|

市場調查報告書

商品編碼

1684193

槍擊檢測系統市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Gunshot Detection System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

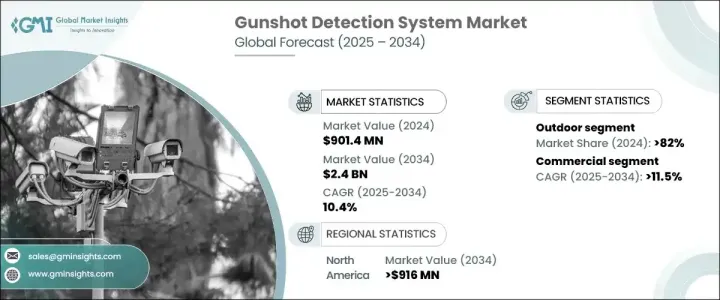

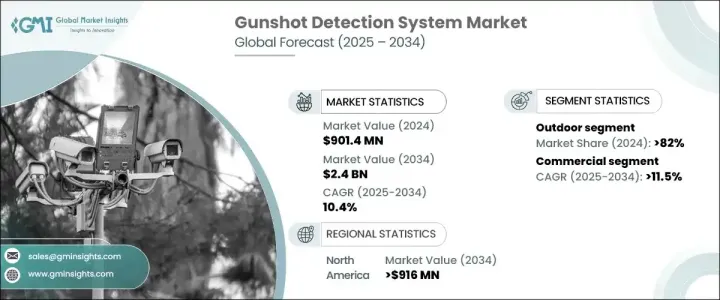

2024 年全球槍擊偵測系統市場規模達到 9.014 億美元,預計 2025 年至 2034 年期間將達到 10.4% 的複合年成長率。隨著公共和私營部門對安全的擔憂日益加劇,對先進安全技術的需求也達到了歷史最高水準。政府、企業和市政當局擴大使用槍擊偵測系統來增強其安全基礎設施。這些系統使執法和安全人員能夠立即確定槍聲的位置,從而縮短響應時間並確保更有效率、準確的緊急情況響應。該技術與監視攝影機和交通管理解決方案等其他安全和通訊系統的整合進一步推動了其應用。在城市地區和高風險環境中尤其如此,因為快速應對事件的能力至關重要。人們對槍擊事件的認知不斷提高,以及需要精準、迅速地應對槍枝暴力,也推動了市場的成長。因此,槍擊探測系統已成為現代安全策略不可或缺的一部分。

市場分為室內和室外兩部分,其中室外類別在 2024 年將佔 82% 的佔有率。室外系統將實現大幅成長,這主要得益於其在智慧城市專案中的作用。透過將戶外偵測系統整合到更廣泛的安全網路中,城市正在增強快速應對緊急情況的能力。這種成長趨勢預計將刺激需求,特別是在城市地區,因為不斷成長的人口和日益嚴重的安全問題要求系統能夠有效覆蓋更大的區域。此類系統的廣泛採用旨在增強公共安全,同時實現更智慧、互聯的安全基礎設施。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.014 億美元 |

| 預測值 | 24億美元 |

| 複合年成長率 | 10.4% |

在終端用戶方面,商業部門預計將經歷最快的成長,到 2034 年預計複合年成長率為 11.5%。槍擊事件的增加使得企業、學校、醫院、商場、劇院和體育場必須實施槍擊檢測技術來保護公共場所的個人。透過向安全人員提供即時警報,這些系統可以快速有效地應對潛在威脅,降低傷害風險並提高整體安全性。商業實體,尤其是人流量大的商業實體,擴大採用這些系統來加強安全措施並保障遊客的安全。

在北美,槍擊檢測系統市場規模預計到 2034 年將達到 9.16 億美元。這一成長是由日益升級的安全問題和技術的持續進步所推動的。特別是槍擊檢測系統與美國智慧城市基礎設施的結合,使得緊急應變工作更有效率,有助於市場的整體擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 槍枝暴力和公共安全問題日益嚴重

