|

市場調查報告書

商品編碼

1667153

去乳化劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Demulsifier Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

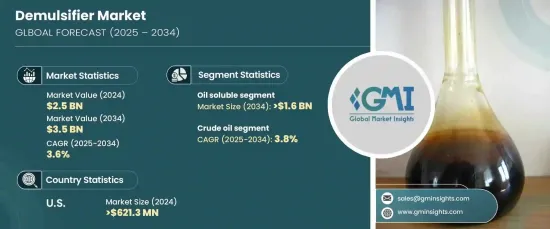

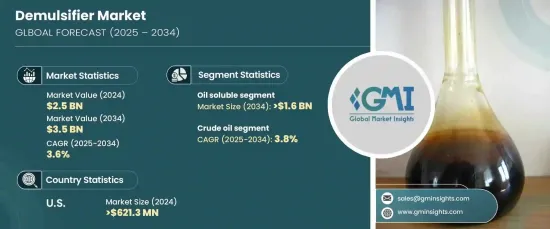

預計全球去乳化劑市場規模將在 2024 年達到 25 億美元,2025 年至 2034 年的預期複合年成長率為 3.6%。隨著對滿足環境法規的日益重視,對更有效率的去乳化劑配方的需求激增,以有效管理油泥和廢水。

除此之外,綠色去乳化劑的創新也日益受到關注,在解決產業永續發展挑戰的同時,促進了市場成長。隨著工業化進程加速和能源需求成長,特別是在亞太地區,預計對去乳化劑的需求將大幅成長。該地區的快速發展,尤其是能源密集產業的快速發展,是全球市場擴張的主要驅動力,進一步強調了對先進水分離技術的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 25億美元 |

| 預測值 | 35億美元 |

| 複合年成長率 | 3.6% |

油溶性去乳化劑領域佔據市場主導地位,2024 年貢獻了 16 億美元,預計在整個預測期內將以 3.7% 的複合年成長率成長。油溶性去乳化劑因其出色的從原油中分離水的能力而受到青睞,可提高最終產品的質量,同時保護煉油設備。這些去乳化劑在海上和陸上油田都特別有效,因為這些油田的原油通常含有高濃度的水和鹽,分離起來很困難。這些充滿挑戰的環境中對高性能去乳化劑的持續需求預計將進一步推動該領域的成長。

原油領域是全球去乳化劑市場的另一個關鍵驅動力,到 2024 年將達到 8.681 億美元。去乳化劑有助於破壞乳狀液,從而有利於水、鹽和雜質從原油中分離出來。這確保了煉油過程順利進行並產生更高品質的最終產品,使去乳化劑成為世界各地石油生產商和煉油廠必不可少的工具。

在美國,2024 年去乳化劑市值為 6.213 億美元,預計在預測期內的複合年成長率為 3.7%。美國仍然是全球去乳化劑市場的主導力量,受益於成熟的石油和天然氣行業、最先進的煉油技術以及對提高原油加工能力的解決方案的穩定需求。美國頁岩氣的繁榮繼續推動對先進水分離解決方案的需求,進一步鞏固了該國作為市場主要參與者的地位。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 原油產量和探勘活動增加

- 對石油精煉製程的需求不斷增加

- 工業廢水處理應用的擴展

- 產業陷阱與挑戰

- 原油價格波動影響市場穩定

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 油溶性

- 水溶性

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 原油

- 油泥處理

- 石油精煉

- 燃油發電廠

- 潤滑油製造

- 其他

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Akzo Nobel

- Baker Hughes

- BASF

- Clariant

- Croda International

- Dorf Ketal

- Dow Chemical

- Ecolab

- Halliburton

- National Chemical & Petroleum Industries

- PT Eonchemicals Putra

The Global Demulsifier Market is projected to reach USD 2.5 billion in 2024, with an expected growth rate of 3.6% CAGR from 2025 to 2034. This growth is driven by the ongoing expansion of the oil and gas industry, especially in regions such as North America and the Middle East, where crude oil production continues to rise. The increasing emphasis on meeting environmental regulations has led to a surge in demand for more efficient demulsifier formulations to manage oil sludge and wastewater effectively.

Alongside this, innovations in green demulsifiers are gaining traction, addressing the industry's sustainability challenges while contributing to market growth. As industrialization accelerates and energy needs grow, particularly in Asia-Pacific, the demand for demulsifiers is expected to see significant growth. The region's rapid development, especially in energy-heavy industries, is a key driver for the global market's expansion, placing further emphasis on the need for advanced water separation technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 billion |

| Forecast Value | $3.5 billion |

| CAGR | 3.6% |

The oil-soluble demulsifier segment dominated the market, contributing USD 1.6 billion in 2024, and is anticipated to expand at a rate of 3.7% CAGR throughout the forecast period. Oil-soluble demulsifiers are preferred for their superior ability to separate water from crude oil, improving the quality of the final product while protecting refining equipment. These demulsifiers are particularly effective in both offshore and onshore oil fields, where crude oil typically contains high concentrations of water and salts, which can be challenging to separate. The ongoing need for high-performance demulsifiers in these challenging environments is expected to further propel this segment's growth.

The crude oil segment is another key driver of the global demulsifier market, accounting for USD 868.1 million in 2024. This segment is projected to grow at a robust CAGR of 3.8% through 2034, thanks to the critical role demulsifiers play in crude oil production and refining processes. Demulsifiers help break emulsions, which facilitates the separation of water, salts, and impurities from crude oil. This ensures that the refining process runs smoothly and results in a higher-quality final product, positioning demulsifiers as an essential tool for oil producers and refineries around the world.

In the U.S., the demulsifier market was valued at USD 621.3 million in 2024 and is expected to grow at a CAGR of 3.7% during the forecast period. The U.S. remains a dominant force in the global demulsifier market, benefiting from a well-established oil and gas sector, state-of-the-art refining technologies, and a steady demand for solutions that enhance crude oil processing. The U.S. shale boom continues to drive the need for advanced water separation solutions, further cementing the country's position as a major player in the market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising crude oil production and exploration activities

- 3.6.1.2 Increasing demand for petroleum refining processes

- 3.6.1.3 Expansion of industrial wastewater treatment applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating crude oil prices impacting market stability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oil-soluble

- 5.3 Water-soluble

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Crude oil

- 6.3 Oil sludge treatment

- 6.4 Petroleum refining

- 6.5 Oil-based power plant

- 6.6 Lubricants manufacturing

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Akzo Nobel

- 8.2 Baker Hughes

- 8.3 BASF

- 8.4 Clariant

- 8.5 Croda International

- 8.6 Dorf Ketal

- 8.7 Dow Chemical

- 8.8 Ecolab

- 8.9 Halliburton

- 8.10 National Chemical & Petroleum Industries

- 8.11 PT Eonchemicals Putra