|

市場調查報告書

商品編碼

1667184

公用事業太陽能光電 EPC 市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Utility Solar PV EPC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

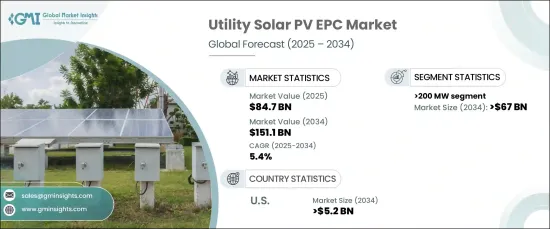

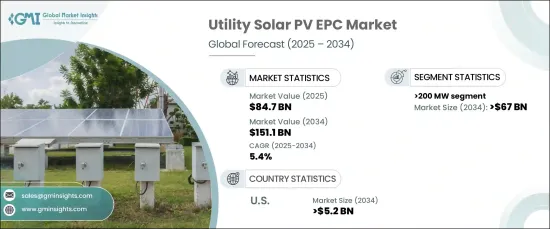

2024 年全球公用事業太陽能光電 EPC 市場價值 847 億美元,預計 2024 年至 2034 年的複合年成長率為 5.4%。市場的成長得益於創新融資方式的採用,包括稅收股權融資和綠色債券,這些方式支持了公用事業規模太陽能專案的擴張。

過去十年,太陽能電池組件和EPC服務的成本大幅降低,隨著規模經濟的提高,成本持續下降,從而降低整體成本並增加市場競爭。此外,電池儲能系統 (BESS) 與公用事業規模太陽能專案的整合正變得越來越普遍。這種搭配有助於減輕太陽能發電的間歇性並確保電網穩定性,使太陽能發電成為更可靠的能源。此外,人們對社區太陽能專案的興趣日益濃厚,特別是在屋頂太陽能採用有限的地區,這也推動了對公用事業太陽能 EPC 服務的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 847億美元 |

| 預測值 | 1511億美元 |

| 複合年成長率 | 5.4% |

預計市場對 200 兆瓦以上容量領域的需求將大幅增加,到 2034 年預計將超過 670 億美元。在持續的技術創新、政府支持和對再生能源日益成長的投入的推動下,美國公用事業太陽能光電 EPC 服務市場規模預計到 2034 年將超過 52 億美元。太陽能專案稅收抵免等關鍵政策(包括 ITC 提供的 30% 稅收抵免)進一步促進了市場的成長。在美國,加州、德州和紐約州等州都推出了再生能源強制規定,要求公用事業公司從再生能源中獲取一定比例的能源,從而進一步刺激需求。太陽能板效率的進步,例如雙面和異質結太陽能電池,正在透過提高能量產量和降低太陽能專案的平準化能源成本 (LCOE) 來推動產業向前發展。

在政府上網電價計畫和再生能源拍賣等措施的支持下,亞太地區的公用事業太陽能光電 EPC 市場將持續成長。在澳洲等國家,電力成本的上升,加上再生能源技術成本的下降,正在推動大規模太陽能光電專案的部署。此外,該地區的政府正致力於透過軟體和數位技術的整合來提高太陽能光電發電能力,進一步推動太陽能解決方案的採用。

目錄

第 1 章:方法論與範圍

- 研究設計

- 基礎估算與計算

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依產能,2021 – 2034 年

- 主要趨勢

- ≤ 10 兆瓦

- > 10 兆瓦至 50 兆瓦

- > 50 兆瓦至 200 兆瓦

- > 200 兆瓦

第6章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 荷蘭

- 義大利

- 德國

- 西班牙

- 俄羅斯

- 瑞典

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第7章:公司簡介

- ACME Solar

- Bharat Heavy Electricals Limited (BHEL)

- BELECTRIC

- COBRA Group

- Canadian Solar

- First Solar

- JUWI AG

- KEC International Limited

- Larsen & Toubro Limited

- Power Construction Corporation of China, Ltd.

- Risen Energy Co. Ltd.

