashan Hengyu Plastic

- Magnum Packaging

- Maskati Bros

- Nan Ya Plastics

- NRR Industries

- Pactiv Evergreen

- Pragya Flexifilm Industries

- Qingdao Kingchuan Packaging

- Shenzhen Jingfeng Industrial

- US Packaging and Wrapping

- Zhengzhou Eming Aluminium Industry

The Global PVC Cling Film Market reached USD 846.9 million in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. A key driver behind this growth is the increasing demand for eco-friendly and sustainable packaging solutions. With rising awareness of environmental challenges and more stringent plastic waste regulations, there is a clear shift toward recyclable materials that align with global sustainability efforts. Consumers and manufacturers alike are prioritizing greener options that reduce carbon footprints and meet the ever-evolving recycling standards. The growing preference for sustainable packaging is particularly visible in sectors like food and non-food packaging, where eco-conscious choices are becoming the norm. As these trends continue to shape consumer behavior, the demand for PVC cling film, especially in its more sustainable forms, is expected to surge.

The market is divided into machine films and manual or handheld films, with the manual segment emerging as a strong contender in terms of growth. By 2034, the manual PVC cling film segment is projected to generate USD 600 million. This growth is largely attributed to the widespread use of manual films for food storage, particularly in households and small-scale packaging operations. Manual cling films offer a practical and budget-friendly solution for keeping food fresh. The simplicity, cost-effectiveness, and ease of use of these films make them the go-to choice for consumers looking for an efficient and affordable food preservation method. Their widespread availability and versatility further contribute to their dominance in this sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $846.9 Million |

| Forecast Value | $1.26 Billion |

| CAGR | 4.1% |

When it comes to end-use applications, the PVC cling film market is largely split between food and non-food packaging. The food packaging segment is leading the way and is expected to grow at a CAGR of 4% from 2025 to 2034. PVC cling films play a vital role in the preservation of fresh food, from meats and vegetables to fruits, by extending shelf life and protecting against contaminants. With a growing focus on fresh, convenient meals and smaller packaging sizes, especially in fast-paced lifestyles, the demand for PVC cling films as a fundamental food storage tool is rising. The popularity of on-the-go meals, ready-to-eat products, and online food deliveries further bolsters the need for high-quality, effective packaging solutions.

North America, particularly the United States, accounted for 26.5% of the PVC cling film market share in 2024. This region is experiencing significant growth, driven by the increasing demand for fresh, visually appealing, and convenient food products. The rise of ready-to-eat meals, the boom in online food delivery services, and the focus on maintaining product quality during transportation are key factors propelling the need for durable and effective packaging options. Additionally, technological innovations in film production, which improve clarity and durability, are contributing to the market's expansion, ensuring that manufacturers can meet the growing demand for high-quality cling films in the food packaging sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for sustainable packaging solutions

- 3.4.1.2 Advancements in film technology and performance

- 3.4.1.3 Cost efficiency through lighter, thinner films

- 3.4.1.4 Increased consumer preference for freshness retention

- 3.4.1.5 Compliance with evolving regulatory requirements

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of advanced films

- 3.4.2.2 Strong market presence of PVC alternatives

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Machine films

- 5.3 Manual or handheld films

Chapter 6 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 10 microns

- 6.3 10 to 15 microns

- 6.4 15-20 microns

- 6.5 Above 20 microns

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food packaging

- 7.2.1 Meat poultry, & seafood

- 7.2.2 Fresh produce

- 7.2.3 Frozen food

- 7.2.4 Bakery and confectionery

- 7.2.5 Others

- 7.3 Non-food packaging

- 7.3.1 Industrial goods

- 7.3.2 Electronics

- 7.3.3 Medical and pharmaceutical

- 7.3.4 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BenKai

- 9.2 Berry Global

- 9.3 Boston Polymers

- 9.4 Changzhou Plastics Researching and Manufacturing

- 9.5 CL Industries India

- 9.6 Divya Plastic Industries

- 9.7 Galaxy Converting

- 9.8 IPG

- 9.9 Jiashan Hengyu Plastic

- 9.10 Magnum Packaging

- 9.11 Maskati Bros

- 9.12 Nan Ya Plastics

- 9.13 NRR Industries

- 9.14 Pactiv Evergreen

- 9.15 Pragya Flexifilm Industries

- 9.16 Qingdao Kingchuan Packaging

- 9.17 Shenzhen Jingfeng Industrial

- 9.18 US Packaging and Wrapping

- 9.19 Zhengzhou Eming Aluminium Industry