|

市場調查報告書

商品編碼

1666989

搜救 (SAR) 設備市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Search and Rescue (SAR) Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

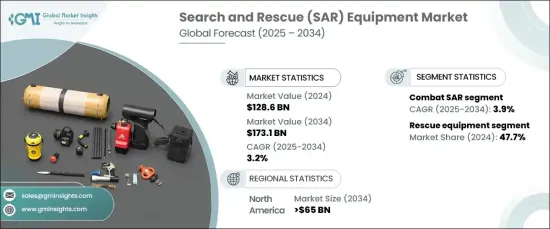

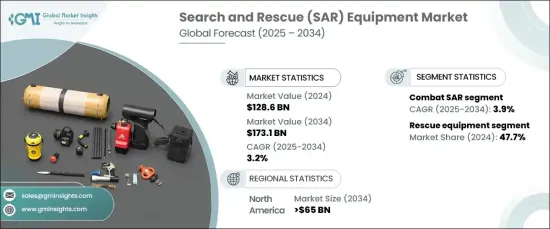

2024 年全球搜救設備市場價值為 1,286 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.2%。衛星通訊系統和物聯網平台等先進的連接解決方案實現了救援隊、指揮中心和設備之間的無縫互動。這些創新透過實現 GPS 追蹤、即時視訊傳送和即時資料共享,增強了態勢感知能力,尤其是在具有挑戰性的條件下。搜救無人機和穿戴式裝置等工具現在可以即時傳輸關鍵資料,有助於快速決策並提高成功率。隨著人們對高效救援工作的重視程度不斷提高,即時通訊系統已成為搜救設備的重要組成部分。

氣候變遷導致的自然災害增多,刺激了全球對搜救設備的需求。颶風、洪水、地震和野火發生的頻率日益增加,凸顯了對先進工具支援災害應變的迫切需求。政府、人道組織和國防機構正在大力投資創新技術,以提高其災害管理能力。這種向高度準備和迅速行動的轉變是市場的主要驅動力,重點是保障生命安全並在危機情況下最大限度地減少損失。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1286億美元 |

| 預測值 | 1731億美元 |

| 複合年成長率 | 3.2% |

2024年,救援設備佔據市場主導地位,佔有47.7%的佔有率。這些工具在搜救任務中發揮著至關重要的作用,為從危險境地中救出受害者提供了必要的支持。輕質材料和人體工學設計的創新提高了擔架、救生筏和安全帶等物品的功能性和耐用性。模組化系統可根據不同的救援場景進行客製化,具有適應山地、洪水和海洋環境的能力。 GPS、通訊設備和熱成像的整合進一步提高了救援行動的精度和效率,減少了回應時間並實現了在危險區域的遠端部署。

戰鬥搜救領域成為 2024 年成長最快的應用類別,預測期內預計複合年成長率為 3.9%。該部門專注於從高風險區域撤回人員,通常需要先進的技術來快速執行。增強的 GPS 追蹤和即時通訊系統改善了各部門之間的協調,而先進的醫療設備則支援拔牙期間的即時護理。軍方對戰術無人機和裝甲車的投資不斷擴大戰鬥搜救行動的能力,優先考慮危險條件下的安全性和作戰速度。

北美仍然是一個重要的市場,預計到 2034 年將超過 650 億美元。公共和私營部門之間的合作努力正在促進創新並確保能夠獲得尖端救援設備。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 即時通訊技術的進步正在徹底改變搜救設備的操作

- 隨著天災不斷升級,全球對搜救設備的需求激增

- 世界各國政府正在加大對 SAR 技術開發項目的投資

- 無人機在當代搜救任務中變得越來越重要

- 技術創新正在增強 SAR 設備系統的有效性

- 產業陷阱與挑戰

- 高成本阻礙SAR設備技術的採用

- SAR 設備在極端環境下面臨運作挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按設備,2021 年至 2034 年

- 主要趨勢

- 救援設備

- 搜尋設備

- 雷達

- 聲納

- 相機

- 信標

- 通訊設備

- 電信設備

- 攜帶式收音機

- 應答器

- 中繼器

- 醫療設備

- 其他

第 6 章:市場估計與預測:按平台,2021-2034 年

- 主要趨勢

- 空降

- 固定翼

- 旋翼機

- 無人駕駛飛行器(UAVS)

- 海洋

- 自主水下航行器(AUVS)

- 遙控水下機器人 (ROVS)

- 兩棲船

- 救生筏

- 特別艇艇隊 (SBU) 艇

- 地面

- 救護車

- 消防和救援車輛

- 無人地面車輛(UGVS)

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 戰鬥搜救

- 城市特區

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Acr Electronics, Inc

- Aeromarine Srt

- Cubic Corporation

- Elbit Systems Ltd.

- Garmin Ltd.

- General Dynamics Corporation

- Honeywell International Inc.

