|

市場調查報告書

商品編碼

1667123

基於斷路器的轉換開關市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Circuit Breaker Based Transfer Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

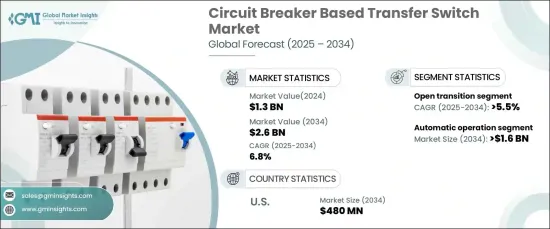

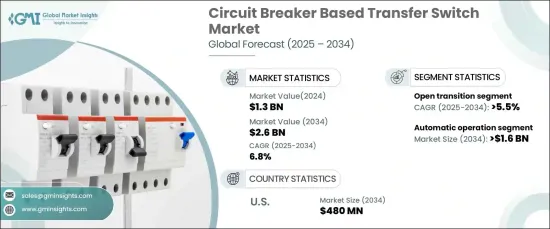

2024資料全球基於斷路器的轉換開關市場規模達到 13 億美元,預計 2025 年至 2034 年的複合年成長率為 6.8%。這些產業嚴重依賴不間斷電源,基於斷路器的轉換開關可確保在停電或故障時實現平穩、高效的電源轉換。

對持續高品質電力的日益依賴進一步推動了這些設備的採用。它們能夠防止電力中斷、處理故障並在惡劣條件下提供無縫性能,這使得它們成為現代電力基礎設施中不可或缺的一部分。隨著企業和組織繼續優先考慮營運連續性,對先進電力傳輸解決方案的需求正在飆升。這種成長尤其受到再生能源和混合動力系統日益融合的影響,這兩者都需要複雜的電源管理解決方案才能有效運作。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 26億美元 |

| 複合年成長率 | 6.8% |

自動化和備用電源系統的激增是推動市場擴張的另一個關鍵因素。自動轉換開關 (ATS) 可在停電期間提供自動、無縫的電力傳輸,並且正在迅速獲得關注,特別是在無法中斷電力的環境中。憑藉遠端監控、智慧控制和先進自動化等附加優勢,ATS 已成為高可靠性要求產業的關鍵解決方案。

這些系統在停電期間提高營運效率方面發揮著不可或缺的作用,使其在醫院、資料中心和工業營運等關鍵應用中發揮著不可估量的作用。新興經濟體的基礎設施發展進一步推動了對這些解決方案日益成長的需求,這些經濟體正致力於升級能源基礎設施以滿足日益成長的持續、穩定電力傳輸的需求。

預計到 2034 年,自動操作市場的規模將達到 16 億美元。這些系統在停電期間提供自動備用電源,讓企業安心,並降低停機風險。另一方面,基於開放式過渡斷路器的轉換開關市場因其經濟性和可靠性而廣受歡迎,預計複合年成長率為 5.5%。這些開關通常用於不太重要的應用場合,這些場合可以接受短暫的電源中斷,這使其成為經常遭遇電源中斷的商業和工業領域的首選。

在美國,基於斷路器的轉換開關市場規模預計到 2034 年將達到 4.8 億美元。美國特別容易受到電力中斷的影響,進一步凸顯了可靠電力管理系統的必要性。此外,旨在提高能源效率的持續監管努力和自動化技術的進步預計將推動這些基本電力解決方案的持續採用。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依營運方式,2021 – 2034 年

- 主要趨勢

- 手動的

- 非自動

- 自動的

- 旁路隔離

第6章:市場規模與預測:依轉型,2021 – 2034 年

- 主要趨勢

- 關閉

- 打開

第 7 章:市場規模及預測:依安裝量,2021 – 2034 年

- 主要趨勢

- 緊急系統

- 法律要求的製度

- 關鍵操作電力系統

- 可選備用系統

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 俄羅斯

- 英國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- ABB

- AEG Power Solutions

- Briggs & Stratton

- Caterpillar

- Cummins

- DAIER

- Eaton

- Generac Power Systems

- General Electric

- Kohler

- Midwest Electric Products

- One Two Three Electric

- Peterson

- Schneider Electric

- Siemens

- Taylor Power Systems

- Vertiv Group

The Global Circuit Breaker Based Transfer Switch Market reached USD 1.3 billion in 2024 and is expected to exhibit a CAGR of 6.8% from 2025 to 2034. This growth is primarily driven by the increasing demand for reliable power transfer solutions across critical industries such as healthcare, data centers, and industrial facilities. These sectors depend heavily on uninterrupted power supply, and circuit breaker-based transfer switches ensure smooth and efficient power transitions in the event of outages or failures.

