|

市場調查報告書

商品編碼

1667170

玉米纖維市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Corn Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

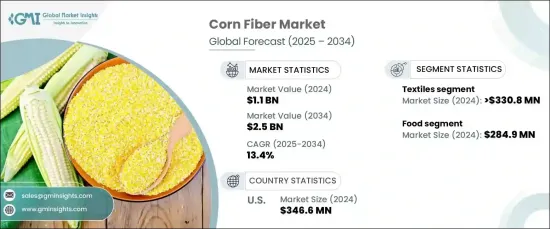

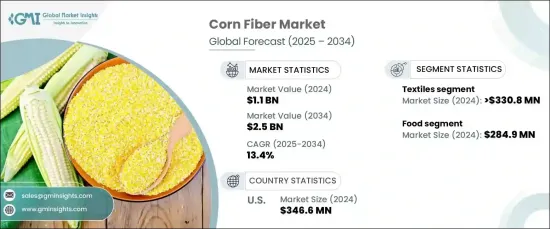

2024 年全球玉米纖維市場價值為 11 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 13.4%。這種成分因其促進消化健康的作用而受到認可,因此在食品和其他行業中越來越受歡迎。

政府措施和飲食指南強調增加纖維消費,大大促進了對玉米纖維的需求。人們越來越意識到膳食纖維對整體健康的重要性,這推動了其被納入各種各樣的產品中,特別是功能性食品和飲料領域。隨著越來越多的消費者重視腸道健康並尋求植物性、富含纖維的選擇,預計未來幾年市場將穩定成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 11億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 13.4% |

紡織品部分佔據了市場的很大一部分,到 2024 年將達到 3.308 億美元,預計未來十年的複合年成長率為 12.8%。玉米纖維擴大被認可為合成纖維的永續和可生物分解的替代品。其獨特的性能,如吸濕性、耐用性和柔軟性,使其成為服裝、家居裝飾和工業紡織品應用的理想選擇。對環保材料的需求不斷成長以及生產方法的進步進一步加速了其在紡織領域的應用。

同時,食品業仍然是一個主要貢獻者,2024 年的收入估計為 2.849 億美元,預計到 2034 年的複合年成長率為 14%。隨著消費者健康意識的增強,清潔標籤和植物性飲食的趨勢在食品配方中進一步加強。其使用範圍不斷擴大,主要是由於消費者對天然和功能性成分的偏好,以及對促進體重管理和腸道健康的關注。

美國引領全球玉米纖維市場,2024 年價值為 3.466 億美元,預計到 2034 年複合年成長率為 13.3%。產品配方的持續創新將持續支持各領域的市場成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 提高消費者對纖維重要性的認知

- 轉向清潔標籤產品

- 功能性食品的需求

- 食品創新

- 產業陷阱與挑戰

- 生產成本高

- 供應鏈複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食物

- 麵包店

- 早餐麥片和零食

- 糖果

- 乳製品

- 肉製品

- 嬰兒食品

- 飲料

- 製藥

- 動物營養

- 豬

- 反芻動物

- 家禽

- 寵物

- 紡織品

- 服飾

- 不織布

- 家紡

- 產業用紡織品

- 其他(醫療、汽車、個人護理和化妝品)

第6章:市場估計與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第7章:公司簡介

- Archer Daniels Midland Company

- Cargill Incorporated

- Doshi Group

- Grain Processing Corporation

- HL Agro

- Ingredion Incorporated

- J. Rettenmaier & Söhne GmbH & Co. KG

- Roquette Freres

- SunOpta, Inc.

- Tate & Lyle PLC

The Global Corn Fiber Market, valued at USD 1.1 billion in 2024, is set to grow at a robust CAGR of 13.4% from 2025 to 2034. Corn fiber, extracted from the hulls of corn kernels, is gaining traction across various applications due to its rich fiber content and associated health benefits. This ingredient is recognized for its role in promoting digestive health, making it increasingly popular in food products and other industries.

Government initiatives and dietary guidelines emphasizing higher fiber consumption have significantly boosted the demand for corn fiber. The growing awareness of the importance of dietary fiber for overall health has fueled its incorporation into a wide range of products, particularly within the functional food and beverage segments. As more consumers prioritize gut health and seek plant-based, fiber-enriched options, the market is expected to experience steady growth over the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 13.4% |

The textiles segment accounted for a substantial portion of the market, reaching USD 330.8 million in 2024 and is forecasted to grow at a CAGR of 12.8% during the next decade. Corn fiber is increasingly being recognized as a sustainable and biodegradable alternative to synthetic fibers. Its unique properties, such as moisture absorption, durability, and softness, make it a favorable option for applications in clothing, home furnishings, and industrial textiles. Rising demand for eco-friendly materials and advancements in production methods further accelerate its adoption in the textile sector.

Meanwhile, the food segment remains a key contributor, with revenues estimated at USD 284.9 million in 2024 and projected to grow at a CAGR of 14% through 2034. Corn fiber's versatility allows it to be incorporated into various food products to enhance fiber content and support digestive health. With the rise of health-conscious consumers, the trend toward clean-label and plant-based diets has further strengthened its presence in food formulations. Its growing use is driven by consumer preferences for natural and functional ingredients, as well as a focus on promoting weight management and gut health.

The U.S. leads the global corn fiber market, with a value of USD 346.6 million in 2024 and a CAGR of 13.3% anticipated through 2034. Increasing consumer interest in health-focused, high-fiber products propels demand, particularly in snacks, beverages, and bakery goods. Ongoing innovation in product formulations will continue to support market growth across various sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing consumer awareness of the importance of fiber

- 3.6.1.2 Shift towards clean-label products

- 3.6.1.3 Demand for functional foods

- 3.6.1.4 Innovation in food products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.2.2 Supply chain complexities

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Food

- 5.2.1 Bakery

- 5.2.2 Breakfast cereals & snacks

- 5.2.3 Confectionery

- 5.2.4 Dairy

- 5.2.5 Meat products

- 5.2.6 Infant food

- 5.3 Beverages

- 5.4 Pharmaceutical

- 5.5 Animal nutrition

- 5.5.1 Swine

- 5.5.2 Ruminants

- 5.5.3 Poultry

- 5.5.4 Pet

- 5.6 Textiles

- 5.6.1 Apparels

- 5.6.2 Nonwovens

- 5.6.3 Home textiles

- 5.6.4 Industrial textiles

- 5.7 Others (Medical, Automotive, Personal care & Cosmetics)

Chapter 6 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 UK

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Spain

- 6.3.6 Russia

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia

- 6.5 Latin America

- 6.5.1 Brazil

- 6.5.2 Mexico

- 6.6 MEA

- 6.6.1 South Africa

- 6.6.2 Saudi Arabia

- 6.6.3 UAE

Chapter 7 Company Profiles

- 7.1 Archer Daniels Midland Company

- 7.2 Cargill Incorporated

- 7.3 Doshi Group

- 7.4 Grain Processing Corporation

- 7.5 HL Agro

- 7.6 Ingredion Incorporated

- 7.7 J. Rettenmaier & Söhne GmbH & Co. KG

- 7.8 Roquette Freres

- 7.9 SunOpta, Inc.

- 7.10 Tate & Lyle PLC