|

市場調查報告書

商品編碼

1666997

魷魚市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Squid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

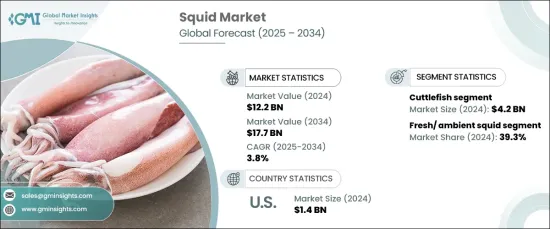

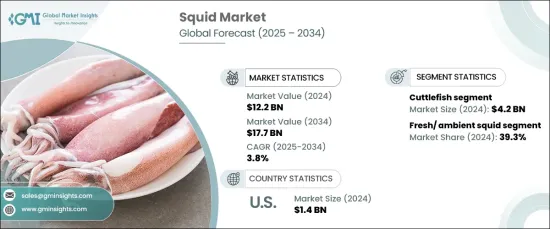

2024 年全球魷魚市場價值為 122 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 3.8%。魷魚以其獨特的風味和多功能性而聞名,其形態多種多樣,從整隻新鮮魷魚到流行的加工食品,如乾魷魚零食、魷魚圈和魷魚排。由於消費者對新烹飪體驗的興趣日益濃厚,對優質海鮮的需求激增,進一步推動了魷魚市場的擴張。

由於包裝、分銷和物流方面的進步,魷魚市場取得了顯著成長,確保新鮮和加工魷魚比以往更有效地進入國際市場。消費者對海鮮高蛋白、低脂肪等健康益處的認知不斷提高,也導致了海鮮需求的激增。此外,魷魚在許多高檔餐廳和地中海、日本和其他亞洲美食中扮演著重要的角色,鞏固了其在全球美食界的地位。然而,該行業面臨重大障礙,包括過度捕撈和氣候變遷的威脅,這些都影響了供應鏈和供應。為了應對這些挑戰,永續水產養殖措施和漁業法規正在幫助穩定市場,並為長期確保魷魚供應提供解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 122億美元 |

| 預測值 | 177億美元 |

| 複合年成長率 | 3.8% |

魷魚產品依品種分類,主要有日本飛魚、烏賊、阿根廷短鰭魷魚、歐洲魷魚等。烏賊類產品是 2024 年最大的市場貢獻者,創造了 42 億美元的收入。墨魚以其肉質細嫩、味道濃郁而聞名,受到廣泛的消費者歡迎,並繼續佔據主導地位。歐洲魷魚由於其多功能性和烹飪價值而在市場上佔有重要地位,尤其是在歐洲家庭和餐廳中。

市場根據產品形式進一步分類,主要包括新鮮/常溫魷魚、冰鮮魷魚和冷凍魷魚。 2024 年新鮮/常溫魷魚佔總市場佔有率的 39.3%,是成長最快的細分市場。隨著對高品質、低加工海鮮的需求不斷成長,新鮮魷魚在高檔食品店中特別受歡迎。這些產品在地中海、日本和其他亞洲美食中尤其受歡迎,因為魷魚是這些美食中必不可少的食材。

在美國市場,魷魚的價值將在 2024 年達到 14 億美元,這得益於消費者對海鮮作為健康蛋白質替代品的偏好日益增加。以魷魚為主食的地中海和亞洲菜餚的流行也促進了這一成長。美國海岸線的永續捕魚實踐和冷鏈物流的改善確保了新鮮和冷凍魷魚的穩定可靠供應,以滿足日益成長的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 海鮮消費量上升