- 感測器技術的進步

- 與監控和通訊系統整合

- 增加對公共和私人邊界安全的投資

- 大都會地區的擴張和改善城市安全基礎設施的需求

- 產業陷阱與挑戰

- 初期投資成本高

- 監管和法律障礙

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按安裝量,2021 年至 2034 年

- 主要趨勢

- 固定安裝

- 車載

- 士兵安裝系統

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 室內的

- 戶外的

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 商業的

- 國防和政府

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Acoem

- Amberbox

- Aselsan

- Databuoy

- Eagl Technology

- Israel Aerospace Industries

- Microflown Avisa

- Omnilert

- Qinetiq

- Response Technologies

- Rheinmetall

- Shooter Detection Systems

- Sound Thinking

- Thales

- Tracer Technology System

The Global Gunshot Detection System Market reached USD 901.4 million in 2024 and is projected to experience a robust growth rate of 10.4% CAGR from 2025 to 2034. As public and private sector safety concerns escalate, the demand for advanced security technologies is at an all-time high. Governments, businesses, and municipalities are increasingly turning to gunshot detection systems to enhance their security infrastructure. These systems allow law enforcement and security personnel to instantly pinpoint the location of gunshots, improving response times and ensuring a more efficient and accurate emergency response. The technology's integration with other safety and communication systems, such as surveillance cameras and traffic management solutions, is further fueling its adoption. This is especially true in urban areas and high-risk environments where the ability to respond quickly to incidents is critical. The market's growth is also supported by the rising awareness of active shooter situations and the need to address gun violence with precision and speed. As a result, gunshot detection systems have become an indispensable component of modern security strategies.

The market is divided into indoor and outdoor segments, with the outdoor category commanding an impressive 82% share in 2024. Outdoor systems are set for substantial growth, largely driven by their role in smart city projects. By integrating outdoor detection systems into wider security networks, cities are enhancing their ability to respond rapidly to emergencies. This growing trend is expected to fuel demand, particularly in urban areas, where expanding populations and increasing security concerns call for systems that can cover larger areas efficiently. The widespread adoption of such systems aims to enhance public safety while enabling more intelligent, connected security infrastructures.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $901.4 Million |

| Forecast Value | $2.4 Billion |

| CAGR | 10.4% |

In terms of end users, the commercial sector is expected to experience the fastest growth, with a projected CAGR of 11.5% by 2034. Rising active shooter incidents have made it crucial for businesses, schools, hospitals, malls, theaters, and stadiums to implement gunshot detection technology to protect individuals in public spaces. By providing real-time alerts to security personnel, these systems offer a fast and effective response to potential threats, reducing the risk of harm and improving overall safety. Commercial entities, especially those with high foot traffic, are increasingly incorporating these systems to fortify their security measures and safeguard the well-being of their visitors.

In North America, the gunshot detection systems market is projected to reach USD 916 million by 2034. This growth is driven by escalating safety concerns and ongoing advancements in technology. In particular, the integration of gunshot detection systems with smart city infrastructure in the United States is making emergency response efforts more efficient, contributing to the overall expansion of the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising gun violence and public safety concerns

- 3.6.1.2 Advancements in sensor technologies

- 3.6.1.3 Integration with surveillance and communication systems

- 3.6.1.4 Increasing investments in securing public and private perimeters

- 3.6.1.5 Expansion of metropolitan areas and the need for improved urban security infrastructure

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment costs

- 3.6.2.2 Regulatory and legal barriers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Installation, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed installation

- 5.3 Vehicle mounted

- 5.4 Soldier mounted system

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Indoor

- 6.3 Outdoor

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Commercial

- 7.3 Defense and government

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acoem

- 9.2 Amberbox

- 9.3 Aselsan

- 9.4 Databuoy

- 9.5 Eagl Technology

- 9.6 Israel Aerospace Industries

- 9.7 Microflown Avisa

- 9.8 Omnilert

- 9.9 Qinetiq

- 9.10 Response Technologies

- 9.11 Rheinmetall

- 9.12 Shooter Detection Systems

- 9.13 Sound Thinking

- 9.14 Thales

- 9.15 Tracer Technology System