|

市場調查報告書

商品編碼

1667194

電子處方市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測e-prescribing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

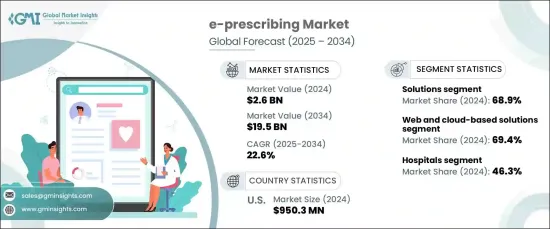

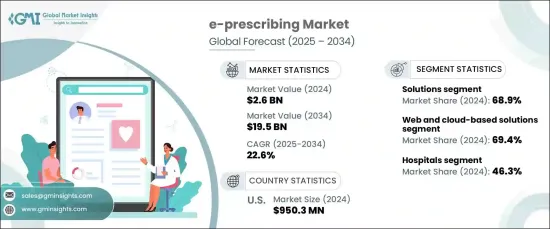

2024 年全球電子處方市場價值為 26 億美元,預計 2025 年至 2034 年期間的複合年成長率為 22.6%。電子處方系統正在徹底改變處方管理,提高醫療保健服務的準確性、效率和病人安全性。隨著醫療保健提供者越來越重視數位轉型,創新技術的整合正在成為現代醫療實踐的關鍵組成部分。

電子處方平台透過與電子健康記錄 (EHR) 的無縫整合,使醫療保健專業人員能夠存取全面的患者資料,包括病史、過敏和當前藥物。這種整合支持明智的臨床決策,簡化工作流程,並降低藥物不良事件的風險。這些系統也促進了供應商之間的加強協作,從而更好地協調病患照護。隨著全球各國政府和醫療保健組織都強調數位化,電子處方解決方案將在醫療保健基礎設施的現代化中發揮重要作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 195億美元 |

| 複合年成長率 | 22.6% |

市場分為解決方案和服務。由於對強大的藥物管理工具的需求不斷成長以及減少處方錯誤的努力,解決方案在 2024 年佔據了 68.9% 的顯著市場佔有率。這些解決方案分為整合和獨立選項,滿足醫療保健提供者的多樣化需求。整合解決方案越來越受歡迎,它提供了全面的功能和與現有系統的互通性。同時,獨立的解決方案可以滿足小型診所和診所的特殊需求。

服務也是市場的一個重要組成部分,包括支援和維護、實施、網路和培訓服務。這些產品確保了電子處方系統的順利部署和運行,同時滿足了醫療保健行業的動態需求。透過提供持續的技術支援和系統更新,服務提供者幫助醫療保健組織保持最佳效能並遵守不斷變化的法規。

根據部署,市場包括基於網路和雲端的解決方案以及內部部署系統。 2024 年,基於 Web 和雲端的解決方案佔據 69.4% 的市場佔有率,反映了其可負擔性、可擴展性和易用性。這些解決方案消除了對昂貴的硬體和基礎設施的需求,因此對中小型企業尤其有吸引力。它們的互通性和遠端存取功能使醫療保健提供者能夠有效地管理處方,同時提高患者的安全性和滿意度。

在促進醫療保健數位化的監管框架的推動下,美國在 2024 年創造了 9.503 億美元的收入。聯邦授權和財政激勵措施加速了 EHR 和電子處方系統的採用,而嚴格的合規要求和對資料安全的高度關注進一步促進了市場成長。隨著基於雲端的解決方案和人工智慧工具的使用日益增多,電子處方市場將改變藥物管理,確保改善患者治療效果並提高整個醫療保健系統的運作效率。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 數位健康解決方案和電子健康記錄的採用日益增多