- Ritis Meera Infra Energy LLP

- STEAG GmbH

- Swinerton Renewable Energy

- Sterling and Wilson

- SunPower Corporation

- SUNGROW

- TBEA Co., Ltd.

- Tata Power Solar Systems Ltd.

- Topsun Energy Limited

- Trina Solar

The Global Utility Solar PV EPC Market, valued at USD 84.7 billion in 2024, is expected to grow at a CAGR of 5.4% from 2024 to 2034. Utility Solar PV EPC services are critical for large-scale solar photovoltaic (PV) power plants that supply electricity to the grid, typically ranging from tens to hundreds of megawatts. The market's growth is fueled by the adoption of innovative financing methods, including tax equity financing and green bonds, which have supported the expansion of utility-scale solar projects.

Over the past decade, there has been a significant reduction in the costs of solar modules and EPC services, which continue to decline as economies of scale improve, driving down overall costs and increasing market competition. Additionally, the integration of battery energy storage systems (BESS) with utility-scale solar projects is becoming more common. This pairing helps mitigate the intermittent nature of solar power and ensures grid stability, making solar power a more reliable source of energy. Furthermore, the rising interest in community solar projects, particularly in areas with limited rooftop solar adoption, is contributing to the demand for utility solar EPC services.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $84.7 Billion |

| Forecast Value | $151.1 Billion |

| CAGR | 5.4% |

The market is expected to see a substantial demand in the >200 MW capacity segment, projected to surpass USD 67 billion by 2034. As companies worldwide work to increase their renewable energy share, utility-scale solar PV projects are becoming more competitive due to the growing availability of resources, increased capacity potential, and more affordable technologies. The U.S. market for utility solar PV EPC services is forecasted to exceed USD 5.2 billion by 2034, driven by continued technological innovations, government support, and a growing commitment to renewable energy. Key policies such as tax credits for solar projects, including the ITC offering a 30% tax credit, further enhance the market's growth. In the U.S., states like California, Texas, and New York have renewable energy mandates that require utilities to obtain a percentage of their energy from renewable sources, further boosting demand. Advancements in solar panel efficiency, such as bifacial and heterojunction solar cells, are driving the industry forward by increasing energy yield and lowering the Levelized Cost of Energy (LCOE) for solar projects.

The Asia Pacific region will see continued growth in the utility solar PV EPC market, supported by government initiatives like feed-in tariff schemes and renewable energy auctions. In countries like Australia, the rising cost of electricity, combined with the decreasing costs of renewable technologies, is encouraging the deployment of large-scale solar PV projects. Additionally, governments in the region are focusing on enhancing solar PV capacity through the integration of software and digital technologies, further boosting the adoption of solar energy solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 ≤ 10 MW

- 5.3 > 10 MW to 50 MW

- 5.4 > 50 MW to 200 MW

- 5.5 > 200 MW

Chapter 6 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.2.3 Mexico

- 6.3 Europe

- 6.3.1 France

- 6.3.2 UK

- 6.3.3 Netherlands

- 6.3.4 Italy

- 6.3.5 Germany

- 6.3.6 Spain

- 6.3.7 Russia

- 6.3.8 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 Australia

- 6.4.3 India

- 6.4.4 Japan

- 6.4.5 South Korea

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 South Africa

- 6.5.4 Egypt

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 ACME Solar

- 7.2 Bharat Heavy Electricals Limited (BHEL)

- 7.3 BELECTRIC

- 7.4 COBRA Group

- 7.5 Canadian Solar

- 7.6 First Solar

- 7.7 JUWI AG

- 7.8 KEC International Limited

- 7.9 Larsen & Toubro Limited

- 7.10 Power Construction Corporation of China, Ltd.

- 7.11 Risen Energy Co. Ltd.

- 7.12 Ritis Meera Infra Energy LLP

- 7.13 STEAG GmbH

- 7.14 Swinerton Renewable Energy

- 7.15 Sterling and Wilson

- 7.16 SunPower Corporation

- 7.17 SUNGROW

- 7.18 TBEA Co., Ltd.

- 7.19 Tata Power Solar Systems Ltd.

- 7.20 Topsun Energy Limited

- 7.21 Trina Solar