- 民族美食越來越受歡迎

- 魷魚的健康益處

- 產業陷阱與挑戰

- 過度捕撈

- 魷魚價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 烏賊

- 歐洲魷魚

- 阿根廷短鰭魷魚

- 巨型飛魷魚

- 日本飛魷魚

- 其他

第6章:市場估計與預測:依類別,2021-2034 年

- 主要趨勢

- 新鮮/常溫魷魚

- 冷凍魷魚

- 冰鮮魷魚

- 其他

第 7 章:市場估計與預測:依包裝,2021-2034 年

- 主要趨勢

- 罐頭

- 托盤

- 其他

第 8 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 食品零售

- 超市場

- 大賣場

- 專賣店

- 其他

- 餐飲服務

- 食品零售

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Bigsams

- Freshkatch

- Holmes

- Holt

- Lee Fishing

- Minh Khue

- Pescanova

- Qingdao Seaflying Food

- Seafood Pride International

- Seaquest

- Thai Union

- Xiamen Taiseng

The Global Squid Market was valued at USD 12.2 billion in 2024 and is set to grow at a steady CAGR of 3.8% from 2025 to 2034. As consumer appetite for exotic seafood continues to rise, squid has earned its place as a highly sought-after delicacy in many cuisines around the world. Known for its unique flavor profile and versatility, squid is featured in a variety of forms, from whole fresh squid to popular processed items like dried squid snacks, calamari rings, and squid steaks. The surge in demand for premium seafood options, driven by growing consumer interest in new culinary experiences, has further propelled the squid market expansion.

The squid market has seen notable growth thanks to advancements in packaging, distribution, and logistics, ensuring that fresh and processed squid reach international markets more effectively than ever before. Increased consumer awareness of seafood's health benefits, including high protein and low-fat content, has also contributed to this surge in demand. Additionally, squid plays a vital role in many high-end restaurants and Mediterranean, Japanese, and other Asian cuisines, strengthening its place in the global food scene. However, the industry faces significant hurdles, including the threats posed by overfishing and climate change, which impact supply chains and availability. In response to these challenges, sustainable aquaculture initiatives and fisheries regulations are helping stabilize the market, offering solutions to secure the squid supply in the long term.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 3.8% |

Squid products are categorized by species type, with Japanese flying squid, cuttlefish, Argentine shortfin squid, and European squid being the main contenders. The cuttlefish segment was the leading market contributor in 2024, generating USD 4.2 billion in revenue. Cuttlefish, known for their tender texture and rich flavor, continue to dominate due to their broad consumer appeal. European squid is also a prominent player in the market, especially in European households and restaurants, thanks to its versatility and culinary value.

The market is further divided by product form, with fresh/ambient squid, chilled squid, and frozen squid being the primary categories. Fresh/ambient squid accounted for 39.3% of the total market share in 2024 and is the fastest-growing segment. The rising demand for high-quality, minimally processed seafood has made fresh squid particularly popular among premium food establishments. These products are especially coveted in Mediterranean, Japanese, and other Asian cuisines, where squid is an essential ingredient.

In the U.S. market, squid was valued at USD 1.4 billion in 2024, driven by an increasing consumer preference for seafood as a healthy protein alternative. The popularity of Mediterranean and Asian dishes featuring squid-based meals has also contributed to this growth. Sustainable fishing practices along the U.S. coastline and improvements in cold-chain logistics have ensured a steady and reliable supply of both fresh and frozen squid to meet growing demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising seafood consumption

- 3.6.1.2 Growing popularity of ethnic cuisines

- 3.6.1.3 Health benefits associated with squid

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Overfishing

- 3.6.2.2 Price volatility of squid

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cuttlefish

- 5.3 European squid

- 5.4 Argentine shortfin squid

- 5.5 Jumbo flying squid

- 5.6 Japanese flying squid

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Category, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fresh/ ambient squid

- 6.3 Frozen squid

- 6.4 Chilled squid

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Packaging, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Cans

- 7.3 Trays

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.1.1 Food retail

- 8.1.1.1 Supermarket

- 8.1.1.2 Hypermarket

- 8.1.1.3 Specialty store

- 8.1.1.4 Others

- 8.1.2 Food service

- 8.1.1 Food retail

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bigsams

- 10.2 Freshkatch

- 10.3 Holmes

- 10.4 Holt

- 10.5 Lee Fishing

- 10.6 Minh Khue

- 10.7 Pescanova

- 10.8 Qingdao Seaflying Food

- 10.9 Seafood Pride International

- 10.10 Seaquest

- 10.11 Thai Union

- 10.12 Xiamen Taiseng