- Leonardo SPA

- Raytheon Company

- Rockwell Collins, Inc.

- Thales Group

The Global Search And Rescue Equipment Market was valued at USD 128.6 billion in 2024 and is projected to grow at a CAGR of 3.2% from 2025 to 2034. The integration of real-time communication technologies is transforming search and rescue operations, enabling faster coordination and improved response times. Advanced connectivity solutions, such as satellite communication systems and IoT platforms, allow seamless interaction between rescue teams, command centers, and equipment. These innovations enhance situational awareness, particularly in challenging conditions, by enabling GPS tracking, live video feeds, and instant data sharing. Tools like SAR drones and wearable devices now transmit critical data in real-time, facilitating quick decision-making and higher success rates. The rising emphasis on efficient rescue efforts has positioned real-time communication systems as an essential component of SAR equipment.

Increasing natural disasters caused by climate change have spurred global demand for search and rescue equipment. The growing frequency of hurricanes, floods, earthquakes, and wildfires underscores the urgent need for advanced tools to support disaster response. Governments, humanitarian organizations, and defense agencies are heavily investing in innovative technologies to improve their disaster management capabilities. This shift towards heightened preparedness and swift action is a key driver for the market, with a significant focus on safeguarding lives and minimizing damage in crisis scenarios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $128.6 billion |

| Forecast Value | $173.1 billion |

| CAGR | 3.2% |

In 2024, rescue equipment dominated the market, holding a 47.7% share. These tools play a critical role in SAR missions, providing essential support for extracting victims from perilous situations. Innovations in lightweight materials and ergonomic designs have improved the functionality and durability of items such as stretchers, life rafts, and harnesses. Modular systems allow customization for different rescue scenarios, offering adaptability across mountain, flood, and maritime environments. The integration of GPS, communication devices, and thermal imaging further enhances the precision and efficiency of rescue operations, reducing response times and enabling remote deployments in hazardous areas.

The combat search and rescue segment emerged as the fastest-growing application category in 2024, with a CAGR of 3.9% projected during the forecast period. This sector focuses on retrieving personnel from high-risk zones, often requiring advanced technologies for rapid execution. Enhanced GPS tracking and real-time communication systems improve coordination between units, while advanced medical equipment supports immediate care during extractions. Military investments in tactical drones and armored vehicles continue to expand the capabilities of combat SAR operations, prioritizing safety and operational speed in dangerous conditions.

North America remains a significant market, expected to surpass USD 65 billion by 2034. The region's growing focus on disaster readiness is driving investments in advanced SAR technologies to strengthen emergency response efforts. Collaborative efforts between public and private sectors are fostering innovation and ensuring access to cutting-edge rescue equipment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Real-time communication advancements are revolutionizing SAR equipment operations

- 3.6.1.2 Global demand for SAR equipment surges in response to escalating natural disasters

- 3.6.1.3 Governments worldwide are ramping up investments in SAR technology development programs

- 3.6.1.4 Drones are becoming increasingly integral to contemporary search and rescue missions

- 3.6.1.5 Technological innovations are amplifying the effectiveness of SAR equipment systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High costs hinder the adoption of SAR equipment technology

- 3.6.2.2 SAR equipment faces operational challenges in extreme environments

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Equipment, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Rescue equipment

- 5.3 Search Equipment

- 5.3.1 Radar

- 5.3.2 Sonar

- 5.3.3 Cameras

- 5.3.4 Beacons

- 5.4 Communication Equipment

- 5.4.1 Telecommunications equipment

- 5.4.2 Portable radios

- 5.4.3 Transponders

- 5.4.4 Repeaters

- 5.5 Medical equipment

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Airborne

- 6.2.1 Fixed wing

- 6.2.2 Rotary wing

- 6.2.3 Unmanned Aerial Vehicles (UAVS)

- 6.3 Marine

- 6.3.1 Autonomous Underwater Vehicles (AUVS)

- 6.3.2 Remotely Operated Underwater Vehicles (ROVS)

- 6.3.3 Amphibious crafts

- 6.3.4 Life Rafts

- 6.3.5 Special Boat Unit (SBU) Crafts

- 6.4 Ground-based

- 6.4.1 Ambulances

- 6.4.2 Fire & Rescue vehicles

- 6.4.3 Unmanned Ground Vehicles (UGVS)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Combat SAR

- 7.3 Urban SAR

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acr Electronics, Inc

- 9.2 Aeromarine Srt

- 9.3 Cubic Corporation

- 9.4 Elbit Systems Ltd.

- 9.5 Garmin Ltd.

- 9.6 General Dynamics Corporation

- 9.7 Honeywell International Inc.

- 9.8 Leonardo S.P.A.

- 9.9 Raytheon Company

- 9.10 Rockwell Collins, Inc.

- 9.11 Thales Group