The rising reliance on continuous, high-quality power is further boosting the adoption of these devices. Their ability to prevent power disruptions, handle faults, and provide seamless performance under harsh conditions makes them essential in modern power infrastructure. As businesses and organizations continue to prioritize operational continuity, the demand for advanced power transfer solutions is soaring. This growth is particularly influenced by the increasing integration of renewable energy sources and hybrid power systems, both of which require sophisticated power management solutions to operate efficiently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 6.8% |

The surge in automation and backup power systems is another critical factor fueling the market's expansion. Automated transfer switches (ATS), which provide automatic, seamless power transfers during outages, are rapidly gaining traction, especially in environments where power disruptions are not an option. With the added benefits of remote monitoring, smart controls, and advanced automation, ATS has become a key solution for sectors demanding high reliability.

These systems play an integral role in enhancing operational efficiency during power outages, making them invaluable in critical applications like hospitals, data centers, and industrial operations. The growing demand for these solutions is further bolstered by infrastructure developments in emerging economies, which are focusing on upgrading energy infrastructure to meet the increasing need for continuous, stable power delivery.

The automatic operation segment of the market is expected to reach USD 1.6 billion by 2034. The widespread adoption of ATS is a major driver of this growth, particularly in industries with stringent power reliability needs. These systems provide automatic backup power during outages, offering businesses peace of mind and reducing the risk of downtime. On the other hand, the open transition circuit breaker-based transfer switch market, which is popular for its affordability and dependability, is expected to grow at a CAGR of 5.5%. These switches are commonly used in less-critical applications where brief power interruptions are acceptable, making them a go-to option for commercial and industrial sectors that frequently experience power disruptions.

In the U.S., the circuit breaker-based transfer switch market is poised to reach USD 480 million by 2034. This growth is primarily attributed to the nation's increasing focus on modernizing its energy infrastructure and the rising demand for backup power solutions across various sectors. The U.S. is particularly vulnerable to power disruptions, which further underscores the need for reliable power management systems. Additionally, ongoing regulatory efforts aimed at improving energy efficiency and advancements in automation technologies are expected to drive the continued adoption of these essential power solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Operations, 2021 – 2034 (‘000 Units, USD Million)

- 5.1 Key trends

- 5.2 Manual

- 5.3 Non-automatic

- 5.4 Automatic

- 5.5 By-pass isolation

Chapter 6 Market Size and Forecast, By Transition, 2021 – 2034 (‘000 Units, USD Million)

- 6.1 Key trends

- 6.2 Closed

- 6.3 Open

Chapter 7 Market Size and Forecast, By Installation, 2021 – 2034 (‘000 Units, USD Million)

- 7.1 Key trends

- 7.2 Emergency systems

- 7.3 Legally required systems

- 7.4 Critical operations power systems

- 7.5 Optional standby systems

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (‘000 Units, USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 Russia

- 8.3.4 UK

- 8.3.5 Italy

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 South Korea

- 8.4.4 India

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 UAE

- 8.5.2 South Africa

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 AEG Power Solutions

- 9.3 Briggs & Stratton

- 9.4 Caterpillar

- 9.5 Cummins

- 9.6 DAIER

- 9.7 Eaton

- 9.8 Generac Power Systems

- 9.9 General Electric

- 9.10 Kohler

- 9.11 Midwest Electric Products

- 9.12 One Two Three Electric

- 9.13 Peterson

- 9.14 Schneider Electric

- 9.15 Siemens

- 9.16 Taylor Power Systems

- 9.17 Vertiv Group