- 提高對遠距醫療服務的認知

- 減少用藥錯誤的需求日益增加

- 越來越關注減少醫療保健詐欺和濫用

- 產業陷阱與挑戰

- 與系統整合和互通性相關的技術挑戰

- 與資料隱私和安全相關的擔憂

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 解決方案

- 整合解決方案

- 獨立解決方案

- 服務

- 支援和維護服務

- 實施服務

- 網路服務

- 培訓和教育服務

第6章:市場估計與預測:依部署模式,2021 – 2034 年

- 主要趨勢

- 基於 Web 和雲端的解決方案

- 本地解決方案

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 辦公室醫生

- 藥局

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AdvancedMD

- athenahealth

- CompuGroup Medical

- DrFirst.com

- eClinicalWorks

- Epic Systems Corporation

- GE Healthcare

- Greenway Health

- Henry Schein

- McKesson Corporation

- Medical Information Technology

- NextGen Healthcare

- Oracle Corporation

- Surescripts

- Veradigm

The Global E-Prescribing Market, valued at USD 2.6 billion in 2024, is projected to expand at a CAGR of 22.6% between 2025 and 2034. This growth is fueled by the rapid adoption of digital health solutions, increasing awareness of telemedicine, and a heightened focus on minimizing medication errors and preventing healthcare fraud. E-prescribing systems are revolutionizing prescription management, enhancing accuracy, efficiency, and patient safety in healthcare delivery. As healthcare providers increasingly prioritize digital transformation, the integration of innovative technologies is becoming a critical component of modern medical practices.

E-prescribing platforms enable healthcare professionals to access comprehensive patient data, including medical history, allergies, and current medications, through seamless integration with electronic health records (EHRs). This integration supports informed clinical decision-making, streamlines workflows, and reduces the risk of adverse drug events. These systems also foster enhanced collaboration among providers, allowing for better coordination in patient care. With governments and healthcare organizations globally emphasizing digitalization, e-prescribing solutions are poised to play an essential role in the modernization of healthcare infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $19.5 Billion |

| CAGR | 22.6% |

The market is categorized into solutions and services. Solutions accounted for a significant 68.9% market share in 2024, driven by the growing demand for robust medication management tools and efforts to reduce prescription errors. These solutions are divided into integrated and standalone options, catering to the diverse needs of healthcare providers. Integrated solutions have become increasingly popular, offering comprehensive functionality and interoperability with existing systems. Meanwhile, standalone solutions address niche requirements for smaller practices and clinics.

Services also form a critical component of the market, encompassing support and maintenance, implementation, networking, and training services. These offerings ensure the smooth deployment and operation of e-prescribing systems while addressing the dynamic demands of the healthcare sector. By providing ongoing technical support and system updates, service providers help healthcare organizations maintain optimal performance and compliance with evolving regulations.

Based on deployment, the market includes web and cloud-based solutions and on-premise systems. Web and cloud-based solutions dominated with a 69.4% market share in 2024, reflecting their affordability, scalability, and ease of use. These solutions eliminate the need for costly hardware and infrastructure, making them particularly attractive to small and mid-sized practices. Their interoperability and remote access capabilities allow healthcare providers to manage prescriptions efficiently while enhancing patient safety and satisfaction.

The United States generated USD 950.3 million in 2024, driven by regulatory frameworks that promote healthcare digitalization. Federal mandates and financial incentives have accelerated the adoption of EHRs and e-prescribing systems, while strict compliance requirements and a strong focus on data security further bolster market growth. With the increasing use of cloud-based solutions and AI-powered tools, the e-prescribing market is set to transform medication management, ensuring improved patient outcomes and operational efficiency across healthcare systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of digital health solutions and electronic health records

- 3.2.1.2 Increasing awareness towards telemedicine services

- 3.2.1.3 Increasing demand for reducing medication errors

- 3.2.1.4 Growing focus towards reducing healthcare fraud and abuse

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technical challenges related to system integration and interoperability

- 3.2.2.2 Concerns related to data privacy and safety

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Integrated solutions

- 5.2.2 Standalone solutions

- 5.3 Services

- 5.3.1 Support and maintenance services

- 5.3.2 Implementation services

- 5.3.3 Network services

- 5.3.4 Training and education services

Chapter 6 Market Estimates and Forecast, By Deployment Mode, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Web and cloud-based solutions

- 6.3 On-premise solutions

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Office-based physicians

- 7.4 Pharmacies

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AdvancedMD

- 9.2 athenahealth

- 9.3 CompuGroup Medical

- 9.4 DrFirst.com

- 9.5 eClinicalWorks

- 9.6 Epic Systems Corporation

- 9.7 GE Healthcare

- 9.8 Greenway Health

- 9.9 Henry Schein

- 9.10 McKesson Corporation

- 9.11 Medical Information Technology

- 9.12 NextGen Healthcare

- 9.13 Oracle Corporation

- 9.14 Surescripts

- 9.15 Veradigm