|

市場調查報告書

商品編碼

1667100

電動越野車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Electric Off-Road Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

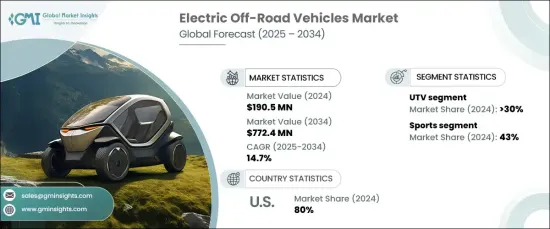

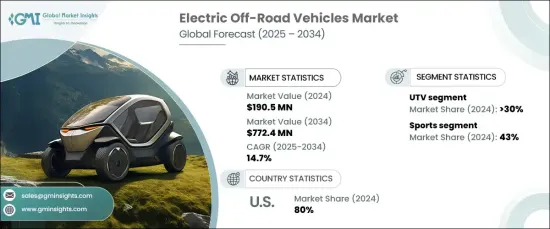

2024 年全球電動越野車市場價值為 1.905 億美元,預計 2025 年至 2034 年期間將以 14.7% 的強勁複合年成長率擴張。隨著人們對氣候變遷和環境保護的認知不斷增強,個人和產業擴大接受減少排放和生態影響的替代方案。與傳統內燃機驅動的車型相比,電動越野車因其零排放、減少噪音污染和降低環境影響而越來越受歡迎。

製造商正在利用先進技術來提高車輛性能、最佳化能源效率並提供更長的續航里程,使電動車型對更廣泛的受眾更具吸引力。消費者被功能性和永續性的無縫整合所吸引,電動越野車兼具卓越的性能和減少的環境危害。政府的激勵措施、電池技術的進步以及消費者日益成長的環保生活方式進一步促進了這種轉變。這些因素正在推動越野車領域的深刻變革,使電動車型成為市場發展的關鍵參與者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.905億美元 |

| 預測值 | 7.724 億美元 |

| 複合年成長率 | 14.7% |

市場分為多用途地形車 (UTV)、全地形車 (ATV)、雪地摩托車和越野摩托車。 2024 年,UTV 佔據了 30% 的市場佔有率,並且由於消費者對環保替代品的偏好不斷上升而經歷快速成長。電動 UTV 運行更安靜、更清潔、更有高效,滿足了符合永續生活方式的車輛需求,同時保持了各種越野應用的出色實用性和多功能性。

電動越野車的應用涵蓋公用事業、運動、娛樂和軍事領域。 2024 年,體育板塊佔據市場主導地位,貢獻了 43% 的佔有率。高性能電動車在越野活動中的日益普及是主要的成長動力。增強的電池技術和更快的充電解決方案使電動車能夠征服具有挑戰性的地形並行駛更長的距離,使其成為越野騎行、山地探險和其他休閒活動的理想選擇。

在美國,電動越野車市場在 2024 年佔據了 80% 的佔有率。電動越野車比傳統車型更清潔、更安靜,對具有環保意識的冒險家和專業人士都有吸引力。

電池技術的進步(包括更大的容量和效率)進一步推動了市場的發展軌跡。隨著製造商推出創新解決方案並擴大其電動產品組合,電動越野車的普及將會加速,這反映了全球對更環保移動解決方案的承諾。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 組件提供者

