|

市場調查報告書

商品編碼

1666971

味精市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Monosodium Glutamate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

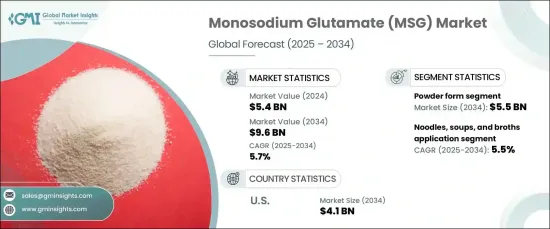

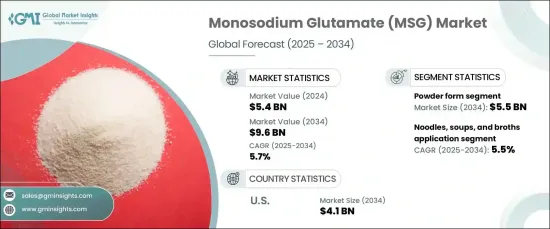

2024 年全球味精市場規模達到 54 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.7%。 味精因其增強風味的能力而得到廣泛認可,是食品工業中的重要成分,可提供提升各種菜餚品質的鮮味。隨著消費者偏好轉向快速、美味、方便的食品,對味精的需求持續增加。從包裝食品到餐廳菜餚,它在不同應用領域的多功能性進一步提升了它的知名度。

市場也受益於食品技術的創新,這些創新簡化了味精在生產過程中的加入,確保了始終如一的品質和風味。然而,消費者對清潔標籤和天然產品的興趣日益濃厚,促使製造商探索創新的味精配方,在增強風味和透明度之間取得平衡,以滿足現代飲食趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 54億美元 |

| 預測值 | 96億美元 |

| 複合年成長率 | 5.7% |

預計到 2034 年,味精粉的市場規模將達到 55 億美元,預測期內的複合年成長率為 5.4%。它的受歡迎程度源於其卓越的易用性、快速溶解性以及與自動化製造程序的兼容性。味精粉可無縫融入調味品、小吃和即食食品等應用,提供一致的風味分佈並提高操作效率。這種形式的精細質地確保了它的廣泛吸引力,特別是對於追求產品品質和便利性的餐飲服務經營者和包裝食品製造商而言。

從應用方面來看,味精在麵條、湯和肉湯中的作用無與倫比。該部分在 2024 年佔據了 35.1% 的市場佔有率,價值 19 億美元。隨著這些產品因其美味、舒適的口味和便利性而越來越受歡迎,味精的吸引力也不斷增強。它能夠增強鮮味,確保消費者無需花費太多準備時間就能享受令人滿意的口味,這使其成為這一領域必不可少的成分。

在美國,味精市場規模預計到 2034 年將達到 41 億美元,複合年成長率為 4.9%。這種成長的動力源自於美國消費者隨著快節奏的生活方式而對加工食品和簡便食品的日益偏好。味精能夠改善食品的風味和品質,鞏固了其作為中國食品工業關鍵原料的地位。同時,清潔標籤運動促使製造商進行創新,探索將味精與其他天然增味劑結合的更健康配方,以滿足消費者對更透明和天然成分清單不斷變化的需求。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 產業衝擊力

- 成長動力

- 對加工食品和簡便食品的需求不斷增加

- 餐飲業的成長

- 發展中國家可支配所得不斷增加

- 市場挑戰

- 原物料價格上漲

- 成長動力

- 法規和市場影響

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:依形式,2021-2034 年

- 主要趨勢

- 粉末

- 顆粒

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 麵條、湯和肉湯

- 肉製品

- 調味品和調味料

- 其他

第 7 章:市場規模及預測:按配銷通路,2021-2034 年

- 主要趨勢

- B2B

- B2C

- 超市和大賣場

- 便利商店

- 專賣店

- 網路零售

- 其他

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Ajinomoto Co., Inc.

- Arshine Food Additives

- Foodchem International

- Fufeng Group

- Great American Spice Company

- Linghua Group

- Meihua Holdings Group

- Meihua Holdings Group Co., Ltd

- Ningxia Eppen Biotech Co., Ltd

- Prinova

- Vedan International (Holdings) Limited

The Global Monosodium Glutamate Market reached USD 5.4 billion in 2024 and is expected to grow at a CAGR of 5.7% between 2025 and 2034. Widely recognized for its ability to enhance flavor, MSG is a vital ingredient in the food industry, delivering the savory umami taste that elevates a wide variety of dishes. As consumer preferences shift toward quick, flavorful, and convenient food options, the demand for MSG continues to expand. Its versatility across diverse applications, from packaged foods to restaurant dishes, further drives its prominence.

The market is also benefiting from innovations in food technology, which have streamlined the incorporation of MSG into production processes, ensuring consistent quality and flavor. However, evolving consumer interest in clean-label and natural products is pushing manufacturers to explore innovative MSG formulations that balance flavor enhancement with transparency, catering to modern dietary trends.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.4 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 5.7% |

The powdered form of MSG is expected to reach USD 5.5 billion by 2034, growing at a CAGR of 5.4% during the forecast period. Its popularity stems from its exceptional ease of use, rapid dissolution, and compatibility with automated manufacturing processes. Powdered MSG seamlessly integrates into applications such as seasonings, snacks, and ready-to-eat meals, offering consistent flavor distribution and improved operational efficiency. This form's fine texture ensures its broad appeal, particularly among foodservice operators and packaged food manufacturers aiming for both quality and convenience in their products.

In application terms, MSG's role in noodles, soups, and broths remains unmatched. This segment captured a 35.1% market share in 2024, valued at USD 1.9 billion. As these products grow in popularity for their savory, comforting flavors and convenience, MSG continues to enhance their appeal. Its ability to intensify umami flavors ensures that consumers enjoy satisfying taste profiles without compromising on preparation time, making it an essential ingredient in this segment.

In the United States, the MSG market is projected to hit USD 4.1 billion by 2034, growing at a CAGR of 4.9%. This growth is fueled by the rising preference for processed and convenience foods among American consumers, driven by fast-paced lifestyles. MSG's ability to improve flavor and quality has solidified its position as a key ingredient in the country's food industry. At the same time, the clean-label movement has prompted manufacturers to innovate, exploring healthier formulations that combine MSG with other natural flavor enhancers to meet evolving consumer demands for more transparent and natural ingredient lists.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for processed and convenience foods

- 3.7.1.2 Growth of the foodservice industry

- 3.7.1.3 Rising disposable incomes in developing countries

- 3.7.2 Market challenges

- 3.7.2.1 Rising prices of raw material

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Granules

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Noodles, soups, and broths

- 6.3 Meat products

- 6.4 Seasonings & dressings

- 6.5 Others

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 B2B

- 7.3 B2C

- 7.3.1 Supermarkets and hypermarkets

- 7.3.2 Convenience stores

- 7.3.3 Specialty stores

- 7.3.4 Online retail

- 7.3.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ajinomoto Co., Inc.

- 9.2 Arshine Food Additives

- 9.3 Foodchem International

- 9.4 Fufeng Group

- 9.5 Great American Spice Company

- 9.6 Linghua Group

- 9.7 Meihua Holdings Group

- 9.8 Meihua Holdings Group Co., Ltd

- 9.9 Ningxia Eppen Biotech Co., Ltd

- 9.10 Prinova

- 9.11 Vedan International (Holdings) Limited