- 生產

- 經銷商

- 最終用途

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 成本分析

- 衝擊力

- 成長動力

- 電動越野車產業新參與者的出現

- 對電動車採用的認知不斷提高

- 越野娛樂活動的參與度不斷提高

- 全球旅遊業前景樂觀

- 原始設備製造商對新產品開發的投資不斷增加

- 產業陷阱與挑戰

- 充電基礎設施有限

- 惡劣環境下的效能限制

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 越野車

- 全地形車

- 雪地摩托車

- 越野摩托車

第 6 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 公用事業

- 運動的

- 娛樂

- 軍隊

第7章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第8章:公司簡介

- Alke

- American Landmaster

- Cub Cadet

- Daymak

- DRR

- Ecocharger

- Eco Rider

- Electric Motion

- Evolet

- Hisun Motors

- HuntVe

- Intimidator

- Kaxa Deere

- KTM

- Nikola

- Polaris

- TACITA

- Vanderhall

- Volcon

- Zero Motorcycle

The Global Electric Off-Road Vehicles Market was valued at USD 190.5 million in 2024 and is anticipated to expand at a robust CAGR of 14.7% from 2025 to 2034. This remarkable growth is fueled by a surging demand for eco-friendly and sustainable transportation solutions. As awareness about climate change and environmental preservation continues to grow, individuals and industries are increasingly embracing alternatives that minimize emissions and reduce ecological impact. Electric off-road vehicles are gaining popularity due to their zero-emission operation, reduced noise pollution, and lower environmental footprint compared to traditional internal combustion-powered models.

Manufacturers are leveraging advanced technologies to enhance vehicle performance, optimize energy efficiency, and provide longer ranges, making electric options more appealing to a broader audience. Consumers are drawn to the seamless integration of functionality and sustainability, with electric off-road vehicles offering a combination of exceptional performance and reduced environmental harm. The shift is further amplified by government incentives, advancements in battery technology, and a growing trend among consumers to adopt environmentally conscious lifestyles. These factors are driving a profound transformation in the off-road vehicle landscape, positioning electric models as a key player in the market's evolution.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $190.5 Million |

| Forecast Value | $772.4 Million |

| CAGR | 14.7% |

The market is segmented into utility terrain vehicles (UTVs), all-terrain vehicles (ATVs), snowmobiles, and off-road motorcycles. UTVs held a 30% market share in 2024 and are experiencing rapid growth due to rising consumer preferences for eco-friendly alternatives. Electric UTVs offer quieter, cleaner, and more efficient operation, meeting the demand for vehicles that align with sustainable lifestyles while maintaining excellent utility and versatility for various off-road applications.

Applications of electric off-road vehicles span utility, sports, recreation, and military sectors. In 2024, the sports segment dominated the market, contributing a 43% share. The increasing popularity of high-performance electric vehicles for off-road activities is a major growth driver. Enhanced battery technology and faster charging solutions have enabled electric vehicles to conquer challenging terrains and travel longer distances, making them ideal for activities such as trail riding, mountain exploration, and other recreational pursuits.

In the United States, the electric off-road vehicles market held an 80% share in 2024. Growing environmental awareness and heightened consumer interest in sustainable outdoor activities are key factors driving this dominance. Electric off-road vehicles present a cleaner, quieter alternative to traditional models, appealing to eco-conscious adventurers and professionals alike.

The market's trajectory is further bolstered by advancements in battery technology, including greater capacity and efficiency. As manufacturers introduce innovative solutions and expand their electric product portfolios, the adoption of electric off-road vehicles is poised to accelerate, reflecting a global commitment to greener mobility solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacture

- 3.1.4 Distributors

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cost analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Emergence of new players in the electric off-road vehicles industry

- 3.9.1.2 Rising awareness related to adoption of electric vehicles

- 3.9.1.3 Growing participation in off-road recreational activities

- 3.9.1.4 Positive outlook of the tourism industry across the world

- 3.9.1.5 Growing investments by OEMs in new product development

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Limited charging infrastructure

- 3.9.2.2 Performance limitations in harsh environments

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 UTV

- 5.3 ATV

- 5.4 Snowmobile

- 5.5 Off-road motorcycle

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Utility

- 6.3 Sports

- 6.4 Recreation

- 6.5 Military

Chapter 7 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 MEA

- 7.6.1 UAE

- 7.6.2 South Africa

- 7.6.3 Saudi Arabia

Chapter 8 Company Profiles

- 8.1 Alke

- 8.2 American Landmaster

- 8.3 Cub Cadet

- 8.4 Daymak

- 8.5 DRR

- 8.6 Ecocharger

- 8.7 Eco Rider

- 8.8 Electric Motion

- 8.9 Evolet

- 8.10 Hisun Motors

- 8.11 HuntVe

- 8.12 Intimidator

- 8.13 Kaxa Deere

- 8.14 KTM

- 8.15 Nikola

- 8.16 Polaris

- 8.17 TACITA

- 8.18 Vanderhall

- 8.19 Volcon

- 8.20 Zero Motorcycle